Table of Contents

ToggleWhy Financial Reporting & Compliance Valuation Matters

In the high-stakes world of corporate finance, numbers don’t just talk, they testify. For Indian businesses navigating a globalized marketplace, financial reporting and compliance valuation have evolved from statutory formality to strategic necessity. Today’s investors, regulators, and stakeholders demand more than clean books; they demand clarity, comparability, and credibility.

Enter Ind AS (Indian Accounting Standards), India’s answer to the global call for financial transparency. These standards, aligned with International Financial Reporting Standards (IFRS), ensure that Indian companies present an economic narrative that can be read and trusted worldwide.

But the true game-changer lies in valuation. Whether it’s for M&A activity, equity transactions, or fair value disclosures, a robust Business Valuation Report by a Registered Valuer is now the backbone of financial integrity. Accurate valuation isn’t just about ticking a compliance box; it’s about building confidence in every number on the balance sheet.

As India marches toward greater financial accountability, compliance valuation has become an essential compass, guiding decision-making, managing regulatory risk, and winning investor trust.

India's Financial Reporting Framework: Key Pillars

India’s financial reporting framework is a hybrid of global best practices and local statutory nuances, designed to elevate financial disclosures without diluting contextual relevance.

At the heart of this framework are Indian Accounting Standards (Ind AS), a set of accounting guidelines developed by the Institute of Chartered Accountants of India (ICAI) under the oversight of the Accounting Standards Board (ASB) and in consultation with the National Financial Reporting Authority (NFRA). These bodies act as the guardians of consistency, ensuring that financial reporting is both globally aligned and locally enforceable.

Since their phased rollout in 2016, Ind AS has become mandatory for:

- All listed companies, regardless of net worth.

- Unlisted companies with a net worth of ₹250 crore or more;

- Financial institutions, including banks, NBFCs, and insurance firms, are surpassing specified thresholds.

For companies falling under these categories, compliance isn’t optional; it’s embedded into the regulatory fabric. Valuation practices, therefore, must reflect the spirit and specifics of Ind AS standards, particularly in areas such as fair value measurement and impairment testing.

And this is where precision matters. Leveraging a Merchant Banker Valuation Report or a PPA-compliant valuation from a qualified advisor, such as Marcken Consulting, ensures that your financial disclosures withstand both auditor scrutiny and investor analysis.

Want to check the official thresholds and reporting criteria? You can refer directly to the Ministry of Corporate Affairs Valuation Rules for the full legislative context.

The Legal Mandate Behind Valuations

Valuation in India isn’t just good practice; it’s codified in law.

Under Section 247 of the Companies Act, 2013, any valuation of shares, securities, assets, liabilities, or net worth required for regulatory compliance must be conducted by a Registered Valuer. This isn’t a loose recommendation, it’s a statutory commandment.

To be a Registered Valuer, one must:

- Be registered with the Insolvency and Bankruptcy Board of India (IBBI),

- Belong to a recognised RVO (Registered Valuer Organisation),

- Hold the relevant qualification and experience in asset class-specific domains (such as Securities or Land & Building),

- Abide by the Companies (Registered Valuers and Valuation) Rules, 2017, a detailed legislative framework that governs their appointment, conduct, and reporting obligations.

You can verify recognised professionals directly via the ICAI’s official list of Registered Valuers.

Critically, a Registered Valuer must maintain impartiality and independence. That means:

- No direct or indirect interest in the asset or transaction being evaluated,

- Full disclosure of any prior relationship with the client,

- Objective, well-documented methodologies, assumptions, and conclusions.

At Marcken Consulting, our valuation reports for regulatory filings adhere strictly to these mandates, ensuring our clients pass audit reviews with confidence and clarity.

Valuation in Ind AS: Where It’s Required & Why

Valuation is not an appendix to financial reporting; it’s embedded deep into the heart of Ind AS. These standards require fair value measurement and regular reassessments across multiple financial elements to ensure that statements reflect real-world value, not just historical cost.

Here’s a breakdown of where and why valuation is required under Ind AS:

Ind AS Standard | Area of Valuation | Description |

Ind AS 113 | Fair Value Measurement | Establishes the framework for determining fair value using the Market, Income, or Cost approach. Applies across other Ind AS standards. |

Ind AS 36 | Impairment of Assets | Requires testing of assets (including goodwill) for impairment, with valuation based on recoverable amounts. |

Ind AS 103 | Business Combinations | Mandates Purchase Price Allocation (PPA), assigning fair value to acquired assets and liabilities. |

Ind AS 109 / 32 | Financial Instruments | Valuation of financial assets and liabilities at fair value or amortised cost, including derivatives. |

Ind AS 102 | Share-Based Payment | Requires valuation of ESOPs and other equity-based compensation instruments. |

These standards aren’t theoretical; they directly affect your balance sheet. Take, for example, a company undergoing a merger: Ind AS 103 requires a detailed Purchase Price Allocation exercise, including valuation of intangible assets like customer contracts or brand names.

Similarly, companies issuing ESOPs need to file defensible reports under Ind AS 102. That’s where Marcken’s expertise in share-based payment valuation comes into play, delivering reliable valuations that withstand regulatory scrutiny.

Ind AS doesn’t leave room for guesswork, only for precision, defensibility, and compliance.

Valuation Methodologies Explained

Valuation is as much an art as it is a science, but even art has structure.

Ind AS (especially Ind AS 113) prescribes three principal approaches to fair value measurement: Market, Income, and Cost. The choice of method depends on what’s being valued, the purpose of the valuation, and the availability of data.

Market Approach

Best used when:

- Active market data exists for identical or comparable assets/liabilities.

- You’re valuing listed securities, real estate, or assets recently transacted in open markets.

This method reflects what others are paying; ideal for investor-ready companies preparing to file a Registered Valuer Report for compliance or fundraising.

Income Approach

Best used when:

- There are predictable future cash flows.

- You’re valuing startups, brands, IP, or financial instruments with no active market.

Discounted Cash Flow (DCF), the most common variant, is often used for startup valuations, impairment testing, or equity-based compensation analysis.

Cost Approach

Best used when:

- The asset is not income-generating or actively traded.

- You’re valuing tangible assets (like plant & machinery) or internally developed intangibles.

This approach estimates how much it would cost to recreate or replace the asset today.

Regardless of the method, valuation standards call for:

- Maximizing observable inputs (e.g., market quotes, interest rates),

- Minimizing subjective assumptions unless well-supported,

- Documenting all sources, models, and logic behind the final number.

At Marcken Consulting, our valuation experts rigorously evaluate which approach fits your case, not just by the textbook, but in context. After all, one size doesn’t fit all—but precision always fits purpose.

Compliance Protocols: Best Practices for Reporting

A valuation report is only as good as the confidence it inspires. That confidence comes from compliance with not just the letter, but the spirit of regulatory expectations.

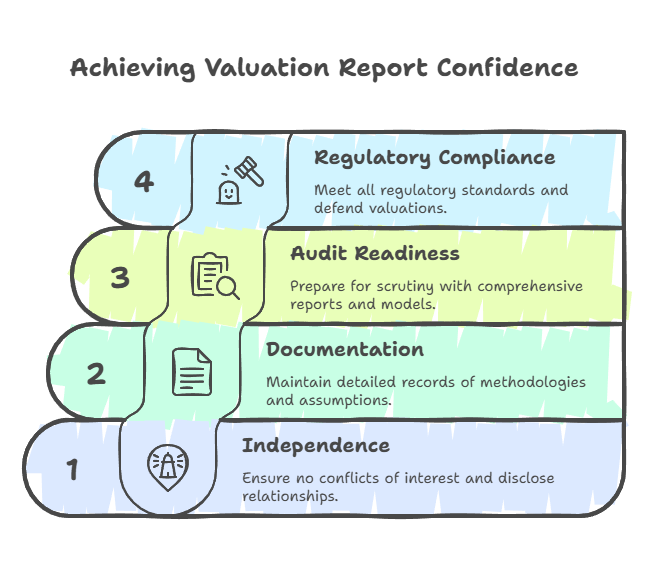

Independence Is Non-Negotiable

Registered Valuers and Merchant Bankers must:

- Have no direct or indirect interest in the asset or entity being valued,

- Disclose any past or present relationship with the client,

- Provide a signed declaration of independence in every report.

Documentation Standards That Stand Up to Scrutiny

Every credible valuation must include:

- Methodologies used and their justification,

- Assumptions made (e.g., growth rates, beta values),

- Adjustments applied (like Discount for Lack of Marketability (DLOM) or Minority Interest Discounts),

- Source data and observable inputs.

For example, our Merchant Banker Valuation Reports include detailed annexures, working papers, and valuation models that meet both audit and regulatory review standards.

Built for Audits, Ready for Regulators

With increasing scrutiny by auditors, tax officers, and regulators (including SEBI and RBI), it’s not enough to “arrive at a number.” You need to defend it, document it, and stand by it.

That’s why Marcken Consulting goes beyond just preparing reports; we prepare our clients for due diligence, audit queries, and investor Q&As, helping them stay compliant while projecting financial credibility.

For additional clarity on how valuation practices are governed, you can refer to the official Companies (Registered Valuers and Valuation) Rules.

Practical Challenges and Strategic Solutions

Let’s be clear: Valuation is rarely black and white. It lives in the grey, where assumptions meet estimates, and judgment guides methodology. For Indian businesses, navigating this uncertainty is both an art and a regulatory necessity.

The Subjectivity Challenge

From selecting the right discount rate to estimating terminal growth, valuation involves judgment calls. The margin for error can be narrow, but the impact on compliance is massive. That’s why firms must lean on valuation advisors who not only know the math but also the mind of regulators and auditors.

At Marcken Consulting, we use scenario testing and sensitivity analysis to validate assumptions, offering our clients a defensible valuation, not just a number on a spreadsheet.

Consistency Across Reporting Periods

Switching valuation methods or tweaking assumptions without proper disclosure raises red flags with auditors and investors alike. Consistency isn’t just about compliance, it’s about trust.

Our team ensures methodological consistency year-over-year while adapting to new data, ensuring your valuation reports align with both Ind AS and market conditions.

Aligning with Global Standards

India’s convergence with IFRS gives local companies a global lens, but only if their valuations are framed correctly. Investors in London or Singapore expect clarity, comparability, and narrative cohesion.

By preparing valuations aligned with IFRS principles and global methodologies, our firm helps clients meet the expectations of cross-border investors, PE firms, and IPO-bound audit committees, often by offering both Registered Valuer Reports and Merchant Banker Valuation Reports under one roof.

The Evolving Landscape: What’s Next?

If the past decade was about introducing compliance valuation, the next one is about elevating it.

Upcoming Regulatory Shifts

With increasing economic liberalization and tech penetration, India’s regulatory bodies, especially NFRA, SEBI, and the IBBI, are tightening guidelines around disclosure, independence, and reporting structure.

We expect enhanced:

- Uniform valuation formats for specific use cases,

- Mandatory disclosures of key assumptions,

- Greater accountability for valuations used in Startups, NBFCs, and M&A transactions.

Rise of Valuation Tech and AI Modeling

Gone are the days of Excel-only modeling. AI-powered platforms are enabling faster scenario analysis, automated DCFs, and even real-time updates based on market conditions.

Marcken Consulting stays ahead by integrating smart valuation tools into our process, without losing the human layer that ensures judgment and compliance.

Want a glimpse of how we blend tech with precision? Check out our work in NBFC Due Diligence and Valuation, where turnaround times are short, but expectations are sky-high.

Increased Scrutiny, Tighter Compliance

Auditors are asking harder questions. Regulators are demanding better documentation. Investors are no longer impressed by lofty projections; they want justified, defensible valuations backed by verifiable assumptions.

That’s why we believe the future belongs to valuation specialists who combine regulatory depth, financial acumen, and tech adoption, exactly what we do at Marcken Consulting.

As India steps into a new era of financial integrity, valuation isn’t just a back-office task; it’s a front-page headline. Make sure your reports are written to impress not just regulators, but the markets you serve.

Conclusion: Building Trust Through Transparency

In an era where corporate credibility is currency, accurate and compliant valuation has become more than just a financial requirement; it’s a strategic advantage.

Whether you’re reporting fair value under Ind AS, testing impairment, issuing ESOPs, or preparing for an IPO, the clarity and integrity of your numbers define how the market sees you. This is where valuation, done right, by the right professionals, becomes indispensable.

At Marcken Consulting, we blend regulatory expertise, financial precision, and technology-enabled insights to deliver valuation reports that not only meet compliance standards but also instill confidence across boards, auditors, and regulators.

The future of financial reporting in India will be shaped by:

- Valuation professionals who understand both law and logic,

- Auditors and CFOs who demand accountability and structure,

- And technology that enhances, not replaces, judgment.

So the next time valuation appears on your checklist, remember: it’s not just about numbers, it’s about building trust through transparency.

Ready for audit. Ready for investors. Ready for the future.

Frequently Asked Questions (FAQs)

Valuation is essential for fair value measurement, impairment testing, and accurate disclosure under Ind AS. It ensures that financial statements present a true and fair view aligned with global standards.

Only Registered Valuers recognized under Section 247 of the Companies Act, 2013, or SEBI-registered Merchant Bankers (in certain cases) are permitted to conduct such valuations. These professionals must follow prescribed rules and maintain independence.

Valuation under Ind AS typically uses the Market, Income, or Cost Approach—selected based on the nature of the asset and availability of data. The goal is to use observable, reliable inputs for defensible valuations.

Marcken Consulting provides Registered Valuer Reports and Merchant Banker Valuation Reports that adhere strictly to Ind AS, SEBI, and Companies Act requirements—backed by deep documentation, defensibility, and audit-readiness.

Non-compliance can lead to audit red flags, regulatory penalties, or loss of investor confidence. Inaccurate or undocumented valuations can also delay transactions and damage a company’s credibility.