Table of Contents

ToggleIntroduction

For Indian startups eyeing global growth, 2025 is shaping up to be a year of tighter scrutiny and evolving compliance norms. As more founders expand into the United States or attract capital from US-based investors, a term once confined to the corridors of American tax law is now front and center in Indian boardrooms: the 409A valuation.

Why has this phrase become such a talking point? Because it directly affects how startups reward their teams, satisfy investors, and prepare for future exits. For founders, investors, and employees alike, a 409A valuation is no longer just a technical formality; it’s a signal of credibility, transparency, and strategic foresight.

In this blog, we’ll break down exactly what a 409A valuation is, why it matters for startups in 2025, when it’s required, and the steps needed to stay compliant.

What Is a 409A Valuation?

A 409A valuation is an independent assessment of the fair market value (FMV) of a private company’s common stock. In simple terms, it determines the objective share price at which employees can be granted stock options or equity compensation.

The requirement comes from Section 409A of the US Internal Revenue Code, which was introduced to regulate deferred compensation practices and prevent tax abuses. While this may sound like a US-centric regulation, its impact extends far beyond American borders.

For Indian startups, the relevance is immediate. Many ambitious ventures establish US holding companies, subsidiaries, or investor relationships as part of their global strategy. In such cases, 409A valuations are essential not only for legal compliance but also for building investor trust and offering employee stock options at defensible strike prices. Without one, startups risk exposure to tax penalties, compliance challenges, and weakened confidence among global stakeholders.

Why Every Startup Needs a 409A Valuation in 2025

A 409A valuation is not just a regulatory checkbox; it is a cornerstone of responsible financial management for any startup operating with US links. Here are the key reasons why it matters in 2025:

1. Regulatory Compliance

For Indian startups with a US holding company, subsidiary, or employees, a 409A valuation is legally required under US tax law. Without one, companies expose themselves and their employees to severe tax consequences, including immediate income recognition, interest charges, and penalties. Timely compliance ensures startups operate smoothly across jurisdictions and stay on the right side of regulatory frameworks.

2. Investor Confidence

Global investors, particularly those based in the US, expect startups to maintain transparent and defensible valuation practices. A properly conducted 409A valuation signals professionalism and compliance, boosting investor trust during funding rounds and partnership discussions.

3. Retention and Recruitment

Employee Stock Option Plans (ESOPs) are among the most attractive tools for retaining and motivating top talent. By setting a fair and defensible strike price, a 409A valuation allows startups to offer employees equity packages that are both competitive and compliant. For Indian startups competing in international markets, this can be a decisive factor in attracting skilled professionals.

4. IPO or Exit Readiness

As startups move toward an IPO, merger, or acquisition, compliance records undergo close scrutiny by auditors, regulators, and potential acquirers. Having a history of clean and timely 409A valuations demonstrates strong governance and reduces the risk of last-minute complications that can derail a deal.

5. Indian Tax Context

Although Section 409A is a US regulation, Indian startups are increasingly impacted by tax issues around equity compensation. With evolving rules around angel tax and valuation disclosures, startups with cross-border structures must manage compliance in both jurisdictions. A 409A valuation helps create a consistent, defensible basis for handling these challenges.

When Do You Need a 409A Valuation?

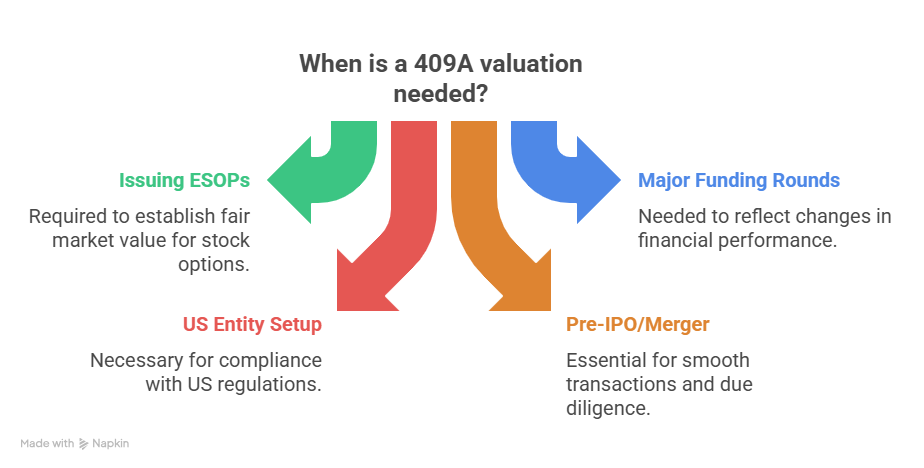

Not every Indian startup will require a 409A valuation, but for those with US connections, knowing the right timing is critical. A valuation is typically needed in the following scenarios:

- Issuing new ESOPs or equity grants: Before granting stock options to employees, companies must establish a fair market value through a 409A valuation.

- After major funding rounds or business milestones: Significant changes in financial performance, business outlook, or ownership structure trigger the need for an updated valuation.

- When setting up or operating a US parent or subsidiary, any Indian startup with a US entity must comply with Section 409A rules if it issues equity compensation.

- Pre-IPO, merger, or acquisition: A compliant valuation record is essential for ensuring a smooth transaction and avoiding regulatory red flags during due diligence.

The 409A Valuation Process

Conducting a 409A valuation involves a structured and independent assessment carried out by qualified professionals. The process typically includes the following steps:

1. Company Analysis

The first stage is an in-depth review of the company’s fundamentals. This includes evaluating financial statements, the business model, revenue streams, growth potential, and competitive positioning. For startups, qualitative factors such as leadership strength and scalability of operations also carry significant weight.

2. Market Review

A broader market analysis follows, taking into account industry trends, sector performance, peer comparisons, and macroeconomic indicators. This helps place the company within a realistic market context and ensures the valuation reflects both internal performance and external conditions.

3. Valuation Methodologies

Specialists apply one or more accepted valuation methods, depending on the company’s maturity and available data. Common approaches include:

- Income Approach: Based on projected future cash flows.

- Market Approach: Benchmarked against comparable companies or transactions.

- Cost Approach: Focused on the net asset value of the business.

The chosen methodology must be appropriate, well-documented, and defensible, as it forms the basis of the valuation report.

4. Independent Report

Finally, a third-party valuation expert prepares an official report. This independent documentation is essential for establishing “safe harbor” compliance, which protects both the company and its employees from IRS challenges, provided the report is prepared according to accepted standards.

Risks & Penalties of Non-Compliance

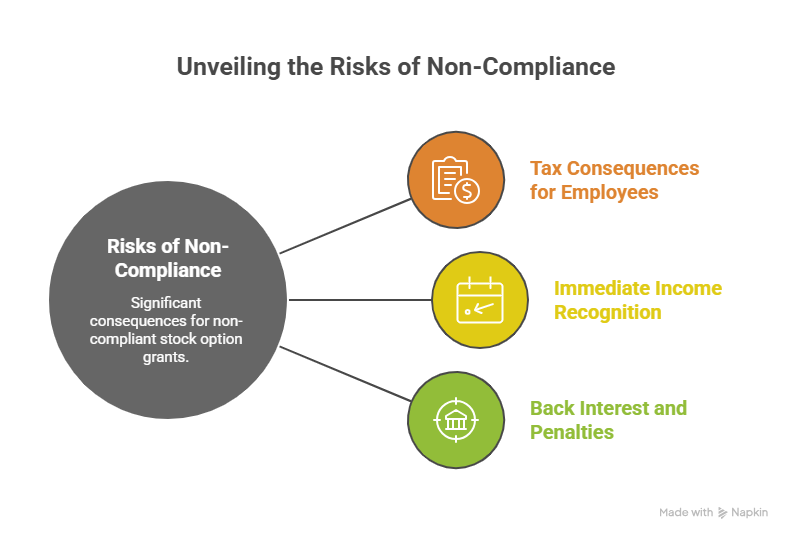

Failing to obtain a valid 409A valuation, or relying on an outdated or non-compliant one, can lead to significant consequences, particularly for employees receiving stock options. Key risks include:

- Tax Consequences for Employees: Employees may be forced to recognize income at the time of option grant, rather than upon exercise, leading to unexpected tax liabilities.

- Immediate Income Recognition: Equity compensation may lose its deferred tax benefit, resulting in employees paying taxes long before they realize any liquidity.

- Back Interest and Penalties: The US Internal Revenue Service (IRS) imposes additional interest charges and penalties on non-compliant stock option grants, further increasing the financial burden.

For startups, these risks can undermine employee trust, strain relationships with investors, and raise red flags during audits or due diligence. Staying compliant through timely, professional 409A valuations is not just a legal requirement; it is a safeguard for long-term growth and stability.

Additional Considerations for Indian Founders

While 409A valuations are indispensable for many startups with global operations, not every Indian company is required to obtain one. Founders should carefully assess their specific structure and objectives before investing in the process.

Who Needs It vs. Who Doesn’t

- Who Needs It: Indian startups that have a US parent company, US subsidiary, US employees, or US-based investors must comply with 409A valuation requirements before issuing stock options or equity compensation.

- Who Doesn’t: Startups that operate solely within India, without US ties or employees subject to US tax law, generally do not need a 409A valuation. Instead, they must follow Indian valuation rules for ESOPs and tax purposes.

Difference Between Indian ESOP Valuation and 409A

Indian regulations around ESOPs primarily fall under the Income Tax Act and the Companies Act, with valuations typically performed by a registered valuer or a Category I Merchant Banker. These valuations focus on Indian tax compliance and reporting.

A 409A valuation, however, is strictly aligned with US tax regulations and safe harbor standards. While both aim to establish a fair market value, they serve different legal frameworks and cannot be substituted for one another. Startups with cross-border structures often require both valuations to satisfy the respective authorities.

Why Professional Help Is Non-Negotiable

The complexities of global tax laws, cross-border corporate structures, and compliance requirements make professional expertise essential. Engaging a qualified valuation specialist ensures:

- Accuracy in selecting and applying valuation methodologies.

- Documentation that withstands scrutiny from regulators, investors, and auditors.

- Protection from costly errors that can expose employees and the company to penalties.

For Indian founders navigating international growth, professional guidance is not a luxury but a necessity. It ensures compliance, builds credibility, and provides peace of mind as the business scales.

Conclusion

A 409A valuation is far more than a compliance requirement; it is the foundation of credibility, transparency, and growth readiness for startups in 2025. By establishing the fair market value of equity, it protects both employees and founders, reassures investors, and ensures smooth progress toward future milestones like funding rounds, IPOs, or acquisitions.

For Indian startups with US ties, being proactive is the best safeguard. Obtaining timely 409A valuations helps avoid costly tax pitfalls, strengthens investor confidence, and positions the business for sustainable expansion in global markets.

If your startup is planning a new ESOP grant, a funding round, or preparing for an international exit, now is the right time to act. Consult with experienced valuation experts to ensure your compliance framework is solid and your growth story remains uncompromised.

Frequently Asked Questions (FAQs)

A 409A valuation is an independent assessment of the fair market value (FMV) of a private company’s common stock. It is required under US tax law to determine the strike price for employee stock options.

No. Only startups with US entities, employees, or investors are required to comply. Purely domestic Indian companies generally follow Indian ESOP valuation rules instead.

Typically, at least once every 12 months or sooner if a material event occurs—such as a new funding round, significant revenue growth, or a major change in business outlook.

Skipping or using a non-compliant valuation exposes employees to heavy tax liabilities, including immediate income recognition, penalties, and back interest under US tax law.

No. While both assess share value, they serve different legal frameworks. A 409A valuation aligns with US tax law, whereas Indian ESOP valuations are required under the Indian Income Tax Act and Companies Act.