Table of Contents

Toggle1. Introduction

Budgeting for company valuation fees is a critical step for businesses across India, whether they are startups, growing enterprises, or well-established firms. A valuation provides an authoritative assessment of a company’s or asset’s worth, forming the basis for key decisions such as funding rounds, mergers and acquisitions, ESOP issuance, regulatory compliance, or taxation. Without a well-planned budget, businesses risk encountering unforeseen costs, delays, or compliance challenges.

Accurate budgeting is essential for several reasons. First, it ensures regulatory compliance, as certain valuations—such as those required for capital gains tax, FEMA, or company restructuring—must be conducted by registered valuers, with prescribed fee expectations. Second, it supports financial planning, enabling businesses to allocate adequate resources for valuation without disrupting operational cash flows. Finally, it underpins strategic decision-making, as knowing the potential cost of valuation services allows management to choose the right scope, level of expertise, and service provider that aligns with both compliance needs and financial constraints.

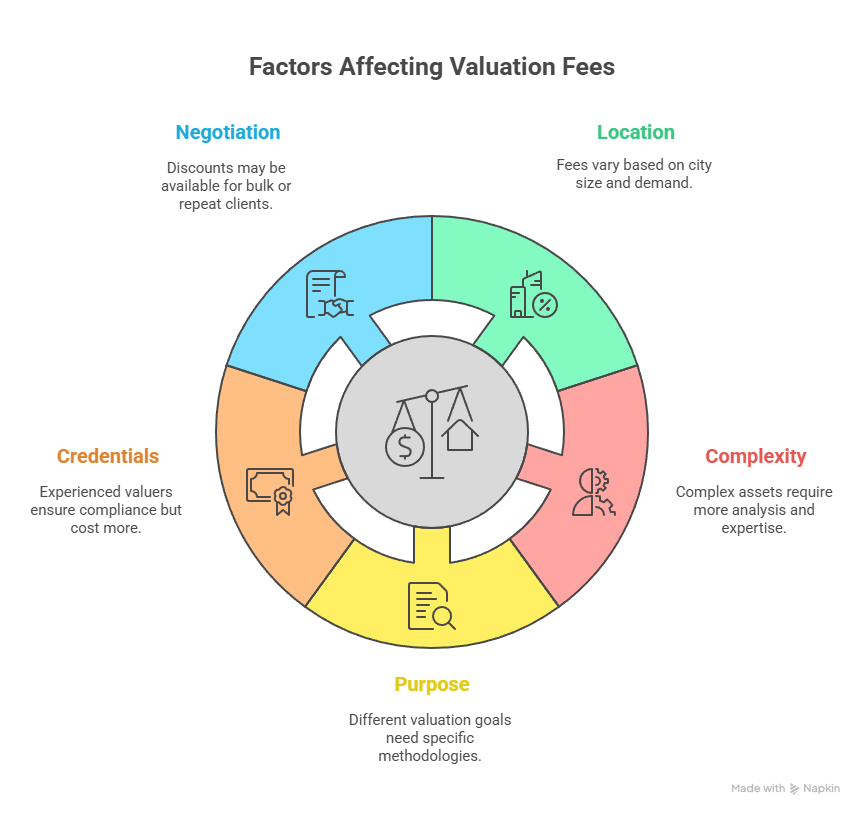

Several factors influence valuation fees, including the complexity of the business or asset, the purpose of the valuation, the credentials and experience of the valuer, and geographical considerations such as regional fee differences across India. Understanding these elements is the first step in creating a realistic and comprehensive budget for valuation services.

2. Understanding Valuation Fee Models in India

In India, valuation fees typically follow one of two models: slab-based fees or percentage-based fees. These models are designed to standardize professional charges while accommodating differences in asset value, complexity, and scope of work.

Slab-Based Fees

Slab-based fees involve a predetermined fixed fee for specific valuation assignments. For example, property valuations or standard business valuation reports often fall into specific fee slabs based on asset value or report type. Minimum and maximum caps are usually applied by banks or institutional valuers to ensure consistency and prevent overcharging. Standard fees for property valuation reports generally range from ₹2,500 to ₹4,500, depending on the region, while more specialized valuations, such as those required for capital gains or regulatory purposes, may start from ₹12,000 or higher. For high-value properties exceeding ₹1 crore, institutional caps may reach ₹40,000–₹50,000, subject to negotiation.

Percentage-Based Fees

Percentage-based fees are calculated as a proportion of the asset or business value, often adhering to government or banking guidelines. Typical structures may include:

- 0.5% for the first ₹50,000 of asset value

- 0.25% for the next ₹1,00,000

- 0.125% for the next ₹50,00,000

This model is particularly common for high-value transactions, regulatory compliance reports, and institutional assignments, providing a scalable approach where fees naturally increase with the size and complexity of the asset.

By understanding these models, Indian businesses can anticipate the likely cost of valuations and make informed decisions about the level of expertise and type of valuer required for their specific needs. Accurate knowledge of fee structures also facilitates better negotiation, ensures transparency, and prevents budget overruns.

3. Slab-Based Fees Explained

Slab-based valuation fees are a commonly adopted model in India, especially for standard property and business valuations. Under this structure, the valuer charges a fixed fee that corresponds to a defined range of asset values or report types, rather than a variable percentage of the asset’s worth. This approach provides clarity for businesses and ensures predictable costs for straightforward assignments.

For instance, standard property valuation reports in India typically fall within the following fee slabs:

- Gujarat and Maharashtra: ₹2,500

- North India: ₹4,000

- South India: ₹4,500

- East India and other regions: ₹3,500

Specialized valuations, such as capital gains or regulatory compliance reports, generally attract higher fees starting at ₹12,000.

Banks and institutional valuers often apply minimum and maximum caps to these slabs to maintain consistency and transparency. For properties or assets valued above ₹1 crore, the professional fee is usually capped between ₹40,000 and ₹50,000, though negotiation may be possible depending on the assignment’s scope and complexity. By understanding slab-based fees, businesses can plan budgets effectively, especially for routine or regional valuations.

4. Percentage-Based Fees

Percentage-based fees provide a flexible model where the valuation fee is calculated as a proportion of the asset or business value. This approach is commonly used for high-value assignments, bank-related valuations, or regulatory requirements, offering scalability and alignment with government or institutional guidelines.

A typical stepwise structure for percentage-based fees is as follows:

- 0.5% for the first ₹50,000 of asset or property value

- 0.25% for the next ₹1,00,000

- 0.125% for the next ₹50,00,000

- 0.05% for amounts exceeding ₹1 crore

In addition, most banks or institutional valuers set upper caps on the total fee to avoid excessive charges. For example, even if the calculated percentage exceeds the cap, the fee will be limited to a predetermined maximum, which can range between ₹10,000 and ₹50,000 depending on the institution.

Negotiation is also a practical option, particularly for bulk assignments, repeat clients, or high-value properties, allowing businesses to optimize costs while still engaging qualified valuers. By understanding percentage-based fees, companies can better estimate total costs and make informed decisions regarding valuer selection and scope of work.

When budgeting for valuation services in India, businesses must consider several key factors that directly influence the final cost. Understanding these elements helps in estimating realistic fees and avoiding budget overruns.

1. Location:

Valuation charges vary significantly depending on the city or region. Metro cities, such as Mumbai, Delhi, Bengaluru, and Chennai, typically command higher fees due to elevated operational costs and higher demand for registered valuers. Tier-2 and Tier-3 cities often have lower fee structures, though access to experienced valuers may be limited.

2. Complexity of Assets or Business:

The nature and complexity of the asset or business being valued play a critical role in determining fees. Industrial properties, technical equipment, diversified business portfolios, and companies with multiple subsidiaries require detailed analysis, expert judgment, and often longer engagement times. Consequently, such valuations attract higher professional fees.

3. Purpose of Valuation:

Different valuation objectives demand different levels of analysis and report formats. Regulatory or tax valuations (e.g., capital gains, FEMA compliance), M&A valuations, ESOP valuations, and funding-related assessments each require specific methodologies. The purpose directly affects both the time required and the expertise needed, influencing the overall fee.

4. Valuer Credentials:

The experience, qualifications, and reputation of the valuer or firm also impact fees. Registered valuers, chartered engineers, or well-established consulting firms typically charge higher fees than less experienced practitioners. Selecting a valuer with recognized credentials ensures compliance and reliability but may increase costs.

5. Negotiation Opportunities:

Businesses may be able to negotiate fees in certain scenarios. Institutions often provide discounts for bulk assignments, repeat clients, or high-value properties. Being aware of potential negotiation levers can help optimize the budget without compromising on quality.

6. Additional Costs to Budget

Apart from the core professional fee, several additional costs should be factored into the valuation budget to ensure comprehensive financial planning:

1. Government Taxes:

Professional fees are subject to applicable taxes such as GST or service tax, which are typically charged over and above the quoted valuation fee. Including these taxes in the budget ensures accurate cost forecasting.

2. Conveyance, Travel, and Outstation Charges:

Valuers often incur travel and accommodation expenses, particularly for site visits or outstation assignments. These costs may be reimbursed at actuals or based on predefined rates, and should be accounted for in the overall budget.

3. Incidental Costs for Complex or Remote Valuations:

Complex assignments may involve additional expenses such as data collection, specialized software, or engagement of subject-matter experts. Similarly, valuations conducted in remote locations may incur higher logistical costs.

4. Specialized Reports:

Certain types of valuations—such as ESOPs, intellectual property, or intangible assets—require advanced methodologies, expert inputs, and detailed documentation. These specialized reports generally command higher fees compared to standard property or business valuations.

By accounting for these factors and additional costs, businesses can create a realistic budget that covers both professional fees and associated expenditures, ensuring smooth execution and compliance of the valuation process.

7. Sample Fee Table

To provide a clear perspective on typical valuation costs in India, the following table summarizes standard fee ranges across different assignment types:

Assignment Type | Typical Fee (Range) | Notes |

Standard Property Report | ₹2,500 – ₹4,500 | Fees vary by region (Metro vs Tier-2/Tier-3 cities) |

Capital Gains / Compliance Report | ₹12,000+ | Required for tax, regulatory, or statutory compliance |

Bank Assignments (High-Value Assets) | ₹40,000 – ₹50,000 | Often capped by banks for properties above ₹1 crore |

Slab / Percentage-Based Structures | 0.5% (first ₹50,000), 0.25% (next ₹1,00,000), 0.125% (next ₹50,00,000), 0.05% (above ₹1 Cr) | Typically subject to maximum cap; suitable for high-value assets |

8. Budgeting Strategies

Creating an effective budget for valuation fees requires a combination of research, planning, and strategic negotiation. The following strategies can help businesses manage costs while ensuring compliance and accuracy:

1. Estimate Fees Based on Valuation Purpose:

Begin by clearly defining the purpose of the valuation—be it for tax, regulatory, ESOP, funding, or M&A purposes. Each purpose has different complexity and report requirements, which directly impacts the fee. Accurate purpose identification helps in selecting the right fee bracket.

2. Gather Multiple Quotations from Registered Valuers:

Soliciting proposals from multiple qualified valuers allows businesses to compare fees, methodologies, and timelines. This practice promotes transparency and ensures you are paying a competitive rate for the desired level of service.

3. Negotiate Bulk or Repeat Assignments:

Many institutions and valuers offer concessions for bulk engagements, repeat clients, or high-value assignments. Leveraging these opportunities can reduce the overall cost per assignment without compromising the quality of the report.

4. Confirm Inclusion/Exclusion of Taxes and Additional Charges:

Always verify whether GST, service taxes, travel expenses, or incidental costs are included in the quoted fee. Incorporating these expenses in your budget prevents unexpected financial surprises and ensures a comprehensive cost plan.

By following these strategies, businesses can develop a realistic and well-structured budget, aligning professional valuation fees with operational and financial planning objectives.

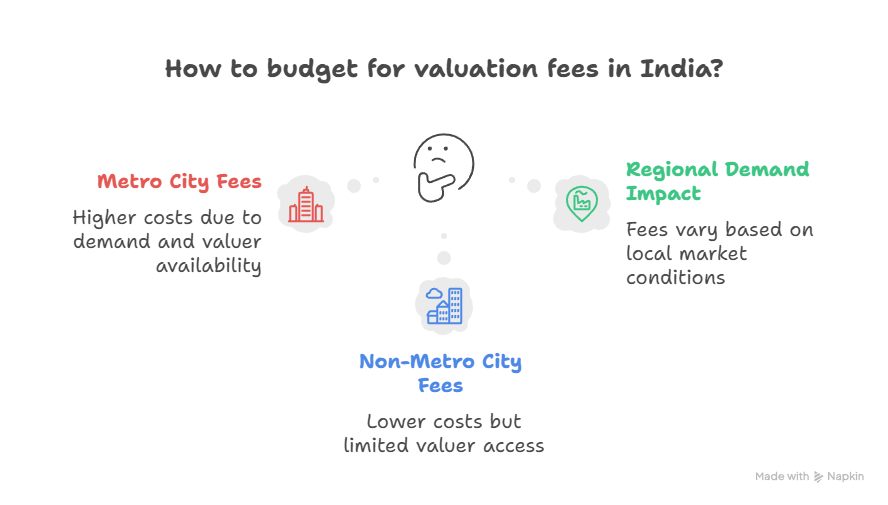

9. Regional Considerations

Valuation fees in India are not uniform and can vary significantly depending on geographical location. Understanding regional differences is crucial for accurate budgeting and informed decision-making.

1. Differences Across States and Cities:

Fees are often higher in states with major commercial hubs due to greater demand for professional valuers and higher operational costs. For example, property or business valuations in Mumbai, Delhi, Bengaluru, or Chennai typically command higher fees compared to Tier-2 or Tier-3 cities.

2. Metro vs Non-Metro Pricing Implications:

Metro cities tend to have a premium pricing structure, reflecting higher living costs, more complex assignments, and availability of highly experienced valuers. Non-metro cities, while generally more cost-effective, may have limited access to specialized valuers, which can impact report timelines or quality.

3. Impact of Local Market Demand and Valuer Availability:

Valuers’ availability and local demand also influence fees. In regions with a high concentration of industrial assets or rapidly growing startups, valuation charges may be elevated due to increased competition for professional services. Conversely, in markets with fewer qualified valuers, businesses may need to budget for additional travel or outstation costs.

By factoring in these regional variations, businesses can allocate realistic budgets and select valuers who balance both cost and expertise.

10. Planning for Special Valuation Scenarios

Certain valuation assignments require specialized expertise, advanced methodologies, or detailed reporting, which often translates into higher fees. Planning for these scenarios ensures that budgets are comprehensive and aligned with strategic objectives.

1. ESOP and Employee Stock Option Valuations:

Valuations related to ESOP issuance require adherence to regulatory standards, such as those set by SEBI or the Companies Act. These valuations often involve complex modeling, multiple grant types, and periodic reassessments, resulting in higher professional fees.

2. Intangible Asset Valuations (IP, Goodwill, Patents):

Assessing intangible assets requires specialized knowledge, including market comparables, discounted cash flow analysis, or industry-specific metrics. Intellectual property, goodwill, and patents often demand detailed due diligence, increasing both the time and cost of the assignment.

3. M&A, Capital Restructuring, or Compliance-Specific Reports:

Valuations conducted for mergers and acquisitions, corporate restructuring, or specific regulatory compliance are inherently complex. They involve thorough financial analysis, legal considerations, and scenario-based projections, which elevate professional fees.

By anticipating these specialized scenarios, businesses can allocate adequate budgets, avoid underestimating costs, and engage valuers with the requisite expertise for accurate and compliant reports.

11. Best Practices for Cost Efficiency

Effectively managing valuation fees requires strategic planning and judicious engagement of resources. The following best practices can help businesses optimize costs while maintaining high-quality outcomes:

1. Leveraging Tiered Valuer Engagement:

For assignments of varying complexity, consider tiered engagement—using junior valuers for routine or straightforward tasks and senior valuers for complex analyses. This approach can reduce overall costs without compromising accuracy or compliance.

2. Aligning Valuation Scope with Regulatory Requirements:

Clearly define the scope of valuation to match regulatory or statutory requirements. Avoid unnecessary over-analysis that inflates fees; instead, ensure that the report covers all essential elements mandated by law or institutional guidelines.

3. Documenting Fees and Additional Costs:

Maintain detailed records of all professional fees, taxes, travel, and incidental costs. This internal documentation not only aids in budgeting future valuations but also provides transparency for audits and internal financial planning.

By implementing these practices, businesses can achieve cost efficiency, regulatory compliance, and optimized resource allocation during valuation assignments.

12. Conclusion

Budgeting for company valuation fees in India is a critical component of financial and regulatory planning. By understanding fee structures—whether slab-based or percentage-based—along with the key factors influencing fees such as location, asset complexity, valuation purpose, and valuer credentials, businesses can allocate resources more effectively.

Additional charges, including taxes, travel, and specialized reports, should also be considered to avoid unexpected costs. Implementing best practices for cost efficiency, gathering multiple quotations, and leveraging authoritative resources ensures a transparent and realistic budgeting process.

Ultimately, early planning and engagement with qualified valuers enable Indian businesses to achieve accurate, compliant, and actionable valuation reports, supporting strategic decision-making and long-term growth.

Frequently Asked Questions (FAQs)

Valuation fees vary depending on the type, complexity, and purpose of the valuation. Standard property or business reports usually range from ₹2,500 to ₹4,500 regionally, while specialized reports for capital gains, ESOPs, or regulatory compliance may start at ₹12,000. High-value bank assignments can reach ₹40,000–₹50,000.

Slab-based fees are fixed amounts charged for specific report types or asset value ranges, providing predictability. Percentage-based fees are calculated as a proportion of the asset or business value, often following stepwise slabs with an upper cap, and are commonly used for high-value or regulatory assignments.

Key factors include:

- Location (metro vs non-metro cities)

- Complexity of the asset or business

- Purpose of the valuation (tax, regulatory, funding, M&A, ESOP)

- Credentials and reputation of the valuer

- Opportunities for negotiation in bulk or repeat assignments

Yes. Businesses should budget for GST or service tax, travel and outstation expenses, incidental costs for complex or remote valuations, and specialized reports such as intangible assets or ESOPs, which may incur higher charges.

Best practices include:

- Engaging a tiered valuer team (junior vs senior) based on assignment complexity

- Aligning valuation scope strictly with regulatory requirements

- Requesting multiple quotations from registered valuers

- Negotiating fees for bulk or repeat assignments

- Documenting all costs, including taxes and incidental expenses, for accurate budgeting