Table of Contents

Toggle1. Introduction

Employee Stock Option Plans(ESOP)s one of the most powerful tools for startups to attract, motivate, and retain talent. In India’s fast-growing startup ecosystem, where competition for skilled professionals is intense, ESOPs offer employees more than a paycheck—they provide a stake in the company’s long-term success. However, the effectiveness of these plans depends heavily on how they are structured and valued.

At the heart of this lies the valuation of company stock, which determines how fairly ESOPs are priced. A poorly calculated strike price can discourage participation, create compliance risks, and even lead to employee attrition. Conversely, a transparent and defensible valuation can transform ESOPs into a wealth-creation tool that strengthens loyalty and reduces talent flight.

For Indian startups with global ambitions—especially those employing U.S. citizens or establishing U.S. entities—the 409A valuation becomes essential. Originally rooted in U.S. tax law, the 409A framework sets standards for how companies must determine the fair market value (FMV) of their stock when granting equity to employees. It ensures that ESOPs are legally compliant, financially credible, and trusted by both staff and investors.

This blog explores how a 409A valuation serves as more than just a regulatory checkbox. It is, in fact, a bridge between compliance, trust, and employee retention—helping Indian companies compete globally while nurturing a motivated workforce at home.

2. Understanding 409A Valuation in the Indian Startup

A 409A valuations an independent appraisal of a private company’s common stock to establish its fair market value. Mandated under Section 409A of the U.S. Internal Revenue Code, it ensures that employee stock options are granted at a fair strike price rather than an arbitrary or discounted value. This valuation protects employees from punitive tax consequences and gives companies a defensible framework for equity compensation.

For Indian startups, the relevance of a 409A valuation is increasingly significant. Many homegrown companies are expanding into U.S. markets, hiring American citizens, or setting up subsidiaries abroad. In such cases, compliance with IRS requirements becomes unavoidable. Without a defensible 409A valuation, ESOPs granted to U.S.-based employees could trigger severe tax penalties—undermining the very purpose of offering equity incentives.

At the same time, Indian regulations also emphasize accurate reporting and documentation of foreign employee compensation. By conducting a proper 409A valuation, startups not only meet U.S. compliance standards but also strengthen their standing with Indian authorities, auditors, and investors. This dual alignment ensures that equity schemes remain both legally sound and strategically effective across jurisdictions.

In essence, a 409A valuation allows Indian companies to operate confidently on the global stage. It provides employees with assurance that their stock options reflect genuine value, while positioning the company as a responsible and transparent employer ready for international growth.

3. Why ESOPs Are a Strategic Tool for Retention

In the dynamic environment of Indian startups, Employee Stock Option Plans (ESOPs) have emerged as a cornerstone of talent strategy. Beyond serving as a financial incentive, ESOPs foster a sense of ownership, aligning employee goals with the long-term growth of the company. For early-stage ventures that may not be able to match the cash compensation offered by established firms, ESOPs provide a competitive edge by promising future value creation.

The accuracy of valuations plays a pivotal role in determining how effective ESOPs are as a retention mechanism. Employees are quick to assess whether the strike price at which they receive their options reflects the true market value of the company’s stock. If valuations appear arbitrary or inflated, confidence in the ESOP plan erodes, reducing its motivational impact. On the other hand, a defensible, transparent valuation strengthens employee trust, reinforcing their belief that the company is committed to fairness.

This issue is even more pronounced in an increasingly global workforce. As talent becomes mobile and opportunities extend beyond borders, Indian startups must ensure their ESOPs are competitive not only locally but also in comparison with global peers. Accurate valuations ensure that stock options offered by Indian companies are perceived as credible and rewarding, helping to retain high-quality talent that might otherwise be lured away by international employers.

4. Sets Fair Strike Price for ESOPs

One of the most direct ways a 409A valuation influences ESOPs is by establishing the fair market value (FMV) of a company’s common stock. This FMV becomes the benchmark for determining the strike price—the price at which employees can exercise their options in the future. Setting this price fairly is crucial, as it dictates the potential upside employees may realize and directly impacts their perception of the value of their equity grants.

When employees see that the strike price is derived from a rigorous, independent appraisal, it enhances their confidence in the ESOP program. They recognize that their interests are being protected and that the company is committed to fairness rather than inflating or manipulating valuations. This fairness in pricing is not just about numbers; it is about trust and loyalty, which are essential for retention.

The importance of fair strike pricing is amplified for Indian startups with U.S. employees or subsidiaries. The Internal Revenue Service (IRS) requires a defensible 409A valuation for such cases, and failure to comply can expose employees to heavy tax penalties. By obtaining a proper 409A valuation, Indian companies demonstrate both regulatory compliance and employee-centric responsibility, making their ESOP offerings more attractive in a competitive global talent market.

5. Ensures Legal and Tax Compliance

For companies with global aspirations, particularly Indian startups employing U.S. citizens or operating U.S. subsidiaries, compliance with IRS Section 409A is non-negotiable. The regulation mandates that deferred compensation plans, including ESOPs, must be based on a defensible and independent valuation of the company’s common stock. Failure to adhere to this requirement can expose both the company and its employees to severe tax consequences, including immediate income recognition, additional tax liabilities, and penalty charges.

A properly conducted 409A valuation helps companies steer clear of these risks by establishing a safe harbor. Employees can then participate in ESOPs without fear of unexpected tax burdens, while companies shield themselves from regulatory disputes and reputational damage. Beyond the U.S. framework, Indian startups must also ensure that their cross-border equity structures comply with domestic reporting obligations. Accurate valuation supports the preparation of financial statements, disclosures to regulators, and compliance with the Foreign Exchange Management Act (FEMA) when dealing with foreign employees or subsidiaries.

In this way, a 409A valuation not only fulfills international legal standards but also strengthens a company’s compliance posture at home, giving it the regulatory clarity needed to focus on growth and global expansion.

6. Builds Employee Trust Through Transparency

Trust is one of the most valuable currencies in employee retention, and a 409A valuation provides exactly that. By engaging an independent, third-party appraiser, companies ensure that ESOPs are priced fairly and impartially, free from internal biases or manipulation. This independence signals to employees that their equity compensation is grounded in reality, not inflated promises.

Transparency in valuation goes a long way in reassuring employees that the wealth they are building through ESOPs is both legitimate and sustainable. When employees understand that their stock options are tied to a credible market value, they develop confidence in the company’s governance practices. This sense of fairness not only boosts morale but also fosters long-term loyalty, reducing the likelihood of attrition.

In a competitive market where skilled professionals often weigh offers from multiple employers, such transparency becomes a differentiating factor. Employees are more inclined to stay with companies where they feel their contributions are rewarded through equity schemes they can trust—making the 409A valuation a powerful driver of retention.

7. Maintains Investor Confidence and Fundraising Potential

- For startups, credibility with investors is as critical as credibility with employees. During due diligence, venture capitalists and institutional investors closely review whether a company has adhered to 409A compliance when issuing stock options. A defensible valuation signals financial discipline, governance maturity, and readiness for future funding rounds. Conversely, lapses in compliance raise red flags, potentially delaying or derailing investment negotiations

- A strong 409A valuation therefore operates on two levels. For investors, it demonstrates that the company is managing equity responsibly and mitigating potential risks that could surface post-investment. For employees, it reinforces the perception that their ESOPs are tied to a business that is not only growing but also respected by external stakeholders. Knowing that their equity has value in the eyes of both regulators and investors enhances the attractiveness of staying on board.

- Ultimately, adherence to 409A valuation standards strengthens a company’s fundraising potential while simultaneously boosting employee confidence in the long-term value of their stock options.

8. Prevents Talent Flight by Avoiding Penalties and Disputes

Improperly priced ESOPs expose employees to significant risks. If options are granted at a strike price below the fair market value without a valid 409A valuation, employees could face severe tax penalties when exercising their stock. These financial shocks not only erode trust but also create resentment, undermining the very retention goals ESOPs are meant to achieve.

In addition to personal tax burdens, disputes may arise between employees and employers over the fairness or legality of equity grants. Such conflicts can damage morale, tarnish the company’s reputation, and prompt valuable team members to seek more secure opportunities elsewhere.

A properly conducted 409A valuation provides “safe harbor” protection by ensuring that ESOPs comply with IRS standards. Employees can participate with confidence, knowing they are safeguarded against unexpected penalties. For companies, this safe harbor not only reduces legal risk but also serves as a retention shield, helping preserve their talent base in an increasingly competitive market.

9. The Broader Retention Advantage of a Sound 409A Valuation

When viewed in isolation, each aspect of a 409A valuation—fair strike price, compliance, transparency, and investor confidence—adds value. But collectively, they create a powerful ecosystem that directly supports employee retention. By ensuring fairness, minimizing risks, and reinforcing trust, a sound valuation transforms ESOPs from a mere financial instrument into a long-term wealth-building opportunity.

Employees who perceive their stock options as legitimate, defensible, and valuable are more likely to commit to the company’s vision. Instead of viewing ESOPs as speculative promises, they begin to regard them as part of a tangible financial future. This shift in perception reduces attrition, particularly in a competitive market where skilled professionals are constantly courted by alternative opportunities.

In essence, a robust 409A valuation doesn’t just protect companies from legal and financial pitfalls; it also strengthens the psychological contract between employer and employee. For Indian startups aiming to compete globally, this retention advantage can be the deciding factor in building a stable, motivated, and loyal workforce.

10. Challenges and Misconceptions Indian Startups Face

Despite its growing relevance, many Indian startups still harbor misconceptions about 409A valuations. One common misunderstanding is that 409A rules apply only to U.S.-incorporated entities. In reality, any Indian company employing U.S. citizens or offering stock options through a U.S. subsidiary must adhere to IRS standards. Ignoring this can result in significant compliance failures.

Another challenge arises from underestimating the global compliance risks associated with cross-border employment. Startups expanding abroad may focus heavily on fundraising or market entry but overlook the legal and tax complexities of issuing ESOPs internationally. This oversight can lead to employee dissatisfaction, regulatory scrutiny, and even reputational harm.

Finally, some companies believe that conducting an internal valuation is sufficient for determining the strike price of stock options. However, IRS guidelines require an independent, third-party appraisal to establish safe harbor protection. Relying on internal calculations not only fails to meet regulatory standards but also undermines the trust of both employees and investors.

Addressing these misconceptions is critical. Startups that take 409A valuations seriously not only safeguard compliance but also enhance their credibility as responsible employers capable of managing global equity programs effectively.

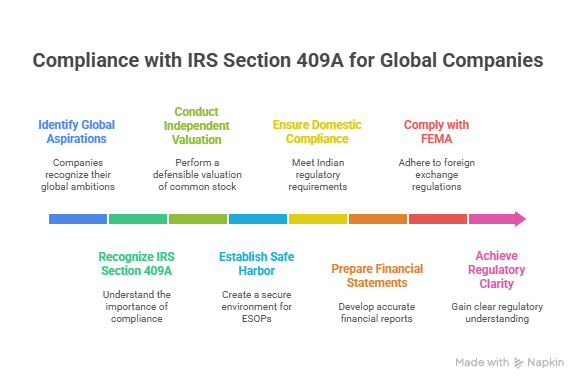

11. Practical Steps for Indian Startups Implementing 409A Valuations

For Indian startups with global ambitions, implementing a 409A valuation is not as complex as it may initially seem. The key lies in timing, choosing the right experts, and maintaining consistency.

- When to get a 409A valuation

The ideal time is before issuing ESOPs to U.S.-based employees or global hires. Beyond that, a valuation should be conducted at least annually, or sooner if there is a material event such as a new fundraising round, significant change in business model, acquisition, or any event that materially alters the company’s fair market value (FMV).

- Who should conduct it

IRS guidelines make it clear: an independent third-party valuation is required to establish safe harbor. For Indian startups, this typically means working with registered valuers or specialized independent firms experienced in cross-border ESOP and 409A valuations. Their expertise ensures that the strike price is defensible, transparent, and compliant with both U.S. and Indian requirements.

- How often to update it

Best practice is to refresh the valuation every 12 months, even in the absence of material changes. This not only ensures compliance but also reassures employees and investors that the ESOP program remains fair, current, and aligned with the company’s true market position.

By institutionalizing this process, startups can avoid last-minute scrambles and instead build a culture of discipline and foresight

12. Conclusion

A 409A valuation may appear, at first glance, to be a compliance checkbox. But in reality, it is a strategic lever that touches every dimension of a startup’s growth journey—setting a fair strike price, ensuring compliance, building trust, boosting investor confidence, and preventing talent disputes.

For Indian startups, especially those aspiring to tap into U.S. markets and attract global talent, a robust 409A valuation is not optional—it is essential. More than just a legal requirement, it acts as a foundation for retention, transparency, and long-term credibility.

As India’s startup ecosystem continues to scale globally, founders must view 409A valuations as an investment in trust and growth, not as a cost of compliance. Prioritizing professional valuations today will pay dividends tomorrow—in employee loyalty, investor backing, and sustained competitiveness.

The takeaway: If your startup is eyeing international markets and planning to issue ESOPs beyond India, securing a professional 409A valuation is one of the smartest moves you can make to safeguard your business and strengthen your workforce.

FAQs

1. What is a 409A valuation and why is it important for startups?

A 409A valuation determines the fair market value (FMV) of a private company’s common stock. It is crucial for startups offering ESOPs to ensure fair strike pricing, legal compliance, and to avoid IRS penalties.

2. How does a 409A valuation impact employee retention?

Accurate 409A valuations build transparency and trust by ensuring fair ESOP pricing. Employees feel valued and confident in their equity rewards, improving morale and long-term retention.

3. Do Indian startups need a 409A valuation?

Yes. Indian startups employing U.S. citizens or planning U.S. expansion must comply with IRS Section 409A. Even otherwise, conducting a 409A valuation demonstrates professionalism, governance, and investor readiness.

4. How often should a company update its 409A valuation?

A 409A valuation should be updated annually or whenever there’s a material change—such as a new funding round, acquisition, or significant financial shift—to maintain compliance and safe harbor protection.

5. Who can perform a 409A valuation for Indian startups?

A qualified, independent third-party valuer or valuation firm registered under relevant Indian or U.S. guidelines should conduct it. Using an external expert ensures credibility, accuracy, and defensible documentation.