Table of Contents

ToggleIntroduction

An Employee Stock Ownership Plan (ESOP) is a mechanism through which a company offers its employees an ownership stake in the business, typically in the form of shares or stock options. ESOPs serve as both a financial incentive and a motivational tool, allowing employees to participate in the company’s growth and success. By aligning employee interests with organizational performance, ESOPs foster a culture of ownership, accountability, and long-term commitment.

In India, ESOPs are gaining significant traction, particularly among startups, technology firms, and high-growth companies. With the war for talent intensifying, businesses are seeking innovative ways to attract, retain, and motivate top performers. ESOPs have emerged as a strategic instrument not only for rewarding employees but also for promoting loyalty, productivity, and organizational alignment.

However, designing and implementing an ESOP is a complex process that involves navigating legal regulations, tax considerations, valuation requirements, and administrative responsibilities. Without expert guidance, businesses risk making costly errors that can impact compliance, employee trust, and financial outcomes. This is where an ESOP consultant becomes indispensable, providing specialized knowledge and structured support to ensure the successful execution of an ESOP plan.

2. Plan Design and Structuring

One of the primary responsibilities of an ESOP consultant is to design and structure a plan that aligns with the company’s strategic objectives. This process begins with a feasibility study, which assesses whether an ESOP is suitable for the company’s size, growth stage, and financial position. The study evaluates potential benefits, costs, and the long-term impact on both the organization and its employees.

Once feasibility is established, consultants customize equity compensation plans to meet the specific needs of the business. This can include traditional ESOPs, Stock Appreciation Rights (SARs), Restricted Stock Units (RSUs), or Phantom Stock plans. Each type of plan carries unique financial, legal, and tax implications, and the consultant ensures that the chosen structure aligns with the company’s objectives and employee expectations.

Drafting the necessary legal documents is a critical component of plan structuring. Consultants prepare plan documents, shareholder agreements, and grant letters, ensuring clarity, transparency, and compliance with Indian regulations. This legal foundation is essential for protecting both the company and its employees while providing a clear framework for the administration of the ESOP.

Finally, the ESOP structure is carefully aligned with the company’s strategic goals, ensuring that employee incentives drive performance, retention, and long-term growth. By integrating business objectives with employee rewards, consultants help create a plan that benefits all stakeholders while positioning the company for sustainable success.

3. Regulatory Compliance

Navigating the regulatory landscape is one of the most critical aspects of implementing an ESOP in India. An ESOP consultant ensures that the plan complies with all applicable laws, including the Companies Act, SEBI regulations, and income tax provisions. This compliance is crucial to avoid legal disputes, penalties, and potential disqualification of the plan.

Consultants coordinate statutory filings and disclosures required by Indian authorities. Key documentation includes Form SH-6, which records the allotment of shares under the ESOP, and Form MGT-14, which covers approvals from the Board or shareholders. Timely and accurate filings demonstrate transparency, maintain corporate governance standards, and protect the company from regulatory scrutiny.

Beyond filing requirements, ESOP consultants identify potential structural pitfalls in plan design and administration. By proactively addressing these issues, they minimize legal risks and ensure that the ESOP operates smoothly and in full compliance, providing confidence to both management and employees.

4. Valuation and Financial Modeling

An essential responsibility of an ESOP consultant is to determine the fair value of shares offered to employees. Accurate valuation is necessary for compliance with tax regulations, calculation of employee benefits, and maintaining shareholder confidence. Consultants typically employ accepted methods such as Net Asset Value (NAV) and Profit Earning Capacity Value (PECV) to arrive at an independent and defensible valuation.

In addition to valuation, consultants develop detailed financial models to assess the impact of the ESOP on the company’s financial health. These models consider changes to equity, the balance sheet, potential tax liabilities, and overall company growth. By simulating various scenarios, consultants help management understand how the ESOP will influence capital structure, profitability, and shareholder returns.

Through precise valuation and robust financial modeling, ESOP consultants ensure that the plan is both equitable for employees and sustainable for the company, balancing incentives with long-term corporate strategy.

5. Employee Communication and Engagement

A well-designed ESOP is only effective if employees understand and appreciate its benefits. ESOP consultants play a key role in designing and implementing communication strategies that clearly convey the purpose, structure, and advantages of the plan. This ensures that employees see the ESOP as a tangible and meaningful component of their overall compensation.

Consultants often conduct town halls, workshops, and Q&A sessions to educate employees about how the plan works, the value of their equity, and the procedures for exercising options. These sessions help demystify technical aspects of stock ownership, fostering transparency and trust between employees and management.

By actively engaging employees, consultants help build a culture of ownership. When employees understand how their performance impacts company growth and their personal stake in its success, participation rates increase, retention improves, and overall productivity rises. In essence, communication and engagement are central to maximizing the ESOP’s strategic value.

6. Ongoing Administration and Trust Setup

Effective ESOP management requires meticulous administration, which begins with the establishment of an ESOP Trust. Consultants help set up these trusts to efficiently manage the allocation, grant, and exercise of stock options, ensuring compliance with Indian laws and company policies.

Beyond the initial setup, consultants oversee the full lifecycle of the ESOP, including grant schedules, exercise timelines, and vesting periods. They track employee entitlements, coordinate with legal and finance teams, and maintain accurate records to support smooth operations.

Additionally, ESOP consultants adapt the plan to evolving business needs and regulatory changes. As companies grow, raise capital, or revise strategic priorities, the ESOP structure may need adjustments. Consultants ensure that these modifications are implemented seamlessly, maintaining the plan’s effectiveness while staying fully compliant.

7. Objective, Impartial Advice

An ESOP consultant serves as an independent advisor, providing guidance that is free from internal conflicts of interest. This impartiality is essential because ESOPs involve multiple stakeholders, shareholders, management, and employees, each with distinct perspectives and interests.

By offering conflict-free advice, consultants help ensure balanced decision-making. Their recommendations are guided by best practices, legal compliance, and strategic alignment rather than internal politics. This approach promotes fairness, transparency, and trust, ensuring that the ESOP delivers value equitably across all parties.

8. Navigating Complexity

Implementing an ESOP is inherently complex, requiring a deep understanding of legal regulations, tax implications, financial modeling, and corporate governance. Missteps in any of these areas can lead to significant penalties, compliance issues, or erosion of employee trust.

ESOP consultants bring cross-disciplinary expertise that goes beyond what most in-house teams possess. They integrate legal, financial, and operational insights to manage technical challenges, streamline processes, and provide actionable recommendations. By navigating this complexity, consultants enable businesses to implement ESOPs efficiently, accurately, and strategically, minimizing risk while maximizing the plan’s impact.

9. Risk Mitigation

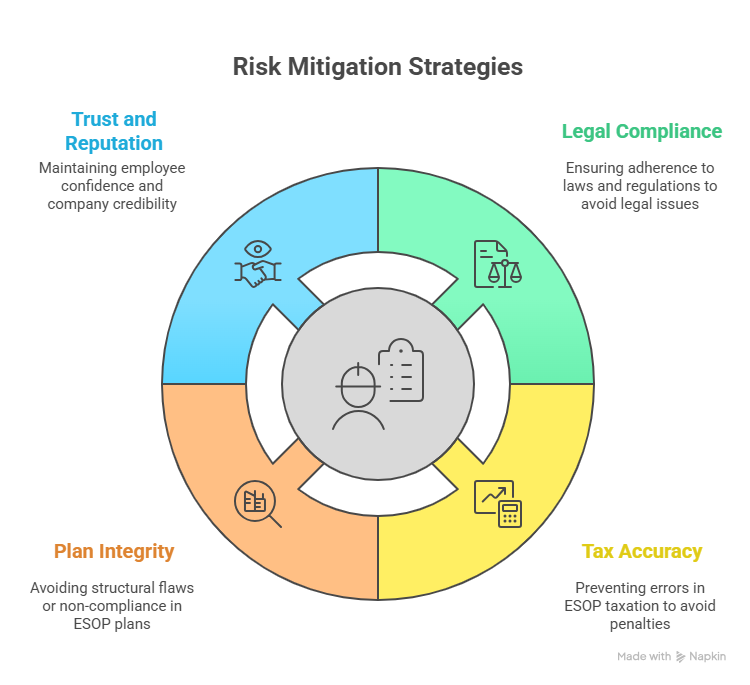

ESOP consultants play a crucial role in reducing organizational risk associated with stock ownership plans:

- Legal Compliance: Ensure adherence to the Companies Act, SEBI regulations, and tax laws, avoiding potential litigation or fines.

- Tax Accuracy: Prevent errors in ESOP taxation that could lead to penalties for both employees and the company.

- Plan Integrity: Avoid structural flaws or non-compliance that could result in plan disqualification.

- Trust and Reputation: Protect employee confidence and maintain the company’s credibility in the market.

10. Efficiency

Consultants streamline ESOP implementation and administration, providing measurable operational benefits:

- Process Optimization: Standardize grant, exercise, and vesting workflows for smoother administration.

- Time Savings: Reduce managerial workload, allowing leadership to focus on strategic initiatives.

- Resource Management: Minimize internal resource allocation to ESOP administration through expert guidance.

- Faster Implementation: Enable quicker rollout of ESOPs without sacrificing accuracy or compliance.

11. Maximizing Employee Engagement, Retention, and Financial Benefits

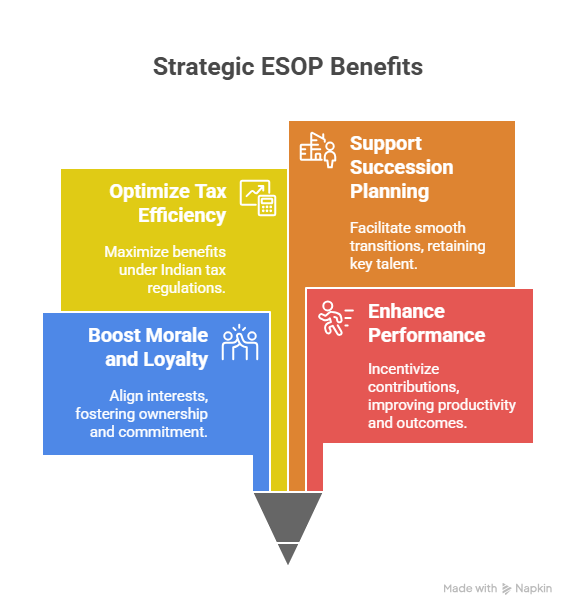

ESOP consultants help businesses leverage stock ownership plans to drive both employee satisfaction and corporate success:

- Boost Morale and Loyalty: Align employees’ interests with company growth, fostering a sense of ownership and commitment.

- Enhance Performance: Incentivize employees to contribute to strategic objectives, improving productivity and outcomes.

- Optimize Tax Efficiency: Structure ESOPs to maximize benefits under Indian tax regulations for both employees and the company.

- Support Succession Planning: Facilitate smooth transitions in ownership and leadership while retaining key talent.

- Long-term Financial Gains: Create sustainable value for employees and shareholders through equitable and well-managed equity distribution.

Conclusion

ESOP consultants play a pivotal role in helping businesses navigate the multifaceted world of employee stock ownership plans. Their expertise spans strategic planning, legal compliance, financial modeling, and cultural engagement, ensuring that ESOPs are not only legally sound but also aligned with company objectives. By engaging an ESOP consultant early, businesses can avoid costly errors, streamline administration, and foster a culture of ownership that drives employee loyalty and performance. Ultimately, ESOPs, when guided by specialists, become more than just a compliance exercise—they transform into a powerful tool for growth, retention, and long-term value creation for both the company and its employees.

Frequently Asked Questions (FAQs)

An ESOP consultant designs, structures, and manages employee stock ownership plans while ensuring compliance with Indian legal and tax regulations. They also handle valuations, employee communication, and ongoing administration of the scheme.

While some companies attempt to manage ESOPs internally, the process involves legal, financial, and regulatory complexities that require specialized, cross-disciplinary expertise. Mistakes in compliance or valuation can lead to penalties and employee dissatisfaction.

No. ESOPs are widely used by startups, mid-sized businesses, and large corporations alike. For startups and growth-stage companies, ESOPs are often crucial for attracting and retaining top talent without immediate cash outflow.

ESOP consultants ensure adherence to the Companies Act, SEBI guidelines, and applicable tax laws. They coordinate statutory filings like Form SH-6 and MGT-14, prepare shareholder agreements, and keep the structure audit-ready.

By engaging an ESOP consultant, businesses gain accurate valuations, tax-efficient structuring, smoother implementation, and higher employee engagement. This leads to stronger retention, better financial planning, and long-term value creation.