Table of Contents

Toggle1. Introduction: Why Equity Valuation Matters

India’s startup and SME ecosystem is booming, but knowing when to raise capital, what it’s worth, and how much equity to dilute can make or break a business. Whether you’re a first-time founder, a seasoned investor, or a stakeholder preparing for acquisition, valuation is the compass guiding these high-stakes decisions.

Equity valuation is the process of determining the fair market value of a company’s shares, not just for paperwork, but for power plays.

From IPO pricing to strategic funding rounds, equity valuation gives stakeholders clarity, control, and confidence. And in India’s fast-growing, compliance-heavy business environment, it’s no longer optional, it’s essential.

2. What is Equity Valuation?

Equity valuation is the structured, analytical process of calculating the current worth of a company’s ownership, in simple terms, what its shares are truly worth. This process blends finance, forecasting, market signals, and regulatory benchmarks to assign a value that investors and business owners can act upon.

In India, where capital markets are maturing rapidly and private funding is flowing into early-stage ventures, understanding your company’s value is critical. Whether you’re applying for a term sheet or complying with regulatory requirements, valuation anchors your growth journey.

3. Why is Equity Valuation Important in India?

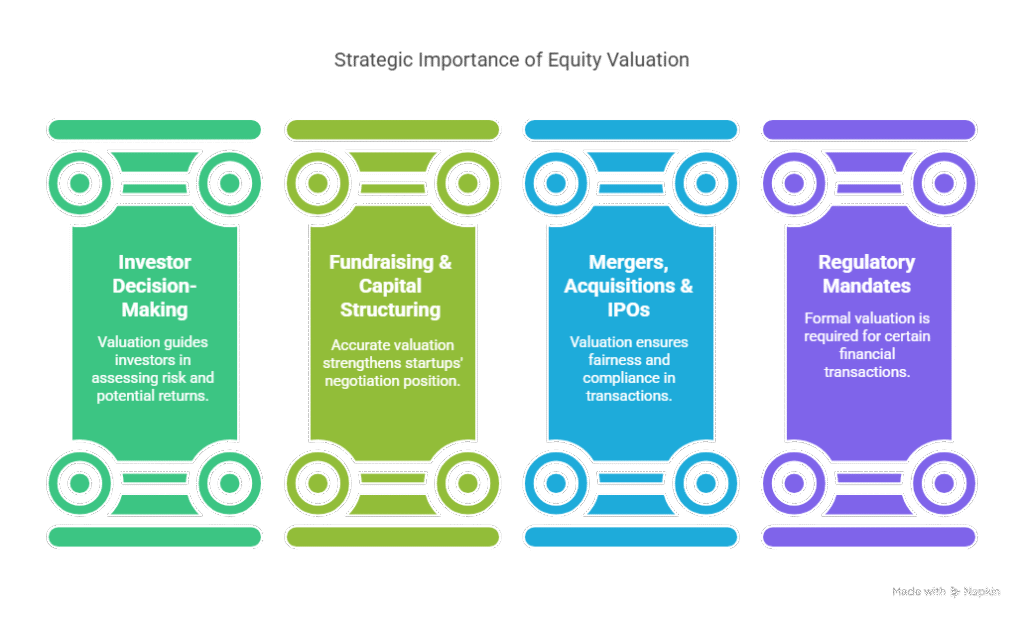

In India’s dynamic business landscape, equity valuation serves as more than just a financial tool; it’s a strategic necessity.

- Investor Decision-Making: For investors, from angels to institutional funds, valuation is the cornerstone of whether a deal is worth pursuing. It helps them benchmark risk, returns, and sector potential across a saturated startup landscape.

- Fundraising & Capital Structuring: For Indian startups and SMEs seeking valuation reports for funding, an accurate equity valuation strengthens their position during negotiations. It sets the tone for dilution, investor expectations, and long-term strategy.

- Mergers, Acquisitions & IPOs: Valuation drives fairness. Whether it’s determining swap ratios in an M&A deal or setting the right price during an IPO, equity valuation ensures all parties are aligned and compliant.

- Regulatory Mandates: Under the Companies Act, 2013, certain transactions, such as rights issues, share buybacks, and cross-border deals, require formal valuation by a Registered Valuer.

India’s equity market is becoming more sophisticated with every budget, RBI circular, and startup unicorn. For anyone navigating this landscape, understanding valuation is no longer a “nice to have,” it’s a survival skill.

4. Key Methods of Equity Valuation in India

India follows two dominant paths to arrive at equity valuation: the Market Approach and the Income Approach. Each method suits different types of businesses, depending on their maturity, structure, and data availability.

4.1 Market Approach (Relative Valuation)

This approach pegs a company’s value by comparing it with similar businesses in the same industry. It’s fast, intuitive, and widely used when there are reliable market benchmarks.

Key Techniques Include:

- Price-to-Earnings (P/E) Ratio – Ideal for comparing listed companies within sectors like FMCG or IT.

- Price-to-Book Value (P/BV) – Common in asset-heavy sectors such as real estate and banking.

- Price-to-Sales (P/S) – Useful for early-stage startups with revenue but little or no profit.

Enterprise Value to EBITDA (EV/EBITDA) – Favoured in private equity for its debt-adjusted, cash-flow-focused view.

Pros:

- Quick and reflects current market sentiment

- Leverages real-time data from listed peers

Cons:

- Less effective for early-stage or unique businesses

- Needs high-quality data from true comparables

Use Cases:

- Relative valuation is ideal when a company has clear competitors and access to industry data, such as equity valuation for listed companies, where benchmarking provides clarity and confidence.

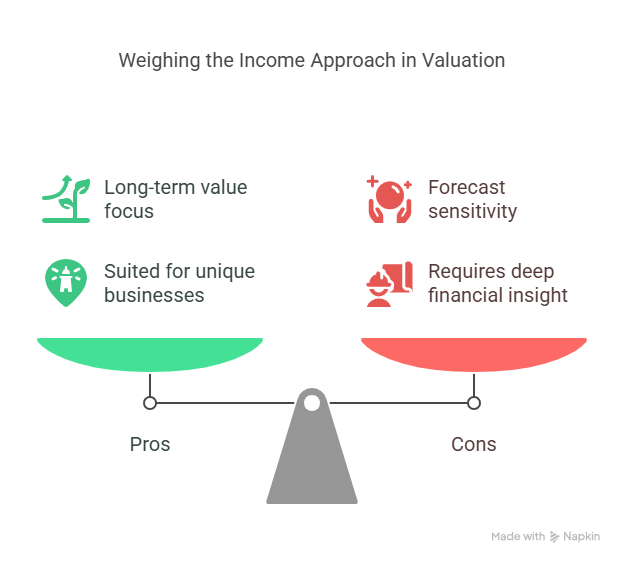

4.2 Income Approach (Intrinsic Valuation)

When market comparables are limited, a common scenario for Indian startups or family-owned businesses, the income approach is the go-to method. It values a company based on its future earning potential, adjusted to today’s value.

Key Techniques Include:

- Discounted Cash Flow (DCF) – Forecasts future cash flows and discounts them using a weighted average cost of capital (WACC).

- Capitalization of Earnings/Cash Flows – Suitable for businesses with stable earnings over time.

- Income Multiplier Method – Applies industry-standard multiples to current earnings.

Pros:

- Focuses on long-term value and company fundamentals

- Best suited for businesses without listed peers or standard benchmarks

Cons:

- Highly sensitive to forecast assumptions

- Requires deep financial modeling and industry insight

Use Cases:

Ideal for startup founders preparing valuation reports for early-stage fundraising, or SMEs needing compliance-ready valuations for strategic decision-making.

5. Regulatory Framework Around Equity Valuation in India

Equity valuation in India isn’t just a strategic tool; it’s also a legal necessity. The country’s financial ecosystem is governed by a blend of regulatory bodies, and each has clearly defined expectations when it comes to share valuation, especially in private transactions and cross-border deals.

SEBI & RBI Guidelines:

When shares of an Indian company are transferred to or from non-residents, the Reserve Bank of India (RBI) mandates that the transaction must be carried out at not less than the fair valuation, certified by a SEBI-registered Merchant Banker or a Chartered Accountant (with ICAI registration). The Discounted Cash Flow (DCF) method is generally accepted in such cases.

Companies Act, 2013 Requirements:

Under Section 247 of the Companies Act, 2013, all valuations related to corporate actions, such as rights issues, mergers, demergers, and ESOP allocations, must be carried out by a Registered Valuer. This person must be formally appointed by the company’s Board or Audit Committee.

Practical Compliance Scenarios:

At Marcken Consulting, we often assist SMEs and startups in meeting these compliance standards through structured, regulator-ready reports. Whether you’re raising funds, onboarding a foreign partner, or restructuring equity, valuation isn’t just helpful, it’s mandatory.

6. The Indian Equity Market Landscape

India’s equity market is in the middle of a paradigm shift, and equity valuation plays a front-row role in how capital is deployed.

Rising Domestic Investor Flows:

A surge in SIPs, retail investors, and family offices has reshaped market participation. Domestic flows are increasingly outpacing foreign institutional investors, creating a valuation uplift across sectors. This shift has made valuation more dynamic and sentiment-driven than ever before.

India’s Valuation Premium:

Compared to other emerging markets, India continues to command a valuation premium. This is due to robust corporate earnings, a digital-first economy, and policy predictability. As a result, businesses seeking valuation reports for IPOs or M&A deals need to understand not just fundamentals, but also the market mood.

Sentiment, Growth, and Policy:

India’s long-term story is strong, with digital infrastructure, startup incentives, and financial inclusion pushing growth forward. Yet, factors like elections, global interest rates, and sectoral regulation can influence valuation multiples overnight.

At Marcken Consulting, we help clients navigate this complexity with data-driven insights, offering business valuation services that align with both local context and global standards.

7. Common Challenges and Mistakes in Equity Valuation

Even the most sophisticated investors and founders can stumble when it comes to getting valuation right. These common pitfalls often lead to skewed numbers, poor negotiation outcomes, or non-compliance:

- Misjudging Terminal Value in DCF:

In Discounted Cash Flow analysis, the terminal value often makes up 50–70% of the final valuation. A minor tweak in growth assumptions or discount rate can drastically alter the outcome, making accuracy and realism critical. - Using Foreign Comparables for Indian Firms:

Indian companies operate under different tax regimes, consumer behaviours, and regulatory landscapes. Using U.S. or global comparables without adjusting for local variables can distort fair value, especially for early-stage businesses. - Ignoring Regulatory Impact on Unlisted Shares:

For private companies, valuation isn’t just about market sentiment; it must align with regulations laid out by the RBI, SEBI, and the Ministry of Corporate Affairs. Skipping these can not only jeopardize deals but invite scrutiny.

At Marcken Consulting, we’ve seen how precision, context, and compliance make all the difference in unlocking valuation that holds up in both negotiation rooms and audit trails.

8. Conclusion: The Power of Knowing Your Worth

Equity valuation is more than a balance sheet exercise; it’s a strategic enabler. Whether you’re courting investors, structuring equity, preparing for an IPO, or exploring a merger, understanding your company’s true worth is non-negotiable.

From market-based benchmarking to future-focused cash flow modeling, the right valuation method depends on where you are in your journey and where you’re headed.

That’s where we come in.

At Marcken Consulting, we specialise in providing expert valuation services for startups and SMEs in India, combining technical rigour with strategic insight. If you’re looking to raise funds, restructure equity, or simply want clarity before your next big move, let’s talk.

Because in today’s evolving financial landscape, knowing your worth is the first step to proving it.

Frequently Asked Questions (FAQs)

Equity valuation helps determine the fair market value of a company’s shares. In India, it plays a crucial role in investment decisions, fundraising, mergers & acquisitions, and regulatory compliance. Accurate valuation ensures businesses are neither overvalued nor undervalued — providing clarity for all stakeholders involved.

For startups, the Income Approach, particularly the Discounted Cash Flow (DCF) method, is most commonly used. Since early-stage ventures may not have listed peers or stable earnings, intrinsic valuation based on projected cash flows offers a better reflection of long-term potential. Marcken Consulting specialises in preparing DCF-based reports for startups across sectors.

Yes, under the Companies Act, 2013, a Registered Valuer is mandatory for corporate actions such as mergers, demergers, rights issues, and ESOP allotments. These professionals are empanelled with the IBBI and must be formally appointed by the company’s Board or Audit Committee.

Equity valuation directly influences how much equity an SME will need to dilute in exchange for capital. It helps in negotiating better terms with investors, justifying business potential, and presenting financial credibility. Valuation reports also act as a due diligence checkpoint in VC and angel funding rounds. Marcken Consulting offers valuation reports for funding that are investor-ready and regulator-compliant.

No. For share transfers involving non-residents, the Reserve Bank of India (RBI) requires valuation to be conducted using Indian valuation standards — typically the DCF method — and certified by a SEBI-registered Merchant Banker or a Chartered Accountant. Using foreign valuation benchmarks without localization can lead to regulatory challenges.