Table of Contents

ToggleIntroduction

In India’s corporate and financial ecosystem, the credibility of a business valuation can often determine the success of a merger, acquisition, fundraise, or regulatory compliance exercise. This is where a Registered Valuer comes in. A Registered Valuer is a professional recognized under the Companies (Registered Valuers and Valuation) Rules, 2017, regulated by the Insolvency and Bankruptcy Board of India (IBBI).

These rules were introduced to ensure that valuations are not left to subjective judgment but are carried out by qualified professionals with the right academic background, experience, and ethical standards. By creating a structured framework, IBBI ensures that valuations used in legal, regulatory, or commercial contexts are reliable, transparent, and in the best interest of stakeholders.

Before assuming this role, however, there are stringent eligibility conditions that must be met. From educational qualifications to professional experience and regulatory clearances, the path to becoming a Registered Valuer is rigorous. Understanding these requirements is essential for both aspiring valuers and businesses that rely on their reports.

2. Understanding the Role of a Registered Valuer

A Registered Valuer is a professional authorized to determine the fair value of assets, businesses, or financial securities for purposes such as corporate restructuring, regulatory filings, taxation, dispute resolution, or transactions like mergers and acquisitions. Their reports often form the foundation of critical business decisions, making accuracy and compliance non-negotiable.

Valuation is not merely about assigning a number. In India, it plays a deeper role in ensuring fairness, transparency, and regulatory compliance. For instance, when companies raise funds, issue shares, or undergo restructuring, the valuation report ensures that no stakeholder is disadvantaged, whether it be promoters, investors, creditors, or regulators.

Under the current framework, Registered Valuers are recognized for three primary asset classes:

- Plant and Machinery – covering industrial equipment, production facilities, and technical installations.

- Land and Building – covering real estate, civil structures, and related assets.

- Securities or Financial Assets – covering shares, bonds, derivatives, and other financial instruments.

Each of these categories requires specialized expertise, which is why IBBI mandates different academic and professional qualifications depending on the asset class. This asset-specific approach ensures that individuals with a deep understanding of the subject matter conduct valuations.

3. Essential Qualifications and Eligibility Criteria

To become a Registered Valuer in India, one must satisfy a combination of educational, professional, and regulatory requirements. These are prescribed under the Companies (Registered Valuers and Valuation) Rules, 2017, and monitored by the Insolvency and Bankruptcy Board of India (IBBI). The criteria vary depending on the type of assets an applicant wishes to value.

3.1 Educational Qualifications (Asset-Class Wise)

The qualifications are designed to ensure that valuers possess both academic knowledge and practical exposure in their respective asset classes. Below is a structured view of the eligibility requirements:

Asset Class | Minimum Qualification | Minimum Experience |

Plant and Machinery | Graduate in Mechanical, Electrical, Electronics & Communication, Instrumentation, Production Engineering, or a degree in Valuation of Plant and Machinery (or equivalent). | 5 years (Graduate) / 3 years (Post Graduate) |

Land and Building | Graduate in Civil Engineering, Architecture, or Town Planning (or equivalent). | 5 years (Graduate) / 3 years (Post Graduate + specialization in Valuation/Real Estate Valuation) |

Securities or Financial Assets | Member of ICAI, ICSI, ICMAI, or MBA/PG Diploma with Finance specialization. | 3 years |

Key Distinction:

- Graduates must typically demonstrate at least five years of experience in their respective fields.

- Postgraduates, on the other hand, benefit from a reduced requirement of three years’ experience.

This balance ensures that only candidates with substantial academic depth or practical exposure qualify for registration.

3.2 Professional and Regulatory Requirements

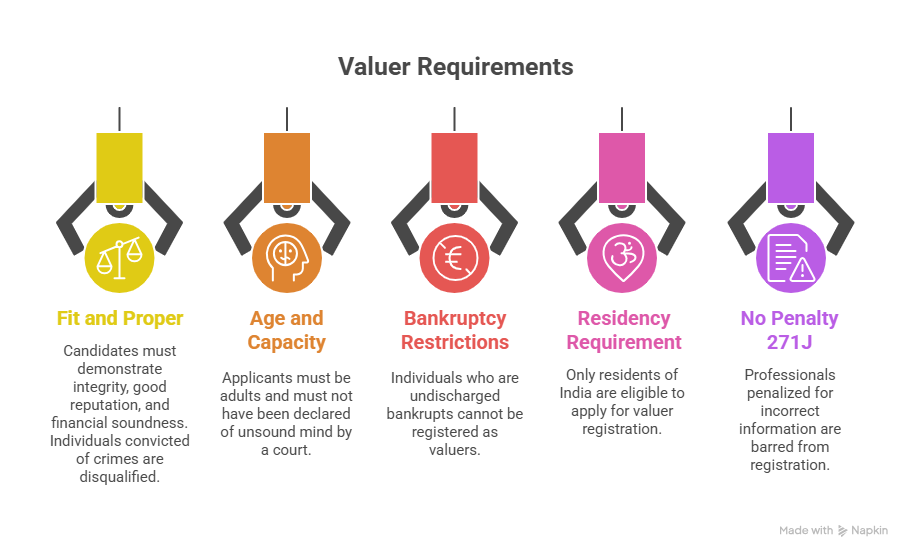

Beyond academic credentials, aspiring valuers must also meet regulatory and character-based requirements. These conditions are in place to maintain the integrity and credibility of the valuation process:

- Fit and Proper Person Criteria: Candidates must demonstrate integrity, good reputation, and financial soundness. Individuals convicted of crimes involving moral turpitude, fraud, or dishonesty are disqualified.

- Age and Legal Capacity: Applicants must be adults, not minors, and must not have been declared of unsound mind by a competent court.

- Bankruptcy Restrictions: Individuals who are undischarged bankrupts or have ongoing insolvency proceedings against them cannot be registered.

- Residency Requirement: Only residents of India are eligible to apply.

- No Penalty under Section 271J of the Income Tax Act: Professionals penalized for furnishing incorrect information in reports or certificates under this section are barred from registration.

These checks go beyond technical expertise. They are meant to ensure that valuers act as independent, unbiased professionals whose reports can withstand regulatory scrutiny and command the confidence of stakeholders.

4. Role of Registered Valuer Organisations (RVOs)

While qualifications and professional experience provide the foundation, the Registered Valuer Organisation (RVO) acts as the formal gateway to becoming a Registered Valuer in India.

An RVO is a professional body recognised by the Insolvency and Bankruptcy Board of India (IBBI). It is responsible for setting professional standards, conducting training, guiding applicants through the registration process, and ensuring the continuous professional development of its members.

Importance of RVOs

- Structured Training: They provide courses and resources designed to prepare applicants for valuation practice and the IBBI examination.

- Ethical Oversight: RVOs maintain codes of conduct to ensure members uphold integrity and independence in valuations.

- Professional Community: Membership provides access to a professional network, knowledge sharing, and updates on regulatory changes.

- Regulatory Compliance: RVOs act as intermediaries between individual valuers and IBBI, helping ensure that all applications and practices align with legal requirements.

Recognised Examples of RVOs

Some of the leading RVOs in India include:

- ICAI RVO (Institute of Chartered Accountants of India Registered Valuers Organisation)

- ICSI RVO (Institute of Company Secretaries of India Registered Valuers Organisation)

- ICMAI RVO (Institute of Cost Accountants of India Registered Valuers Organisation)

- IOV RVF (Institution of Valuers Registered Valuers Foundation)

Requirement to Become a Member

Before applying for registration as a valuer, an individual must first become a Valuer Member of an RVO. Membership is mandatory and involves meeting eligibility criteria, enrolling in the prescribed training programme, and adhering to the RVO’s code of conduct.

5. Mandatory Training and Examination

Once an applicant has the necessary academic background and RVO membership, the next step is to undergo structured training and demonstrate competence through examination.

50-Hour Valuation Education Course

Every aspiring Registered Valuer must complete a 50-hour valuation education course conducted by their RVO. This course covers:

- Fundamentals of valuation methods and approaches.

- Legal and regulatory framework for valuations in India.

- Asset-class-specific valuation techniques.

- Case studies and practical applications.

This training ensures that even experienced professionals gain uniform exposure to valuation practices as prescribed under Indian law.

IBBI Valuation Examination

After completing the course, candidates must pass the Valuation Examination conducted by the IBBI. The exam tests technical knowledge, regulatory understanding, and analytical ability specific to the chosen asset class.

- The exam must be cleared within three years of application for registration.

- Passing the exam is non-negotiable and acts as the final proof of an applicant’s competence before they can be formally registered.

Together, the education course and the valuation exam ensure that every Registered Valuer meets a consistent national benchmark of competence, irrespective of their background.

6. Application Process for Registration

Once the educational, professional, and examination requirements are fulfilled, candidates can formally apply for registration as a valuer. The process is designed to be transparent and streamlined under IBBI regulations.

Step 1: Application via RVO Recommendation

The application must be submitted through the Registered Valuer Organisation (RVO) with which the applicant is enrolled as a member. The RVO first reviews the application and ensures that all eligibility requirements are met before recommending the candidate to the IBBI.

Step 2: Prescribed Form and Fees

- The application is filed in the prescribed format (Form-A) as per the Companies (Registered Valuers and Valuation) Rules, 2017.

- A fee of Rs. 5,000 (for individuals) is payable at the time of submission.

- The payment is processed through online channels only.

Step 3: Online Submission and Processing

Applications are submitted electronically to the IBBI via the RVO. Once received, the IBBI evaluates the application for compliance with educational, professional, and regulatory criteria.

- Processing Timeline: Applications are typically reviewed within 60 days, excluding any additional time granted for clarifications.

- If approved, the applicant is entered into the Register of Valuers, officially becoming a Registered Valuer authorised to conduct valuations in India.

7. Additional Considerations

Becoming a Registered Valuer is not the end of the journey — it comes with ongoing obligations and responsibilities.

Renewal and Compliance Obligations

- Registered Valuers must adhere to the Code of Conduct prescribed by IBBI and their respective RVOs.

- They are subject to monitoring and disciplinary mechanisms to ensure the quality and independence of their valuation reports.

- Renewal of registration may be required as per evolving IBBI regulations, and non-compliance can result in suspension or cancellation of registration.

Importance of Continuous Learning

Valuation is a dynamic discipline influenced by market trends, financial innovations, and regulatory changes. Therefore, a Registered Valuer is expected to:

- Participate in continuing professional education (CPE) programmes organised by RVOs.

- Stay updated on amendments to laws, accounting standards, and valuation methodologies.

- Enhance their expertise to maintain credibility and deliver valuations that meet stakeholder expectations and regulatory scrutiny.

In short, registration is both a professional milestone and an ongoing commitment to ethical practice and lifelong learning.

8. Conclusion

Becoming a Registered Valuer in India is a rigorous, structured journey that blends academic qualifications, professional integrity, specialized training, and regulatory oversight. From obtaining the right educational foundation to fulfilling eligibility requirements, enrolling with a Registered Valuer Organisation, completing the mandatory 50-hour course, clearing the IBBI Valuation Examination, and finally applying for registration — every step reinforces credibility and compliance.

This pathway ensures that only competent and trustworthy professionals are entrusted with valuations that influence critical business, investment, and regulatory decisions. In essence, holding the title of “Registered Valuer” is not a mere designation; it is a marker of professional excellence, ethical standing, and regulatory trust.

For businesses, choosing a Registered Valuer is equally vital. A certified valuation not only strengthens regulatory filings but also builds investor confidence and withstands scrutiny in transactions, litigation, or funding rounds.

If your business is seeking accurate, credible, and regulatorily compliant valuation reports, consult experts who are trained and registered under the IBBI framework. The right advisor can turn valuation from a compliance requirement into a strategic advantage.

Frequently Asked Questions (FAQs)

A Registered Valuer is a professional recognized by the Insolvency and Bankruptcy Board of India (IBBI) under Section 247 of the Companies Act, 2013. They are authorized to carry out valuations of assets, businesses, or securities in compliance with Indian regulatory standards. Only those enrolled with an RVO (Registered Valuer Organisation) and registered with IBBI can use this title.

The candidate must meet three conditions:

- Educational qualification – typically a postgraduate degree or professional qualification (like CA, CS, CMA, MBA in Finance, Engineering, etc.), depending on the asset class.

- Experience – minimum 3–5 years of relevant work experience.

Membership with an RVO – such as ICAI RVO, ICSI RVO, or ICMAI RVO.

Registered Valuer Organisations (RVOs) act as frontline institutions that guide, train, and recommend candidates for registration with IBBI. They conduct the mandatory 50-hour training course, provide study support, and ensure members follow ethical and professional standards.

The IBBI Valuation Examination is designed to test a candidate’s technical expertise, regulatory knowledge, and practical application of valuation principles. With proper preparation and completion of the RVO training, most candidates find it manageable. The exam must be cleared within 3 years of enrolling with an RVO.

Hiring a Registered Valuer ensures that the valuation report is credible, regulatorily compliant, and defensible before authorities or investors. Whether it’s for mergers, acquisitions, fundraising, financial reporting, or insolvency proceedings, a certified valuation adds weight and trust to the transaction.