Private equity valuation isn’t just a spreadsheet exercise; it’s a calculated blend of financial modeling, strategic judgment, and contextual understanding. Unlike public companies, where stock exchanges provide a real-time, market-tested price, private equity operates in a far less transparent world. In India, where private businesses range from thriving tech unicorns to family-owned manufacturing giants, pinning down a company’s true worth often feels like aiming at a moving target.

What makes private equity valuation so distinct? Public companies benefit from transparent disclosures, continuous trading, and analyst coverage. Private companies, in contrast, lack frequent market transactions, standardized reporting, and, often, reliable financial visibility. Add to this the complications of illiquidity, information asymmetry, and negotiation-driven pricing, and you have a uniquely complex valuation environment.

For Indian investors, founders, and analysts, this challenge is particularly relevant. As India’s private equity landscape booms, fueled by digital transformation, demographic dividends, and regulatory reforms, accurate valuations have become mission-critical. Whether you’re negotiating an investment round, evaluating an acquisition, or planning an exit, understanding how to calculate the value of private equity can be the difference between seizing an opportunity and overpaying for risk.

Table of Contents

ToggleThe Fundamentals of Private Equity Valuation

At its core, private equity valuation is about answering one deceptively simple question: What is this company worth today? But behind that question lies a complex array of factors, from cash flows and growth projections to market comparables and sector-specific risks.

What Exactly Are We Calculating?

We’re calculating the enterprise’s economic value: how much an investor should be willing to pay for partial or full ownership of the business, based on its current financial health, prospects, and market conditions. This isn’t just an academic exercise; it’s a crucial input for deal-making, capital allocation, financial reporting, and portfolio management.

Purpose: Investment, Acquisition, Exit & Beyond

The purpose of valuation may vary:

- Investment rounds (Series A, B, growth capital, etc.)

- Mergers & acquisitions (M&A)

- Buyouts or recapitalization

- Exit planning (IPOs, strategic sales, secondary market deals)

- Financial reporting (IFRS, Ind AS compliance)

Each scenario may demand a slightly different lens and valuation methodology.

Quick Snapshot of India’s Growing PE Market (2024-2025)

India’s private equity scene is no longer emerging; it’s surging. In 2024, private equity investments rebounded to approximately $43 billion, with deal activity thriving in sectors like technology, healthcare, infrastructure, and real estate. The startup ecosystem remains vibrant, drawing both domestic and international capital. Government reforms, improved regulatory oversight, and growing investor confidence are further fueling this momentum, making India one of the most dynamic PE markets globally in 2025.

A. Market Approach (Relative Valuation)

Concept and Relevance for Indian PE Deals

The market approach values a private company by benchmarking it against publicly traded peers. The logic: if similar companies in the same sector are worth a certain multiple of earnings or sales, the private firm should command a comparable valuation, with some adjustments. In India’s active PE scene, where sectors like tech and healthcare have plenty of listed comparables on NSE and BSE, this approach provides a practical starting point.

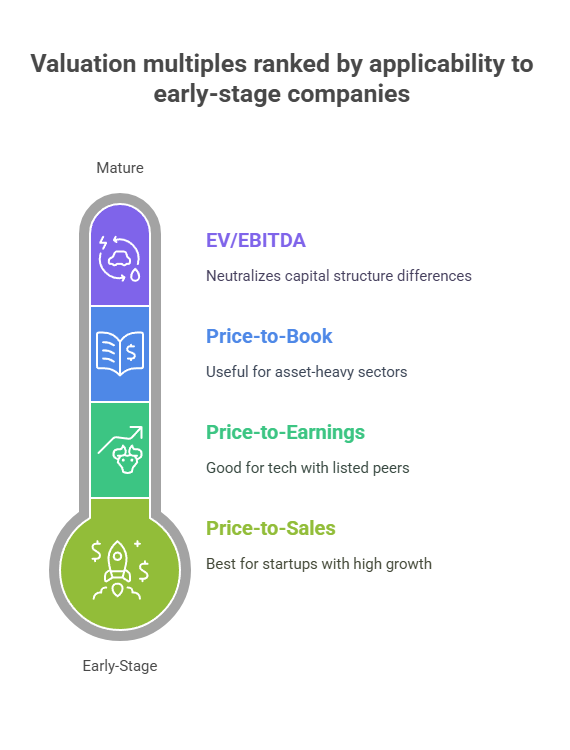

Common Multiples Explained

- Price-to-Earnings (P/E) Ratio: Measures share price relative to earnings per share (EPS). A company with an EPS of ₹8 and an industry average P/E of 25x implies a valuation of ₹200 per share.

- Price-to-Book Value (P/BV) Ratio: Useful for asset-heavy sectors like banking and infrastructure. A P/BV ratio below 1 may indicate undervaluation, while a high ratio could reflect growth prospects or market sentiment.

- Price-to-Sales (P/S) Ratio: Especially useful for early-stage startups with minimal or negative profits but strong top-line growth. In India’s booming SaaS and fintech segments, this multiple sees heavy use.

- Enterprise Value to EBITDA (EV/EBITDA): Neutralizes differences in capital structure, making it a favorite for infrastructure, manufacturing, and private equity funds assessing acquisition targets.

Indian Sector-Wise Applicability

- IT & SaaS: P/S, P/E

- Banking & Financial Services: P/BV

- Startups: P/S, EV/EBITDA

- Infrastructure & Real Estate: EV/EBITDA

Advantages & Limitations

Advantages:

- Simple and widely used.

- Market sentiment is reflected in real-time.

- Abundant comparables in mature sectors.

Limitations:

- True comparables may be hard to find.

- Can be distorted by short-term market fluctuations.

- Doesn’t capture company-specific growth potential.

B. Income Approach (Intrinsic Valuation)

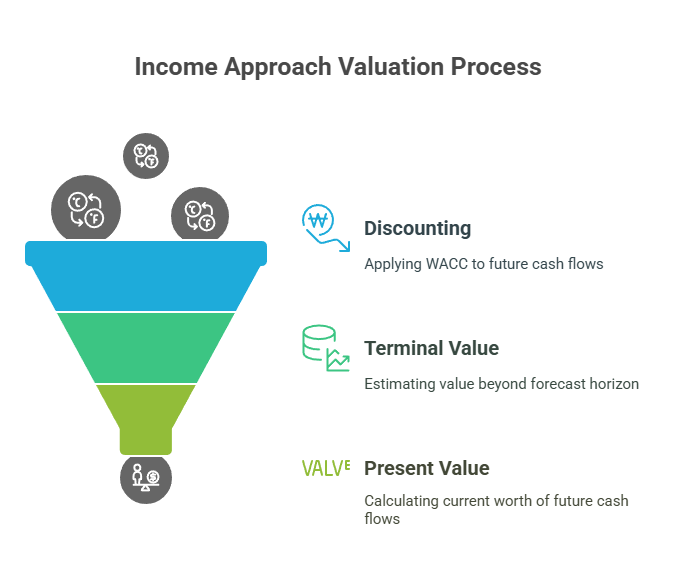

Concept: Focus on the Company’s Earning Potential

Unlike the market approach, the income approach values a company based on its ability to generate cash in the future, discounted to present value. It’s particularly useful for high-growth, innovation-driven Indian businesses where future potential often outweighs current earnings.

Key Techniques

Discounted Cash Flow (DCF)

DCF projects future free cash flows (FCF) over 5–10 years and discounts them using the Weighted Average Cost of Capital (WACC) to arrive at present value.

DCF Formula:

Where:

- FCFt= Free Cash Flow in year

- rrr = Discount rate (WACC)

- TVTVTV = Terminal Value

- nnn = Forecast horizon

Earnings Yield Method

Simpler and often used for mid-market Indian PE deals:

For example, ₹25 crore in earnings at a 10% return requirement gives a valuation of ₹250 crore.

India-Specific Nuances

- Tech & Healthcare: High growth projections make DCF highly relevant.

- Startups: Often use aggressive revenue growth models but need cautious discounting.

- Regulatory Risk: WACC adjustments for political, currency, and market risks.

Advantages & Limitations

Advantages:

- Captures long-term growth and profitability.

- Highly customizable for sector specifics.

- Preferred by sophisticated institutional investors.

Limitations:

- Sensitive to assumptions (growth rates, WACC, terminal value).

- Requires detailed, reliable financial data.

- Complex to model accurately for early-stage companies.

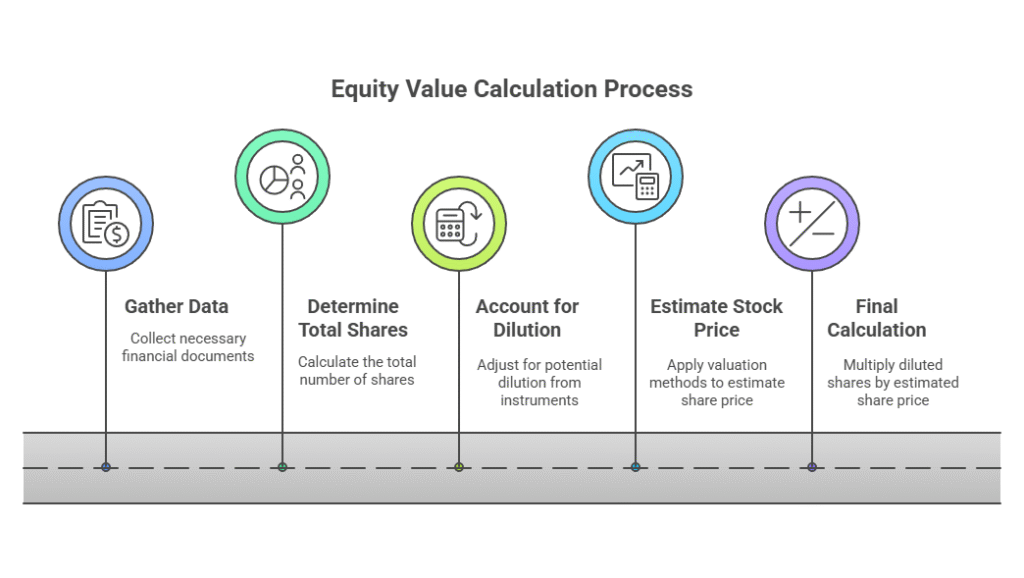

C. Equity Value Formula for Private Companies

Formula Breakdown

Equity Value = Total Diluted Shares X Stock Price

While simple in structure, each input requires careful estimation for private companies.

Steps Involved

- Determining Total Shares: Gather data from the company’s cap table, shareholder register, or audited financials.

- Accounting for Dilution: Factor in stock options, warrants, convertible notes, and other instruments using the Treasury Stock Method to calculate total diluted shares.

- Estimating Stock Price: Apply valuations derived from the market or income approaches to calculate an implied per-share price.

- Final Calculation: Multiply diluted shares by the estimated share price to arrive at total equity value.

India-Specific Practical Considerations

Data Availability Challenges

- Private companies may not disclose audited financials.

- Reliance on management projections, due diligence findings, and industry reports is often necessary.

- Valuation accuracy hinges on data credibility.

Sector-Specific Adjustments

- Different sectors demand different multiples and assumptions.

- For instance, fintech startups may warrant higher revenue multiples than traditional manufacturing.

Accounting for India's Macroeconomic & Regulatory Environment

- RBI, SEBI, and sector-specific regulators heavily influence market dynamics.

- Currency fluctuations, inflation rates, and government policy shifts need to be factored into WACC and growth forecasts.

Importance of Cross-Verification Using Multiple Methods

- No single method gives a perfect answer.

- Robust valuations blend market and income approaches.

- Cross-verifying estimates helps minimize bias and over-optimism.

Summary Table: Quick Comparison of Valuation Methods

Valuation Method | Key Metric/Formula | Best Used For | Indian Context Example |

Market Approach | P/E, P/BV, P/S, EV/EBITDA | Benchmarking against peers | Comparing a fintech startup to NSE-listed Paytm or banking sector peers |

Income Approach (DCF) | Projected FCF discounted via WACC | High-growth, cash flow-focused sectors | Valuing SaaS, healthcare, or renewable energy startups |

Income Approach (Earnings Yield) | Earnings ÷ Required Rate of Return | Mid-market or steady-state businesses | Estimating the value of a mature manufacturing or services firm |

Equity Value Formula | Total Diluted Shares × Share Price | Ownership stake calculations | Shareholder exit or buyout valuation for an unlisted startup |

When to Use Which Method?

- Use the Market Approach when there are reliable public comparables.

- Use DCF for startups, growth-stage companies, or sectors with high projected cash flows.

- Use Earnings Yield for steady, profit-generating businesses with stable earnings.

- Use the Equity Value Formula when translating enterprise value into per-share terms for ownership or deal negotiations.

Expert Insights: Common Mistakes to Avoid

1. Over-relying on Market Multiples

Many Indian founders and investors lean too heavily on market multiples without fully accounting for differences in size, maturity, and risk profile. Public comparables may trade at premium valuations that don’t reflect the realities of private businesses, especially for early-stage or niche companies.

2. Ignoring Sectoral Growth Rates

Applying flat valuation assumptions across sectors is risky. India’s tech, healthcare, and renewable energy sectors may justify higher growth premiums compared to traditional industries. Failing to build sector-specific growth curves can dramatically skew valuation outcomes.

3. Not Adjusting for Dilution or Market Volatility

Ignoring the impact of convertible instruments, ESOPs, or warrants leads to inflated equity value calculations. Similarly, neglecting India’s market volatility, driven by currency shifts, global macro trends, or regulatory changes, can make valuations overly optimistic or dangerously conservative.

4. Underestimating Regulatory Risks

From RBI’s fintech oversight to SEBI’s listing norms and FDI restrictions, India’s regulatory framework plays a significant role in company performance and risk. A valuation model that overlooks compliance and regulatory bottlenecks may misprice both risk and opportunity.

Conclusion: The Art + Science of Private Equity Valuation

Valuing private equity isn’t a formula you punch into a calculator; it’s a deliberate balance of hard numbers and seasoned judgment. While market multiples offer quick benchmarks, they rarely tell the whole story, especially in India’s highly segmented, fast-evolving market. Income-based models like DCF bring long-term growth potential into focus but demand robust data and cautious forecasting.

For Indian investors, founders, and analysts, the key lies in blending approaches, aligning sector-specific trends, macroeconomic realities, regulatory frameworks, and company-specific fundamentals. The private equity valuation process must adapt to India’s dynamic business environment, where sectors rise and regulatory shifts reshape risk almost overnight.

At its core, private equity valuation in India remains a dynamic, multi-factor discipline, part science, part art, requiring both technical precision and contextual wisdom.

Frequently Asked Questions (FAQs)

Private equity valuation lacks transparent market prices, unlike public companies. It relies on estimated cash flows, comparable company analysis, and adjusted financial data. The absence of real-time trading makes it more complex and subjective.

The Discounted Cash Flow (DCF) method is often ideal for Indian startups due to their high growth potential. Market multiples like P/S may also apply when earnings are inconsistent. A blended approach often provides better accuracy.

Indian sectors use different multiples based on industry norms. For example, EV/EBITDA is common for infrastructure, P/E for banking, and P/S for tech startups. These help align valuations with market realities.

Dilution accounts for stock options, warrants, and convertible securities that affect total ownership. Ignoring dilution can overstate a company’s equity value. Accurate dilution adjustment is crucial for fair valuations.

Common errors include over-relying on market multiples, ignoring sector growth rates, underestimating regulatory risks, and failing to adjust for dilution. Each can lead to significantly flawed valuations.