Table of Contents

ToggleI Introduction: The Exit Door Is Not an Afterthought

For decades, the archetype of the Indian entrepreneur was the builder—the founder who poured sweat, capital, and conviction into a venture for the long haul. But the landscape is shifting. In India’s maturing economy, entrepreneurs are no longer just focused on growth; they are thinking strategically about Business Valuation for Exit Strategy right from day one. And rightly so.

A well-planned exit is not a signal of retreat but a mark of strategic evolution. Whether the goal is to sell to a competitor, merge with a larger player, go public, pass the reins to family, or wind down operations, one element determines the quality of that decision: a robust business valuation.

Valuation is not a post-facto exercise. It is the lens through which you understand what you’ve built—and the currency with which you negotiate your future. It helps determine whether your exit is timely, profitable, and aligned with your vision.

Exits come in many forms: a high-stakes merger, a high-growth IPO, a silent succession, or even a clean shutdown. In all cases, valuation isn’t background noise—it’s the starting pitch. Done right, it anchors your exit strategy in objectivity, giving you leverage when it matters most.

II. Why Valuation is the Beating Heart of Any Exit Strategy

Defining the Exit Objective: Tailoring Valuation to Your Route

Each type of exit calls for a distinct valuation approach. A startup eyeing an IPO must present compelling growth projections backed by discounted cash flow (DCF) models. A family-run manufacturing unit planning succession might require an asset-backed valuation to divide ownership fairly. A Series C-funded tech firm entertaining acquisition talks will need a hybrid approach that blends EBITDA multiples with market comparables.

Understanding the “why” behind the valuation shapes everything that follows. It determines the methodology, the documentation, the level of scrutiny, and the parties involved in the process. An exit strategy without a purpose-aligned valuation is a shot in the dark.

Clarity, Credibility, Confidence: Why Valuations Cut Through Ambiguity

Valuation brings structure and clarity at a time when emotions, egos, and expectations often collide. For entrepreneurs and investors alike, it’s a confidence-building tool. It converts stories and vision into numbers, forecasts, and financial logic. In buyer-seller negotiations, valuation becomes the rational middle ground—especially in India, where valuation gaps often derail deals.

Credibility is another critical factor. In an ecosystem where informal deals are still common, a third-party valuation helps instill trust. It signals professionalism and readiness, reducing the risk premium that buyers might otherwise apply.

SEBI, Tax & Legal Contexts: Valuation is Also Your Regulatory Safety Net

In India, business exits are not just financial transactions—they are compliance-heavy events. SEBI regulations, especially under ICDR norms, require rigorous valuation disclosure for IPO-bound firms. Mergers and acquisitions fall under Companies Act and Income Tax Act provisions that mandate independent valuation reports. FEMA guidelines further tighten the rules when cross-border transactions are involved.

Missteps here can be costly, both financially and reputationally. That’s why valuation isn’t just about fetching the right price—it’s about navigating the legal maze without triggering red flags.

III. The Indian Lens: Key Factors That Shape Your Valuation

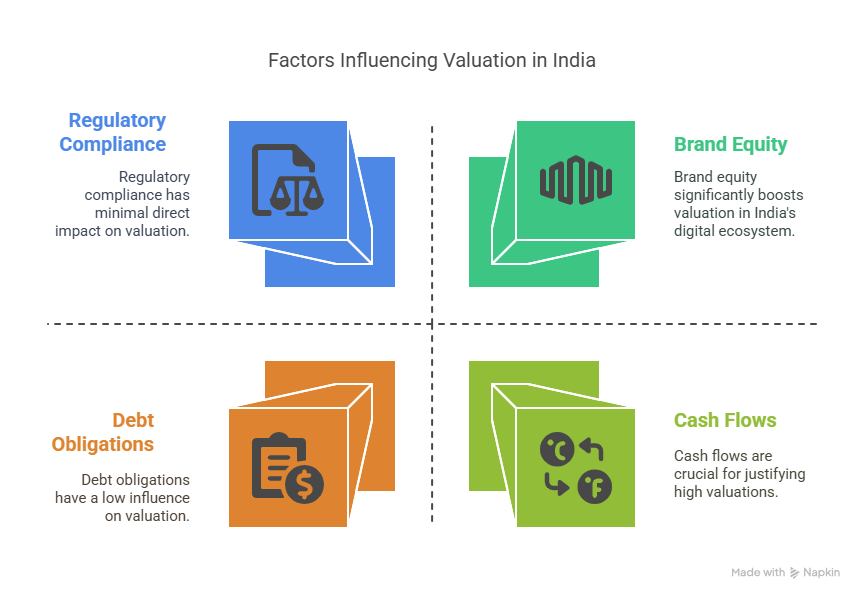

India is not a generic market—it’s a multilayered, fast-shifting, regulation-heavy arena where valuation is influenced by more than just financials. Understanding these context-specific variables is crucial if you want your valuation to hold water during an exit.

1. Market Pulse: Riding the Economic Waves

India’s economic rhythm is volatile, but full of opportunity. From bull runs in IT and manufacturing to liquidity crunches in NBFCs or global shocks, macroeconomic sentiment can shift overnight. A company valued at ₹100 crore in a bullish cycle may struggle to justify even half that figure in a downturn.

This market dependency means valuations in India need to be dynamic and defensible, not static pitch decks pulled from global templates.

2. Industry Heatmaps: Innovation Drives Premiums

India is witnessing sectoral revolutions. Fintech, EV, SaaS, edtech, and D2C brands are commanding premium valuations, while traditional sectors like textiles or real estate may stagnate unless they’ve innovated or digitized.

Industry saturation also matters: If you’re one of 200 healthtech startups, your differentiation better be tangible. If you’re a monopolistic supplier in a niche B2B vertical, your valuation power spikes.

3. Compliance Pressure: SEBI, RBI, FEMA—A Tightrope Walk

Exit scenarios often involve regulatory scrutiny. SEBI norms require merchant banker-certified fair value reports for IPOs and related-party transactions. Cross-border M&As invoke FEMA and RBI pricing guidelines. Incorrect valuations can trigger tax scrutiny, penalties, or even derail the deal.

Valuation isn’t just about value—it’s about being on the right side of the law.

4. Your Financial Spine: No Shortcuts to the Numbers

No matter how compelling the pitch, your valuation ultimately rests on fundamentals:

- Cash flows (actual, not just projected)

- Margins and operating leverage

- Debt obligations and asset-based

If your books aren’t clean, audited, and consistent across years, expect discounts—or buyer walkaways.

5. Intangibles as Game-Changers: The Hidden Multipliers

In India’s digital-first ecosystem, what you can’t touch often matters more than what you can:

- Brand equity drives pricing power and loyalty

- Proprietary tech/IP boosts defensibility and investor interest.

- Customer base and retention rates hint at long-term revenue potential.l

These are the X-factors that often don’t show up in spreadsheets but drive valuation multiples.

IV. Valuation Toolkits: Methods Every Indian Founder Should Know

There’s no one-size-fits-all. Each valuation method suits a specific kind of business, industry, and exit context. Here’s a sharp breakdown for Indian entrepreneurs

Method | Best For | Why It Works in India |

Discounted Cash Flow (DCF) | Cash-generating, growth-oriented firms | Captures India’s inflation-adjusted returns & volatile discount rates |

Market Comparables | Tech, consumer, scalable sectors | India now has a maturing private + public deal database |

Asset-Based Valuation | Manufacturing, real estate, and infrastructure-heavy businesses | Gives a defensible floor value, ideal when earnings are lumpy |

EBITDA/Revenue Multiples | VC/PE-backed companies in M&A contexts | Common shorthand among investors, especially in fast-growth plays |

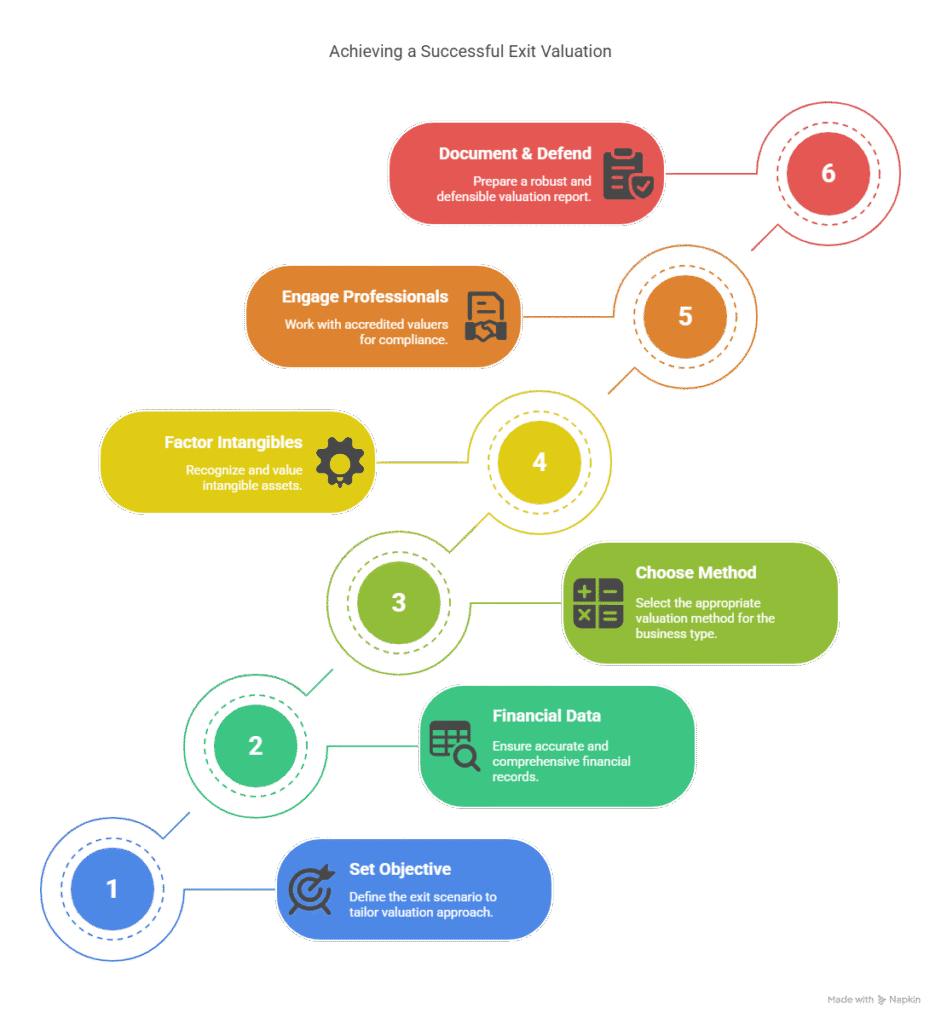

V. The Exit Valuation Process: A Step-by-Step Roadmap

Valuation isn’t just about arriving at a number—it’s about telling a story that is grounded in data, aligned with your exit objectives, and compliant with Indian regulatory standards. Whether you’re handing over your company to family, preparing for an IPO, or negotiating an M&A deal, the valuation process must be rigorous, defendable, and strategically structured.

Here’s how Indian founders should approach it—step by step:

1. Set the Objective – Tailor Valuation to Your Exit Path

The starting point of any meaningful valuation exercise is clarity of purpose. Different exit scenarios require different valuation lenses.

- Selling to a strategic or financial buyer? You need a valuation that highlights synergies, profitability, and scalability.

- Succession planning within the family? Fair market valuation is critical to avoid disputes, align stakeholders, and support wealth transfer planning.

- IPO-bound? Your valuation must meet SEBI norms and withstand scrutiny from investment bankers, auditors, and public investors.

- Liquidation? A net realizable asset-based approach becomes the focus.

Why it matters: Each exit scenario has different regulatory implications, stakeholder expectations, and valuation sensitivities. A mismatched approach can derail the deal or invite compliance risks.

2. Financial Data Deep Dive – No Room for Gaps

The credibility of your valuation is only as strong as the numbers it’s built on. In the Indian context, where due diligence is exhaustive and tax scrutiny is stringent, sloppy financials can cost you dearly.

- Prepare at least 3–5 years of audited financials.

- Ensure clean, well-reconciled profit & loss statements, balance sheets, and cash flow statements.

- Scrub out inconsistencies in revenue recognition, inventory accounting, and working capital reporting.

- Eliminate personal expenses, related-party anomalies, and undocumented transactions.

Why it matters: Investors, auditors, and regulators don’t buy stories—they buy substance. Loose numbers often result in a discount or rejection altogether.

3. Choose the Right Valuation Method – Match Sector, Scale, and Stage

Applying a one-size-fits-all valuation model is one of the most common mistakes Indian founders make. Instead, align your method with the nature of your business:

- High-growth SaaS or digital-first startups: Use revenue multiples or a forward-looking DCF model based on user growth and LTV/CAC metrics.

- Asset-heavy enterprises (e.g., real estate, infrastructure, manufacturing): Lean toward Net Asset Value (NAV) or replacement cost methods.

- Mid-stage profitable businesses: Blend EBITDA multiples with market comps to anchor valuation within peer benchmarks.

Why it matters: A wrong method can misrepresent value by crores, undermining negotiations, credibility, and compliance.

4. Factor in Intangibles – They’re the New Power Multipliers

In India’s digital and consumer-focused economy, intangibles have emerged as key value drivers. These assets, once overlooked, are now being monetized in valuation reports.

- Technology/IP: Proprietary tech stacks or patented innovations can justify higher multiples.

- Founding Team: Experienced leadership reduces execution risk and improves buyer confidence.

- Customer Traction: A loyal user base or high retention in Tier-II/III markets adds significant value.

- Brand Equity: Especially in regional or vernacular markets, brand trust is often irreplaceable.

Why it matters: Intangible assets can command premiums of 20–30% or more when presented effectively, especially to strategic or global buyers.

5. Engage the Right Professionals – Work with Registered Valuers

Indian regulatory frameworks now demand professional valuation reports in many scenarios, particularly under:

- Companies Act, 2013 (Rule 11UA)

- SEBI (ICDR) Regulations for IPO Pricing

- FEMA for cross-border exits or share transfers

- Income Tax Act for valuation during share buybacks, ESOPs, and unlisted transfers

Use a Registered Valuer (RV) accredited by the IBBI or a professional firm familiar with the sector, valuation methods, and compliance documentation.

Why it matters: Using an unqualified valuer can result in regulatory non-compliance, delayed approvals, and poor investor reception.

6. Document and Defend the Valuation – Be Audit-Ready

Your valuation report is not just for your buyer, it may be reviewed by income tax authorities, SEBI, RBI, statutory auditors, and even the NCLT (in insolvency or M&A scenarios). It must stand the test of scrutiny.

Ensure your report:

- Lays out the valuation purpose and scope

- Explains assumptions and justifies projections

- Uses comparable transactions and industry benchmarks

- Includes scenario analysis or sensitivity checks (e.g., if market conditions shift)

Why it matters: A valuation that cannot be defended during due diligence can lead to re-pricing, regulatory notices, or worse, loss of investor trust.

VI. Exit Routes and What Valuation Means in Each

Exiting a business is not a one-size-fits-all journey. Each route comes with its own set of stakeholders, documentation demands, valuation expectations, and negotiation dynamics. For Indian entrepreneurs, understanding how valuation functions within each exit context is essential to maximize value and minimize friction.

1. Mergers & Acquisitions (M&A)

What it involves:

An acquisition or merger typically means selling your business (fully or partially) to a strategic buyer, competitor, or private equity firm. In India, M&A is a common route for mid-to-large enterprises, and increasingly, for high-growth startups.

Role of Valuation:

Here, valuation becomes your strongest negotiation tool. A third-party, certified valuation report—prepared by a Registered Valuer or reputed valuation firm—is often required for regulatory filings, board approvals, and tax compliance.

- SEBI, RBI, and FEMA regulations require fair valuation, especially if foreign investors are involved.

- Strategic acquirers often pay a control premium if your business brings synergy, such as market access, IP, or customer base.

- For PE-backed or listed buyers, valuation must withstand internal due diligence, external audit, and sometimes even shareholder scrutiny.

Pro tip: Use a triangulated approach (DCF + market comps + multiples) to present a defensible range of values, not a single number. A robust report can influence not just price, but also terms like earn-outs or stock swaps.

2. Secondary Sale

What it involves:

A partial or full exit by early investors, founders, or stakeholders is often during late-stage fundraising or pre-IPO rounds. This is increasingly common in India’s startup ecosystem, especially in Series C and beyond.

Role of Valuation:

In a secondary sale, valuation acts as a reference floor for negotiations. It signals to incoming investors what the current ownership is worth and helps existing stakeholders determine fair exit points.

- Valuation is typically driven by market comparables and investor appetite, not just financials.

- Buyers (PE/VC funds) look for clean cap tables, ESOP structures, and alignment with their return expectations.

- Regulatory clarity is key: FEMA and income tax rules apply if shares are being transferred between residents and non-residents.

Pro tip: Regular internal valuations—even before a transaction—help build credibility and reduce last-minute haggling during secondary deals.

3. Initial Public Offering (IPO)

What it involves:

Listing your company on a stock exchange (like NSE or BSE) to raise capital and allows stakeholders to monetize their holdings. IPOs are capital-intensive and heavily regulated by SEBI.

Role of Valuation:

Valuation for an IPO is about more than just numbers—it’s about perception, governance, and future vision.

- Investment bankers and merchant bankers drive the price discovery process, but the foundation lies in a defensible valuation report.

- SEBI mandates a fair valuation and disclosures in the Draft Red Herring Prospectus (DRHP).

- Market sentiment, peer group analysis, and projected growth play a big role in arriving at the final IPO price band.

Pro tip: Start working on your IPO valuation at least 12–18 months in advance. Build consistency in reporting, disclosures, and performance to justify your valuation to institutional investors and the public.

4. Succession Planning

What it involves:

Transferring ownership or control of a family-run or closely held business to the next generation or professional management. This is one of the most common yet emotionally complex exit routes in India.

Role of Valuation:

A professional valuation acts as a neutral benchmark for all parties, especially when there are multiple heirs or stakeholders.

- Prevents intra-family disputes by assigning a fair value to shares or ownership units.

- Helps in tax planning (gift tax, capital gains) and setting up family trusts or holding companies.

- Assists in designing buy-sell agreements or staggered ownership transfers for smoother transitions.

Pro tip: Combine valuation with estate planning and legal structuring for a tax-efficient and conflict-free succession.

5. Liquidation

What it involves:

Shutting down the business either voluntarily or through insolvency, and distributing the remaining assets to creditors, investors, and shareholders. While it’s the least desired route, it’s sometimes the only viable one.

Role of Valuation:

Liquidation typically uses an asset-based approach, calculating the recoverable value of physical and financial assets after liabilities.

- A valuer must determine the realizable market value, not book value, of assets like real estate, inventory, receivables, and equipment.

- In India, the IBC (Insolvency and Bankruptcy Code) mandates valuation reports by two registered valuers for companies under NCLT proceedings.

- Priority of claims—creditors, vendors, employees, shareholders—makes accurate valuation critical to equitable distribution.

Pro tip: Even in liquidation, a fair and documented valuation protects directors and founders from legal claims and ensures stakeholder trust.

Each exit route demands not just a different valuation approach, but a different mindset. Whether you’re aiming for a premium IPO, a family transfer, or a clean acquisition, valuation is the thread that holds the exit narrative together. Done right, it unlocks value. Done poorly, it can cost you your legacy.

VII. Common Pitfalls: How Founders Undervalue Their Legacy

Even seasoned founders can make critical missteps when it comes to business valuation during exit planning. Here are the most common traps:

Emotional Bias:

Founders often equate years of hard work and personal sacrifice with monetary value. While “sweat equity” matters, buyers focus on data, performance, and future earnings. Emotional overvaluation can kill deals early.

Ignoring Intangibles:

Many entrepreneurs fail to quantify non-physical assets like brand loyalty, proprietary tech, or recurring customer relationships. These can drive premiums, especially in IP-rich or consumer-facing businesses, and overlooking them results in undervaluation.

Inadequate Documentation:

Buyers, auditors, and regulators require clean, verifiable data. Missing contracts, vague customer metrics, or poor bookkeeping often lead to discounted offers—or worse, deal collapse during due diligence.

Using Just One Method:

Relying solely on a single valuation approach (like DCF or asset-based) can skew the perceived value. Triangulating results from multiple methods provides a balanced, more credible valuation that stands up to negotiation.

VIII. Conclusion: Think Exit from Day One

Exit planning isn’t a sign of doubt—it’s a sign of vision. The most successful Indian entrepreneurs understand that a clear exit strategy is not a contingency; it’s a core part of business building.

Valuation is central to that process. It’s more than a number—it’s the tool that translates years of hard work, risk, and innovation into generational wealth, liquidity, or capital for the next venture.

Start early. Build systems. Track your intangibles. And when it’s time to exit, walk away not just with a deal, but with the legacy and value you deserve.

The right valuation doesn’t just tell you what your business is worth—it tells the world. Let it speak volumes.

Frequently Asked Questions (FAQs)

Business valuation is the foundation of any exit strategy. It determines the fair market value of your company, helps in negotiations with buyers or investors, and ensures compliance with Indian regulatory bodies like SEBI, RBI, and the Income Tax Department.

For Indian startups, especially those in tech or digital sectors, revenue multiples or market comparables are often preferred. However, combining methods, like DCF and EBITDA multiples, offers a more realistic and defendable valuation.

In India, valuation for statutory purposes must be done by an IBBI-registered valuer or a professional CA firm with domain expertise. This is mandatory for exits involving IPOs, M&A, or share buybacks under Indian company law.

Yes. Intangible assets like proprietary tech, brand reputation, and customer loyalty can significantly boost your business valuation, especially when targeting strategic buyers or planning an IPO.

Relying on a single method, like only using the EBITDA multiple, can misrepresent your business’s true value. Cross-verifying using multiple valuation approaches ensures accuracy, regulatory defensibility, and better negotiation leverage.