Table of Contents

ToggleThe Funding Puzzle for Indian Entrepreneurs

For Indian startups, securing funding isn’t just a milestone; it’s a lifeline.

It’s what turns prototypes into products, sparks ideas into industries, and transforms side hustles into scale-ready businesses. Yet, while the appetite for entrepreneurship in India is at an all-time high, access to capital often isn’t. Between regulatory red tape, investor scepticism, and sheer competition, the path to funding can feel more like a maze than a runway.

So, where do most Indian entrepreneurs turn when they’re just getting started?

Before the pitch decks, before the venture capital rounds, and even before the angel networks, the majority rely on themselves and their inner circle. Self-financing, commonly known as bootstrapping, and funds from family and friends form the bedrock of India’s startup launchpad.

But why is this model so prevalent in a country buzzing with fintechs, unicorns, and government-backed schemes? Let’s dig deeper.

Bootstrapping: The First and Most Common Step

What Is Bootstrapping?

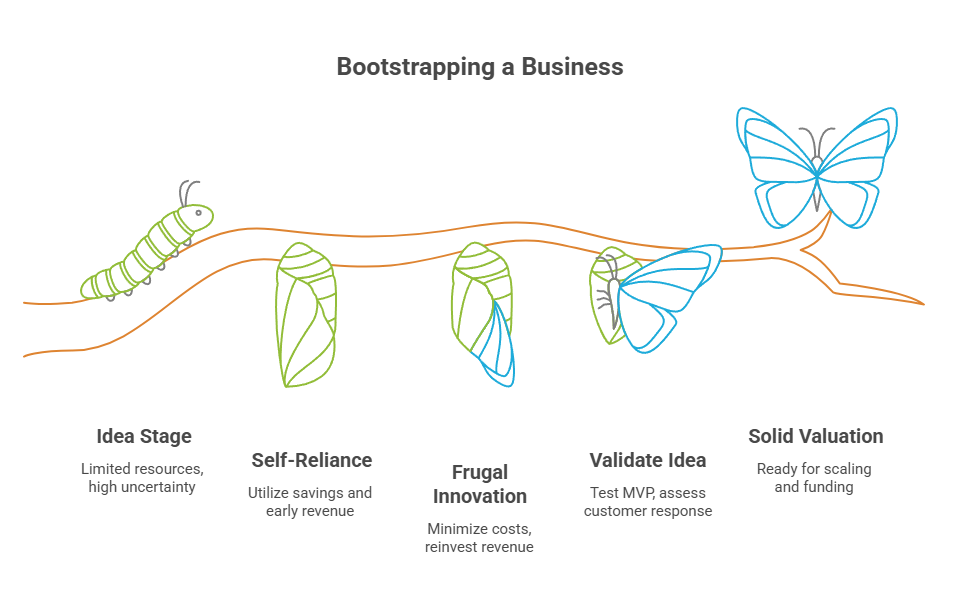

In plain speak, bootstrapping means building your business from the ground up using your savings or money generated by the company itself. It’s a DIY model of startup funding, no outside investors, no loans, no fancy term sheets.

Instead of waiting for validation from banks or VCs, founders often start small: investing their savings, dipping into their employee bonuses, or even repurposing income from freelance gigs. They reinvest early revenue, keep overheads tight, and delay hiring until necessary. This frugal innovation keeps costs low while traction builds.

It’s also how many Indian entrepreneurs prove their mettle, validate ideas, and buy time to create a solid valuation report, something our team at Marcken Consulting frequently assists with when businesses prepare to approach institutional funders.

Why Bootstrapping Is So Common in India

In India, bootstrapping is more than just a fallback; it’s almost a rite of passage.

Culturally, we place a high value on self-reliance. Borrowing, especially from formal lenders, often carries social and financial stigma, particularly in middle-class or conservative households. For many early founders, putting their skin in the game isn’t just practical; it’s the only logical starting point.

Then there’s the funding reality: very few formal channels support businesses at the pre-seed or idea stage. Venture capitalists are risk-averse by design, and banks require revenue history, creditworthiness, and collateral, things most first-time founders simply don’t have.

But perhaps the biggest reason why bootstrapping remains king? Control. No equity dilution. No board pressure. No monthly debt repayments. Just the founder and their vision, full throttle.

This is why many bootstrapped businesses turn to expert advisors like Marcken Consulting only when they’re ready to scale and need precise financial projections or valuation support to back their funding applications.

When and How It Works Best

Bootstrapping is ideal at the pre-seed stage, when the startup is still testing waters, building a minimum viable product (MVP), assessing early customer response, and iterating quickly. You don’t need crores to do this, just focus, resourcefulness, and lean planning.

Let’s say you’re a solo founder building a mobile app to help kirana store owners digitize their inventory. You can design the first version using a low-code tool, onboard five test users in your neighbourhood, and track user behaviour, all for under ₹1 lakh. That’s classic bootstrap territory.

And many iconic Indian brands started exactly this way, from Zoho’s quiet rise without a rupee in VC funding, to Zerodha’s frugal beginnings that eventually made it India’s biggest stockbroking platform.

At this stage, it’s also wise to keep financial documents in order. A startup valuation report, even for bootstrapped ventures, sends a powerful signal to early supporters, government scheme evaluators, or angels you may approach next.

Friends & Family: India’s Informal Seed Round

What It Means to Raise from Friends and Family

Imagine this: you’ve built a prototype of your eco-friendly packaging idea using ₹50,000 of your savings. It’s working, but now you need ₹2 lakhs to scale production for a pilot batch. No bank will look at you without revenue, and VCs won’t take a meeting for such a small ticket.

So you turn to your inner circle, your cousin, an old college friend, maybe even your former boss. These are the people who know you more than your business. You pitch not with decks and data rooms, but with conviction and trust.

This is the essence of raising funds from friends and family. It’s a social trust-based investment, common across India’s startup ecosystem, especially when formal capital is still out of reach.

Why It Works So Often in India

India thrives on relationships. Whether it’s borrowing for weddings or launching a business, our social capital often substitutes for financial capital, especially in the early stages of entrepreneurship.

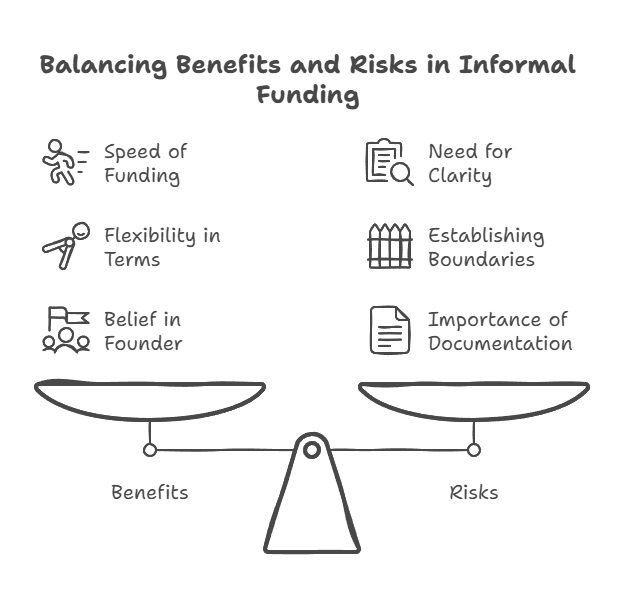

What makes this route popular:

- Speed: You don’t need to wait months for term sheet negotiations.

- Flexibility: Repayment or equity terms are often open-ended or goodwill-based.

- Belief before proof: These early backers believe in you, not just the idea.

Many startups that later approach Marcken Consulting for funding strategy begin their journey with these informal seed rounds. They only seek formal valuation reports when they’re ready to pitch to angels, apply for Startup India Seed Fund, or raise structured equity.

The Flip Side: Risks & Boundaries

It’s tempting to think of friends and family money as a “no-strings-attached” pool, but nothing strains a relationship like a failed business with unclear terms.

Without a written agreement or clear expectations, things can go south fast. That’s why even informal funding should include:

- Simple term sheets or loan notes.

- Clarity on equity vs debt.

- Exit plans or repayment timelines.

We often advise startups at Marcken’s Valuation & Compliance desk to treat these early contributions professionally, not just ethically, but to avoid complications when external investors start due diligence later.

Other Funding Options: What Comes Next?

Once the inner circle support is exhausted, and the business begins to validate itself, startups often graduate to more formal and scalable funding options. Here’s a quick breakdown of what’s next.

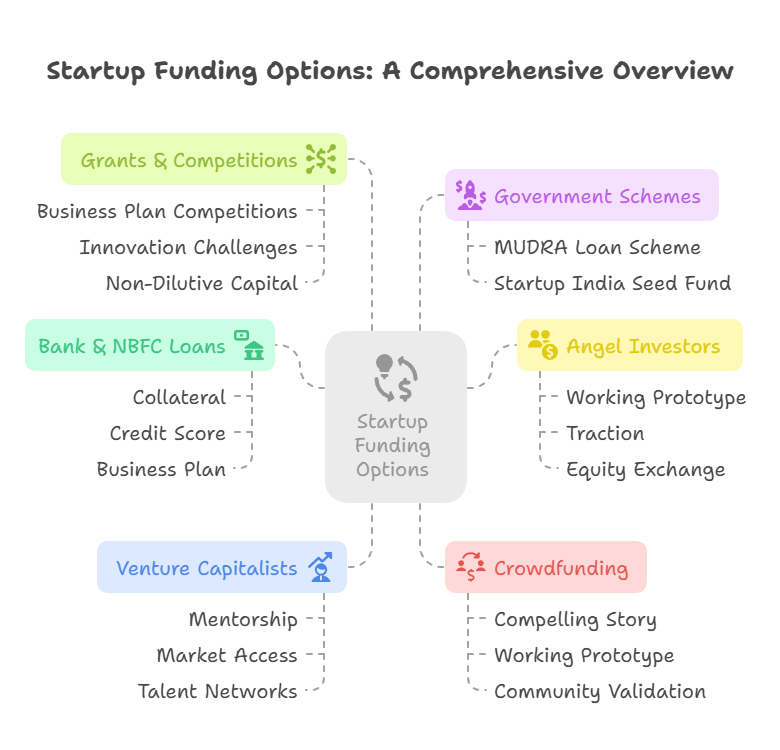

Bank & NBFC Loans

These are traditional lending institutions that offer business loans, usually against:

- Collateral

- Credit score

- A detailed business plan and revenue track

While tough to secure at the ideation stage, they’re a viable option for MSMEs and revenue-generating early-stage ventures.

At this stage, you’ll likely need a professional business valuation report, like the ones offered by Marcken Consulting’s valuation experts, to satisfy lenders and set realistic borrowing limits.

Government Schemes (MUDRA, Startup India Seed Fund)

The Indian government offers several startup-friendly initiatives that provide loans or grants with minimal or no collateral. Two prominent ones include:

- MUDRA Loan Scheme: Ideal for micro-entrepreneurs, offering loans up to ₹10 lakhs under three tiers, Shishu, Kishore, and Tarun.

- Startup India Seed Fund: Grants and soft loans for eligible DPIIT-recognised startups.

Caveat: application processes can be bureaucratic, and the success rate varies by state and sector.

Founders often approach Marcken Consulting to align their pitch decks and valuation models with the eligibility requirements of these schemes.

Angel Investors

These are high-net-worth individuals who invest in early-stage startups, typically in exchange for 10–30% equity.

What they look for:

- A working prototype or MVP.

- Traction (users, revenue, or both).

- A founding team with relevant expertise.

- A credible valuation report to back your funding ask.

Expect a cheque size between ₹25 lakhs to ₹2 crores, depending on your industry and stage.

Venture Capitalists

Venture Capital firms come in at the growth stage, often post-revenue or at product-market fit.

They bring not just money but also:

- Mentorship

- Market access

- Talent networks

But VCs demand rapid scale, clear exit potential, and clean equity structuring, often needing a valuation benchmark that firms like Marcken Consulting help establish.

Not every startup fits a VC thesis, and that’s perfectly okay.

Crowdfunding

For consumer-centric or product-driven startups, crowdfunding (via platforms like Ketto, Wishberry, or Kickstarter) allows you to raise small amounts from a large group of early adopters.

It’s less about equity and more about pre-orders, community validation, and visibility. But you’ll still need:

- A compelling story

- A working prototype

- Transparent cost breakdown

Grants & Competitions

Often underutilized, business plan competitions or innovation challenges by academic institutions, CSR arms of corporations, or incubators can offer non-dilutive capital.

Prize money ranges from ₹50,000 to ₹25 lakhs, more than enough to test and validate a product.

Having a well-documented valuation and market sizing report strengthens your application here, too.

Comparative Table

Funding Source | Stage | Control | Speed | Typical Amount | Risk Level |

Bootstrapping | Pre-seed | Full | Fast | ₹10k–₹5L | Low |

Family & Friends | Pre-seed / Seed | High | Fast | ₹50k–₹20L | Medium |

Bank / NBFC Loans | Early Growth | Full | Medium | ₹5L–₹5Cr | High |

Govt Schemes | Pre-seed / Growth | Full | Medium | ₹50k–₹1Cr | Low |

Angel Investors | Seed | Shared | Medium | ₹25L–₹2Cr | Medium |

Venture Capitalists | Series A+ | Shared | Long | ₹2Cr+ | High |

Crowdfunding | Pre-seed / Seed | Full | Medium | ₹1L–₹50L | Medium |

Grants & Competitions | Idea / Pre-seed | Full | Fast | ₹50k–₹25L | Low |

Key Takeaways: Funding Strategy for First-Time Founders

If you’re launching a startup in India, your first investor is often staring back at you in the mirror or sitting across the dining table.

- Bootstrapping and funds from family and friends remain the two most common ways Indian entrepreneurs take their first steps. They’re fast, flexible, and built on trust.

- But there’s no one-size-fits-all approach. The right funding source depends on your stage, sector, business model, and how fast you need to scale. What works at the idea stage won’t suffice when you’re ready for Series A.

- That’s why you need a funding roadmap, aligned with your business plan and updated as you grow. And that’s where expert guidance, proper documentation, and credible valuation reports matter most.

Whether you’re preparing for your first investor meeting, exploring a government grant, or just getting your startup valuation right, Marcken Consulting is your trusted growth partner.

Frequently Asked Questions (FAQs)

The best method depends on your stage and needs. Most founders begin with bootstrapping or funds from family and friends, then explore bank loans, government schemes, or angel investments as they gain traction. A phased approach, backed by a solid valuation report, works best.

Yes, schemes like the Startup India Seed Fund and MUDRA Loans provide capital support to early-stage startups. These are often sector-specific and require proper registration, documentation, and sometimes, a recommendation from a recognized incubator.

Always document the funding. Use a simple loan agreement or convertible note and define repayment terms or equity allocation. This protects both parties and ensures transparency during future fundraising or audits. For support, consult valuation and funding experts like Marcken Consulting.

Approach VCs when you have a working product, early revenue or traction, and a scalable business model. You should also have a formal startup valuation ready to justify your ask. Pre-seed founders are usually better suited for angels or government support.

Banks typically require a business plan, KYC documents, cash flow projections, collateral details, and in some cases, a valuation report. NBFCs may offer more flexible terms, but credible financial documentation from a trusted advisor like Marcken Consulting will strengthen your application.