Table of Contents

ToggleIntroduction

In today’s dynamic business environment, audits are not just a regulatory formality—they are the backbone of financial transparency, corporate governance, and investor confidence. For Indian companies, whether a startup preparing for its first round of funding or an established SME navigating growth, the role of audits cannot be overstated.

The audit process goes beyond compliance. It helps organizations strengthen internal controls, manage risks effectively, and assure stakeholders that their financial statements are accurate and trustworthy. For businesses looking to raise capital, clear and credible audits can directly influence valuation and investor trust, making them an integral part of the funding journey.

This brings us to an important question: Should your business focus on internal audit, external audit, or both? The answer depends on your company’s size, compliance obligations, and long-term strategic goals. In this blog, we will break down the differences between internal and external audits, explain their applicability in India, and guide you in determining which one your business truly needs.

If your company is preparing for funding or valuation, you may also want to explore our detailed Business Valuation Reports that help align compliance with financial strategy.

2. Understanding the Basics of Audits

At its core, an audit is an independent evaluation designed to assure that a company’s operations and financial records are accurate, reliable, and in line with legal requirements. While many associate audits strictly with financial statements, their scope is broader—covering internal processes, risk management frameworks, and governance structures.

The primary purpose of audits can be summarized into three pillars:

- Accountability: Ensuring management is answerable for how resources are used and how risks are managed.

- Compliance: Verifying that the business adheres to statutory and regulatory obligations prescribed under laws such as the Companies Act, Income Tax Act, and GST Act. For reference, detailed statutory requirements can be reviewed directly on the Ministry of Corporate Affairs website.

- Trust: Providing assurance to shareholders, lenders, investors, and regulators that financial statements and internal controls reflect the true picture of the company.

For startups and SMEs, audits serve as a bridge between internal management and external stakeholders. By validating systems and records, audits build confidence that the business is not only legally compliant but also strategically sound.

To see how audits fit into the broader picture of business readiness, you can also review our Services for Startups and SMEs, where audit support, valuation, and funding assistance come together to support long-term growth.

3. What Is an Internal Audit?

An internal audit is an independent, objective assurance activity conducted within an organization to evaluate and improve the effectiveness of risk management, control systems, and governance processes. Unlike an external audit—which is primarily concerned with statutory financial verification—internal audit takes a more holistic approach, looking at the overall functioning of a company.

The scope of internal audit extends beyond financial accuracy. It involves:

- Risk Management: Identifying vulnerabilities in business operations, systems, or financial management before they turn into costly issues.

- Process Efficiency: Reviewing workflows to highlight inefficiencies and recommending improvements that save time and resources.

- Internal Controls: Testing and strengthening systems that safeguard assets, ensure data accuracy, and prevent fraud.

Internal audit is therefore not just about compliance—it is about creating value. By offering timely insights to management, it helps businesses remain agile, proactive, and strategically aligned. For startups and SMEs, especially those preparing for funding, internal audits can be invaluable in presenting a picture of credibility and strong governance to potential investors.

For a deeper look at how financial checks and audits tie into business growth, our Blogs on Business Advisory and Valuation provide practical insights that go beyond compliance.

4. Applicability of Internal Audit in India

In India, the applicability of internal audit is governed by the Companies Act, 2013, which mandates internal audits for specific categories of companies. According to Section 138 of the Act and related rules:

- Listed Companies: Internal audit is compulsory for all listed entities.

- Unlisted Public Companies: Mandatory if they meet any of the following criteria:

- Turnover of ₹200 crore or more.

- Outstanding loans or borrowings from banks/financial institutions exceeding ₹100 crore.

- Paid-up share capital of ₹50 crore or more.

- Deposits of ₹25 crore or above.

- Turnover of ₹200 crore or more.

- Private Companies: Required if they have:

- Turnover of ₹200 crore or more, or

- Outstanding borrowings exceeding ₹100 crore.

These thresholds ensure that larger businesses maintain internal checks and accountability systems, given the scale and risks they operate with.

That said, many fast-growing startups, MNCs, and financial institutions voluntarily adopt internal audits even when not legally required. For such companies, internal audits serve as an essential governance tool that strengthens investor trust, helps in valuations, and prepares them for future expansion.

If your organization is approaching rapid growth or preparing for fundraising, integrating an internal audit into your governance framework can be a strategic move. As part of our Business Valuation Services, we often recommend internal audits to ensure numbers and processes align with investor expectations and statutory norms.

For official applicability details, businesses can also consult the Income Tax Department of India for related audit compliance under tax laws.

5. Benefits of Internal Audit

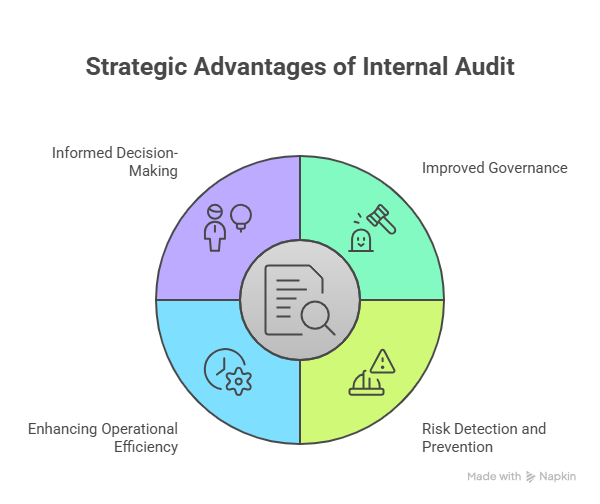

Beyond meeting regulatory obligations, an internal audit delivers substantial strategic and operational advantages to a business. Some of the key benefits include:

- Improved Governance: Internal audits strengthen accountability within an organization. By evaluating decision-making processes, they ensure that management actions are aligned with the company’s long-term objectives and regulatory requirements.

- Risk Detection and Prevention: A proactive audit identifies potential issues—whether operational, financial, or compliance-related—before they escalate into larger risks. This early-warning function makes internal audits especially valuable for fast-growing companies or those managing complex operations.

- Enhancing Operational Efficiency and Decision-Making: Internal audit reports highlight inefficiencies and recommend corrective actions. This helps optimize workflows, reduce costs, and provide leadership with reliable data for informed decision-making.

For startups and SMEs, these benefits go beyond compliance—they provide a foundation for credibility in the eyes of investors and partners. Strong governance and efficient processes can directly impact funding opportunities and valuation outcomes, areas where our team at Marcken Consulting regularly supports clients.

6. What Is an External Audit?

An external audit is an independent examination of a company’s financial statements conducted by a qualified Chartered Accountant or audit firm. Unlike internal audits, which focus on internal processes and controls, external audits are legally mandated to ensure that financial statements present a true and fair view of the company’s performance.

The primary purpose of an external audit is twofold:

- Independent Verification: External auditors assure that the financial records are accurate, complete, and prepared in accordance with statutory requirements. This independence enhances credibility with regulators, shareholders, and potential investors.

- Legal and Regulatory Compliance: External audits confirm that companies comply with the provisions of the Companies Act, Income Tax Act, and other relevant laws. This assurance not only protects stakeholders but also reinforces public trust in the company’s financial disclosures.

For businesses seeking to raise funds or expand operations, an external audit acts as a seal of credibility. Investors, lenders, and regulators rely on audited financial statements to assess the company’s financial health and risk profile.

To understand how audits tie into long-term business growth and investor confidence, you can explore our valuation insights and advisory expertise tailored for startups and SMEs.

7. Applicability of External Audit in India

In India, external audits are not optional—they are a statutory requirement for most businesses. The scope of applicability is broad and touches multiple legal frameworks:

- Statutory Audit (Companies Act, 2013): Every company incorporated under the Companies Act—whether public or private, listed or unlisted—is required to have its annual financial statements audited by a qualified Chartered Accountant. This makes statutory audit universal for all registered companies, irrespective of size or turnover.

- Tax Audit (Income Tax Act, 1961): Businesses and professionals exceeding prescribed turnover or gross receipts thresholds (currently ₹1 crore for businesses and ₹50 lakh for professionals, subject to conditions) must undergo a tax audit to ensure accurate income reporting.

- GST Audit (Goods and Services Tax Act): While recent amendments have relaxed the mandatory audit requirement under GST, businesses crossing turnover thresholds may still require reconciliation and certification by professionals to avoid compliance gaps.

In essence, an external audit is compulsory for every registered company, serving as a safeguard for transparency, compliance, and accountability. Whether you are a startup scaling rapidly or a well-established enterprise, aligning with statutory requirements is non-negotiable.

8. Benefits of External Audit

The external audit is more than just a compliance exercise—it plays a pivotal role in shaping investor confidence, market credibility, and stakeholder trust. Its key benefits include:

- Legal Compliance: External audits ensure that companies meet their obligations under the Companies Act, Income Tax Act, and other regulatory frameworks. This compliance protects businesses from penalties, legal disputes, and reputational damage.

- Independent Assurance for Investors and Regulators: An external audit provides unbiased confirmation that the financial statements are reliable. This assurance is critical for investors, lenders, and regulatory authorities evaluating a company’s performance and stability.

- Detection of Fraud and Misstatements: By independently verifying books of accounts, external auditors can identify material misstatements, fraudulent activities, or accounting irregularities—helping businesses correct issues before they escalate.

- Strengthening Public and Shareholder Trust: Audited financial statements carry significant weight with the public, stakeholders, and financial institutions. They demonstrate transparency, accountability, and good governance, enhancing a company’s credibility in competitive markets.

At Marcken Consulting, we often see how external audits directly support fundraising, mergers, and compliance readiness by giving stakeholders confidence in the company’s financial integrity.

9. Key Differences Between Internal and External Audit

While both internal and external audits aim to strengthen accountability and transparency, they differ significantly in scope, mandate, and objectives. Below is a structured comparison:

Dimension | Internal Audit | External Audit |

Scope | Evaluates internal processes, controls, and risk management. | Focuses on verifying the accuracy and fairness of financial statements |

Mandate | Conducted voluntarily or as required under the Companies Act for certain companies. | Mandatory for all companies under the Companies Act and other laws. |

Frequency | Can be ongoing (monthly, quarterly, or annual) depending on business needs. | Conducted annually, typically at the end of the financial year. |

Audience | Management and Board of Directors. | Shareholders, regulators, investors, and other external stakeholders. |

Reporting | Reports highlight risks, inefficiencies, and recommendations for improvement. | Auditor issues an independent opinion on the true and fair view of accounts. |

This distinction shows that internal audits are inward-looking—focusing on strengthening business processes—while external audits are outward-looking, offering assurance to external stakeholders.

10. Which Audit Does Your Business Need?

The choice between internal and external audit is not an either/or situation—both serve different but complementary purposes.

- External Audit: Non-Negotiable

Every registered company in India must undergo a statutory external audit. This ensures compliance with the Companies Act, 2013, and provides stakeholders with the assurance that financial statements are free from material misstatements. Whether a startup is preparing for funding or a listed company is reporting to shareholders, an external audit is mandatory and unavoidable. - Internal Audit: Mandatory for Some, Beneficial for Many

While internal audit is compulsory only for certain categories of companies (based on size, turnover, or nature of business), it is increasingly adopted voluntarily. For startups and SMEs, internal audits can uncover operational inefficiencies, identify compliance gaps, and provide governance frameworks that improve fundraising prospects. - Tailoring the Choice

- Small private companies: Must comply with external audits; internal audits can be optional but recommended if aiming for funding or scaling.

- Mid-sized and growing businesses: Both audits prove valuable—external for compliance and internal for process improvement and risk management.

- Large corporates and listed entities: Internal audits are generally mandatory and essential, complementing statutory external audits.

- Small private companies: Must comply with external audits; internal audits can be optional but recommended if aiming for funding or scaling.

In practice, a combination of both audits is ideal. External audits keep you compliant and credible in the eyes of regulators and investors, while internal audits ensure the business is resilient, efficient, and strategically prepared for growth.

At Marcken Consulting, we help businesses assess whether they require an internal audit framework in addition to meeting external audit obligations, tailoring solutions to their governance and funding needs.

11. Common Misconceptions About Audits

Audits are often misunderstood, especially among startups and SMEs. Here are some myths that need to be cleared:

- “Internal audits are optional extras.”

Many businesses view internal audits as a luxury or an additional cost. In reality, internal audits are strategic tools that improve governance, strengthen internal controls, and prepare a business for growth. For startups seeking investors, a structured internal audit framework can be the differentiator that builds trust. - “External audits are only about checking the books.”

External audits go beyond simple number-crunching. They provide independent assurance that the company’s financial statements are accurate and transparent. This assurance is invaluable not just for regulators, but also for lenders, shareholders, and potential acquirers. - “You only need one type of audit.”

Internal and external audits serve different purposes but complement each other. A business that invests in both builds credibility with stakeholders while also improving operational resilience.

12. Practical Scenarios and Case Examples

To better understand the value of audits, let’s look at how different types of businesses approach them:

- Small and Medium Enterprises (SMEs):

An SME may see external audits as a compliance necessity. However, those planning to scale or attract investors often adopt voluntary internal audits to identify risks early and present themselves as well-governed entities. - Startups Preparing for Funding:

For high-growth startups, credibility is everything. Conducting internal audits not only strengthens internal processes but also signals to investors that the business takes governance and compliance seriously—improving funding prospects. - Large Listed Companies:

Large corporations are mandated to have both internal and external audits. Internal audits support continuous risk management and compliance across multiple departments, while external audits provide shareholders with transparent financial reporting. The coexistence of both audits creates a robust framework for governance and accountability.

At Marcken Consulting, we’ve seen businesses across these categories benefit from tailored audit support—whether it’s startups preparing valuation reports for funding or corporates aligning with statutory compliance.

Frequently Asked Questions (FAQs)

Internal audits focus on improving internal processes, risk management, and operational efficiency within a company, while external audits provide independent verification of financial statements to ensure statutory compliance and reliability for external stakeholders.

No. Internal audits are mandatory only for listed companies, large public companies, and private companies meeting specified turnover or borrowing thresholds under the Companies Act, 2013. However, smaller businesses may voluntarily adopt internal audits for better governance and investor confidence.

Yes. Every registered company in India, including startups and SMEs, must undergo an annual external audit to comply with the Companies Act and other statutory regulations.

Absolutely. Many businesses, especially large corporations and high-growth startups, adopt both audits. Internal audits improve processes and risk management, while external audits provide statutory compliance and independent assurance for investors and regulators.

Internal audits enhance operational transparency and governance, reducing risks and highlighting efficiency. This creates a stronger impression for investors and can positively influence business valuation reports and funding outcomes, a service supported by Marcken Consulting.