Table of Contents

ToggleThe Hidden Gold of Indian Business

In the evolving landscape of modern business, intangible assets have emerged as powerful drivers of enterprise value. From proprietary software and trademarks to customer relationships and brand equity, these non-physical assets are increasingly shaping the growth trajectories of Indian companies. However, their absence from traditional balance sheets often leads to a significant undervaluation of a company’s true worth.

As India aligns more closely with global accounting and regulatory standards, the need for accurate, transparent, and regulator-compliant valuation of intangibles has become more than a strategic advantage—it is now a business imperative. This comprehensive guide explores why intangible valuation reports are crucial for Indian businesses, when they are required, and how they can unlock opportunities in mergers, investments, taxation, and beyond.

2. Why Indian Businesses Need an Intangible Valuation Report

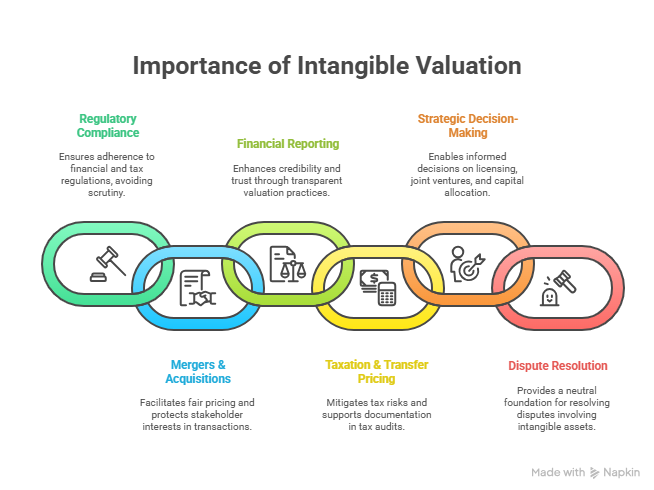

Regulatory Compliance

Indian financial and tax regulations mandate the valuation of intangible assets under several frameworks. IND AS 38 provides detailed guidelines for the recognition and measurement of intangibles. Additionally, provisions under the Income Tax Act, SEBI regulations, and RBI guidelines require periodic valuations for tax filings, financial disclosures, and during corporate actions such as mergers or foreign investments. A formal intangible valuation report ensures compliance with these requirements and avoids regulatory scrutiny.

Mergers, Acquisitions, and Fundraising

In any transaction involving business combinations or capital infusion, intangible assets often form a substantial portion of the enterprise value. A robust valuation report provides an objective assessment of these assets, ensuring fair pricing and protecting the interests of all stakeholders. It enables acquirers, investors, and target companies to negotiate on well-documented terms.

Financial Reporting

Transparent and well-supported valuations enhance the credibility of financial statements, especially when intangible assets such as goodwill, trademarks, or software development costs are involved. This not only aligns the business with global accounting practices but also fosters trust with shareholders, auditors, and financial institutions.

Taxation and Transfer Pricing

Intangible valuation plays a key role in transfer pricing, particularly when assets are transferred between group entities or across borders. It also impacts the computation of capital gains, depreciation, and indirect tax implications. An accurate report helps mitigate tax risks and supports documentation in tax audits and assessments.

Strategic Decision-Making

Valuing intangible assets allows management to make informed decisions related to licensing, joint ventures, divestment, or capital allocation. It provides clarity on the economic contribution of intangibles and enables businesses to leverage them more effectively in growth strategies.

Dispute Resolution

In the event of litigation, shareholder disagreements, or exit negotiations, a defensible valuation report can serve as a reliable reference. It provides a neutral, fact-based foundation to resolve disputes involving intangible asset ownership or valuation.

3. Types of Intangible Assets Requiring Valuation

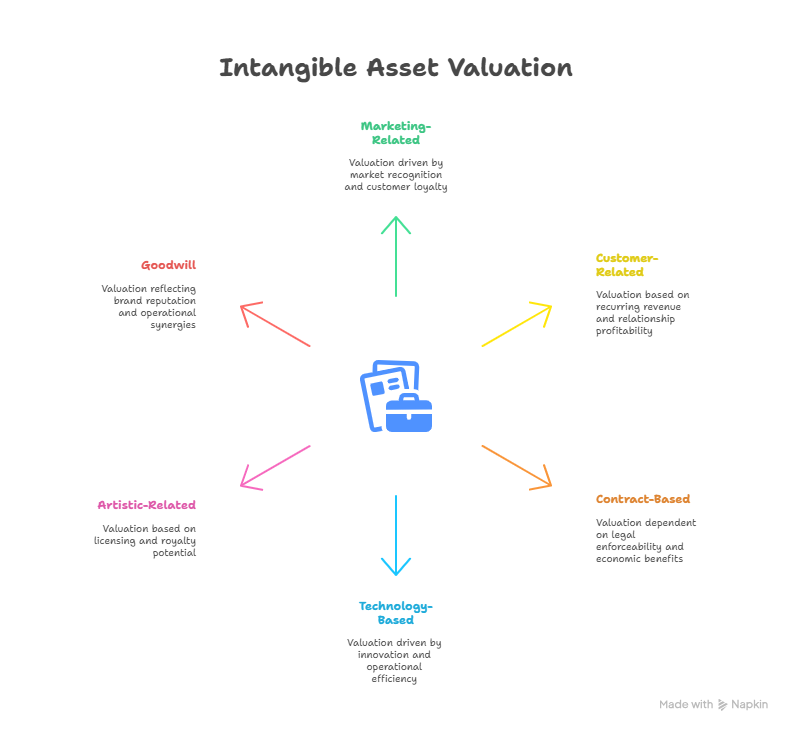

Intangible assets encompass a broad spectrum of non-physical resources that hold economic value for a business. The valuation of these assets is particularly important when they are a key source of competitive advantage or revenue generation. Below are the primary categories of intangible assets that typically require formal valuation in the Indian business context:

Marketing-Related Intangibles

These include brand names, trademarks, logos, internet domain names, and slogans. Their value is often driven by market recognition, customer loyalty, and their influence on purchase decisions.

Customer-Related Intangibles

Customer lists, contractual relationships, customer loyalty programs, and client agreements fall under this category. The economic value is derived from recurring revenue, cross-selling potential, and long-term relationship profitability.

Contract-Based Intangibles

These include franchise agreements, licensing arrangements, permits, non-compete agreements, and other enforceable contracts. The value depends on the legal enforceability and the economic benefits the contract secures over its term.

Technology-Based Intangibles

This category encompasses patents, proprietary software, databases, algorithms, and trade secrets. These assets often drive product innovation, operational efficiency, and entry barriers in tech-driven sectors.

Artistic-Related Intangibles

Includes copyrights and intellectual property associated with creative works such as literary content, music compositions, films, designs, and visual media. Valuation is often based on income potential through licensing or royalties.

Goodwill

Goodwill arises primarily from business combinations and reflects the excess value paid over the fair value of net identifiable assets. It represents factors such as brand reputation, customer loyalty, and operational synergies.

Each category demands a different approach depending on its use, legal protection, and contribution to the business’s cash flows. Understanding the classification of these assets is essential to apply the correct valuation methodology, comply with disclosure norms, and derive actionable insights for financial planning.

4. Key Methods of Intangible Valuation

Section 50B of the Income Tax Act governs the taxation of slump sales—the sale of an entire business undertaking or division as a going concern, for a lump-sum amount, without assigning individual values to assets or liabilities.

This provision ensures that the capital gains from such a transaction are properly computed and taxed.

4.1 Income Approach

This approach estimates the present value of future economic benefits expected to be derived from the intangible asset. It is suitable when the asset contributes directly to identifiable cash flows.

- Relief from Royalty Method (RRM):

Values the asset based on notional royalty payments that would have been paid for its use, had it not been owned. Commonly applied to trademarks, brands, and intellectual property. - Multi-Period Excess Earnings Method (MPEEM):

Calculates the portion of a company’s earnings directly attributable to the intangible asset after deducting returns for other contributing assets. Frequently used for customer relationships and core technologies. - With and Without Method (WaW):

Compares the cash flows of a business with the intangible asset in place without it. The difference in value indicates the contribution of the intangible. - Greenfield Method:

Assumes the business is started from scratch with only the intangible asset in use. Useful for early-stage ventures or standalone IP.

4.2 Market Approach

This method benchmarks the intangible asset against recent transactions or market multiples involving comparable assets. Though limited by data availability, it offers strong validation when suitable comparables exist.

- Comparable Transactions: Analyses sales, licenses, or third-party transactions of similar intangible assets.

- Market Multiples: Applies revenue or earnings-based multiples derived from public or private market data.

4.3 Cost Approach

The Cost Approach estimates the amount required to recreate or replace the asset, adjusted for depreciation and obsolescence. It is typically used when there is limited income or market data.

Replacement Cost Method:

Considers all costs—direct and indirect—necessary to rebuild the intangible to its current utility.

4.4 Top-Down Approach

An increasingly popular framework, particularly in valuations tied to market penetration or proprietary platforms.

- Step 1: Estimate Total Addressable Market (TAM):

Define the full potential market related to the asset. - Step 2: Define Serviceable Available Market (SAM):

Refine TAM to reflect the segments the business can realistically target. - Step 3: Project Profits:

Estimate the business’s achievable market share and associated profits linked to the intangible. - Step 4: Discount to Present Value:

Calculate the net present value (NPV) of forecasted profits using a discount rate that reflects risk.

This approach aligns well with forward-looking strategies, such as software platform monetization or IP commercialisation in high-growth markets.

5. Rules & Guidance under IND AS

The valuation of intangible assets in India is governed by the Indian Accounting Standards (IND AS), particularly IND AS 38 – Intangible Assets, and supplemented by ICAI Valuation Standards. These frameworks provide a structured approach to recognising, measuring, and disclosing intangible assets in a manner consistent with global financial reporting norms.

5.1 IND AS 38: Intangible Assets

Recognition Criteria:

An intangible asset is recognised if:

It is identifiable and non-monetary.

It will probably generate future economic benefits.

Its cost can be reliably measured.

Measurement at Initial Recognition:

Acquired separately: Recorded at acquisition cost.

Acquired through business combinations: Measured at fair value at the acquisition date.

Internally generated: Recognised only if the development phase criteria are met. Expenditure during the research phase is expensed.

Subsequent Measurement:

Entities may choose either the cost model or the revaluation model, though the revaluation model is applicable only if there is an active market.

Intangible assets with finite useful lives are amortised over their estimated economic life.

Assets with indefinite useful lives are not amortised but are tested annually for impairment.

Disclosures:

Nature and carrying amount of each class of intangible asset.

Basis for determining useful lives.

Amortisation methods and rates used.

Impairment losses recognised or reversed.

5.2 ICAI Valuation Standard 302: Valuation of Intangible Assets

The Institute of Chartered Accountants of India (ICAI) issued Valuation Standard 302 to guide valuation professionals in selecting appropriate methods for intangible valuation.

Key Guidelines:

- Choose valuation approaches—market, income, or cost—based on asset characteristics and data availability.

- Clearly define the purpose and premise of valuation.

- Ensure adequate documentation of assumptions, methodologies, and risk factors.

- Maintain independence and objectivity in preparing the report.

These regulatory frameworks ensure that intangible valuations in India are consistent, transparent, and defensible during audits, inspections, or legal proceedings.

6. When Should You Obtain an Intangible Valuation Report?

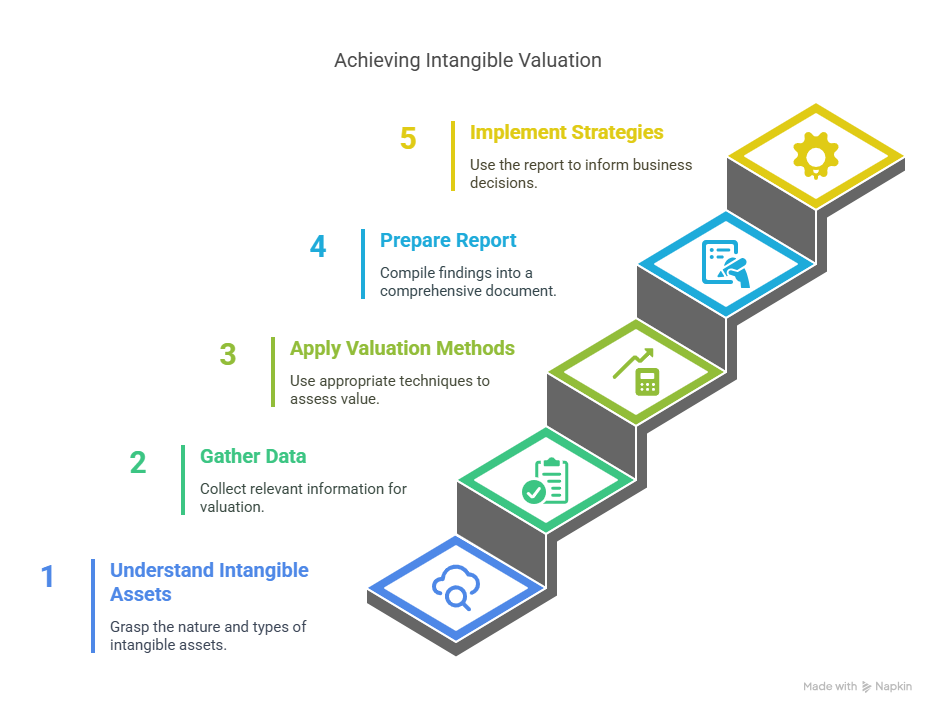

Obtaining an intangible valuation report is not just a regulatory formality—it is a strategic imperative. Businesses should proactively seek such valuations at critical junctures to ensure compliance, support strategic planning, and safeguard stakeholder interests.

Key Scenarios Requiring Intangible Valuation:

- Mergers, Acquisitions, and Corporate Restructuring:

During business combinations, accurate valuation of intangible assets such as goodwill, brand equity, and proprietary technology is essential for negotiating deal terms and ensuring fair allocation of the purchase price. - Fundraising and Investment Rounds:

When raising equity or debt capital, startups and established firms alike must demonstrate the value of their intangible assets to investors and lenders. - Financial Reporting and Annual Audits:

For companies adopting IND AS, periodic revaluation or impairment testing of intangible assets is mandatory to ensure the accuracy of financial statements. - ESOPs and Share-Based Compensation Plans:

Intangible valuation supports fair valuation of equity instruments granted to employees, especially where brand value or software IP significantly contributes to enterprise value. - Transfer Pricing and Tax Compliance:

For multinational or group entities, a valuation report helps in determining arm’s length pricing for inter-company transactions involving intangible assets, as mandated by the Income Tax Act. - Licensing, Strategic Alliances, and IP Monetisation:

Businesses looking to license or monetise their intellectual property need a defensible, third-party valuation to set fair terms and manage risk. - Litigation, Arbitration, or Dispute Resolution:

In shareholder or partnership disputes, an independently prepared intangible valuation report provides an objective basis for settlement or legal determination.Engaging a registered valuer or merchant banker at these points ensures the report is not only technically sound but also regulatorily compliant and credible in the eyes of all stakeholders.

7. What Should an Intangible Valuation Report Include?

An effective intangible valuation report goes beyond numerical estimates. It must present a comprehensive, transparent, and defensible account of how the value of the intangible asset was determined, in line with regulatory expectations and professional standards.

Key Components of an Intangible Valuation Report:

- Executive Summary and Scope of Work

A concise overview detailing the purpose of the valuation, nature of the asset, and intended use of the report (e.g., regulatory compliance, M&A, financial reporting). - Asset Description and Business Context

A clear identification of the intangible asset being valued, including its legal ownership, use, historical development, and role within the business model or strategy. - Financial Data and Projections

Detailed financial inputs, including revenue streams, cost structures, and profit margins, particularly as they relate to the intangible asset. Future cash flows are projected where applicable. - Valuation Methodology and Rationale

A thorough explanation of the valuation approach (Income, Market, Cost, or Top-Down), supported by justifications for the method chosen and its relevance to the asset type. - Market Analysis and Comparable Data

Industry benchmarks, market conditions, and peer transactions are presented to support assumptions, especially when using market or income-based methods. - Assumptions, Risks, and Limitations

A transparent disclosure of the assumptions made (e.g., discount rates, growth projections), potential risks, and any limitations of the data or methodology. - Legal and Management Representations

Any legal consideration, such as ownership rights, disputes, or restrictions, along with input or certifications from management or promoters regarding the asset’s relevance and use. - Certification and Declaration by Valuer

The report concludes with a signed certification from a registered valuer or SEBI-registered merchant banker, affirming the independence, objectivity, and competence of the valuation.

A report structured in this manner ensures it holds up to scrutiny from auditors, investors, regulatory authorities, or courts. It also enhances the decision-making capabilities of internal stakeholders.

- Executive Summary and Scope of Work

8. Unlocking the True Value of Intangibles: Conclusion

In a business environment increasingly driven by innovation, brand equity, proprietary technologies, and customer relationships, the importance of valuing intangible assets accurately cannot be overstated. For Indian businesses navigating regulatory frameworks, competitive fundraising, or strategic restructuring, an intangible valuation report is not just a compliance document—it is a strategic asset in itself.

From aligning with IND AS 38 and tax requirements to building credibility in mergers, partnerships, and financial reporting, a professionally prepared intangible valuation report safeguards interests and unlocks growth opportunities.

However, the nuanced nature of such valuations demands technical expertise, sectoral understanding, and familiarity with regulatory standards. Partnering with experienced professionals ensures that the valuation process is not only defensible but also strategically insightful.

Looking to assess your intangible assets with precision and regulatory clarity?

Contact Marcken Consulting for a tailored, regulator-compliant intangible valuation report aligned with your business goals.

Frequently Asked Questions (FAQs)

An intangible valuation report estimates the fair value of non-physical assets like brands, patents, and customer relationships. Indian businesses need it for regulatory compliance, M&A, financial reporting, tax planning, and strategic decision-making.

Intangible asset valuation is required during mergers, acquisitions, fundraising, ESOP issuance, year-end audits, transfer pricing assessments, or when complying with IND AS 38 and other financial regulations.

In India, intangible valuation reports must be prepared by a registered valuer (as per Companies Act, 2013) or a SEBI-registered merchant banker, depending on the purpose and regulatory requirements.

The most common methods include the Relief from Royalty Method, Multi-Period Excess Earnings Method (MPEEM), Replacement Cost Method, and the Top-Down Market Approach—all based on income, market, or cost valuation techniques.

Transparent valuation of intangible assets enhances the credibility of financial statements, ensures accurate net worth reporting, and boosts investor confidence by showcasing true business potential beyond physical assets.