Table of Contents

Toggle1. Introduction

An MB Valuation Report is a formal document prepared by a SEBI-registered Merchant Banker, presenting an independent and objective assessment of the fair market value (FMV) of a company’s shares or other securities. This valuation is based on extensive analysis and is designed to reflect the price that would be agreed upon between a willing buyer and a willing seller in an arm’s-length transaction.

The MB Valuation Report evaluates several critical aspects of a company’s financial and operational standing, which typically include:

- Share issuance or transfers for startups, private companies, or corporate restructuring.

- Employee Stock Option Plans (ESOPs), where fair market value must be established for tax computation on perquisites.

- Property valuation for sale, gift, or mortgage purposes.

- Other asset transfers that may trigger capital gains or require compliance with specific regulatory provisions.

By understanding the types of documents required, businesses and individuals can streamline the valuation process, ensure compliance with Rule 11UA, and maintain transparency with stakeholders and tax authorities.

2. What is an MB (Merchant Banker) Valuation Report?

An MB Valuation Report is a formal document prepared by a SEBI-registered Merchant Banker, presenting an independent and objective assessment of the fair market value (FMV) of a company’s shares or other securities. This valuation is based on extensive analysis and is designed to reflect the price that would be agreed upon between a willing buyer and a willing seller in an arm’s-length transaction.

The MB Valuation Report evaluates several critical aspects of a company’s financial and operational standing, which typically include:

- Share issuance or transfers for startups, private companies, or corporate restructuring.

- Employee Stock Option Plans (ESOPs), where fair market value must be established for tax computation on perquisites.

- Property valuation for sale, gift, or mortgage purposes.

- Other asset transfers that may trigger capital gains or require compliance with specific regulatory provisions.

By understanding the types of documents required, businesses and individuals can streamline the valuation process, ensure compliance with Rule 11UA, and maintain transparency with stakeholders and tax authorities.

3. Board Resolution or Engagement Letter

A Board Resolution or an Engagement Letter is a critical document that formally authorises a registered valuer to carry out the Income Tax valuation. It establishes the legitimacy of the valuation assignment and ensures clarity regarding the scope and purpose of the engagement.

- Client Authorisation: For companies, a board resolution passed by the directors acts as official consent, while individuals can provide an engagement letter. This authorisation confirms that the valuer has been appointed with proper approval and that the valuation process is being undertaken in good faith.

- Purpose of Valuation: The document must clearly state the objective of the valuation. Common scenarios include share issuance, property transfer, ESOP grants, or asset sales. Specifying the purpose ensures that the valuer applies the appropriate methodology and complies with relevant rules, such as Rule 11UA of the Income Tax Act.

- Compliance Significance: The board resolution or engagement letter not only formalises the engagement but also safeguards the company and valuer against future disputes or regulatory scrutiny. It demonstrates adherence to statutory requirements and serves as a reference for tax authorities in case of queries.Audited financial statements are among the most important documents required for an Income Tax valuation report. They provide a verified snapshot of the company’s financial health and form the basis for accurate valuation calculations.Components: The key components include:

- Time Period: Typically, financial statements for the last three years are required. This historical data helps the valuer identify trends, assess consistency in earnings, and evaluate asset performance over time.

Components: The key components include:

- Balance Sheet: Reflects the company’s assets, liabilities, and shareholders’ equity.

- Profit & Loss Account: Shows revenue, expenses, and net profit over the accounting period.

Schedules and Notes: Provide additional details on specific line items, accounting policies, contingent liabilities, and other disclosures relevant to valuation

- Relevance to Valuation: These statements allow the valuer to apply the appropriate valuation methods, such as Discounted Cash Flow (DCF), Net Asset Value (NAV), or Comparable Company Analysis, depending on the purpose and type of asset being valued. Accurate financial data ensures that the valuation report is both reliable and compliant with Income Tax regulations.

4. Income Tax Returns (ITRs)

Income Tax Returns (ITRs) are essential documents for preparing an accurate Income Tax valuation report. They provide a verified record of income and taxes paid, which helps in reconciling financial statements with actual reported data.

- Time Period: Typically, ITRs for at least the three preceding years are required. This historical perspective allows the valuer to cross-check financial trends, verify income sources, and ensure consistency in reporting.

- Role in Valuation: ITRs serve as a key reference for reconciling reported income and disclosed assets against the company’s or individual’s financial statements. They help identify discrepancies, assess taxable income, and validate assumptions used in the valuation.

- Cross-Verification: By comparing ITRs with balance sheets, profit & loss statements, and bank transactions, the valuer can ensure that the valuation is accurate, credible, and compliant with Income Tax regulations. This verification process is particularly important for transactions involving share issuance, asset transfers, or ESOP allocations.

5. Asset Documentation

The nature of the assets being valued determines the specific documentation required. Proper asset documentation ensures that the valuer has a clear understanding of ownership, rights, and historical transactions related to the asset.

For Shares and Securities:

- Ownership Proof: Sale deed, property tax receipts, or land records confirming legal ownership.

- Encumbrance Certificate: Ensures the property is free from legal or financial liabilities.

- Recent Valuation Certificate: Provides a benchmark for current valuation.

Utility Bills, Gift Deed/Will (if applicable): Supports ownership claims and historical transaction records.

Differentiating by Asset Type: Valuers require different sets of documents depending on whether the valuation pertains to financial instruments or tangible property. Accurate documentation enables the valuer to apply the appropriate methodology, verify asset legitimacy, and provide a compliant valuation report under Rule 11UA.

6. Bank Statements and Financial Transactions

Bank statements and records of financial transactions are critical supporting documents for an Income Tax valuation report. They provide concrete evidence of cash flows, investments, and other asset-related transactions that impact the valuation.

- Relevant Transactions: Valuers typically review statements showing investments, receipts, loan repayments, dividends, and other significant cash movements. This helps ensure that the valuation captures the true financial position of the company or individual.

- Supporting Valuation Assessment: By analysing bank transactions, the valuer can validate income streams, confirm liquidity, and reconcile figures reported in financial statements and ITRs. This step is essential to maintain the accuracy and credibility of the valuation report, particularly when determining fair market value for share issuances, ESOPs, or asset transfers.

7. Valuation Inputs and Forecasts

When a valuation involves forward-looking assessments, such as Discounted Cash Flow (DCF) or projections-based methods, management-provided inputs and forecasts become indispensable.

- Key Documents: These include business plans, budgets, revenue projections, earnings forecasts, and other management representations. They serve as the foundation for assumptions used in the valuation.

- Forward-Looking Valuations: For methods that rely on anticipated future performance, such as DCF or income-based approaches, these inputs allow the valuer to estimate the potential returns and determine the fair market value of shares or assets.

- Substantiating Valuation Conclusions: Documented assumptions, projections, and supporting explanations provide transparency and accountability, demonstrating that the valuation report is based on reasonable, verifiable data. Properly documented forecasts also help in defending the report before tax authorities if required.

9. Supporting Transaction Documents

To provide a clear snapshot of when an MB Valuation Report is required, who can issue it, and the applicable regulatory references, the following summary table has been compiled:

- Agreements and Meeting Records: Includes sale or purchase agreements, memorandums of understanding (MoUs), and minutes of board or shareholder meetings. These records document the terms of asset transfers, share issuances, or other relevant transactions, providing clarity on the basis of valuation.

- Government Orders Affecting Asset Value: Official notifications or government orders related to stamp duty, property valuation, or asset pricing can directly impact the assessed fair market value. Including these documents ensures that statutory adjustments are properly accounted for.

- Declaration of Fair Market Value: For transactions such as share allotment under ESOPs or private placements, a formal declaration of fair market value as per Rule 11UA of the Income Tax Act is necessary. These declarations serve as an authoritative reference point for the valuer and the tax authorities.

10. Correspondence and Regulatory Filings

Certain valuations require additional correspondence and regulatory filings to ensure compliance with sector-specific rules, foreign investment regulations, and prior approvals.

- RBI/FEMA Filings: For foreign investments or cross-border transactions, relevant filings under RBI or FEMA regulations must be included. These demonstrate that the entity has complied with foreign investment norms and reporting requirements.

- Appointment Letters of Valuers or Merchant Bankers: Documents confirming the appointment of a registered valuer or merchant banker establish legitimacy and accountability for the valuation process.

- Prior Regulatory Approvals and Compliance Certificates: Includes forms like Form FC-GPR for foreign share allotment, approvals from regulatory authorities, or any other certificates demonstrating adherence to statutory requirements.

Inclusion of these filings and correspondence ensures that the valuation report is comprehensive, fully compliant, and defensible before tax authorities or during audits.

11. Additional Documents for Specific Use Cases

Certain transactions or asset types require specialized documentation to ensure an accurate and compliant Income Tax valuation.

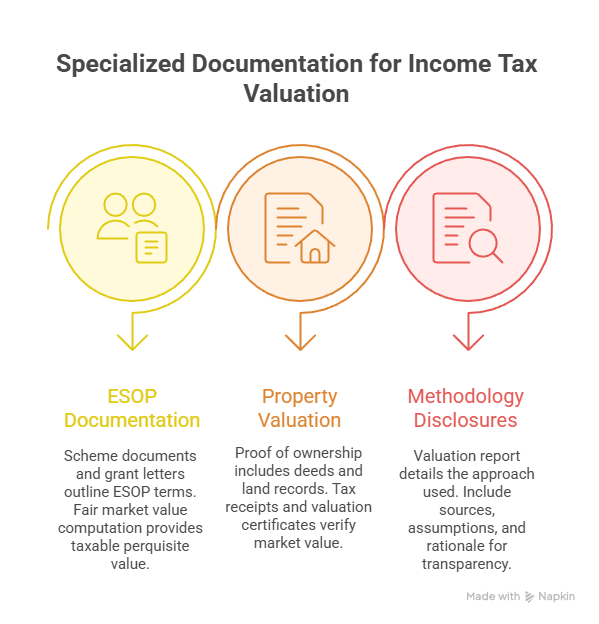

ESOPs (Employee Stock Option Plans):

- Scheme Documents and Grant Letters: Outline the terms of the ESOP, including eligibility, vesting schedules, and exercise conditions.

- Fair Market Value (FMV) Computation: Calculated as per Section 17(2) of the Income Tax Act, providing the taxable perquisite value for employees.

Property Valuations:

- Proof of Ownership: Includes sale deeds, gift deeds, or land records.

- Latest Tax Receipts and Official Valuation Certificates: Necessary for lending, legal, or compliance purposes, and to verify the asset’s market value.

Methodology Disclosures:

- The valuation report must clearly detail the approach used—whether book value, Discounted Cash Flow (DCF), or comparable market value methods.

- Include sources, assumptions, and rationale to demonstrate transparency and regulatory compliance.

By providing these additional documents, the valuer can prepare a robust, credible, and legally defensible report tailored to the specific transaction or asset type.

13. Conclusion

Complete and accurate documentation is the cornerstone of a compliant Income Tax valuation report. From basic identification to specialized asset documents, each record plays a crucial role in ensuring the valuation is reliable, transparent, and defensible.

By systematically preparing documents such as financial statements, ITRs, asset records, bank statements, transaction agreements, and methodology disclosures, businesses and individuals can streamline the valuation process and minimize the risk of regulatory scrutiny.

Key Takeaways:

- Accuracy and completeness are essential for compliance under Rule 11UA.

- Early engagement with a registered valuer ensures proper guidance and smooth preparation.

Proper documentation not only supports valuation conclusions but also protects against potential disputes or audits.

A well-prepared valuation report, backed by comprehensive documentation, provides confidence to both taxpayers and regulators, enabling seamless execution of share issuances, ESOPs, property transfers, and other asset-related transactions.

Frequently Asked Questions (FAQs)

Only SEBI-registered Category I Merchant Bankers are authorized to issue MB Valuation Reports for regulatory purposes such as FEMA compliance, foreign investments, and share issuances under the Income Tax Act, 1961. For other scenarios, like Companies Act valuations, Registered Valuers (IBBI-accredited) may be eligible.

No, MB Valuation Reports are not required when shares are issued at face value, particularly in rights issues offered to existing shareholders. However, if shares are issued at a premium, especially to non-residents or foreign investors, MB valuation becomes mandatory.

Typically, the cost starts at ₹65,000 in India, though it may vary based on transaction complexity, company size, and scope of valuation. On average, it takes approximately 8 business days to prepare and deliver a complete MB Valuation Report.

Merchant Bankers usually apply globally accepted methods such as Discounted Cash Flow (DCF), Comparable Companies Analysis, Precedent Transactions, and Market Multiples. The choice of method depends on the company’s business model, industry standards, and regulatory requirements.

No, MB Valuation Reports are not required when shares are issued at face value, particularly in rights issues offered to existing shareholders. However, if shares are issued at a premium, especially to non-residents or foreign investors, MB valuation becomes mandatory.