Table of Contents

ToggleWhy VC Matters for Indian SMEs?

India’s SME sector is the heartbeat of its entrepreneurial economy, contributing nearly 30% to the country’s GDP and employing over 110 million people. But while innovation and ambition are in abundant supply, access to funding often isn’t.

That’s where venture capital (VC) comes into play. VC isn’t just about big-ticket tech startups anymore; it’s increasingly fueling growth in retail, fintech, manufacturing, and sustainability-focused SMEs. India’s VC market crossed $13.7 billion in funding in 2024, reflecting growing investor confidence in scalable, high-potential small and mid-sized businesses.

For SMEs ready to raise external capital, the process can be complex, from preparing a pitch to negotiating term sheets. That’s where expert guidance makes a real difference. At Marcken Consulting, we help businesses become investment-ready with valuation reports, pitch decks, and strategic advice tailored to the VC world.

What Is Venture Capital & Why It’s Right for SMEs

Venture capital is a form of private equity financing where investors provide capital to businesses in exchange for equity ownership, usually in early or growth stages. It’s not a loan; there’s no repayment, but the investor gains a stake and typically seeks a strong return via business growth or exit events like acquisitions or IPOs.

In India, the VC ecosystem has matured to the point where investment cheques can range from ₹3 crore to ₹40 crore, depending on the startup’s traction, scalability, and sector. And importantly, the market sentiment has shifted, profitability and sustainability now outweigh “growth at any cost.” That’s good news for SMEs with strong fundamentals and a clear path to long-term value creation.

But here’s the catch: getting VC attention requires more than a good idea. It demands data-driven projections, industry benchmarking, and compliance-ready documentation. That’s why many of our clients at Marcken Consulting start by preparing a professional valuation report by a Registered Valuer or Merchant Banker, along with a persuasive, investor-aligned pitch deck, all of which we assist with, end to end.

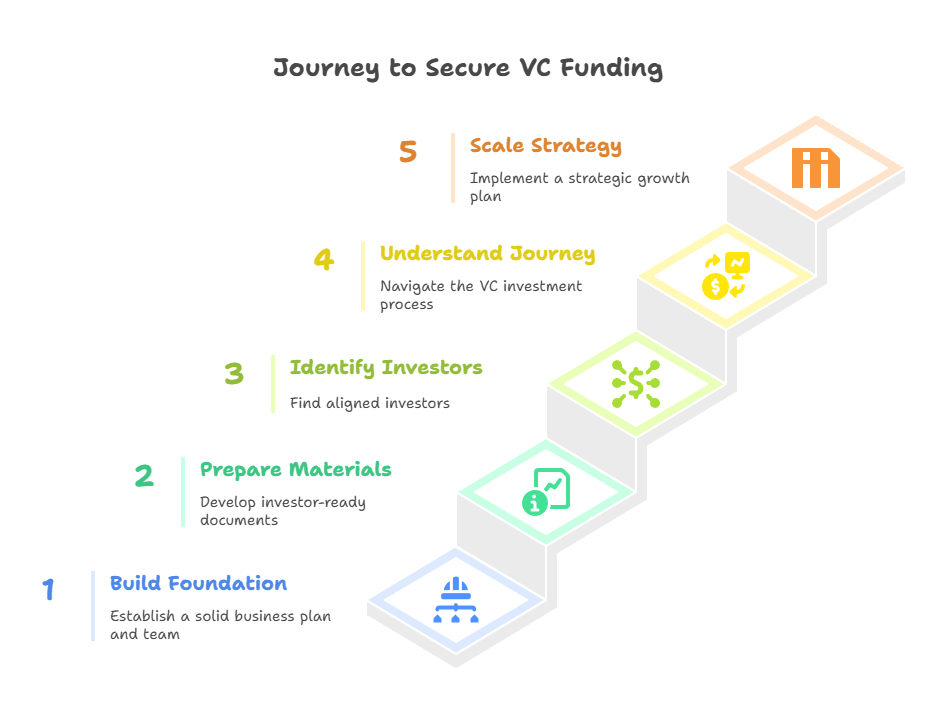

Step-by-Step Guide to Raising VC for Your SME

1. Build a Solid Foundation

Before investors put their money into your business, they want to know you’ve built something real, something sustainable.

Start with a clear, investor-ready business plan. Define your market, competition, pricing, and projected revenues with credible, data-driven assumptions. Your plan isn’t just a document; it’s your business story in numbers.

Next, assemble a high-performance team with a proven track record (or at least deep sector expertise). VCs invest in people before products.

Finally, show traction: paying customers, LOIs, growth metrics, or channel partnerships. These indicators prove your market is listening and buying.

Need inspiration? Even regulated companies like NBFCs require structured planning to raise funds. Here’s how we support that process with our Business Plan for NBFCs—a model many SMEs can learn from.

2. Prepare Investor-Ready Materials

Once your fundamentals are tight, it’s time to get your investor kit in shape.

Start with a killer pitch deck. This should cover the big four: problem, solution, market, and team, with a strong call to action (“We’re raising ₹5 crore for 18 months of runway and GTM expansion”).

Then comes documentation. Investors will eventually request your financial statements, cap table, legal filings, GST returns, and regulatory licenses. Having these ready signals maturity and transparency.

We’ve helped businesses prep investor decks and valuation reports that tick every box—see our Valuation Services for details.

3. Identify & Approach the Right Investors

Not all VCs are built alike. Your job? Find investors who align with your sector, stage, and ambition.

Early-stage VCs love disruption. Growth-stage investors want metrics. Family offices and private equity firms may be more patient, strategic, or even legacy-minded.

Don’t underestimate the power of warm introductions; most VC deals still originate through referrals. Tap your fellow founders to make those intros.

Our advisory team helps startups connect with the right funders based on sector fit and deal appetite, and explore Corporate Advisory services for support.

4. Understand the VC Investment Journey

Getting a “yes” from a VC isn’t a single conversation; it’s a structured funnel. Here’s how it usually flows:

Stage | What Happens |

Deal Sourcing | VCs receive leads via pitch events, referrals, cold emails, and advisors |

Initial Screening | A high-level filter: sector, model, team, and market potential |

Due Diligence | Deep dive into your financials, customer data, compliance, and leadership |

Investment Committee | Partners debate internally and vote on the opportunity |

Term Sheet Negotiation | Equity, valuation, control rights, this is where the deal’s structure takes shape |

Closing | Legal documents signed, funds wired, and the journey begins |

During due diligence, regulatory clarity is key, especially for compliance-heavy sectors. See how we support with NBFC Compliance and Licensing to help startups pass investor scrutiny with confidence.

5. Post-Funding: Scale with Strategy

Congratulations, the money’s in. Now comes the real work, scaling smartly.

VCs bring more than capital. They offer mentorship, board-level insight, hiring help, and access to future investors or acquirers. Use that network.

But in 2025, it’s not about burning fast, it’s about growing lean. Indian VCs today value profit-first playbooks, not vanity metrics.

Planning a strategic exit or next-stage raise? We assist VC-backed companies with IPO readiness; learn more about our SME IPO Services to set up your next chapter.

Government Support for VC-Backed SMEs

India isn’t leaving its SMEs behind. If you’re building with impact, the government is backing your hustle.

SIDBI Venture Capital Limited offers sector-specific funds targeted at growth-stage SMEs, often in manufacturing, green tech, and deep tech.

Then there’s the Self-Reliant India (SRI) Fund, a ₹50,000 crore initiative administered via NSIC Venture Capital Fund Limited. It supports equity investments in MSMEs through aligned VC and PE channels.

Eligibility varies, but typically you’ll need a strong compliance record, sectoral relevance, and a clear business model.

Government programs like the SRI Fund can be pivotal; our experts simplify the process with end-to-end advisory, from eligibility check to documentation and pitch positioning.

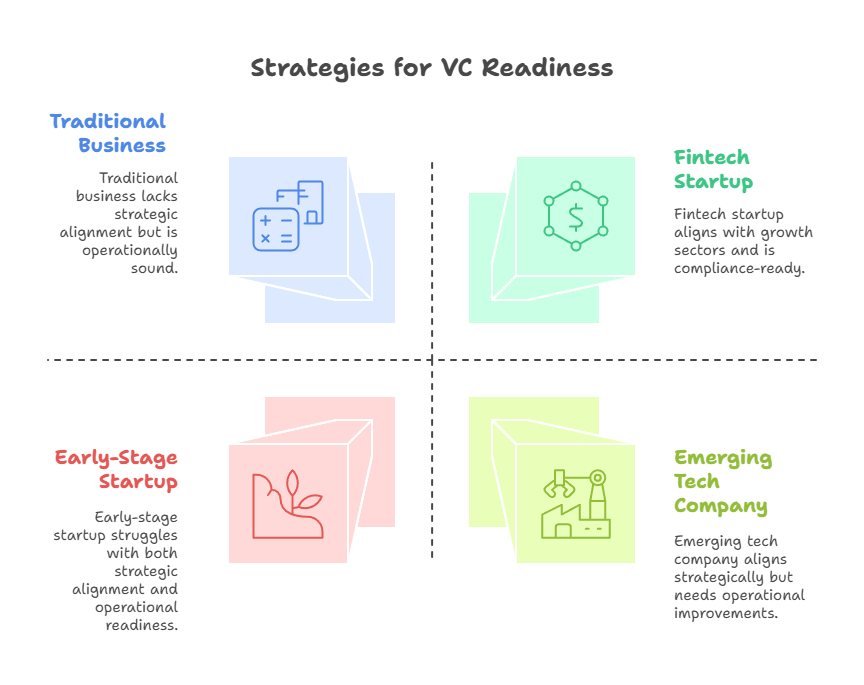

Tips to Increase Your VC Readiness

If you want venture capitalists to take you seriously, you need to show you understand the game and are built to win. Here are a few ways to tilt the odds in your favour:

- Align with growth sectors. Indian VCs are betting big on verticals like fintech, agritech, edtech, EV infrastructure, and SaaS. If you’re operating in or adjacent to these areas, position your offering within current market tailwinds.

- Build a path to profitability. Gone are the days of “burn now, earn never.” VCs now want to see how your business will reach cash flow positivity, without relying on endless funding rounds.

- Stay updated on regulatory changes. India’s startup environment is evolving rapidly, with updates like angel tax reforms, faster startup redomiciling, and ease of doing business initiatives. These impact your fundraising potential and investor perception.

One last (but critical) tip: ensure your company is compliance-ready before entering talks. From licensing to financial disclosures, the cleaner your records, the faster your funding.

Conclusion: Future-Proofing Your SME with Smart Capital

Venture capital can be a game-changer for SMEs ready to scale, but only if approached with clarity, discipline, and the right support.

The process isn’t just about raising money, it’s about raising your standards. VCs don’t just fund growth; they amplify it. But they’ll only invest in businesses that are focused, structured, and future-ready.

So take your time. Build something that lasts. And when you’re ready to pitch, do it with power, precision, and purpose.

🚀 Ready to unlock capital? Marcken Consulting is your partner from pitch deck to funding close.

Frequently Asked Questions (FAQs)

To attract VC funding, SMEs must have a strong business model, a scalable product or service, and some traction (revenue, users, or partnerships). A solid team and a professional valuation report also strengthen your pitch.

It varies, but most SMEs part with 15%–30% equity in early-stage VC deals. The exact percentage depends on your valuation, the amount raised, and how investor-friendly your terms are.

Yes. Government initiatives like the SRI Fund and SIDBI Venture Capital offer equity-based funding support for MSMEs. These funds often co-invest with private VCs and support sector-focused growth.

Typically, 2 to 6 months, depending on deal complexity. This includes pitching, due diligence, negotiations, and legal formalities. Getting investor-ready in advance helps reduce delays.

Absolutely. Marcken Consulting assists with pitch decks, registered valuer/merchant banker reports, and VC strategy advisory, ensuring you’re fully prepared to engage with investors confidently.