Table of Contents

Toggle1. Introduction

Scaling a business in India is a high-stakes game. Rapid growth brings opportunities for expansion, funding, and market leadership, but it also magnifies risks. From regulatory hurdles to financial leakages and operational inefficiencies, even the most promising enterprises can falter if blind spots remain unchecked.

This is where the internal audit comes into play. In the Indian context, an internal audit is a systematic and independent evaluation of a company’s internal controls, risk management systems, and adherence to regulatory frameworks. It is designed not only to verify compliance but also to enhance efficiency, safeguard assets, and ensure long-term sustainability.

For growing businesses, the takeaway is clear: internal audit is not merely a compliance requirement; it is a strategic safeguard. In today’s competitive and regulated business landscape, treating internal audit as optional can mean exposing the company to financial, legal, and reputational risks that could derail growth ambitions. On the other hand, embracing it early lays a foundation of trust, resilience, and governance; critical elements for sustainable success.

2. Why Internal Audit Matters for Indian Businesses

Internal audit functions as the watchdog of governance, ensuring that a business operates within the boundaries of law while maintaining financial discipline and operational efficiency. It goes beyond number-checking to evaluate whether internal processes are effective, risks are managed proactively, and resources are being deployed optimally.

From a statutory perspective, the importance of internal audit in India is undeniable. Section 138 of the Companies Act, 2013 makes internal audit mandatory for certain classes of companies, typically those exceeding specific turnover or borrowing thresholds. This reflects the government’s recognition that larger enterprises need systematic oversight to protect stakeholders and strengthen corporate governance.

However, the value of internal audit is not restricted to large corporates alone. Smaller firms and startups, though not legally bound, stand to gain significantly from adopting proactive internal audits. By identifying process gaps early, ensuring compliance with tax and industry regulations, and instilling investor confidence, internal audits become a growth enabler rather than a regulatory burden. For businesses aspiring to scale quickly or attract external investment, this credibility can make all the difference.

3. Key Benefits for Growing Businesses

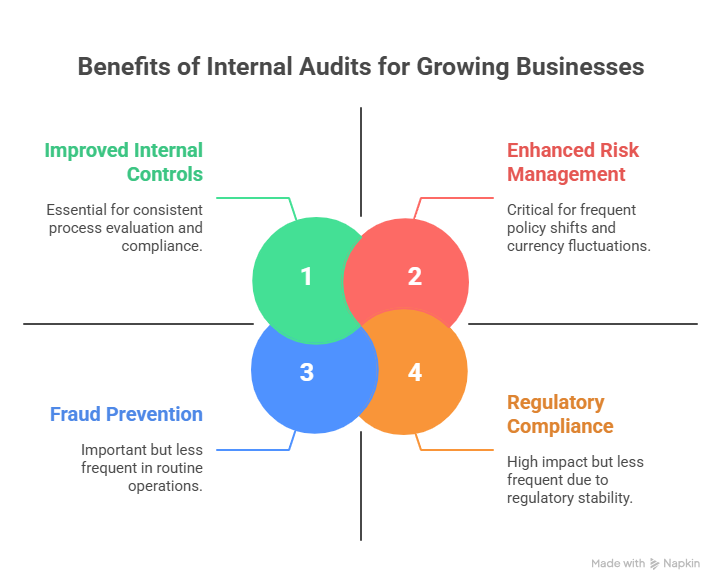

Enhanced Risk Management

In India’s unpredictable business environment, where policy shifts, currency fluctuations, and compliance updates can disrupt operations overnight, risk management is critical. Internal audits act as an early warning system, identifying weaknesses before they escalate into crises. For example, a mid-sized export firm in Gujarat leveraged internal audit findings to address gaps in foreign exchange hedging policies, saving itself from potential multi-crore losses during a sudden rupee depreciation.

Improved Internal Controls

Weak internal controls often translate into missed revenues, leakages, or compliance lapses. Internal audits evaluate whether processes and approvals are watertight. Consider a fast-growing retail chain in Delhi that discovered, through internal auditing, inconsistencies in vendor payments—leading to immediate process reforms that plugged recurring losses.

Operational Efficiency

Scaling businesses frequently accumulate redundancies in processes. Internal audits help streamline workflows, eliminate duplications, and optimize resources. A Bengaluru-based technology startup, for instance, used audit insights to automate manual HR and payroll processes, reducing both time and costs while freeing leadership to focus on growth.

Fraud Prevention

As India becomes more digitized, fraud risks, from cyberattacks to employee misstatements, are on the rise. Internal audits play a preventive and detective role. In one case, an FMCG company in Maharashtra uncovered falsified expense claims by employees through a targeted internal audit review, preventing further misuse and tightening monitoring systems.

Regulatory Compliance

India’s regulatory framework is dense, spanning SEBI, RBI, GST, FEMA, and new ESG disclosures. An internal audit ensures businesses are compliant with these obligations, thus avoiding penalties and reputational damage. For instance, a financial services firm in Mumbai used its internal audit findings to correct lapses in GST filings before a departmental inspection, sidestepping penalties and protecting its license.

Investor Confidence

Strong governance frameworks build credibility. For startups and SMEs seeking investment or bank credit, well-audited internal systems send the right signals to stakeholders. A Pune-based SaaS company raised Series A funding partly because its investors valued the presence of regular internal audits, which demonstrated transparency and discipline in financial reporting.

4. India-Specific Audit Trends and Metrics

Digital & ESG Focus

Indian businesses are embracing technology-driven audit solutions such as data analytics, AI-based anomaly detection, and cloud platforms. In addition, ESG (Environmental, Social, and Governance) factors are now being woven into audit frameworks. Larger Indian corporates report 40–60% adoption of audit tech in 2025, reflecting a shift from manual reviews to real-time digital monitoring.

Audit Plan Completion Rate

The audit profession in India has matured significantly. Mid-sized companies today report an average 90% audit plan completion rate, with 180–220 hours of work per engagement. This signals a culture of discipline and seriousness around internal auditing, even outside large listed entities.

Continuous Audit Adoption

With increasing digital maturity, nearly 30% of Indian firms now rely on continuous audit tools, enabling real-time tracking of financial and operational risks. For instance, large banks and fintech firms use continuous auditing systems to monitor loan disbursements, fraud indicators, and transaction anomalies, offering them agility and resilience in a competitive sector.

5. Why Ignoring Internal Audit is Risky

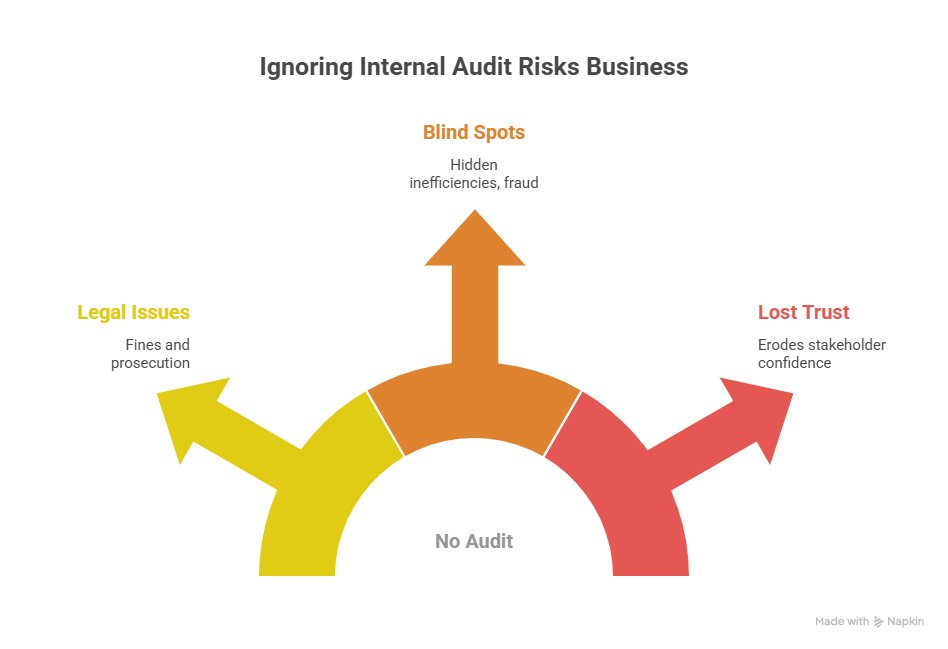

Legal Non-Compliance

India’s regulatory framework is unforgiving. Failure to meet statutory audit obligations can attract hefty fines, disqualification of directors, or even criminal prosecution under the Companies Act, 2013, and other laws. A number of mid-sized firms have faced penalties for non-compliance with GST and FEMA reporting, issues that could have been caught early through an internal audit process.

Operational Blind Spots

Without periodic audits, inefficiencies, leakages, and even fraud often remain hidden. A scaling e-commerce company, for example, discovered post-facto that weak vendor controls had led to inflated procurement costs for months. By the time this was detected, losses had already eroded profitability. Regular internal audits act as a spotlight, revealing such blind spots before they become expensive setbacks.

Lowered Stakeholder Trust

Investors, lenders, and strategic partners increasingly expect robust governance as a precondition for collaboration. A lack of internal audit mechanisms can erode confidence, making it harder to secure capital or partnerships. For instance, several private equity firms in India now include internal audit practices as part of their due diligence checklist—companies without them risk being bypassed in favor of more transparent competitors.

6. Conclusion

For Indian businesses, internal audit is no longer a regulatory checkbox—it is a strategic growth enabler. It strengthens internal controls, enhances risk management, improves operational efficiency, and builds investor confidence. At the same time, it shields enterprises from legal, financial, and reputational harm.

The message is clear: internal audit is not a cost center but an investment in resilience and credibility. Whether you are a listed company, a fast-growing SME, or a startup eyeing its first funding round, internal audit can help you scale with confidence and sustainability.

Forward-looking businesses in India are already embracing proactive audit practices. The question is—can yours afford to ignore it?

Frequently Asked Questions (FAQs)

Not all startups are legally required to conduct internal audits. Section 138 of the Companies Act, 2013 mandates internal audit only for companies crossing specific turnover or borrowing thresholds. However, even early-stage startups benefit from voluntary internal audits, as they build investor trust, streamline operations, and ensure compliance from the outset.

A statutory audit is legally required and focuses on verifying the accuracy of financial statements for regulators and shareholders. An internal audit, on the other hand, is an ongoing process initiated by the company itself. It evaluates internal controls, risk management systems, and compliance practices, aiming to improve governance and efficiency.

While internal audit is valuable across sectors, it is particularly critical in financial services, manufacturing, IT/ITES, healthcare, retail, and e-commerce. These industries face complex regulatory requirements and high operational risks, making proactive audits essential for growth and stability.

The frequency depends on the company’s size, industry, and risk profile. Fast-scaling businesses typically conduct quarterly or half-yearly internal audits, while some digitally mature firms adopt continuous auditing models for real-time oversight. At a minimum, an annual internal audit is recommended for all growing enterprises.

Yes. Internal audits play a proactive role in fraud detection and prevention. By reviewing internal controls, financial transactions, and operational processes, audits can uncover irregularities early, reducing the risk of financial losses and reputational damage. This is particularly crucial for fast-growing companies and digitally enabled enterprises in India.