Table of Contents

Toggle1. Introduction

India’s startup ecosystem has become one of the most dynamic in the world, consistently ranking among the top three globally in terms of new venture creation. With record levels of funding, increasing digital adoption, and a vibrant pool of young entrepreneurs, the country has positioned itself as a fertile ground for innovation. From fintech disruptors to direct-to-consumer brands, Indian startups are rewriting the rules of business.

But this rapid growth comes with a familiar challenge: how to balance innovation with sound financial discipline. Many founders excel at building products, identifying market gaps, and scaling customer acquisition, but often lack the financial expertise to manage cash flow, investor expectations, and regulatory compliance. Hiring a full-time Chief Financial Officer (CFO) at an early stage is rarely feasible, experienced professionals command high salaries, and fixed payroll costs can strain already tight budgets.

This is where the Virtual CFO (vCFO) model comes in. By providing seasoned financial leadership on a flexible, as-needed basis, virtual CFOs give startups access to top-tier expertise without the burden of full-time costs. The result is a perfect middle ground: startups gain strategic guidance, robust financial management, and investor confidence, all while keeping expenses lean.

2. What Is a Virtual CFO?

A Virtual CFO, or vCFO, is a finance professional or team that offers CFO-level services to a business on a part-time, outsourced, or project basis. Unlike traditional CFOs, who are employed full-time within an organization, virtual CFOs provide the same strategic oversight and operational control but with greater flexibility and lower cost structures.

The role of a virtual CFO typically includes:

- Strategic financial planning and forecasting.

- Cash flow and cost management.

- Compliance monitoring and risk mitigation.

- Fundraising support and investor relations.

- Real-time reporting through cloud-based tools.

The difference lies not in the quality of expertise but in the mode of delivery. Traditional CFOs are integral members of the executive team, often working onsite and drawing a significant salary package. In contrast, virtual CFOs operate on a retainer, hourly, or project basis, giving startups access to the same depth of knowledge without committing to permanent overheads.

This concept has gained particular traction in India for three reasons:

- Startup cost sensitivity – Indian founders need financial expertise but cannot afford a senior executive’s compensation.

- Digital adoption – The availability of advanced accounting software and cloud-based financial tools makes remote financial management seamless.

- Complex regulations – With India’s ever-evolving tax and compliance landscape, startups value having an experienced hand to navigate filings, audits, and investor reporting.

In essence, the virtual CFO bridges the gap between financial necessity and affordability, offering startups a smarter way to manage their money while staying agile in a competitive market.

3. The Rise of Virtual CFOs in India’s Startup Ecosystem

Over the past decade, India’s startup ecosystem has moved from a fledgling space to a powerhouse that attracts global investors. With more than 100 unicorns and thousands of growth-stage ventures, financial management has become a central focus for sustainability and expansion. Within this environment, the Virtual CFO model has quickly emerged as a preferred solution for founders who need strategic expertise without overextending their budgets.

The adoption of virtual CFOs has been accelerated by several factors:

- Market trends: Investors and venture capitalists increasingly demand transparent, structured financial reporting before committing funds. Startups that present clear, accurate numbers stand out in competitive funding rounds.

- Digital tools: Cloud-based platforms such as Zoho Books, Tally, and QuickBooks, paired with advanced dashboards, have made financial oversight possible in real time, eliminating the need for a CFO to be physically present in the office.

- Remote expertise: The rise of remote and hybrid work models has normalized outsourcing key business functions. Just as startups rely on external experts for legal or tech needs, financial leadership can now be delivered effectively from anywhere.

The result is an ecosystem where startups no longer view CFO expertise as a luxury reserved for later stages but as a strategic necessity available right from the start, tailored to their growth trajectory.

4. Cost-Effective Financial Leadership (Reason 1)

One of the most compelling reasons Indian startups hire a virtual CFO is cost efficiency. For early-stage ventures, every rupee counts, and allocating large sums to executive salaries is rarely justifiable.

- Save payroll costs: A full-time CFO in India can command an annual package running into several lakhs or even crores. For a startup, this expense can significantly erode working capital. By contrast, a virtual CFO operates on a flexible engagement model, whether hourly, monthly retainer, or project-based, making it far more affordable.

- Pay only for services needed: Unlike salaried executives, virtual CFOs allow startups to customize the scope of work. Founders may need strategic guidance during fundraising, cash flow management for a few critical months, or compliance checks during year-end. This “pay-as-you-go” approach ensures maximum value without wasted resources.

- Access seasoned expertise without overhead: Virtual CFOs are often professionals with years of experience across industries and business cycles. Startups gain the benefit of this expertise without committing to fixed benefits, office space, or long-term employment contracts.

For resource-conscious startups, the virtual CFO model offers financial leadership at a fraction of the cost, allowing them to focus capital on growth, innovation, and market expansion.

5. Strategic Financial Planning & Guidance (Reason 2)

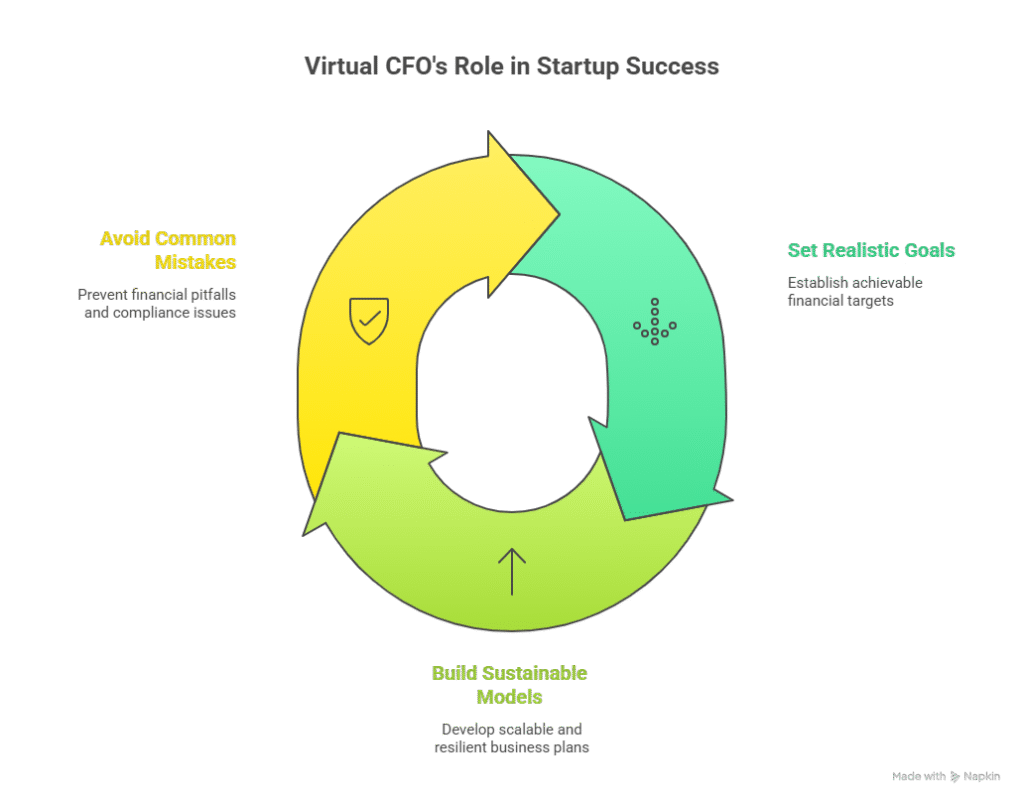

A startup’s vision may be bold, but without a clear financial strategy, even the most innovative idea can falter. This is where a virtual CFO plays a pivotal role, by translating ambition into structured financial plans that align with long-term goals.

- Set realistic financial goals: Founders are often optimistic, sometimes overly so. A virtual CFO tempers this enthusiasm with grounded financial projections, ensuring targets are achievable and aligned with market realities.

- Build sustainable business models: Beyond immediate revenues, startups need to demonstrate scalability and resilience. Virtual CFOs help craft models that account for operational costs, future expansion, and potential market shifts, making the business more attractive to investors and sustainable in the long run.

- Avoid common early-stage mistakes: Many startups stumble by underestimating costs, misallocating resources, or overlooking compliance obligations. With a virtual CFO’s guidance, founders can sidestep these pitfalls, protecting both capital and credibility

In essence, strategic financial planning from a virtual CFO acts as a safety net and growth accelerator, giving startups a stronger foundation to scale confidently.

6. Cash Flow & Cost Management (Reason 3)

Cash flow is the lifeblood of any startup. Even with promising products and enthusiastic customers, poor cash flow management can quickly derail operations. Virtual CFOs bring the discipline and foresight needed to ensure that money flows in and out of the business in a healthy rhythm.

- Optimize resources: Virtual CFOs identify inefficiencies and ensure that funds are allocated to areas that directly contribute to growth, whether that’s product development, marketing, or talent acquisition.

- Forecast capital needs: By projecting revenue streams and expenses, virtual CFOs help startups anticipate funding gaps before they become crises. This proactive approach allows founders to plan fundraising or debt management well in advance.

- Keep burn rate under control: Many startups, especially those fueled by early investor capital, struggle with high burn rates. A virtual CFO monitors expenses, sets strict budgets, and ensures that every rupee spent contributes to the company’s long-term vision.

By combining vigilance with strategic foresight, virtual CFOs enable startups to maintain financial health, weather uncertainty, and remain agile in the face of challenges.

7. Fundraising & Investor Relations Support (Reason 4)

Securing funding is one of the most critical milestones for any startup, and also one of the most challenging. Investors today demand not only a compelling vision but also a solid financial foundation to back it up. A virtual CFO helps bridge this gap.

- Investor-ready financials & pitch decks: Virtual CFOs prepare accurate, professional-grade financial statements and models that instill confidence in potential investors. They also support founders in building pitch decks that combine storytelling with robust financial evidence.

- Valuation and equity structuring support: Startups often struggle to justify their valuation or decide how much equity to part with during negotiations. Virtual CFOs bring expertise in valuation methods and capital structuring, ensuring startups strike a fair balance between raising funds and retaining ownership.

- Boosting credibility during fundraising rounds: The presence of a seasoned financial advisor signals to investors that the startup is serious about governance and financial discipline. This credibility can make all the difference in competitive funding environments.

By aligning financial rigor with investor expectations, virtual CFOs improve not just the chances of raising capital but also the terms on which it is secured.

8. Compliance & Risk Mitigation (Reason 5)

India’s regulatory environment is complex and ever-evolving. From Goods and Services Tax (GST) and Tax Deducted at Source (TDS) to Registrar of Companies (ROC) filings, startups must juggle multiple obligations to remain compliant. Any misstep can lead to penalties, reputational damage, or even legal setbacks. Virtual CFOs ensure founders don’t have to face these risks alone.

- Navigating GST, ROC filings, tax laws: Virtual CFOs manage routine filings, prepare tax documentation, and ensure that all statutory obligations are met on time, reducing the risk of costly errors.

- Implementing controls to reduce fraud/penalties: They establish robust internal controls and financial processes, minimizing the likelihood of fraud, data errors, or regulatory non-compliance.

- Peace of mind for founders: With compliance matters handled professionally, founders can shift their focus back to core activities like product development, customer acquisition, and growth strategy.

In short, a virtual CFO provides protection against financial blind spots, ensuring startups stay on the right side of the law while building investor and customer trust.

9. Real-Time Financial Insights & Reporting (Reason 6)

In today’s fast-paced business environment, timely access to accurate data is no longer optional—it’s essential. Startups thrive on agility, and decision-making must be based on up-to-date insights rather than outdated reports. Virtual CFOs enable this through the use of technology-driven solutions.

- Use of cloud-based tools and dashboards: By integrating accounting platforms and financial dashboards, virtual CFOs provide founders with a clear, real-time view of cash flows, expenses, revenues, and key performance metrics. This eliminates the delays of manual reporting and ensures transparency across the organization.

- Data-driven decisions with up-to-date reports: With instant access to financial insights, startups can pivot quickly, whether it’s adjusting marketing budgets, exploring new markets, or renegotiating supplier contracts. These data-backed decisions reduce uncertainty and improve the chances of sustainable growth.

The ability to harness real-time information not only improves operational efficiency but also strengthens investor confidence, as stakeholders see that the business is built on accurate and actionable intelligence.

10. Scalability and Flexibility (Reason 7)

Startups are dynamic by nature. Their financial needs shift dramatically depending on whether they are bootstrapping, preparing for a seed round, or scaling to new markets. A virtual CFO provides the adaptability required to navigate each stage effectively.

- Support tailored to each growth stage: Early on, a startup may need only basic financial controls and compliance oversight. As it grows, it may require detailed forecasting, sophisticated fundraising support, or international tax planning. A virtual CFO can seamlessly adjust their services to match these evolving demands.

- On-demand, adaptable financial expertise: Unlike a permanent hire, virtual CFOs can expand or scale back their involvement as required. This flexibility helps startups avoid unnecessary costs during lean phases while ensuring they have robust support during critical growth moments.

The result is a financial partnership that evolves with the startup, ensuring founders always have the right level of expertise without overcommitting resources.

11. Beyond the Numbers: How Virtual CFOs Enable Strategic Growth

A virtual CFO’s value extends well beyond compliance checklists and routine reporting. They act as strategic partners—helping startups sharpen their competitive edge and prepare for long-term success.

- More than compliance: a partner in scaling – Virtual CFOs engage with business strategy, aligning financial planning with growth ambitions, new product launches, and market expansion. Their role is not just about managing the books, but about building a sustainable foundation for the future.

- Positioning startups for mergers, acquisitions, or IPO readiness – As Indian startups mature, opportunities for mergers, acquisitions, and even IPOs are increasingly on the horizon. A virtual CFO ensures financial systems, governance structures, and valuations are in place, boosting investor confidence and ensuring smooth transitions when these opportunities arise.

12. Key Takeaways for Indian Startups

The Virtual CFO model is redefining financial leadership for Indian startups. Here’s why it matters:

- Cost-Effective Leadership – Access seasoned financial expertise at a fraction of the cost of a full-time CFO.

- Strategic Guidance – Get professional input on building sustainable models and avoiding early missteps.

- Cash Flow & Cost Control – Keep expenses in check and optimize resources effectively.

- Investor Confidence – Present clear, compliant, and investor-ready financials.

- Compliance & Risk Mitigation – Navigate tax, ROC, and regulatory complexities with ease.

- Real-Time Insights – Leverage dashboards and analytics for agile decision-making.

- Flexibility & Scalability – Adapt financial leadership as your startup grows and evolves.

At the intersection of cost efficiency, strategic foresight, and scalability, virtual CFOs offer exactly what startups need to succeed in a highly competitive market.

13. Conclusion

In the Indian startup ecosystem, where agility and financial discipline must coexist, a Virtual CFO is no longer a luxury; it’s becoming a necessity. They provide the right blend of expertise, flexibility, and strategy that early-stage businesses need to scale sustainably.

Final thought: The most successful startups aren’t just innovative; they’re financially disciplined and future-ready. A Virtual CFO ensures you achieve both.

Call to action: If you’re building a startup in India, consider bringing a Virtual CFO on board early. It may be the smartest decision you make to stay competitive and investor-ready.

Frequently Asked Questions (FAQs)

A traditional CFO is a full-time, in-house executive, while a Virtual CFO works on a flexible, outsourced basis. Startups get access to the same level of expertise without bearing the full-time salary and overhead costs.

(i) sub-clause (a) or sub-clause (b) of clause (A), for consideration received from a resident, by an amount not exceeding ten per cent of the valuation price, the issue price shall be deemed to be the fair market value of such shares;

(ii) sub-clause (a) or sub-clause (b) or sub-clause (d) of clause (A), for consideration received from a non-resident, by an amount not exceeding ten per cent of the valuation price, the issue price shall be deemed to be the fair market value of such shares.

No. While early-stage startups benefit from cost-effective financial expertise, growth-stage companies also use Virtual CFOs for advanced needs like international expansion, M&A preparation, and IPO readiness.

Most Virtual CFOs leverage cloud-based accounting systems, financial dashboards, and reporting tools. These enable real-time monitoring of cash flow, profitability, and compliance, helping founders make quick, data-driven decisions.

If you’re struggling with cash flow visibility, investor reporting, compliance management, or long-term financial planning—and can’t yet afford a full-time CFO—it’s a strong sign that a Virtual CFO could add value to your business.