Table of Contents

ToggleIntroduction

In today’s complex business environment, strong governance is no longer a choice but a necessity. For Indian companies, governance goes beyond regulatory compliance—it defines how an organization is perceived by its stakeholders, investors, regulators, and the public at large. A well-governed company demonstrates integrity in its financial practices, transparency in its operations, and accountability in its decision-making processes.

At the heart of this governance framework lies internal audit. Far from being a mere statutory requirement, internal audit serves as the cornerstone of ethical, transparent, and compliant operations. It provides independent oversight, identifies risks, and ensures that internal controls function as intended. By doing so, it acts as a safeguard against inefficiencies, fraud, and non-compliance, while also enabling leadership to make well-informed strategic decisions.

This blog explores the critical role of internal audit in strengthening business governance in India. It will examine the regulatory landscape, highlight internal audit’s core responsibilities, and showcase how a robust audit function not only supports compliance but also fosters long-term business resilience and trust.

Understanding Business Governance in the Indian Context

Business governance in India has evolved significantly over the past two decades, driven by corporate scandals, regulatory reforms, and rising investor expectations. Today, governance is not simply about meeting legal requirements; it is about creating a framework that ensures companies act responsibly and sustainably.

The key pillars of business governance include:

- Transparency: Open and accurate communication of financial and operational performance.

- Accountability: Clear assignment of responsibilities, with oversight mechanisms to hold decision-makers answerable.

- Compliance: Adherence to statutory obligations under the Companies Act, SEBI regulations, RBI guidelines, and other industry-specific frameworks.

- Resilience: The ability to withstand regulatory, market, and operational shocks while safeguarding stakeholder interests.

Strong governance has a direct bearing on a company’s reputation and ability to attract investment. Investors, both domestic and global, increasingly prioritize businesses that demonstrate ethical conduct and effective oversight. For companies, this translates into lower capital costs, easier access to funding, and stronger partnerships. In essence, governance is not just a matter of compliance—it is a strategic advantage that drives sustainability and long-term value creation.

The Regulatory Landscape in India

India’s regulatory framework places strong emphasis on internal audit as a driver of effective corporate governance. The most prominent provision in this regard is Section 138 of the Companies Act, 2013, which mandates the appointment of internal auditors for certain classes of companies. This requirement applies not only to all listed entities but also to larger unlisted or private companies that exceed specified thresholds of turnover, paid-up share capital, or borrowings. By embedding internal audit into the statutory framework, the law ensures that organizations of significant size remain under continuous scrutiny with respect to their financial and operational processes.

Beyond the Companies Act, other regulators reinforce the role of internal audit in governance. The Securities and Exchange Board of India (SEBI), through its Listing Obligations and Disclosure Requirements (LODR) Regulations, 2015, requires listed firms to maintain an independent and effective internal audit mechanism. Audit committees are expected to review audit findings, ensure timely corrective actions, and document processes in a manner that provides a clear audit trail. Similarly, the Reserve Bank of India (RBI) mandates internal audit structures for banks and non-banking financial companies (NBFCs), focusing on areas such as risk management, fraud detection, and compliance monitoring. Sector regulators in insurance, power, and telecom have also issued guidance encouraging or mandating robust audit practices.

Together, these provisions create a regulatory ecosystem where internal audit is not optional but central to accountability. They also reflect a broader shift in India toward global governance standards, ensuring that businesses align with both domestic expectations and international best practices.

Why Internal Audit Matters for Governance

While compliance with legal requirements is important, the true significance of internal audit lies in its ability to strengthen governance from within. Internal audit provides independent assurance to boards and shareholders by evaluating whether internal controls, policies, and procedures are designed effectively and working as intended. This independence ensures objectivity, which is crucial for building trust in the governance framework.

A second vital role of internal audit is monitoring compliance with laws and regulations. Whether it is the Companies Act, SEBI regulations, tax laws, or sector-specific rules, internal auditors examine how effectively an organization complies with its obligations. This monitoring helps identify gaps early, reducing the risk of penalties, litigation, or reputational damage.

Perhaps most importantly, internal audit acts as a watchdog against misconduct. By scrutinizing transactions, processes, and decision-making, auditors help detect irregularities, prevent fraudulent activities, and encourage a culture of ethical behavior. Their presence sends a clear signal across the organization that oversight mechanisms are active and accountability is enforced.

In essence, internal audit is not limited to ticking regulatory checkboxes; it is a dynamic function that reinforces governance, protects stakeholder interests, and ensures that businesses operate with integrity and resilience.

Core Functions of Internal Audit in Corporate Governance

The value of internal audit lies in its ability to address multiple dimensions of governance simultaneously. Its core functions directly reinforce the pillars of risk management, accountability, and ethical conduct within an organization.

1. Risk management and internal control evaluations

Internal audit plays a pivotal role in assessing whether risk management frameworks and internal controls are robust and effective. Auditors evaluate policies, processes, and systems to ensure they align with both regulatory requirements and organizational objectives. By identifying gaps and recommending improvements, internal audit reduces exposure to operational, financial, and compliance-related risks.

2. Fraud detection and prevention

One of the most visible contributions of internal audit is its capacity to safeguard businesses against fraud and misconduct. Through detailed testing of transactions, monitoring of high-risk areas, and review of internal controls, auditors help uncover irregularities before they escalate into major issues. This proactive oversight fosters a culture where fraudulent activities are both difficult to perpetrate and swiftly addressed when identified.

3. Oversight of ethical conduct and accountability

Internal audit extends beyond financial compliance to encompass organizational ethics. It reviews adherence to codes of conduct, whistle-blower policies, and corporate values. By holding management accountable for ethical standards, internal audit strengthens stakeholder confidence and ensures that the company’s governance framework is more than just a formal compliance exercise.

- Regular reporting to the audit committee and board

A distinguishing feature of internal audit is its direct line of reporting to the audit committee and, ultimately, the board of directors. This reporting structure ensures that findings are not diluted or compromised by management interests. Regular reports allow the board to monitor risk exposures, evaluate the adequacy of internal controls, and ensure timely corrective actions. This strengthens the board’s ability to discharge its fiduciary responsibilities.

Internal Audit as a Continuous Feedback Loop

Internal audit is not a one-time exercise; it is a continuous process that helps organizations adapt to evolving challenges and regulatory expectations. Its findings and recommendations create a feedback loop that directly shapes governance practices.

Shaping governance practices

Audit observations often highlight systemic weaknesses or inefficiencies that might otherwise remain hidden. By recommending corrective actions, auditors push organizations to strengthen governance frameworks, refine policies, and align practices with best standards.

Proactive responses to risks and regulatory changes

Internal audit ensures that businesses are not merely reacting to risks but proactively preparing for them. For example, when regulators introduce new compliance norms, internal audit teams assess readiness, identify potential compliance gaps, and guide the company in adjusting its systems and controls. This agility enables companies to remain compliant and competitive in a fast-changing business environment.

Supporting board-level decision-making

Boards and audit committees rely heavily on internal audit reports for objective insights into organizational health. By providing a clear view of risks, operational bottlenecks, and compliance status, internal audit equips leadership with the information needed to make well-informed decisions. This not only enhances governance oversight but also contributes to better strategic planning and resource allocation.

In this way, internal audit operates as a living mechanism of governance, constantly feeding back information, driving improvements, and reinforcing organizational resilience.

Key Benefits of a Strong Internal Audit Function

Internal audit is not a one-time exercise; it is a continuous process that helps organizations adapt to evolving challenges and regulatory expectations. Its findings and recommendations create a feedback loop that directly shapes governance practices.

Shaping governance practices

Audit observations often highlight systemic weaknesses or inefficiencies that might otherwise remain hidden. By recommending corrective actions, auditors push organizations to strengthen governance frameworks, refine policies, and align practices with best standards.

Proactive responses to risks and regulatory changes

Internal audit ensures that businesses are not merely reacting to risks but proactively preparing for them. For example, when regulators introduce new compliance norms, internal audit teams assess readiness, identify potential compliance gaps, and guide the company in adjusting its systems and controls. This agility enables companies to remain compliant and competitive in a fast-changing business environment.

Supporting board-level decision-making

Boards and audit committees rely heavily on internal audit reports for objective insights into organizational health. By providing a clear view of risks, operational bottlenecks, and compliance status, internal audit equips leadership with the information needed to make well-informed decisions. This not only enhances governance oversight but also contributes to better strategic planning and resource allocation.

In this way, internal audit operates as a living mechanism of governance, constantly feeding back information, driving improvements, and reinforcing organizational resilience.

Internal Audit and Ethical Culture

While systems and processes form the backbone of governance, it is ethical culture that gives it life. Internal audit plays a decisive role in embedding values of integrity and accountability across the organization.

Encouraging integrity and ethical decision-making

Auditors assess adherence to codes of conduct, conflict-of-interest policies, and anti-fraud mechanisms. By spotlighting unethical practices and reinforcing adherence to standards, internal audit promotes a culture where integrity is non-negotiable.

Promoting tone at the top

The tone set by senior leadership often dictates organizational culture. Internal audit reports to the board and audit committee, ensuring that management itself is subject to oversight. This sends a powerful message throughout the organization: ethical conduct and governance standards apply at every level, including the highest echelons of leadership.

Safeguarding reputation through consistent governance

Reputation is one of a company’s most valuable intangible assets. Through vigilance and continuous oversight, internal audit helps prevent misconduct and governance failures that could tarnish a firm’s image. In doing so, it not only protects shareholder value but also enhances long-term sustainability in a competitive market.

Challenges in Implementing Effective Internal Audit

Even though internal audit is recognized as a powerful enabler of governance, companies in India often encounter practical roadblocks in strengthening this function:

- Resource constraints in mid-sized companies: Unlike large corporates, many mid-sized businesses operate with limited budgets and talent pools, making it difficult to establish a fully independent and specialized audit function. This can restrict the scope and depth of audits, particularly in complex operational areas.

- Keeping up with evolving regulatory expectations: The compliance landscape in India continues to expand, with updates to the Companies Act, SEBI guidelines, and sector-specific rules by the RBI, IRDAI, and others. Ensuring that the internal audit function remains aligned with these dynamic requirements is both challenging and resource-intensive.

- Integration with emerging technologies and data analytics: While data-driven audits and automated risk monitoring can significantly improve efficiency, many businesses struggle with the technology adoption curve. Lack of digital tools or in-house expertise may limit their ability to leverage advanced audit practices.

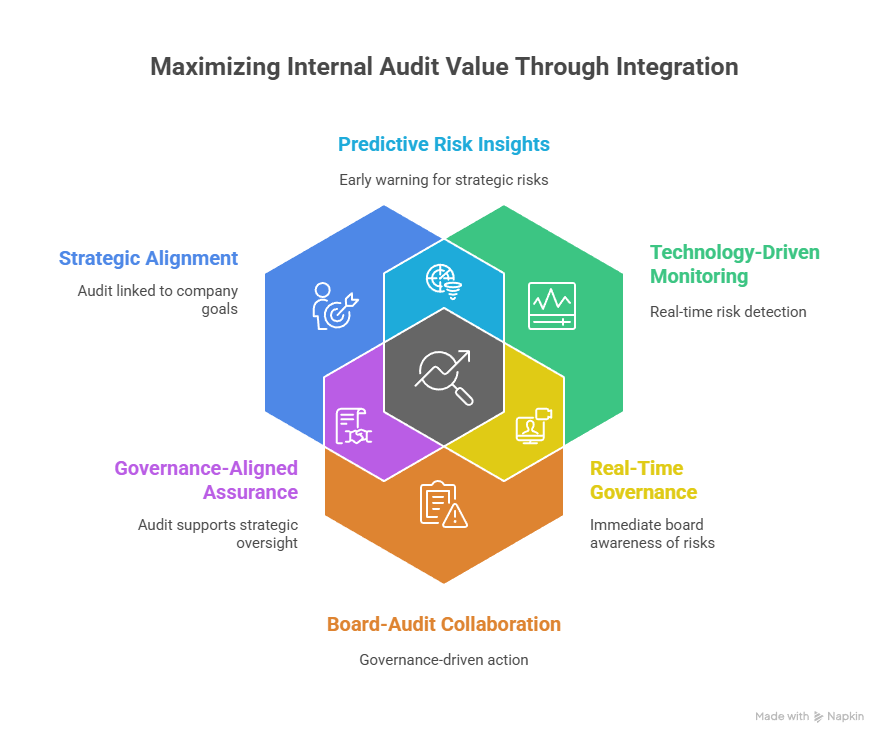

Best Practices for Leveraging Internal Audit for Governance

To overcome these challenges and unlock the full potential of internal audit, Indian businesses can adopt the following best practices:

- Aligning audit with strategic priorities: Internal audit should not be confined to financial checks alone. By linking audit objectives with the company’s broader strategy—such as growth targets, ESG goals, and digital transformation—it can offer insights that are both risk-focused and value-adding.

- Using technology for predictive audits and continuous monitoring: Incorporating advanced analytics, automation, and AI-driven tools enables businesses to shift from reactive audits to predictive ones. Continuous monitoring systems help detect anomalies in real time, allowing management to address risks before they escalate.

- Strengthening board-audit committee collaboration: The impact of internal audit is maximized when its findings directly inform boardroom deliberations. Strong collaboration between the audit committee and the internal audit function ensures that risk insights, compliance updates, and governance gaps translate into timely corrective actions.

The Future of Internal Audit in Indian Governance

As Indian businesses evolve in scale and complexity, the role of internal audit is set to expand beyond its traditional boundaries:

- Increasing emphasis on ESG (Environmental, Social, Governance): With stakeholders demanding greater accountability on sustainability and social responsibility, internal audit will play a critical role in validating ESG disclosures, monitoring performance against sustainability goals, and ensuring responsible governance.

- Role in cyber risk and data privacy oversight: Digital adoption has amplified vulnerabilities around cybersecurity and data protection. Internal audit functions are increasingly tasked with evaluating IT governance frameworks, monitoring data privacy compliance, and strengthening resilience against cyber threats.

- Moving from compliance-checker to strategic partner: The most forward-looking organizations are positioning internal audit as a trusted advisor to the board and management. Instead of focusing solely on control gaps, the function is helping shape strategy, improve operations, and anticipate future risks.

Key References and Further Reading

- Companies Act, 2013 (Section 138) – Governs the applicability and requirements of internal audit for Indian companies.

- SEBI LODR Regulations – Emphasize disclosure, governance, and compliance standards for listed entities.

- ICAI Guidelines and Publications – Provide professional frameworks, technical guidance, and best practices for internal audit.

- Industry Articles and Expert Insights – Offer perspectives on emerging risks, technology-driven audits, and governance trends.

Conclusion

Internal audit has moved from being a compliance obligation to becoming a central pillar of business governance in India. By ensuring transparency in reporting, monitoring risks, and reinforcing ethical culture, it strengthens the very foundation of corporate trust.

Companies that invest in robust internal audit functions are not only safeguarding themselves against penalties and reputational damage but are also building resilience and credibility in the eyes of investors, regulators, and stakeholders.

Final thought: In a rapidly changing business environment, a strong internal audit is not just about compliance — it is about future-proofing governance and sustaining long-term trust.

FAQs

Internal audits focus on improving internal processes, risk management, and operational efficiency within a company, while external audits provide independent verification of financial statements to ensure statutory compliance and reliability for external stakeholders.

No, internal audit is not mandatory for all companies. Under Section 138 of the Companies Act, 2013, it is compulsory for listed companies and certain classes of unlisted public and private companies based on size and financial thresholds.

Internal audit focuses on continuous monitoring, risk management, and governance improvement from within the organization. External audit, on the other hand, provides an independent opinion on financial statements for statutory compliance. Both complement each other in ensuring good governance.

By ensuring transparency in financial reporting, preventing fraud, and maintaining compliance, internal audit reassures investors that the company is governed ethically and managed responsibly. This builds confidence and enhances access to capital.

Key trends include a stronger focus on ESG reporting assurance, greater responsibility for cybersecurity and data privacy oversight, and a shift from being a compliance checker to a strategic partner that supports decision-making at the board level.