In the Indian taxation landscape, valuation reports play a crucial role in ensuring compliance under the Income Tax Act, 1961. These reports, prepared by qualified professionals such as Registered Valuers and Merchant Bankers, provide an authoritative determination of the Fair Market Value (FMV) of shares, assets, or business undertakings. An accurate valuation report is crucial for preventing tax evasion, accurately computing capital gains, and avoiding disputes with tax authorities.

For businesses engaged in share transactions, asset transfers, restructuring, or receipt of shares, awareness of the specific Income Tax Act sections mandating valuation reports is essential. This guide unpacks the key sections where valuation reports are legally required, detailing their purpose, the circumstances triggering valuation, and the professional standards expected. Understanding these provisions not only ensures regulatory compliance but also safeguards businesses from penalties and litigation.

In this comprehensive blog, we will explore the prominent sections of the Income Tax Act that require valuation reports, supported by practical examples and the valuation methodologies prescribed by law. Whether you are a startup founder, an established company, or a tax professional, this guide aims to clarify the critical nexus between tax law and valuation in the Indian business context.

Table of Contents

ToggleOverview of Valuation Report Requirements under the Income Tax Act

The Income Tax Act, 1961, while primarily focused on the assessment and collection of taxes, incorporates several provisions that mandate valuation of assets and shares for accurate tax computation. These valuation requirements are not merely procedural formalities but serve as a robust mechanism to curb tax evasion through under-reporting of income or capital gains.

At the core of these provisions lies the concept of Fair Market Value (FMV) — defined as the price at which an asset would change hands between a willing buyer and a willing seller, neither under compulsion, and both having reasonable knowledge of relevant facts. Determining FMV becomes crucial in scenarios such as the transfer of unquoted shares, gifts of assets, slump sales, or conversion of inventory into capital assets.

The law prescribes that valuation reports must be prepared by qualified professionals — typically Registered Valuers for tangible and intangible assets under most sections, and Merchant Bankers for share valuations in certain contexts such as Employee Stock Ownership Plans (ESOPs) or receipt of shares without adequate consideration.

Failure to comply with these valuation requirements can lead to tax assessments based on deemed FMV by tax authorities, resulting in higher tax liabilities and possible penalties. Moreover, disputed valuations can attract scrutiny under Section 55A, empowering tax authorities to appoint valuation officers for re-assessment.

This section serves as the foundation for understanding the detailed application of valuation reports in the subsequent sections of this blog, where we will examine the specific Income Tax Act sections with mandated valuation obligations.

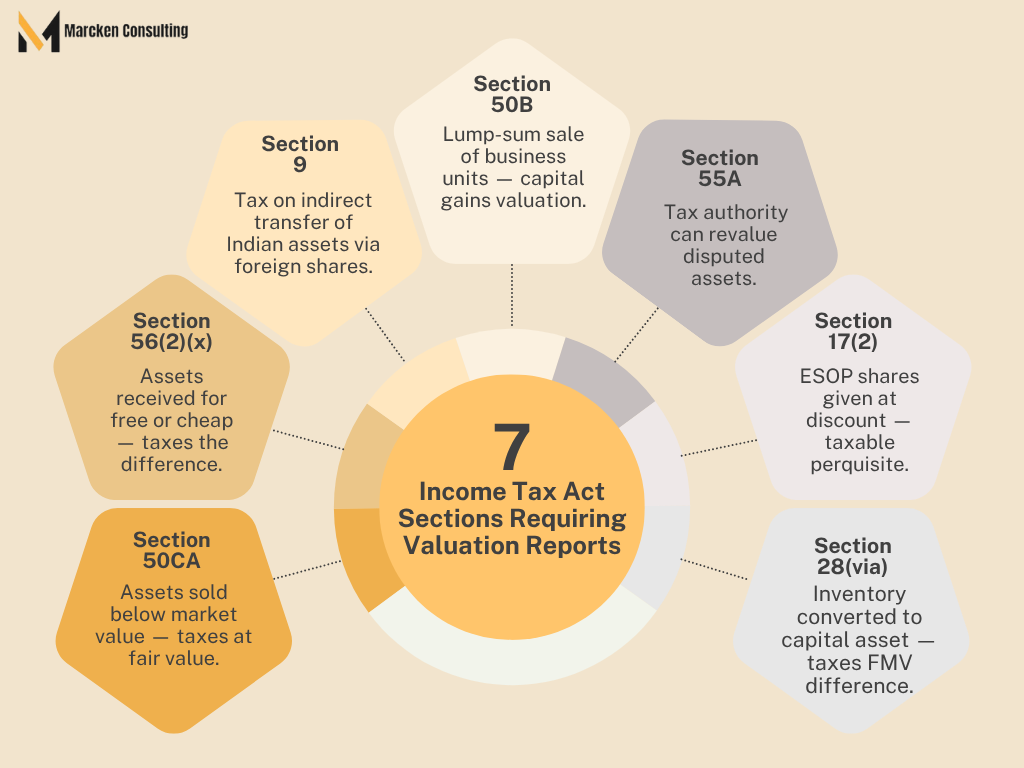

Sections of the Income Tax Act Requiring Valuation Reports

1. Section 50CA – Transfer of Unquoted Shares Below Fair Market Value

Section 50CA of the Income Tax Act, 1961, was introduced to plug a common tax avoidance route—transferring unquoted shares at prices lower than their fair market value (FMV) to reduce capital gains tax liability. This section ensures that capital gains are computed based on the FMV rather than the actual sale consideration in such transactions.

When It Applies

This section is triggered when:

- A taxpayer transfers unquoted shares (i.e., shares not listed on any recognized stock exchange in India),

- The sale consideration received is less than the FMV, and

The transaction is not covered under any exempt category, such as in certain court-approved amalgamations or demergers.

Legal Provision

According to Section 50CA:

“Where the consideration received or accruing as a result of the transfer by an assessee of a capital asset, being share of a company other than a quoted share, is less than the fair market value of such share determined in the prescribed manner, the value so determined shall be deemed to be the full value of consideration.”

In other words, the FMV becomes the sale value for tax purposes, even if the actual price received is lower.

Illustrative Example

- You sell unquoted shares of XYZ Pvt Ltd for ₹7 lakh.

- However, FMV as per the valuation report is ₹10 lakh.

Under Section 50CA, the Income Tax Department will calculate capital gains on ₹10 lakh, not ₹7 lakh.

Who Can Issue the Valuation Report:

- As per Rule 11UA of the Income Tax Rules, the FMV of unquoted equity shares must be determined by:

- A Registered Valuer (for NAV method), or

- A Merchant Banker (for DCF method).

- A Registered Valuer (for NAV method), or

Note: Although Rule 11UA permits both methods, the Discounted Cash Flow (DCF) method is commonly preferred when shares have future growth potential or in startups.

Why It Matters for Businesses:

- Startups raising funds through private placements or internal shareholder transfers must carefully evaluate FMV to avoid Section 50CA implications.

- M&A transactions involving unlisted companies often attract scrutiny under this section.

- Non-compliance or undervaluation can lead to hefty tax assessments, penalties, and even litigation.

Compliance Tip:

Engage a SEBI-registered Merchant Banker or IBBI-recognised Registered Valuer for a defensible FMV report, especially when dealing with high-value or sensitive transactions.

2. Section 56(2)(x) – Tax on Receipt of Assets Without Adequate Consideration

Section 56(2)(x) is one of the most frequently invoked anti-abuse provisions in Indian tax law. It is designed to tax the recipient of certain assets — including shares, property, or other specified assets — when they are received either for free or at a price below their Fair Market Value (FMV).

When It Applies

This section kicks in when a person or entity receives the following from any person:

- Movable property (e.g., shares, jewelry, artwork) without consideration and the FMV exceeds ₹50,000, or

- Movable property for consideration less than FMV, and the difference exceeds ₹50,000, or

- Immovable property (e.g., land or building) either without or below FMV, and the shortfall exceeds specified thresholds.

This applies to:

- Companies, LLPs, partnerships, HUFs, and individuals

- Especially during funding rounds, restructuring, or inter-group transfers

Important Exception: Transactions between relatives or during inheritance, mergers, demergers, and other specified restructuring are not taxable under this section.

Illustrative Example:

Let’s say:

- A startup founder receives shares in their own company at ₹50/share

- The FMV of those shares (determined by a Merchant Banker using DCF) is ₹100/share

- The ₹50 difference per share is considered “income from other sources” and taxed accordingly

So, if 10,000 such shares are received:

- Taxable income = ₹50 x 10,000 = ₹5,00,000

Valuation Requirements:

- FMV must be computed as per Rule 11UA, and the method depends on the type of asset.

- For unquoted equity shares:

- FMV is determined by a Merchant Banker or Chartered Accountant using the Discounted Cash Flow (DCF) or Net Asset Value (NAV) method.

- FMV is determined by a Merchant Banker or Chartered Accountant using the Discounted Cash Flow (DCF) or Net Asset Value (NAV) method.

- For other assets like property or jewelry, FMV is derived via standard market valuation by a Registered Valuer.

Why It Matters for Businesses:

- Startups are heavily impacted during angel or seed funding rounds. If shares are issued to investors or promoters below FMV, the shortfall can become taxable income under Section 56(2)(x).

- In group restructurings or inter-company share transfers, this provision may unexpectedly trigger taxation unless transactions are structured within permissible exemptions.

- Foreign investors and VC firms must also be aware of these rules to avoid complications with Indian tax authorities.

Compliance Tip

Always obtain a formal FMV report from a SEBI-registered Merchant Banker (preferred for share valuations) or Registered Valuer well in advance of executing transactions that could fall under Section 56(2)(x). Also, keep documentation explaining the commercial rationale of the pricing.

3. Section 9 – Indirect Transfer of Indian Assets

Section 9(1)(i) of the Income Tax Act, 1961 deals with “Income deemed to accrue or arise in India.” In simpler terms, it allows the Indian tax authorities to tax capital gains arising from the indirect transfer of Indian assets, even if the transaction takes place entirely outside India.

This provision gained global attention after the landmark Vodafone case, leading to retrospective amendments in the law to close loopholes.

When It Applies

This section applies when:

- A foreign entity (say, located in Mauritius or Singapore) owns assets in India (e.g., a subsidiary, real estate, or business operation).

- Shares of the foreign entity itself are transferred, and the underlying value is substantially derived from assets located in India.

The Income Tax Department can tax the gains from such transfers in India.

Threshold Condition: The Indian asset(s) must contribute at least 50% of the fair market value (FMV) of the foreign entity’s total assets.

Monetary Limit: The value of Indian assets must exceed ₹10 crore.

Illustrative Example:

- A Singapore-based holding company owns 100% of an Indian tech firm.

- If that Singapore entity is sold for ₹100 crore and the Indian subsidiary contributes ₹80 crore of that value, Section 9 is triggered.

- The gains from the sale are deemed to arise in India and are taxable under Indian tax law.

x

Valuation Requirements:

- FMV of Indian and global assets must be determined as per Rule 11UB of the Income Tax Rules.

- The valuation must be conducted by a Registered Valuer, often involving a comprehensive financial model and market-based approach.

- The valuation report must classify:

- Value of Indian assets

- Total global asset value

- Percentage contribution of Indian assets to global value

- Value of Indian assets

Why It Matters for Businesses:

- Especially relevant for startups with foreign holding companies, multinational corporate structures, or foreign private equity deals.

- Can lead to double taxation if not managed carefully with tax treaties or valuation-based exemptions.

- Adds a layer of complexity to cross-border M&A transactions and exit planning.

Compliance Tip

Businesses and investors involved in global structuring should:

- Obtain a professional valuation report from a Registered Valuer outlining the FMV of Indian assets.

- Assess whether Section 9 will apply before any offshore share sale is undertaken.

- Review Double Taxation Avoidance Agreements (DTAAs) to explore relief mechanisms.

4. Section 50B – Slump Sale Valuation

Section 50B of the Income Tax Act governs the taxation of slump sales—the sale of an entire business undertaking or division as a going concern, for a lump-sum amount, without assigning individual values to assets or liabilities.

This provision ensures that the capital gains from such a transaction are properly computed and taxed.

When It Applies

A slump sale occurs when:

A business sells a complete undertaking, rather than individual assets.

The transfer is made for a single consolidated price, without separate valuation of each asset/liability.

Section 50B treats such transactions as transfer of capital assets, and capital gains are computed as the difference between the sale consideration and the net worth of the undertaking.

Illustrative Example:

A manufacturing company sells its entire textile division—including machinery, inventory, receivables, and liabilities—for ₹50 crore. No asset-wise price is assigned.

If the net worth of the division (assets minus liabilities) is ₹30 crore, the capital gain is ₹20 crore, taxable under Section 50B.

Valuation Requirements:

- Mandatory Net Worth Computation:

The seller must compute net worth using the book values of all assets and liabilities (excluding revaluation reserves). - Registered Valuer’s Report Recommended/Required:

Although not explicitly mandated by the section, obtaining a valuation report from a Registered Valuer is highly recommended and often requested during scrutiny or M&A due diligence.

Valuation Includes:

- Tangible assets: land, building, machinery, etc.

- Intangible assets: goodwill, licenses, brand name

- Liabilities: loans, creditors, outstanding dues

The Auditor’s report in Form 3CEA is also required to support the slump sale transaction.- Mandatory Net Worth Computation:

Why It Matters for Businesses:

- Slump sales are common in corporate restructuring, strategic disinvestment, and group consolidation.

- Improper valuation can result in capital gains understatement, tax disputes, or deal delays.

- An accurate and professional valuation ensures regulatory compliance, and also supports transaction pricing during negotiation.

Compliance Tip

Before executing a slump sale:

- Engage a Registered Valuer to compute and document net worth.

- Ensure Form 3CEA is filed by a qualified professional.

- Avoid using revalued asset figures—only book values are permissible for computing net worth under Section 50B.

5. Section 55A – Reference to Valuation Officer

Section 55A of the Income Tax Act empowers the Assessing Officer (AO) to refer a case to a Valuation Officer when there is doubt about the correctness of the value of a capital asset declared by the assessee.

It acts as a safeguard for revenue authorities to re-examine fair market value (FMV) when a taxpayer reports an unusually low or high value for assets involved in a taxable transaction.

When It Applies

This section applies primarily during scrutiny assessments, when:

- The AO believes the value of a capital asset declared in the return of income is less than its fair market value.

- The taxpayer has claimed an inflated cost of acquisition or undervalued sale consideration for capital gain computation.

- There’s a significant difference between the transaction value and the stamp duty value or market benchmarks.

Illustrative Example:

Suppose a taxpayer sells a commercial property for ₹2 crore but the stamp duty valuation is ₹3 crore. If the taxpayer reports capital gains based on the ₹2 crore figure, the AO can refer the property to a Departmental Valuation Officer (DVO) for independent valuation under Section 55A.

If the DVO confirms a higher FMV, capital gains will be recalculated, and tax will be levied on the adjusted amount.

Valuation Requirements:

The DVO, appointed by the Income Tax Department, will assess FMV based on:

- Prevailing market rates,

- Comparable transactions,

- Physical inspection (in some cases),

The DVO submits a valuation report which becomes part of the assessment proceedings.Other accepted valuation methodologies.

- Prevailing market rates,

Important Note:

This section is typically invoked in conjunction with other sections, such as:

- Section 50C (deeming provision for real estate transactions)

- Section 48 (capital gains computation)

- Section 55 (cost of improvement/cost of acquisition)

Why It Matters for Businesses and Investors:

- It affects those selling real estate, shares, or other capital assets.

- Taxpayers declaring low asset values or high cost bases are vulnerable to a DVO referral.

- A discrepancy in valuation can lead to additional tax demand, interest, and even penalties.

Compliance Tip

- Ensure valuation reports used in capital gain computation are accurate, defensible, and prepared by Registered Valuers.

- During real estate or share transactions, if there’s a risk of valuation being challenged, proactively obtain a detailed FMV report to strengthen your case.

- In scrutiny cases, cooperate with the DVO and provide complete documentation to avoid unfavorable assumptions.

6. Section 17(2) – ESOP Taxation as Perquisite Income

Section 17(2) of the Income Tax Act includes Employee Stock Option Plans (ESOPs) as part of “perquisite income” under the head Salaries. When an employee receives shares at a price lower than the Fair Market Value (FMV), the difference is taxed as a perquisite in the year the option is exercised.

This taxation applies irrespective of whether the company is listed or unlisted and is aimed at capturing the economic benefit received by employees through stock-based compensation.

When It Applies

- At the time of exercise of ESOPs (i.e., when shares are allotted, not when options are granted).

- The employer either allots or transfers shares to the employee at a concessional rate or for free.

- The company may be a startup, private limited company, or listed firm, both Indian or foreign.

Illustrative Example:

An employee of an Indian startup is granted 1,000 ESOPs at ₹100 each. On the date of exercise, the FMV is ₹150 per share.

- Perquisite Value: ₹50 x 1,000 = ₹50,000

- This ₹50,000 is taxed as salary income in the hands of the employee.

- The employer must deduct TDS on this perquisite value.

For eligible startups (as per DPIIT notification), tax on ESOPs can be deferred for up to 48 months, but this requires specific compliance.

Valuation Requirements:

For Unlisted Companies:

FMV must be certified by a Category I Merchant Banker (not a Chartered Accountant). The valuation must:

- Be performed on the date of exercise.

- Use either the Discounted Cash Flow (DCF) method or Net Asset Value (NAV) method.

- Be performed on the date of exercise.

For Listed Companies:

FMV is based on the average of opening and closing prices of the shares on the stock exchange on the exercise date.

Why It Matters for Startups and Growing Companies:

- ESOPs are a common tool for retaining and incentivizing talent, especially in startups that can’t offer large cash salaries.

- Mismanagement of ESOP taxation can lead to:

- TDS defaults by the employer.

- Tax notices to employees.

- Compromised goodwill among employees.

- TDS defaults by the employer.

Compliance Tip

- Always obtain a Merchant Banker valuation report on the date of exercise.

- For eligible startups, ensure timely Form 12BA and Form 16 compliance, and understand the tax deferment option under Section 192.

- Educate employees about the tax implications and keep them informed about valuation dates and liabilities.

7. Section 28(via) – Conversion of Inventory into Capital Asset

Section 28(via) was introduced by the Finance Act, 2018 to tax the conversion of inventory into a capital asset. When a business reclassifies an item from inventory (held for sale in the ordinary course of business) into a capital asset (held for investment or long-term appreciation), the law treats this as a taxable event, even though no actual sale has occurred.

When It Applies

- A business converts or treats stock-in-trade as a capital asset.

- Common in real estate, manufacturing, and trading businesses, where land, machinery, or inventory is moved into the books as capital assets.

Illustrative Example:

A real estate developer holds a plot of land as inventory (stock-in-trade) with a book value of ₹5 crore. If the land is reclassified as a capital asset for long-term investment, and the FMV on the date of conversion is ₹8 crore, then:

- ₹8 crore (FMV) – ₹5 crore (book value) = ₹3 crore

- This ₹3 crore is taxed as business income under Section 28(via) in the year of conversion.

When the capital asset is eventually sold:

- Capital gains will be computed using the FMV on the date of conversion as the cost of acquisition and the date of conversion as the starting point for the holding period.

Valuation Requirements:

- FMV must be determined on the date of conversion.

- Valuation must be done by a Registered Valuer, typically using:

- Market Comparable Method (MCM) or

- Land Valuation Index (for land),

- Cost Approach or Income Approach (for other assets).

- Market Comparable Method (MCM) or

This valuation must be defensible and documented for scrutiny during assessments.

Implications for Business Strategy:

- Helps in accurate tax reporting during inventory reclassification.

- Essential in corporate restructuring, where companies shift assets for long-term use or for conversion into subsidiaries, SPVs, or joint ventures.

- Offers capital gain benefits on future sale, especially in rising markets—provided proper valuation is done.

Final Summary Table: Snapshot of All Sections Requiring Valuation Reports

Section | Transaction Scenario | Valuation Required By | Key Purpose |

50CA | Sale of unquoted shares below FMV | Registered Valuer | Prevent capital gains underreporting |

56(2)(x) | Receiving shares/assets at discount | Merchant Banker / CA | Taxation on undervalued receipts |

9 | Indirect transfer of Indian assets | Registered Valuer | Tax cross-border transfers of Indian value |

50B | Slump sale of a business undertaking | Registered Valuer | Compute capital gains on business sale |

55A | FMV dispute by Assessing Officer | Department Valuation Officer | Revaluation when AO disputes reported FMV |

17(2) | ESOPs given to employees | Merchant Banker | Tax perquisite income from ESOPs |

28(via) | Inventory converted into a capital asset | Registered Valuer | Tax FMV difference as business income |

Conclusion: Why Professional Valuation Reports Matter

For Indian businesses, valuations under the Income Tax Act are not just about numbers—they are about compliance, clarity, and credibility. Whether you’re planning an ESOP strategy, restructuring your company, or handling cross-border transactions, valuations performed by Registered Valuers or Merchant Bankers are essential to withstand tax scrutiny and optimize financial outcomes.

At Marcken Consulting, we provide:

- Registered Valuation Reports under Rule 11UA

- DCF, NAV, and Market-based approaches

- Compliance support for Sections 50CA, 56(2)(x), 50B, 28(via), and more

- Advisory for ESOP and startup fundraising structures

Need a valuation report for compliance or funding?

Get in touch with our valuation experts at Marcken Consulting for a consultation tailored to your business goals.

Frequently Asked Questions (FAQs)

A valuation report becomes mandatory under several sections of the Income Tax Act, 1961—especially during transactions involving the transfer of unquoted shares, receipt of assets below fair market value (FMV), slump sales, ESOP allotments, and conversion of inventory into capital assets. Compliance is essential to avoid tax disputes and penalties.

Valuation reports must be issued by a Registered Valuer (as per Rule 11UA of the Income Tax Rules) or a SEBI-registered Merchant Banker, depending on the transaction type. For example, ESOPs and startup share issuances often require a Merchant Banker, while asset transfers and slump sales need a Registered Valuer.

Section 50CA applies to the seller of unquoted shares transferred below FMV, ensuring capital gains are not underreported. In contrast, Section 56(2)(x) applies to the recipient, taxing them if they receive shares or property at a price below FMV or without consideration.

FMV is determined based on prescribed methods such as the Discounted Cash Flow (DCF) Method, Net Asset Value (NAV), or Book Value, depending on the asset type and applicable section. The valuation must be performed by qualified professionals and documented with supporting assumptions.

Failure to obtain a proper valuation report can result in:

Tax demand notices

Interest and penalties

Increased scrutiny from the Assessing Officer

Delays in M&A or funding transactions

Businesses must ensure valuations are accurate, defensible, and compliant with income tax provisions.