Table of Contents

Toggle1.Introduction

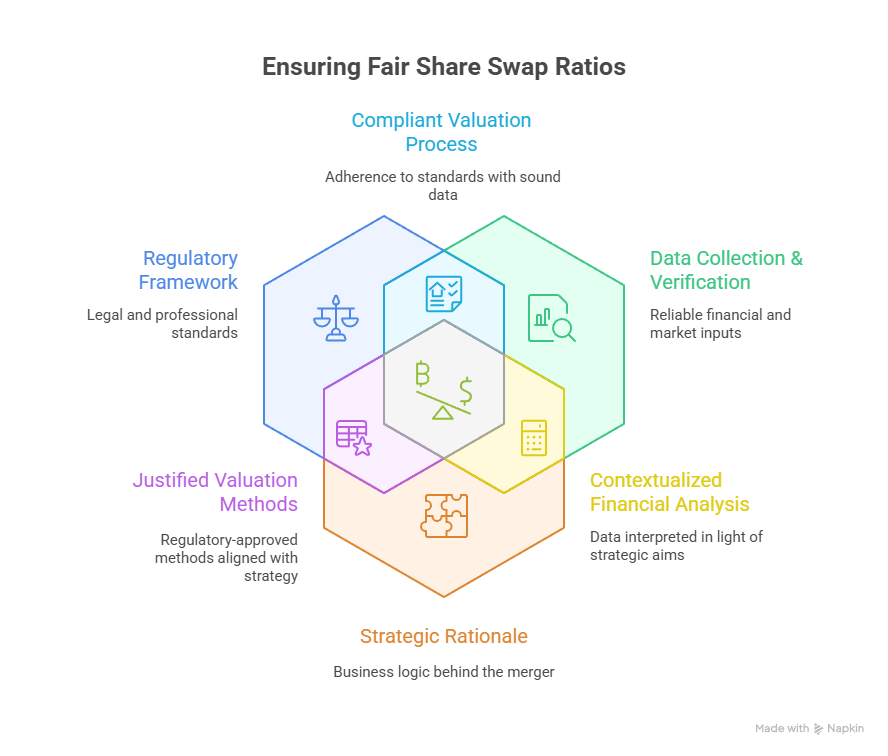

Mergers and acquisitions (M&A) are not just about bringing two companies together—they are about creating a fair, balanced, and sustainable entity for the future. One of the most important aspects of this process is determining how the shareholders of each company will be compensated. This is where a share swap ratio report comes into play.

A share swap ratio report provides the foundation for ensuring that ownership in the merged entity is allocated in a transparent and equitable manner. By blending financial analysis with legal requirements, it serves as a critical tool for boards, regulators, and shareholders in assessing whether a merger or amalgamation is fair to all parties involved.

2.What is a share swap ratio report?

A share swap ratio report is a professional valuation document prepared by an independent valuer to determine the number of shares that shareholders of the target company will receive in exchange for their existing holdings when two entities merge. For example, if Company A acquires Company B, the report specifies how many shares of Company A will be issued to Company B’s shareholders.

The report is not just about crunching numbers—it ensures compliance with Indian corporate and securities law, while also safeguarding the financial interests of stakeholders.

3.Why it is critical in mergers and acquisitions

In M&A transactions, the swap ratio has direct implications on shareholder wealth, voting rights, and long-term ownership structures. An inaccurately determined ratio can lead to disputes, regulatory hurdles, or even collapse of the proposed deal.

Key reasons why it is critical include:

- Fairness and Transparency: Ensures both sets of shareholders feel equitably treated.

- Regulatory Compliance: Required by Indian laws, SEBI guidelines, and accounting standards.

- Investor Confidence: A carefully prepared ratio builds trust in the deal’s financial integrity.

- Risk Mitigation: Reduces chances of litigation, objections from minority shareholders, or rejection by regulators such as the NCLT.

4.Quick overview of the Indian context

In India, share swap ratios are governed by a well-defined legal and regulatory ecosystem. The Companies Act, 2013 lays down the framework for mergers and amalgamations, while the Securities and Exchange Board of India (SEBI) prescribes specific rules for listed entities under its ICDR Regulations, 2018 and subsequent circulars. In addition, the Institute of Chartered Accountants of India (ICAI) provides valuation standards that must be followed by registered valuers.

Together, these frameworks ensure that swap ratio reports are not only based on robust valuation methodologies but also meet disclosure, transparency, and fairness requirements.

5.What Is a Share Swap Ratio?

Put simply, a share swap ratio is the rate at which the acquiring company issues its own shares in exchange for the shares of the target company. For example, a ratio of 3:5 means that shareholders of the target company will receive three shares in the acquirer for every five shares they currently hold.

Importance for shareholders, acquirers, and regulators

- For Shareholders: The swap ratio directly impacts the value of their investment and their stake in the merged entity. A favorable ratio assures them of fair treatment.

- For Acquirers: It determines the extent of dilution in ownership and helps in aligning strategic objectives with financial feasibility.

- For Regulators: It acts as a benchmark to ensure that mergers are not only commercially sound but also equitable and compliant with statutory norms.

In essence, the share swap ratio is the cornerstone of any merger—it is the number that can make or break the deal.

Regulatory Framework in India

The preparation of a share swap ratio report in India is not merely a financial exercise; it is a process tightly bound by statutory and regulatory requirements. Multiple legal instruments and professional guidelines ensure that the valuation is carried out transparently, fairly, and in a manner that protects the interests of all stakeholders.

Companies Act, 2013 (Sections 230–240)

Beyond financial management, a Virtual CFO provides strategic guidance that helps businesses navigate growth opportunities and challenges. By analyzing market trends, benchmarking performance against industry standards, and evaluating investment options, vCFOs enable management teams to make informed decisions. They also help shape business models, prioritize initiatives, and align financial strategy with long-term goals. For Indian startups and SMEs, this strategic input can be crucial for securing funding, scaling operations, and maintaining competitive advantage.

5.4 Comprehensive Compliance Support

The Companies Act, 2013 provides the overarching legal framework for mergers, amalgamations, and arrangements in India. Sections 230–240 outline the procedural and substantive requirements for such transactions. These provisions require:

- Filing of schemes of arrangement or amalgamation with the National Company Law Tribunal (NCLT).

- Approval by the boards of directors and shareholders of the respective companies.

- Disclosure of valuation reports and fairness opinions as part of the merger documentation.

The Act makes it clear that valuation, including the share swap ratio, must be presented in a way that satisfies the scrutiny of regulators, shareholders, and creditors.

SEBI (ICDR) Regulations, 2018 & Master Circular 2023

For listed companies, the Securities and Exchange Board of India (SEBI) imposes additional obligations. Under the Issue of Capital and Disclosure Requirements (ICDR) Regulations, 2018, companies must follow detailed pricing and disclosure rules when issuing shares as consideration in a merger or amalgamation.

The SEBI Master Circular, 2023 further consolidates these requirements, ensuring that investors in listed entities receive consistent, transparent, and reliable information. Key aspects include:

- The use of prescribed pricing formulas such as the volume-weighted average price (VWAP).

- The requirement for an independent merchant banker to provide a fairness opinion on the swap ratio.

- Disclosure obligations that prevent information asymmetry between promoters, institutional investors, and minority shareholders.

ICAI and Indian Valuation Standards

The Institute of Chartered Accountants of India (ICAI) has issued valuation standards that are binding on registered valuers. These standards mandate the use of globally recognized valuation approaches—asset-based, income-based, and market-based—while requiring transparency in assumptions and methodology.

Every swap ratio report must therefore:

- Clearly state the valuation methods adopted.

- Justify why certain approaches were included or excluded.

- Disclose key assumptions, limitations, and reliance on external information.

Together, the Companies Act, SEBI regulations, and ICAI standards form a three-tiered regulatory backbone, ensuring that the share swap ratio is calculated fairly and withstands both regulatory and judicial review.

Preliminary Data Collection

Before any valuation method can be applied, a comprehensive collection and verification of data is essential. The quality of inputs directly influences the accuracy and credibility of the final swap ratio report.

Financial statements and audit requirements

The starting point is the audited financial statements of both companies involved in the transaction. Audited accounts provide reliability, minimize manipulation risks, and create a common baseline for comparison. Where applicable, interim financials may also be reviewed to reflect recent performance.

Financial statements and audit requirements

The starting point is the audited financial statements of both companies involved in the transaction. Audited accounts provide reliability, minimize manipulation risks, and create a common baseline for comparison. Where applicable, interim financials may also be reviewed to reflect recent performance.

Market data (if listed)

For listed entities, market-based data is indispensable. Analysts typically review stock prices, trading volumes, and price multiples such as Price-to-Earnings (P/E) and Price-to-Book (P/B) ratios. SEBI requires the use of volume-weighted averages over specified time frames to ensure that temporary volatility does not distort the valuation

Capital structure, profitability, and other metrics

A detailed examination of each company’s capital structure is critical. This includes debt levels, preference share obligations, reserves, and contingent liabilities. Profitability ratios such as EBITDA margins, earnings per share (EPS), and return on equity (ROE) help to assess the intrinsic strength and long-term sustainability of the business.

Strategic rationale for merger

Numbers alone cannot justify a merger. The strategic rationale—whether it is achieving synergies, expanding into new markets, or consolidating operations—must also be factored into the valuation. A sound swap ratio report therefore ties financial data with strategic intent, demonstrating to regulators and shareholders that the transaction makes both commercial and financial sense.

7.Choosing the Right Valuation Methodologies

The choice of valuation methodology is one of the most crucial steps in preparing a share swap ratio report. A well-prepared report does not rely on a single method; instead, it evaluates multiple approaches and assigns appropriate weights based on the nature of the businesses involved, industry practices, and regulatory guidance.

Asset-Based Approach

This method values a company based on the net value of its assets minus liabilities. It is particularly useful when:

- The company has significant tangible assets such as real estate or machinery.

- The business is not generating consistent profits, making income-based valuation less reliable.

- Liquidation or asset-heavy considerations dominate the merger.

However, for service-oriented or technology-driven businesses, this method often understates true value since it does not capture future earnings potential or intangible assets like intellectual property and brand equity.

Market-Based Approach

The market-based approach uses stock market indicators and comparable company analysis to estimate fair value. Common metrics include:

- Market Capitalization of listed entities.

- Price Multiples such as Price-to-Earnings (P/E) and Price-to-Book (P/B) ratios.

- Comparable Transactions, where the valuation multiples from similar mergers are applied.

This approach is most relevant for listed companies where sufficient trading data is available. It reflects real-time investor sentiment and provides a benchmark against peer companies in the same industry.

Income-Based Approach

The income-based approach values a company based on its expected future earnings. Two widely used techniques are:

- Discounted Cash Flow (DCF): Projects future cash flows and discounts them to present value using a suitable discount rate.

- Profit Capitalization: Estimates maintainable profits and applies a capitalization rate to arrive at value.

This approach is most effective for companies with stable operations and predictable growth patterns. However, it requires careful judgment in estimating future cash flows, growth rates, and discount factors.

Assigning Weights to Different Methods

In practice, valuation reports often combine methods to provide a balanced outcome. For instance:

- A manufacturing firm may rely more on the asset-based and market-based approaches.

- A service or technology firm may emphasize income-based and market-based valuations.

- Asset-based may even be assigned zero weight where intangibles dominate business value.

The final decision on weight allocation must be clearly justified in the report, supported by industry context, financial performance, and regulatory norms.

8.Determining Relative Value Per Share

Once valuations are carried out using different methods, the next step is to translate those figures into the relative value per share of each company. This ensures a fair comparison between the acquirer and the target before arriving at the final swap ratio.

Fair Value Computation for Both Companies

For each valuation approach adopted, the fair value per share of both companies is calculated. This involves:

- Dividing the enterprise value by the number of outstanding equity shares.

- Adjusting for preference shares, options, or other instruments where relevant.

- Normalizing earnings or excluding extraordinary items to ensure consistency.

Weighting Multiple Valuation Approaches

After individual fair values are derived, the weighted average method is applied. For example:

- 50% weight to income-based valuation,

- 50% weight to market-based valuation,

- 0% weight to asset-based valuation (in knowledge-based industries).

This weighted calculation yields a balanced fair value per share for each company, reducing the risk of bias from a single approach.

SEBI’s Requirement for Listed Companies

For listed entities, SEBI requires that the price determined by the valuation exercise must also consider the volume-weighted average price (VWAP) over prescribed time frames. Importantly, SEBI mandates that the higher of the two values—the fair value determined by the valuer or the SEBI-prescribed price—be taken for the final computation.

This ensures that minority shareholders of listed companies are not disadvantaged by temporary dips in market prices or overly optimistic projections in valuation models.

9.Calculating the Swap Ratio

Once the relative value of each company’s shares has been determined using appropriate valuation methods, the next step is the actual computation of the swap ratio.

Formula for Swap Ratio:

Swap Ratio=Fair Value of Target Company’s ShareFair Value of Acquirer Company’s Share\text{Swap Ratio} = \frac{\text{Fair Value of Target Company’s Share}}{\text{Fair Value of Acquirer Company’s Share}}Swap Ratio=Fair Value of Acquirer Company’s ShareFair Value of Target Company’s Share

This ratio indicates how many shares of the acquiring company will be issued for every share of the target company.

Examples of Expression:

- 3 shares of the Acquirer for every 5 shares of the Target.

- 1 share of the Acquirer for every 2 shares of the Target.

The expression must be both mathematically accurate and commercially fair to all shareholders. Regulators, auditors, and independent valuers often test these ratios against benchmarks and peer transactions to ensure fairness and compliance.

10.Drafting the Share Swap Ratio Report

The share swap ratio report formalizes the valuation exercise into a document that regulators, shareholders, and company boards can rely on.

Typical Structure of the Report:

- Introduction – Purpose of the report and background of the transaction.

- Scope and Methodologies – Explanation of valuation approaches used (asset, income, and market-based).

- Valuation Analysis – Step-by-step presentation of computations, assumptions, and data sources.

- Result and Recommendation – The final swap ratio, expressed clearly for implementation.

- Disclosures and Limitations – Caveats, reliance on audited data, compliance with Indian Valuation Standards, and professional disclaimers.

The report should be written in a transparent, technically sound, and regulator-friendly manner. Clarity in presentation not only helps secure quick approvals from SEBI, NCLT, and stock exchanges (where applicable) but also builds trust with shareholders who must ultimately approve the merger scheme.

11.Mandatory Disclosures and Compliance Checks

Transparency is a cornerstone of a credible share swap ratio report. Regulators and shareholders place significant reliance on the disclosures made by the valuer and the companies involved.

Key Compliance Requirements:

- Explanation of Methods Used and Omitted – The valuer must clearly outline which valuation methodologies were applied, why they were chosen, and why certain approaches may have been excluded. This prevents any perception of bias or selective application.

- Fairness Opinion (Listed Companies) – SEBI mandates that a fairness opinion be obtained from a SEBI-registered Category I Merchant Banker for listed company mergers. This independent certification assures shareholders that the recommended swap ratio is equitable.

- Independence Declaration by Valuers – The report must carry a declaration confirming that the valuer is independent, free from conflicts of interest, and compliant with the Companies (Registered Valuers and Valuation) Rules, 2017.

These disclosures not only strengthen the credibility of the report but also help mitigate legal and regulatory risks.

12.Approvals and Regulatory Filings

Once the share swap ratio report is finalized, it triggers a series of procedural and regulatory steps before the merger can be implemented.

Approval Stages:

- Board Approval –Both companies’ boards must review the report and approve the draft scheme of merger.

- Shareholder Approval – Special resolutions are typically required, with voting thresholds under the Companies Act, 2013.

- NCLT Scrutiny – The scheme, along with the swap ratio, must be filed with the National Company Law Tribunal (NCLT), which assesses compliance with statutory requirements.

Sector-Specific Approvals:

- RBI – For NBFCs and other regulated financial institutions.

- IRDAI – For insurance companies.

- CCI (Competition Commission of India) – If the merger crosses prescribed asset or turnover thresholds.

- Other Regulators – Depending on the industry, approvals from TRAI, SEZ authorities, or sectoral ministries may also apply.

By the time the transaction reaches this stage, the swap ratio has already passed through rigorous checks. Still, smooth navigation of the approval process depends heavily on the quality and defensibility of the share swap ratio report.

13.Key Considerations for the Indian Context

Mergers and acquisitions in India operate under a highly scrutinized regulatory and shareholder environment. A few considerations are particularly important:

- Transparency and Documentation Standards – Every assumption, methodology, and data source must be carefully documented. Lack of clarity can invite objections from regulators or shareholders.

- Strategic Factors Beyond Numbers – Valuations must also account for business synergies, debt restructuring potential, and market expansion opportunities. Ignoring these can undervalue or overvalue the true economic benefit of the merger.

- Regulatory Scrutiny and Risk of Rejection – SEBI, RBI, and NCLT have become increasingly vigilant. A poorly justified or inadequately supported swap ratio can lead to outright rejection or delays, causing reputational and financial damage.

A credible, defensible share swap ratio report can therefore be the difference between a smooth merger and a failed transaction.

Sample Formats, Resources, and Templates

Professionals and businesses can refer to established standards and sample documents to ensure compliance and accuracy:

- ICAI Guidance Notes – The Institute of Chartered Accountants of India regularly issues notes on valuation methodologies and reporting.

- SEBI Circulars and Master Formats – These provide detailed instructions for listed companies, including fairness opinions and disclosure requirements.

- Published Swap Ratio Reports – Several reports are available through stock exchange filings (NSE/BSE) that can serve as real-world references.

While templates are useful, every merger is unique and requires customized valuation and reporting by qualified professionals

14.Conclusion

The preparation of a share swap ratio report is far more than a mechanical exercise. It demands rigorous data collection, careful application of valuation methodologies, transparent disclosures, and compliance with a complex regulatory framework. From the initial financial analysis to the final report submitted to NCLT, each stage must uphold the principles of compliance, fairness, and transparency. A defensible ratio not only satisfies regulators but also builds shareholder confidence in the merger’s value proposition.

For businesses navigating mergers and acquisitions, the safest route is to engage professional registered valuers who combine technical expertise with regulatory experience. The credibility of your share swap ratio report could very well determine the success of your merger.

Frequently Asked Questions (FAQs)

A share swap ratio report is typically prepared by a Registered Valuer (under the Companies Act, 2013) or a Category I Merchant Banker (in case of listed companies). These professionals ensure that the valuation methodologies, assumptions, and disclosures comply with SEBI, ICAI, and Indian Valuation Standards.

Yes, for listed companies, SEBI mandates that an independent Category I Merchant Banker provide a fairness opinion on the swap ratio recommended by the valuer. This serves as an external validation of the report’s objectivity and protects shareholder interests.

Valuers commonly apply a combination of the Asset-Based, Market-Based, and Income-Based (DCF or profit capitalization) approaches. The final ratio is derived using a weighted average of these methods, based on the relevance to the specific industry and business model.

Yes. While the valuation establishes fair values per share, the final swap ratio may also consider strategic, operational, or synergistic factors. However, any deviation must be clearly justified and disclosed in the report.

The timeline depends on the complexity of the transaction, data availability, and regulatory requirements. Typically, it can take 3–6 weeks from the start of financial data collection to final issuance, including review and board approvals.