Table of Contents

ToggleWhy Purchase Price Allocation (PPA) Matters for Indian Businesses

In an era of aggressive mergers, acquisitions, and corporate restructuring, one question remains central to financial transparency: How do we account for the price paid during a business combination? That’s where Purchase Price Allocation (PPA) steps in.

For Indian businesses, especially those adhering to Indian Accounting Standards (Ind AS) or International Financial Reporting Standards (IFRS), PPA is not just a regulatory necessity—it’s a strategic tool. It ensures that when a company acquires another, every rupee of the purchase price is mapped to identifiable assets, liabilities, and, if applicable, goodwill. Done correctly, PPA enhances investor trust, streamlines compliance, and provides deeper insights into what was purchased, beyond just a brand name or a balance sheet.

At Marcken Consulting, we work with acquirers, CFOs, and auditors across industries to ensure their purchase price allocation meets the highest standards of accuracy, regulatory compliance, and strategic clarity. Whether you’re acquiring a tech startup, a pharma company, or an industrial asset, PPA is the cornerstone of reliable post-deal financial reporting.

Let’s unpack what PPA is and why it deserves a front seat in your deal-making playbook.

What is Purchase Price Allocation (PPA)?

Purchase Price Allocation (PPA) is the systematic process of assigning the total purchase consideration paid in a business acquisition to the fair values of the identifiable assets acquired and liabilities assumed. It’s a requirement under Indian Accounting Standard (Ind AS) 103 — Business Combinations — and aligns with IFRS 3 globally.

Let’s break it down:

When one company acquires another, the buyer typically pays a premium over the book value of the acquired company’s net assets. This premium may reflect various intangible elements like brand equity, customer loyalty, or anticipated synergies. Through PPA, that premium is not just recorded as a single goodwill figure. Instead, it’s dissected and allocated to the individual tangible and intangible components that make up the acquired business.

If the total consideration exceeds the fair value of net identifiable assets, the difference is recorded as goodwill. Conversely, if the consideration is less, the buyer records a bargain purchase gain.

Example:

If Company A acquires Company B for ₹100 crore, and the fair value of B’s net identifiable assets is ₹75 crore, the ₹25 crore difference is allocated as goodwill unless some portion can be attributed to identifiable intangibles like brand or customer relationships.

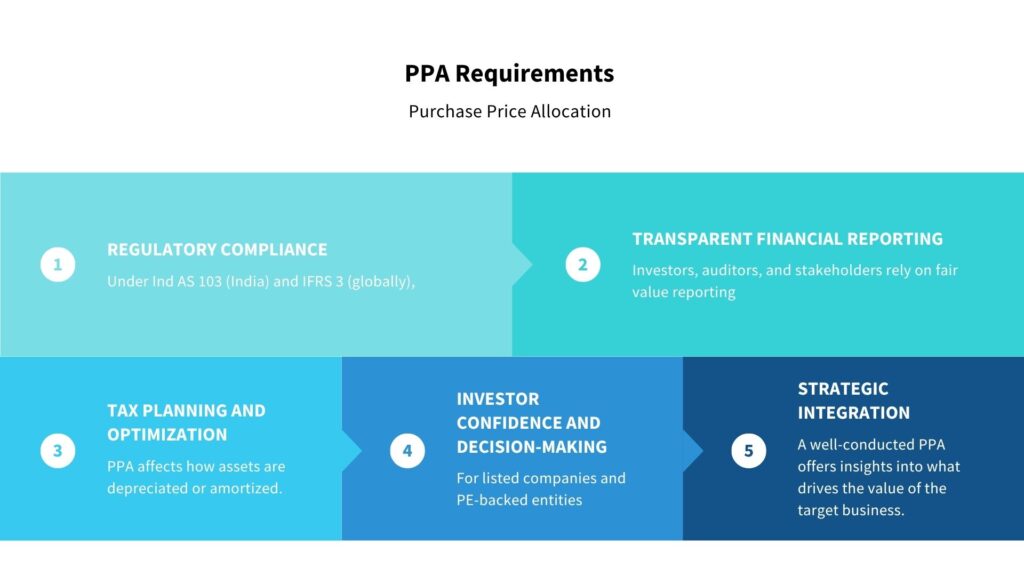

Why is PPA Required?

PPA isn’t just a box-ticking exercise for accountants—it’s a regulatory and strategic imperative. Here’s why Indian businesses must take PPA seriously:

1. Regulatory Compliance

Under Ind AS 103 (India) and IFRS 3 (globally), every business combination must go through the PPA process. It ensures that all assets and liabilities acquired are fairly valued on the acquirer’s books from Day One.

Failing to conduct a compliant PPA can lead to adverse audit outcomes or regulatory scrutiny, especially from the MCA, RBI, SEBI, and Income Tax authorities.

2. Transparent Financial Reporting

Investors, auditors, and stakeholders rely on fair value reporting to understand how a transaction affects the buyer’s financials. PPA brings clarity by highlighting what exactly was acquired: is the value sitting in brand equity, technology, or customer contracts?

3. Tax Planning and Optimization

PPA affects how assets are depreciated or amortized. Accurate allocation helps optimize deferred tax liabilities or assets, thereby impacting the tax outflow in future periods. For instance, if more value is allocated to depreciable intangibles, it could create tax shields.

4. Investor Confidence and Decision-Making

For listed companies and PE-backed entities, clear visibility into the composition of acquired value supports better decision-making, enhances valuation confidence, and builds investor trust.

5. Strategic Integration

A well-conducted PPA offers insights into what drives the value of the target business. This can be vital for post-merger integration, as management can prioritize retaining high-value assets like key customers or proprietary technologies.

Key Components of Purchase Price Allocation

At its core, Purchase Price Allocation (PPA) is about assigning fair value to everything the buyer gains—and everything they assume—during a business combination. These elements go far beyond just buildings and bank balances. In today’s knowledge-driven economy, intangibles often hold more value than tangibles.

Below are the key components typically assessed and allocated in a PPA exercise:

1. Tangible Assets

These are the physical assets acquired in the transaction and typically the easiest to value.

- Examples: Land, buildings, plant & machinery, vehicles, inventory, and furniture.

- Valuation Basis: Market price, replacement cost (less depreciation), or income potential (for revenue-generating assets).

In India, real estate valuation must adhere to guidance issued by regulatory bodies like the Institute of Valuers or RERA, where applicable.

2. Intangible Assets

Often, the most complex and strategically important part of a PPA. These assets don’t have a physical form but can significantly influence deal value.

- Examples:

- Trademarks and brands

- Customer contracts or relationships

- Patented technology or proprietary software

- Non-compete agreements

- Domain names or licenses

- Trademarks and brands

These are only recognized separately from goodwill if they are identifiable (i.e., separable or arise from legal/contractual rights), as per Ind AS 103.

3. Goodwill

Goodwill captures the residual value of the transaction—the premium the buyer pays over and above the fair value of identifiable assets and liabilities.

Represents: Expected synergies, assembled workforce, strategic benefits, or buyer-specific advantages.

Treatment under Ind AS: Not amortized. Must be tested annually for impairment under Ind AS 36.

For example, if the acquirer believes they can enter new markets or cross-sell more effectively through the acquisition, this expectation often sits in goodwill.

4. Liabilities Assumed

These are obligations the buyer agrees to take on, which must be fairly valued at acquisition.

Examples: Loans, trade payables, legal claims, employee benefit obligations, lease liabilities.

Special Case: Contingent liabilities—like warranties or ongoing litigations—must be evaluated carefully for probability and impact.

5. Deferred Tax Liabilities (DTLs)

These arise when the fair value of acquired assets exceeds their tax base (i.e., the value used for tax purposes).

- Example: If a brand is valued at ₹10 crore in PPA but has no corresponding tax base, a deferred tax liability may arise.

- Importance: Ignoring DTLs can overstate net assets and understate goodwill. These must be recognized and disclosed clearly.

Summary Table of Components

Component | What It Includes | Key Considerations |

Tangible Assets | Land, buildings, equipment, inventory | Valued using market or cost approaches |

Intangible Assets | Trademarks, customer lists, and patents | Must be identifiable and valued separately from goodwill |

Goodwill | Residual premium after allocation | Reflects synergies and buyer-specific advantages |

Liabilities Assumed | Debt, payables, legal claims | Must include contingent obligations where applicable |

Deferred Tax Liabilities | Arising from book vs tax base differences | Must be accurately calculated based on local tax rules |

A comprehensive PPA exercise leaves no asset or liability unaccounted for. It brings balance sheet integrity and helps stakeholders understand what was truly bought, why it matters, and how it impacts future performance.

Types of Purchase Price Allocation

Purchase Price Allocation isn’t a one-size-fits-all exercise. Depending on the purpose, regulatory framework, and stakeholder requirements, PPA can take different forms. While the underlying principles remain consistent—assigning fair value to assets and liabilities—the context in which it’s applied determines how it’s conducted and disclosed.

Let’s explore the three primary types of PPA:

1. Statutory PPA (For Financial Reporting)

This is the most common and mandatory form of PPA under Ind AS 103 or IFRS 3, required whenever a business combination occurs. It’s primarily used for financial statement reporting and must comply with India’s accounting standards.

Key Highlights:

- Mandatory for mergers, acquisitions, and slump sales that qualify as business combinations.

- All identifiable assets and liabilities must be reported at fair value.

- Intangibles must be separately recognized if they meet the criteria (separability or contractual/legal origin).

- Resulting goodwill is tested annually for impairment under Ind AS 36.

Use Case:

A listed company acquires a startup to expand its tech capability. As per Ind AS, the acquisition must be reported with full PPA in the consolidated financials.

2. Tax PPA (For Direct Tax and Compliance Planning)

In India, the tax treatment of business combinations varies depending on the nature of the transaction (e.g., slump sale vs asset sale). A Tax PPA is used to determine the tax base of each asset and how future depreciation or amortization is computed.

Key Highlights:

- Aligns with provisions under the Income Tax Act, 1961.

- Helps in optimizing tax liabilities through appropriate asset classification.

- Especially relevant in asset purchases and slump sales, where tax depreciation is impacted by asset allocation.

Use Case:

A buyer acquires a manufacturing unit via a slump sale. The way plant, land, and intangibles are valued affects the buyer’s future depreciation claims and Minimum Alternate Tax (MAT) exposure.

3. Management/Internal PPA (For Strategic Planning or Fundraising)

This type of PPA isn’t required by regulators but is often used internally for business planning, performance tracking, or during capital raising. It’s customized to suit the business’s strategic focus.

Key Highlights:

- Not disclosed in statutory filings.

- Helps management evaluate ROI, synergy realization, and asset-specific performance.

- Frequently used in joint ventures, internal restructuring, or pre-investment due diligence.

Use Case:

An investor evaluating a stake in a consumer brand may request a PPA-style analysis to understand the value of trademarks and customer loyalty before investing.

Methods Used in PPA Valuation

Purchase Price Allocation requires more than just accounting—it demands precise valuation of diverse asset classes. To achieve this, professionals rely on a combination of globally accepted valuation methodologies tailored to the nature of the acquired assets and liabilities.

Ind AS 103 mandates that all identifiable assets and liabilities be recorded at their fair value on the acquisition date. But how is this fair value determined?

Here are the three most commonly used valuation approaches in PPA assignments:

1. Market Approach

The Market Approach estimates an asset’s value based on observable market transactions involving identical or comparable assets.

Best suited for:

- Tangible assets like land, vehicles, and machinery

- Certain intangibles like licenses or customer contracts (if comparable deals exist)

Techniques Used:

- Comparable Transactions Method: Value derived from recent sales of similar assets.

- Guideline Public Company Method: Applies valuation multiples (e.g., EV/EBITDA) from peer companies to the target.

Indian Context Example:

If a company acquires a factory, land valuation can be benchmarked against recent land sales in the same industrial zone.

2. Cost Approach

Also known as the Replacement Cost Method, this approach estimates the value of an asset by calculating the cost to recreate or replace it, adjusted for depreciation or obsolescence.

Best suited for:

- Tangible assets like plant & machinery, buildings, or furniture

- Certain intangible assets like software or non-unique databases

Key Steps:

- Estimate replacement cost (cost to construct or buy a similar asset)

- Deduct depreciation for physical wear and tear, functional, or economic obsolescence

Indian Context Example:

In a hospital acquisition, custom medical software can be valued using the cost approach based on current development costs minus technological obsolescence.

3. Income Approach

The Income Approach values an asset based on the present value of future cash flows expected to be generated by the asset. This method is especially vital when valuing intangible assets that generate measurable income over time.

Best suited for:

- Intangibles such as trademarks, brands, customer relationships, and technology

- Goodwill estimation (as a residual after all other assets and liabilities are valued)

Common Technique:

- Discounted Cash Flow (DCF): Projects asset-specific cash flows and discounts them to present value using a suitable discount rate.

Variants:

- Multi-Period Excess Earnings Method (MPEEM) – widely used for customer relationships

- Relief-from-Royalty Method – used for brands and trademarks

Indian Context Example:

In the acquisition of a cosmetics brand, the Relief-from-Royalty Method may be applied to value the brand name, estimating what the company would have paid in royalties if it didn’t own the brand.

Key Consideration:

The chosen method must reflect market participant assumptions and be consistent with economic reality. Moreover, valuation professionals must ensure that the methods used comply with Ind AS 113: Fair Value Measurement and withstand scrutiny from auditors and regulators.

PPA Under Ind AS: Rules and Compliance

Under Indian Accounting Standards (Ind AS), particularly Ind AS 103 (Business Combinations) and Ind AS 113 (Fair Value Measurement), Purchase Price Allocation is not just a best practice—it’s a legal and financial imperative. These standards ensure that every acquisition is recorded transparently and consistently, aligned with global financial reporting norms such as IFRS 3.

Below is a detailed breakdown of key rules and compliance obligations under Ind AS for PPA:

1. Mandatory Application of PPA

Ind AS 103 mandates that all business combinations—not just acquisitions—require purchase price allocation. This includes:

- Mergers

- Acquisitions

- Slump sales

- Joint ventures (in some cases)

The acquiring entity must identify the acquisition date and measure all acquired assets and liabilities at fair value as of that date.

2. Recognition of Identifiable Assets and Liabilities

All assets and liabilities acquired must be evaluated for:

- Separability (can they be sold or licensed separately?)

- Arising from contractual or legal rights

Only assets that meet these criteria are recognized separately from goodwill.

Example:

Customer contracts, patents, and licenses are typically recognized separately, while employee skillsets or internally developed goodwill are not.

3. Fair Value Measurement

Ind AS 113 provides the framework for fair value measurement. Key considerations include:

- Market participant assumptions (what others in the market would pay)

- Orderly transaction basis (not distressed sales)

Hierarchy of inputs: prioritizing observable inputs like market prices over internal estimates

4. Goodwill Recognition

Once all identifiable assets and liabilities are accounted for at fair value, any residual amount of the purchase price is recorded as goodwill.

Important Note:

- Goodwill cannot be amortized under Ind AS.

- It must be tested annually for impairment under Ind AS 36.

- Any impairment loss must be reflected in the P&L and cannot be reversed in future periods.

5. Deferred Tax Implications

Differences between book and tax values of the newly recognized assets/liabilities must be addressed:

- Deferred Tax Assets (DTA) or Deferred Tax Liabilities (DTL) must be recognized as per Ind AS 12.

This often affects long-term tax planning and future effective tax rates.

6. Bargain Purchase

In rare cases where the purchase consideration is less than the fair value of net assets acquired, the acquirer must:

- Reassess the measurements to ensure accuracy

If valid, recognize the difference as a gain in profit or loss (not negative goodwill)

7. Disclosure Requirements

To maintain transparency and meet compliance standards, Ind AS 103 mandates detailed disclosure in financial statements, including:

- The names and descriptions of the acquirees

- Acquisition date and rationale

- Purchase consideration breakdown

- Values and descriptions of each identified asset and liability

- Goodwill amount and reason

- Methodologies used for valuation

Deferred tax effects and impairment policies

Regulatory Scrutiny:

Given the technical nature and high impact of PPA, transactions are closely examined by:

- Auditors

- SEBI (in listed companies)

- Income Tax authorities (for tax alignment)

Ensuring strict compliance with Ind AS guidelines not only reduces audit risks but also enhances credibility with investors and regulators.

Frequently Asked Questions (FAQs)

Purchase Price Allocation (PPA) is the process of assigning the total purchase consideration in a business acquisition to the fair value of acquired assets and liabilities, as required under Ind AS 103.

Ind AS 103 mandates PPA for every business combination to ensure accurate and transparent financial reporting, identify goodwill, and comply with regulatory standards.

PPA includes valuation of tangible assets (land, machinery), intangible assets (brands, customer contracts), liabilities, goodwill, and deferred tax liabilities using market, cost, and income approaches.

Accurate PPA helps optimize depreciation, amortization, and deferred tax liabilities, which directly affects a company’s future tax obligations and compliance under the Income Tax Act.

PPA is required at the time of mergers, acquisitions, slump sales, or joint ventures. It is also useful during internal restructuring or for investor due diligence.