Table of Contents

ToggleIntroduction

Business valuation is a cornerstone of strategic financial decision-making, influencing outcomes in fundraising, mergers and acquisitions, IPOs, regulatory compliance, and shareholder transactions. Merchant bankers play a vital role in this process by determining a company’s fair value using structured, globally accepted valuation methodologies aligned with Indian regulatory frameworks.

Unlike indicative pricing, a merchant banker’s valuation is comprehensive, defensible, and compliant with guidelines issued by SEBI, RBI, FEMA, and the Companies Act. By applying a combination of income-based, market-based, and asset-based approaches, merchant bankers ensure that valuations reflect true business fundamentals, market realities, and transaction-specific objects Below are the key valuation methods commonly applied by merchant bankers:

1. Discounted Cash Flow (DCF) Method

The DCF method values a business by estimating its future cash flows and discounting them to present value. It is commonly used for startups, growth-stage companies, private equity transactions, and FEMA valuations due to its forward-looking and fundamentals-driven approach.

2. Market Multiple Method (Comparable Companies)

The Market Multiple Method values a business by comparing it with similar listed companies operating in the same industry. Merchant bankers apply commonly used multiples such as P/E, EV/EBITDA, EV/Revenue, or Price-to-Book to the company’s financials to arrive at a valuation. This method reflects prevailing market conditions and investor sentiment and is widely used for mature businesses, IPO pricing, and benchmarking valuations.

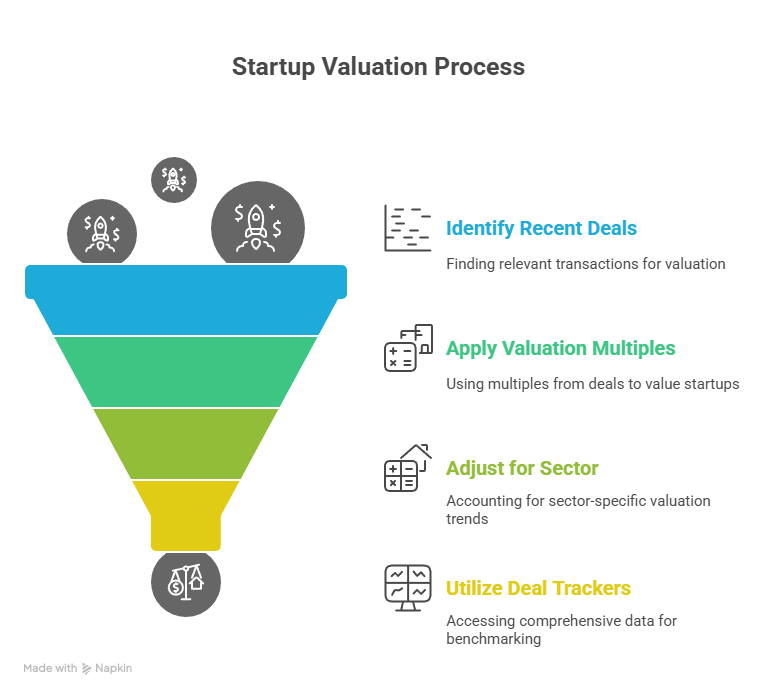

3. Comparable Transaction Method

The Comparable Transaction Method values a business by analysing past mergers, acquisitions, or investment deals involving similar companies. Merchant bankers study transaction multiples, deal premiums, and control factors from these transactions and apply relevant adjustments to the subject company. This method is particularly useful in acquisitions, takeovers, and strategic investments, as it reflects actual prices paid in real market transactions.This approach analyses past M&A or investment transactions in similar companies to determine valuation benchmarks. It is commonly used in acquisition, takeover, and strategic investment scenarios.

4. Net Asset Value (NAV) / Asset-Based Method

The Net Asset Value method determines a company’s value based on the net worth of its assets after deducting liabilities. Merchant bankers often adjust asset values to reflect their current market or realizable value rather than book value. This method is commonly used for asset-heavy businesses, investment holding companies, real estate entities, manufacturing firms, and restructuring or liquidation scenarios, where asset strength is more relevant than future earnings.

5. Earnings Capitalization Method

The Earnings Capitalization Method values a business by capitalizing its sustainable or normalized earnings using an appropriate capitalization rate. Merchant bankers apply this method to stable and mature businesses with predictable profits, particularly SMEs and closely held companies. It is a simplified income-based approach that works best where growth is steady and long-term earnings visibility is high.

6. Venture Capital (VC) Method

Used for early-stage startups, this method estimates the company’s exit value and discounts it based on expected investor returns.The Venture Capital Method is used to value early-stage and high-growth startups by estimating the company’s expected exit value and discounting it to present value based on target investor returns.

Key Points:

- Focuses on future exit value (IPO or acquisition)

- Applies high expected return rates to reflect risk

- Commonly used in angel and VC funding rounds

- Suitable for startups with limited operating history

Business Valuation Methods Used by Merchant Bankers

Focuses on future exit value (IPO or acquisition):

- The VC Method starts by estimating the value a startup can achieve at exit, such as through an IPO or strategic acquisition, rather than its current financial performance.

Applies high expected return rates to reflect risk:

- Since early-stage businesses carry higher uncertainty, merchant bankers apply higher target return rates to account for business, market, and execution risks.

Commonly used in angel and VC funding rounds:

- This method aligns closely with how angel investors and venture capital funds evaluate investments, making it widely accepted in startup fundraising transactions.

Suitable for startups with limited operating history:

- The VC Method is ideal when historical financial data is limited, as it relies more on growth potential, scalability, and exit assumptions rather than past earnings.

conclusion

Business valuation is a critical exercise that requires professional judgment, regulatory awareness, and a deep understanding of business fundamentals. Merchant bankers use a combination of income-based, market-based, and asset-based valuation methods to arrive at a fair and defensible value, depending on the nature of the business and the purpose of valuation.

By applying the appropriate valuation approach—such as DCF for growth companies, market multiples for mature businesses, asset-based methods for asset-heavy entities, or the VC method for startups—merchant bankers ensure valuations are credible, compliant, and aligned with investor and regulatory expectations. Engaging experienced professionals helps businesses support informed decisions, strengthen negotiations, and achieve successful transaction outcomes.

Frequently Asked Questions (FAQs)

Merchant bankers use multiple valuation methods to ensure accuracy and credibility. Different methods capture different aspects of a business—future earnings, market trends, and asset strength—helping arrive at a fair and defensible valuation.

For startups, the Discounted Cash Flow (DCF) Method and Venture Capital (VC) Method are commonly used. These methods focus on future growth potential rather than historical financial performance.

Market Multiple Method (Comparable Companies) is widely used for IPO pricing, along with DCF analysis, to align valuations with market expectations and investor sentiment.

The NAV or Asset-Based Method is preferred for asset-heavy businesses, investment holding companies, real estate firms, and restructuring or liquidation cases.

Yes. While both aim to determine value, an Income Tax Valuation Report is primarily compliance-driven, ensuring FMV reporting for taxation, whereas a business valuation report may focus on broader objectives like fundraising, M&A, or strategic planning.