Table of Contents

Toggle1. Introduction

Employee Stock Option Plans (ESOPs) have emerged as one of the most powerful tools for Indian startups to attract, retain, and motivate top talent. By offering employees a stake in the company, ESOPs transform them from mere contributors into invested partners in the business’s long-term success. In a highly competitive startup ecosystem, where skilled professionals have multiple options, a well-structured ESOP can be a decisive factor in building loyalty and commitment.

However, designing an effective ESOP is far from straightforward. Indian startups must navigate a complex web of regulatory requirements, taxation rules, and compliance obligations. At the same time, founders need to ensure that equity allocation aligns with long-term business objectives without jeopardizing their control or diluting ownership excessively. This is where ESOP consultants play a critical role—providing expert guidance to strike the delicate balance between legal compliance, employee motivation, and strategic growth.

As the Indian startup ecosystem matures, regulations governing ESOPs are becoming increasingly structured. Recent amendments under the Companies Act, 2013, along with SEBI guidelines and DPIIT provisions for recognized startups, require careful planning and documentation. Expert consultants help startups interpret these frameworks, ensuring that ESOPs are not only legally sound but also aligned with the company’s evolving business strategy.

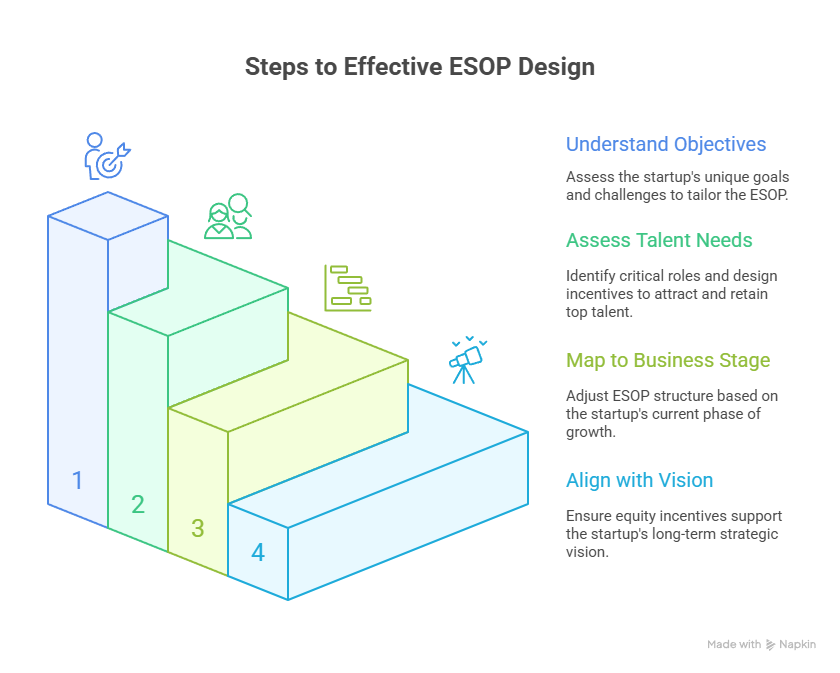

2. Understanding the Startup’s Unique Objectives

Every startup has its own growth trajectory, challenges, and talent needs. An ESOP consultant begins by conducting a thorough assessment of the company’s objectives to ensure that the ESOP is a strategic enabler rather than just a compliance formality.

Assessing Talent Acquisition and Retention Goals

Startups often face stiff competition in hiring skilled employees, especially in sectors like technology, fintech, and healthcare. Consultants help identify which roles are critical for growth and design grant structures that attract top-tier talent. Simultaneously, they craft vesting schedules and performance-linked incentives that enhance retention, ensuring employees remain committed through key business milestones.

Mapping ESOP Design to Business Stage

The stage of the startup—seed, early-stage, or growth—affects how the ESOP is structured. Early-stage companies may offer larger equity grants to offset lower cash compensation, while growth-stage startups might focus on performance-linked options and alignment with investor expectations. Consultants leverage their experience to tailor the ESOP to the company’s funding stage, cash flow considerations, and strategic roadmap.

Aligning Equity Incentives with Long-Term Vision

A core principle of effective ESOP design is ensuring that equity incentives reinforce the startup’s long-term vision. Consultants work closely with founders to balance immediate employee motivation with sustainable equity allocation. This alignment ensures that employees’ interests are closely tied to the company’s growth, creating a win-win scenario where both the team and founders benefit from increased valuation and successful exit outcomes.

By understanding the startup’s unique objectives and challenges, ESOP consultants lay the foundation for a plan that is both motivating for employees and strategically aligned with the business’s long-term goals.

3. Designing the ESOP Structure

Once the startup’s objectives are clear, the next step is to design a robust ESOP structure that balances employee motivation with strategic equity management. ESOP consultants play a crucial role in defining key parameters that make the plan both attractive and sustainable.

Determining the Pool Size

One of the first decisions is setting the size of the ESOP pool, which typically ranges from 10–15% of the total equity. Consultants assess the company’s current capital structure, growth plans, and talent requirements to recommend a pool size that is sufficient to incentivize employees without causing excessive dilution for founders and early investors.

Assigning Grant Sizes Based on Roles and Seniority

Not all employees receive the same allocation. Consultants help structure tiered grants, ensuring that senior management and critical hires receive options proportionate to their impact, while entry-level employees are incentivized appropriately. This approach maintains fairness and aligns rewards with contribution and responsibility.

Setting Eligibility Criteria and Vesting Schedules

Eligibility for ESOPs must be clearly defined to avoid disputes and ensure compliance. Consultants help determine which employees or categories qualify for participation. They also recommend vesting schedules—commonly a 4-year vesting period with a 1-year cliff—that balance long-term retention with immediate engagement. This means employees earn their options gradually, creating a strong incentive to remain with the company through key growth phases.

Balancing Motivation with Founder Equity Protection

A well-designed ESOP motivates employees without compromising founder control. Consultants carefully model equity dilution, simulate potential exit scenarios, and structure grants to ensure that the startup can attract talent while protecting the founders’ strategic and ownership interests. The result is a plan that drives engagement, loyalty, and performance while maintaining the company’s long-term vision.

4. Ensuring Legal Compliance

ESOPs in India are governed by complex regulatory requirements. Missteps in compliance can lead to legal challenges, taxation issues, or investor concerns. ESOP consultants provide end-to-end guidance to navigate the legal landscape, ensuring that plans are both enforceable and aligned with statutory obligations.

Drafting ESOP Schemes under Section 62(1)(b)

Section 62(1)(b) of the Companies Act, 2013, governs the issuance of shares under ESOPs. Consultants help draft comprehensive ESOP schemes that comply with this section, covering all critical elements such as grant terms, eligibility, vesting schedules, and exercise rules.

Guiding Board and Shareholder Approvals

Before implementation, ESOP schemes must receive approval from the board of directors and, in most cases, the shareholders. Consultants prepare detailed documentation, present recommendations, and ensure all corporate approvals are obtained efficiently, reducing delays and mitigating legal risks.

Coordinating Filings like Form PAS-3 with ROC

Certain filings, such as Form PAS-3 with the Registrar of Companies (ROC), are mandatory for recording ESOP allotments. Consultants manage these submissions accurately and on time, avoiding penalties or procedural complications.

Engaging SEBI-Registered Merchant Bankers for Fair Valuation

For unlisted startups, independent valuation of shares is a legal necessity. ESOP consultants coordinate with SEBI-registered merchant bankers to determine fair market value, ensuring compliance and transparency. This step also establishes confidence among employees and investors that equity allocations are based on credible valuations.

By meticulously handling legal and regulatory requirements, ESOP consultants help startups launch compliant, risk-free plans that protect both the company and its employees while building a strong foundation for sustainable growth.

5. Employee Communication and Education

Even the most meticulously structured ESOP can fall short if employees do not understand its value. ESOP consultants ensure that employees are fully informed and engaged, turning equity plans into genuine motivators rather than abstract promises.

Workshops and Awareness Campaigns

Consultants organize workshops, webinars, and regular communication campaigns to explain key ESOP terms such as vesting schedules, exercise price, and exit clauses. By translating technical jargon into simple, relatable language, employees gain a clear understanding of how their stock options work and what benefits they can anticipate over time.

Educating on Tax Deferral Benefits

For startups recognized by DPIIT, ESOP consultants highlight tax deferral opportunities, explaining how employees can defer tax liability until the shares are exercised. This guidance ensures employees are aware of financial advantages and can make informed decisions regarding their options.

Building Engagement and Trust Through Transparency

Transparent communication fosters trust and engagement. When employees understand why a certain pool size was allocated, how vesting works, and what to expect in case of resignation or acquisition, they are more likely to feel ownership in the company’s success. Consultants help create documentation, FAQs, and ongoing updates that keep employees informed and motivated.

6. Supporting Valuation and Tax Planning

A key component of effective ESOP management is ensuring that valuation and tax implications are carefully addressed. ESOP consultants help startups navigate these technical areas to maximize the plan’s impact while maintaining compliance.

Coordinating Independent Valuations

For private companies, an independent valuation of shares is legally mandatory before issuing options. Consultants coordinate with SEBI-registered merchant bankers or certified valuers to determine fair market value, ensuring compliance and instilling confidence among both employees and investors.

Structuring Grants to Minimize Dilution

Consultants design grants that balance equity allocation with founder control. By simulating funding rounds and potential exits, they structure options in a way that incentivizes employees while minimizing dilution, preserving both ownership and strategic decision-making power.

Clarifying Tax Treatment

The tax treatment of ESOPs can be complex, with implications at both grant and exercise stages. Consultants provide guidance on how capital gains, perquisites, and deferred taxes apply, helping employees plan their financial decisions effectively.

Aligning Exercise Periods and Post-Resignation Timelines

Exercise periods, post-resignation timelines, and other terms must align with market standards and startup goals. ESOP consultants ensure that timelines are practical, competitive, and legally sound, protecting both the company and its employees while maintaining motivation and retention.

7. Ongoing Administration and Compliance Monitoring

Implementing an ESOP is just the beginning; maintaining its accuracy, compliance, and relevance requires continuous oversight. ESOP consultants provide startups with the systems and processes necessary to manage their plans efficiently and mitigate potential risks.

Setting Up Tracking Systems

Consultants help implement grant tracking systems that monitor vesting schedules, exercise dates, and option expirations. Accurate record-keeping ensures transparency for employees and simplifies reporting for management and auditors.

Updating ESOPs with Business Changes

Startups are dynamic by nature, often experiencing new funding rounds, expansions, or strategic pivots. ESOP consultants ensure the plan remains aligned with these changes, updating grant structures, pool sizes, and vesting schedules as needed. This keeps the plan both motivating for employees and compatible with evolving business goals.

Regular Compliance Checks

Regulatory frameworks and tax rules governing ESOPs continue to evolve. Consultants conduct periodic compliance audits, verifying that all filings, valuations, and internal records are current and accurate. This proactive approach prevents legal issues and preserves investor and employee confidence in the ESOP.

8. Plan Performance Review and Optimization

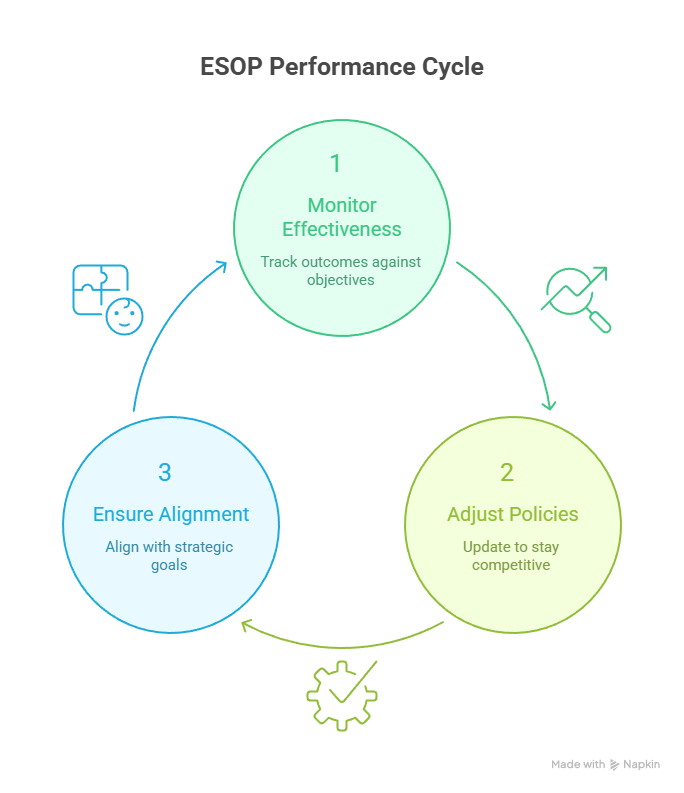

A high-performing ESOP is not static—it requires continuous evaluation and refinement to remain effective in driving retention, motivation, and long-term growth.

Monitoring Effectiveness Against Objectives

Consultants track whether the ESOP is achieving its intended outcomes, such as retaining key talent, incentivizing performance, and supporting valuation growth. Metrics and feedback mechanisms help assess both employee engagement and business impact.

Adjusting Policies to Stay Competitive

To maintain a competitive edge in talent markets, consultants recommend policy adjustments, including new grants, revised vesting schedules, or tailored incentives for critical roles. These updates ensure the ESOP remains a compelling part of the overall employee value proposition.

Ensuring Long-Term Alignment

By continuously reviewing and refining the plan, consultants guarantee that ESOPs remain aligned with the company’s strategic goals, fostering a sense of ownership among employees while safeguarding founder equity. This iterative approach helps the ESOP evolve alongside the startup, creating sustained value for all stakeholders.

9. Mitigating Risk for Founders and Startups

While ESOPs are powerful tools for growth and engagement, they also carry potential risks if not carefully managed. ESOP consultants help identify, evaluate, and mitigate these risks, ensuring that the plan supports business objectives without unintended consequences.

Managing Over-Dilution Risks

Excessive equity allocation can dilute founders’ ownership and control. Consultants model potential scenarios, including multiple funding rounds and exits, to recommend pool sizes and grant structures that minimize dilution while keeping employees motivated.

Ensuring Regulatory and Legal Safeguards

Legal missteps can lead to penalties or disputes. Consultants verify that all aspects of the ESOP comply with Companies Act provisions, SEBI guidelines, and tax regulations, providing a protective framework for both the company and its employees.

Protecting Company Culture and Strategic Goals

Equity is not just a financial instrument—it influences culture. Consultants help structure the plan so it reinforces collaboration, loyalty, and long-term strategic alignment, maintaining the startup’s vision and values even as it scales.

10. Best Practices in ESOP Design

Experienced ESOP consultants employ best practices to make the plan effective, fair, and sustainable.

Tiered Grant Structures and Performance-Linked Vesting

Allocating options based on roles, seniority, and performance ensures fairness while incentivizing key contributors to deliver measurable results.

Clear Communication and Employee Engagement

Regular workshops, documentation, and transparent updates ensure that employees understand the plan, its benefits, and how it aligns with their personal growth, fostering trust and motivation.

Benchmarking Against Industry Standards

Consultants compare ESOP practices with competitors and sector norms, ensuring that the plan is attractive to top talent while remaining aligned with investor expectations.

11. Conclusion

ESOP consultants play a pivotal role in helping Indian startups design, implement, and optimize equity plans that balance compliance, employee motivation, and founder equity. By leveraging their expertise, startups can ensure that their ESOPs not only comply with legal and regulatory requirements but also act as strategic tools for retention, engagement, and long-term growth.

Engaging professional guidance early allows startups to structure scalable and effective ESOPs, mitigating risks, reinforcing culture, and creating a genuine sense of ownership among employees. In India’s rapidly evolving startup ecosystem, partnering with an ESOP consultant is not just an operational choice—it’s a strategic investment in the company’s future success.

Frequently Asked Questions (FAQs)

An ESOP consultant guides startups in designing, implementing, and managing Employee Stock Option Plans. They ensure legal compliance, optimize equity allocation, communicate the plan effectively to employees, and help align the ESOP with the company’s long-term goals.

Indian startups must navigate complex regulations under the Companies Act, SEBI guidelines, and tax laws. Expert consultants help prevent compliance errors, avoid over-dilution, and structure the plan to maximize both employee motivation and founder control.

Consultants recommend a pool size based on the company’s stage, talent requirements, and growth plans. Typically, startups allocate 10–15% of total equity, balancing the need to incentivize employees while protecting founder ownership.

Consultants run workshops, create clear documentation, and maintain ongoing communication campaigns. They explain vesting schedules, exercise prices, tax implications, and exit scenarios, ensuring employees understand the value and benefits of their equity.

Yes. Beyond initial design, consultants assist with grant tracking, vesting schedules, compliance audits, plan updates after funding rounds, and performance reviews to ensure the ESOP remains effective and aligned with business objectives.