Table of Contents

Toggle1. Introduction: What Is a Share Swap Ratio Report?

In the evolving landscape of corporate restructuring, mergers and acquisitions (M&A) have become a vital tool for companies seeking growth, diversification, or strategic alignment. While cash transactions remain common, many corporate combinations are increasingly being structured using non-cash alternatives, the most prominent of which is the share swap.

A share swap enables one company to acquire or merge with another by issuing its shares in exchange for the shares of the target company, thereby eliminating the need for an immediate cash outlay. This mechanism allows for smoother integrations, especially when conserving liquidity or aligning shareholder interests is a key objective.

At the heart of this process lies the Share Swap Ratio Report, a critical document that determines the exchange ratio — the number of shares the acquiring company will issue for each share of the target company. This ratio not only impacts the ownership structure of the merged entity but also carries direct implications for control, governance, and shareholder value.

The Share Swap Ratio Report plays a vital role in ensuring fairness and transparency for all stakeholders involved. It acts as the formal basis for negotiations, shareholder communication, and regulatory scrutiny. A well-prepared report ensures that the interests of minority shareholders, promoters, and institutional investors are protected and that the transaction adheres to the principles of financial prudence and equitable value exchange.

In the Indian regulatory context, this report is not optional. It is mandated by several key legislations and regulatory frameworks, including the Companies Act, 2013, SEBI regulations, and the Foreign Exchange Management Act (FEMA). Each of these mandates the appointment of qualified independent valuers to ensure that the swap ratio is based on sound financial principles, comprehensive analysis, and adherence to disclosure norms.

As M&A activity in India continues to gain momentum — both domestically and across borders — the Share Swap Ratio Report has become a cornerstone document in the due diligence and valuation process, ensuring that business combinations are not only strategic but also legally compliant and economically justified.

2. Share Swap Ratio Explained

A share swap ratio is the proportion at which shares of one company are exchanged for the shares of another during a merger or acquisition. In essence, it represents the agreed value of the target company relative to the acquiring company, expressed through the issuance of equity rather than cash. This ratio determines how many shares shareholders of the target company will receive in the acquiring company after the transaction is completed.

To illustrate, consider an example where Company A is acquiring Company B. If the agreed share swap ratio is 1:5, it means that for every five shares held by a shareholder in Company B, they will receive one share of Company A. So, if a shareholder owns 1,000 shares in Company B, they would receive 200 shares in Company A as part of the deal. No money changes hands in this transaction — only ownership.

The share swap structure is attractive for several reasons. Firstly, it allows companies to preserve cash reserves, which can be crucial during uncertain economic conditions or when capital is required for other strategic investments. Secondly, it helps in aligning the interests of both sets of shareholders, as all parties now hold a stake in the combined entity and benefit from its future performance.

Moreover, share swaps are often more tax-efficient, both for the companies and their shareholders, depending on the jurisdiction and structure of the deal. In India, for example, share swap transactions can qualify for certain exemptions under capital gains tax if structured appropriately and compliant with existing laws.

From a strategic standpoint, a share swap also facilitates faster deal execution, especially when the acquiring company is publicly listed and has a high market capitalization, enabling it to leverage its stock as an acquisition currency. This approach is commonly seen in sectors where asset-light models dominate, such as technology, services, and financial institutions.

In summary, the share swap ratio is not just a mathematical expression — it is a reflection of the relative valuation, strategic rationale, and financial strength of the entities involved. Its determination, therefore, must be based on a robust, transparent, and well-documented valuation process, which will be further explored in the sections that follow.

3. How the Share Swap Ratio is Calculated

The share swap ratio is not a one-size-fits-all formula. It is the product of a structured valuation process, backed by both quantitative financial metrics and qualitative business insights. Given the impact it has on ownership and equity distribution post-merger, its calculation demands precision, objectivity, and compliance with Indian regulatory standards.

Key Financial Parameters Used

This approach pegs a company’s value by comparing it with similar businesses in the same industry. It’s fast, intuitive, and widely used when there are reliable market benchmarks.

Valuers assess the relative worth of both companies through various financial indicators. These include:

- Profit After Tax (PAT): Reflects the actual earnings of the company, essential for profitability comparisons.

- Earnings Per Share (EPS): A measure of earnings allocated to each outstanding share, indicating shareholder return.

- Book Value per Share: Shows the intrinsic value of a company based on its balance sheet strength.

- Market Value (for listed companies): Reflects investor sentiment and real-time demand for the stock.

- Net Worth & Reserves: Determines financial stability and asset base.

- Liabilities and Debt Levels: Higher debt reduces equity value, and this must be factored in.

Each metric provides a different lens into a company’s financial health, and no single parameter is sufficient on its own.

Consideration of Qualitative Factors

In addition to hard numbers, valuation experts must account for qualitative business variables that impact future performance and integration success:

- Company Size and Market Position: Larger or dominant players may command a premium.

- Strategic Importance of the Merger: Whether the transaction is a horizontal expansion, vertical integration, or diversification.

- Synergy Potential: Opportunities for cost savings, cross-selling, or revenue expansion post-merger.

- Regulatory Compliance History & Litigation Risks

- Brand Equity and Customer Loyalty

These intangible elements often influence how value is perceived, even if it’s not fully reflected in historical financials.

The Exchange Ratio Formula

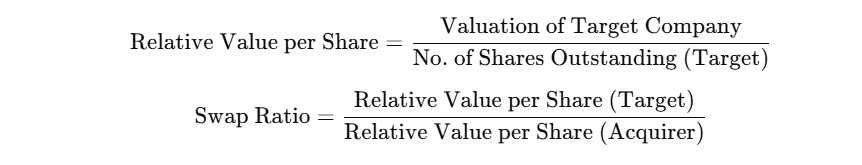

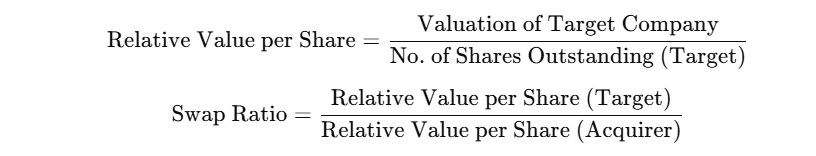

The core output of the report — the recommended share swap ratio — is derived by calculating:

The final recommended ratio is typically rounded and presented in a simplified format (e.g., “1.12 shares of Company A for every 1 share of Company B”). If multiple scenarios are assessed (e.g., with or without synergies), sensitivity analysis may also be included.

Fixed vs Floating Share Swap Ratios

- Fixed Ratio: This is locked in at the time of signing and remains constant, regardless of share price fluctuations before the deal closing. It provides certainty to both parties.

- Floating Ratio: Adjusts based on stock price movements during a specific period or at the time of closing. It introduces flexibility but can lead to valuation volatility and shareholder risk.

In India, fixed ratios are typically preferred, especially in public sector and banking mergers, as they simplify the approval process and maintain shareholder confidence.

4. Indian Case Studies: Real-World Examples

India has witnessed several high-profile share swap mergers, especially in the banking sector. These deals demonstrate how swap ratios are calculated, reviewed, and approved in real-world scenarios

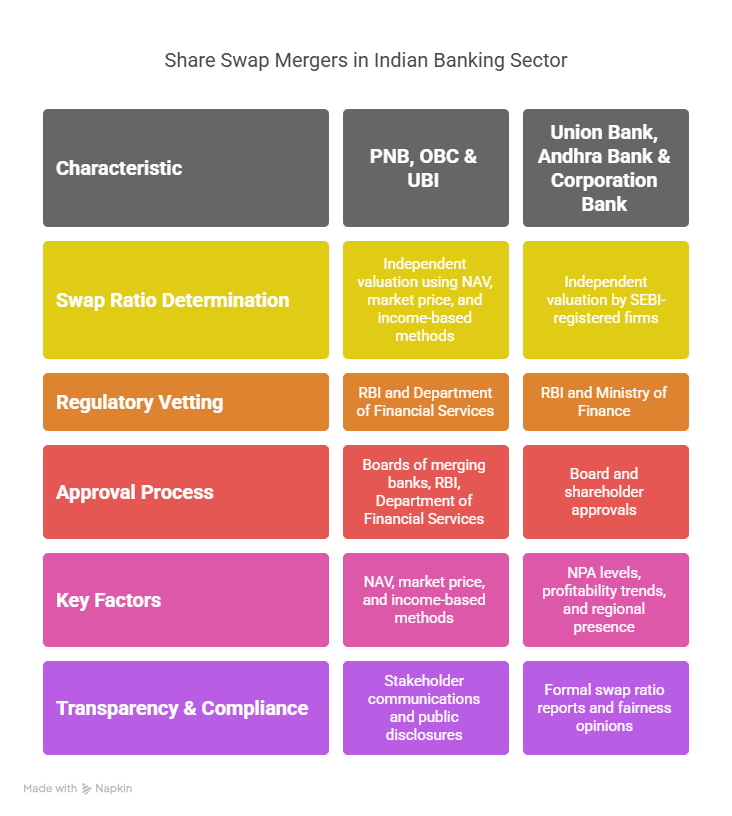

PNB, OBC & UBI Merger (2020)

In 2020, the Indian government initiated a major public sector bank consolidation. Punjab National Bank (PNB) merged with Oriental Bank of Commerce (OBC) and United Bank of India (UBI) to create India’s second-largest bank.

Swap Ratios:

- 1,150 shares of PNB for every 1,000 shares of OBC

- 121 shares of PNB for every 1,000 shares of UBI

These ratios were determined by independent valuers using a combination of NAV, market price, and income-based methods. The proposed ratios were reviewed and approved by:

- The boards of all merging banks

- The Reserve Bank of India (RBI)

- The Department of Financial Services

Stakeholder communications and public disclosures were made to ensure transparency and compliance.

Union Bank Merger with Andhra Bank and Corporation Bank

Another prominent example is the amalgamation of Andhra Bank and Corporation Bank into the Union Bank of India. The deal aimed to create a stronger, more resilient banking entity.

Approved Swap Ratios:

- 325 equity shares of Union Bank for every 1,000 shares of Andhra Bank

- 330 equity shares of Union Bank for every 1,000 shares of Corporation Bank

Like the PNB merger, this deal followed a structured process involving:

- Independent valuation by SEBI-registered firms

- Regulatory vetting by the RBI and the Ministry of Finance

- Board and shareholder approvals

- Formal swap ratio reports and fairness opinions

These ratios reflected the financial and operational position of each bank, including factors like NPA levels, profitability trends, and regional presence.

These cases highlight the rigor and regulation involved in share swap ratio determination. They show that the report is not just an internal document — it is a public-facing, regulated valuation instrument that underpins the credibility of the entire merger process.

5. Regulatory Framework in India

The share swap ratio may be a financial calculation, but in India, it sits firmly within the boundaries of a robust regulatory ecosystem. Whether it’s a domestic merger or a cross-border acquisition, companies must adhere to multiple layers of legislation and oversight to ensure fairness, transparency, and legal validity.

Companies Act, 2013: Valuation Requirements

Under the Companies Act, 2013, any issuance of shares other than for cash — such as through a share swap — must be backed by a valuation conducted by a registered valuer. The key sections include:

- Section 62(1)(c): Deals with the issue of shares to non-shareholders for consideration other than cash.

- Section 247 mandates the use of a registered valuer who meets the eligibility criteria prescribed by the Insolvency and Bankruptcy Board of India (IBBI).

In the context of mergers, valuation reports are also required under Sections 230–232 to support the scheme of amalgamation or arrangement filed with the National Company Law Tribunal (NCLT). These reports become part of the merger petition submitted to stakeholders and regulators.

SEBI Regulations: Listed Company Considerations

For listed companies, the share swap process must align with SEBI regulations. The most relevant frameworks include:

- SEBI (ICDR) Regulations: These govern the pricing and disclosures involved in preferential allotments and share exchanges.

- SEBI (LODR) Regulations: Ensure that listed entities maintain transparency in disclosure, especially when issuing equity shares through a merger or acquisition.

- SEBI (Substantial Acquisition of Shares and Takeovers) Regulations (SAST): Triggered if a share swap results in crossing acquisition thresholds (typically 25%).

Additionally, SEBI mandates that listed companies disclose swap ratios and valuation reports in public filings and shareholder communication, and often requires a fairness opinion from a SEBI-registered merchant banker.

FEMA: Cross-Border Implications and ODI Guidelines

When the transaction involves a non-resident shareholder or a foreign entity, it must comply with the Foreign Exchange Management Act (FEMA), governed by the Reserve Bank of India (RBI). Key considerations include:

- Inbound Investment: If a foreign investor is allotted shares of an Indian company, the swap must be priced per Foreign Direct Investment (FDI) guidelines.

- Outbound Investment: If an Indian company acquires a foreign entity through a share swap, it must follow Overseas Direct Investment (ODI) norms.

Valuation in such cases must be conducted by a SEBI-registered merchant banker or Category I investment banker, depending on the residency of the parties involved.

Primary vs Secondary Share Swap Permissions

- Primary Share Swap: Involves the issuance of new shares to the shareholders of the target company. This is typically allowed under the automatic route, subject to compliance with pricing and sectoral caps.

- Secondary Share Swap: Involves the transfer of existing shares between shareholders. These may attract additional scrutiny and, in some cases, require prior approval from the RBI or other regulators.

Each route requires its own set of compliance checks, including pricing benchmarks, valuation disclosures, and reporting forms (such as FC-GPR or FC-TRS).

In short, every share swap is a regulated transaction, and the Share Swap Ratio Report acts as a foundational compliance document in ensuring all legal, financial, and procedural requirements are met.

6. Valuation Methodologies Used in Swap Ratio Reports

The credibility of a Share Swap Ratio hinges on the strength of the valuation methodology behind it. In India, valuation professionals commonly use a combination of globally accepted approaches, each of which brings its own perspective to the analysis.

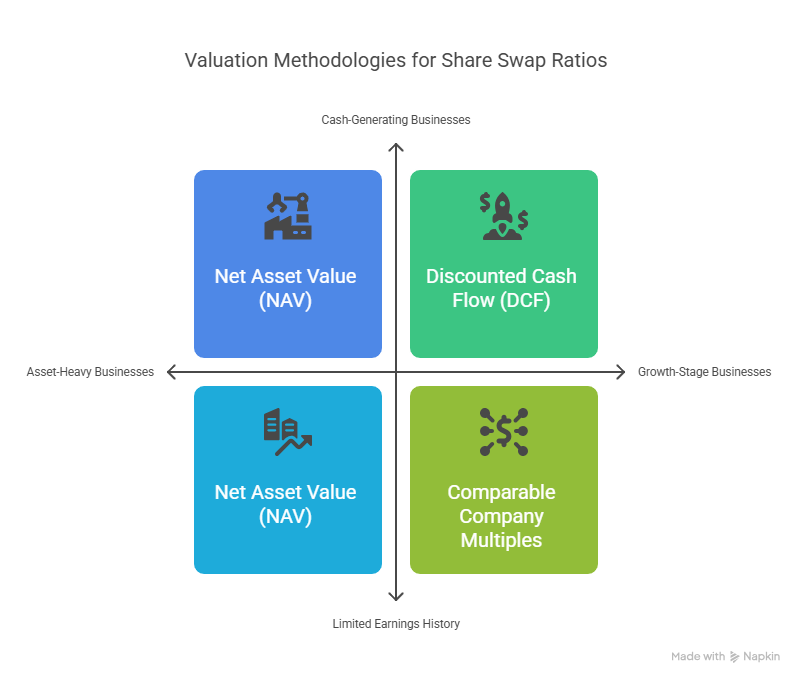

1. Asset Approach (Net Asset Value – NAV)

This method determines the value of a company by subtracting liabilities from total assets, providing a snapshot of the company’s intrinsic worth.

- Most appropriate for asset-heavy businesses or companies with limited earnings history.

- Commonly used in infrastructure, manufacturing, or investment holding companies.

- Limitation: It may undervalue intangible assets such as brand, goodwill, or growth potential.

2. Income Approach (Discounted Cash Flow – DCF)

The DCF method projects the future cash flows of a company and discounts them back to their present value using an appropriate discount rate (WACC or COE).

- Highly useful for growth-stage or cash-generating companies.

- Captures value based on forward-looking profitability and strategic potential.

Sensitive to assumptions: A minor change in growth rate or discount rate can significantly alter the valuation.

3. Market Approach (Comparable Company or Transaction Multiples)

This method compares the company’s performance and valuation metrics (like P/E, EV/EBITDA, or P/B) to peer companies or past transactions in the same industry.

- Reflects real-world market benchmarks and investor expectations.

- Ideal for companies in active, competitive sectors with listed peers or recent deals.

Risk: May be skewed by market volatility or non-comparable business models.

Weighting Methods and Rationale

Valuation reports often assign weightages to different methods based on:

- Company type (asset-based vs service-based)

- Availability and reliability of data

- Industry norms and historical practices

- Stage of business and revenue profile

For instance, in a merger between a legacy manufacturing firm and a digital startup, the valuer might give higher weight to NAV for the former and DCF for the latter.

The goal is to arrive at a balanced, defensible valuation that supports a fair swap ratio — one that can stand up to board scrutiny, regulatory review, and potential legal challenge.

7. Anatomy of a Share Swap Ratio Report

A Share Swap Ratio Report is not merely a valuation memo — it is a comprehensive, formal document that brings together data, analysis, regulatory compliance, and professional judgment. Its format and content are shaped by statutory requirements, industry best practices, and expectations from stakeholders such as company boards, shareholders, and regulators.

Here’s what typically goes into a robust Share Swap Ratio Report in India:

1. Valuation Assumptions and Methods

The report begins by clearly stating the valuation approaches adopted (NAV, DCF, Market Multiples), along with justifications for their selection and the relative weight assigned to each.

Key assumptions disclosed include:

- Forecast period and revenue projections

- Terminal growth rate (for DCF)

- Discount rate (WACC or Cost of Equity)

- Market benchmarks or transaction comparables

- Adjustments for debt, non-operating assets, or extraordinary items

All assumptions must be reasonable, justified, and well-documented, as they are subject to scrutiny by boards, auditors, and, if challenged, the NCLT or tax authorities.

2. Supporting Financials and Working Papers

This includes:

- Historically audited financials of both companies (usually past 3–5 years)

- Pro forma financial statements (especially in mergers)

- Management forecasts (in DCF-based valuations)

- Asset and liability breakdowns (for NAV)

- Peer company data and multiples (for Market Approach)

Attachments often include Excel-based workings, tables, and notes used to arrive at per-share values. This data transparency strengthens the report’s credibility.

3. Computation of the Swap Ratio

The core output of the report — the recommended share swap ratio — is derived by calculating:

The final recommended ratio is typically rounded and presented in a simplified format (e.g., “1.12 shares of Company A for every 1 share of Company B”). If multiple scenarios are assessed (e.g., with or without synergies), sensitivity analysis may also be included.

4. Statutory Disclosures and Presentation to Stakeholders

The report concludes with formal sections on:

- Valuer’s credentials and declarations under the Companies Act or SEBI guidelines

- Limitations and disclaimers

- List of documents reviewed

- Date of valuation and cut-off period for data

- Compliance statements with relevant laws (SEBI, FEMA, Companies Act, etc.)

Once finalized, the report is:

- Submitted to the boards of both entities for approval

- Filed with regulatory bodies (SEBI, RBI, NCLT as applicable)

- Shared with shareholders through explanatory statements or circulars

In listed entities, the report may also be uploaded to the stock exchange and corporate website to ensure public access and investor confidence.

8. Conclusion: Why the Report Matters

In the intricate world of mergers and acquisitions, a Share Swap Ratio Report serves as both a financial compass and a legal anchor. It defines how value will be exchanged, how ownership will be reshaped, and how trust will be preserved throughout the transaction.

This report is not just about numbers. It is about governance, transparency, and accountability.

Importance for Stakeholders:

- Acquirer: Ensures the deal is value-accretive and legally sound

- Target Company: Validates fairness and equity in the offer

- Shareholders: Provides clarity on the impact of the merger on their holdings

- Regulators: Assure that the transaction is in line with the law and public interest

In a market where corporate reputation and stakeholder trust can be fragile, the independent preparation of a professionally sound share swap ratio report is a cornerstone of responsible deal-making. Whether the transaction is a strategic acquisition or a regulatory merger, this document reflects the rigor behind the numbers and the integrity of the process.

Final takeaway?

If a share swap is the bridge between two companies, the swap ratio report is the blueprint that ensures it stands strong.

Frequently Asked Questions (FAQs)

A share swap ratio determines how many shares of the acquiring company will be exchanged for each share of the target company. It directly impacts shareholder ownership in the combined entity.

The report is prepared by a registered valuer or a SEBI-registered merchant banker, depending on whether the companies involved are private, listed, or cross-border.

Not necessarily. While market price is a factor for listed companies, the ratio is typically based on a combination of valuation methods like NAV, DCF, and comparables.

Yes. Shareholders, regulators, or courts (e.g., NCLT) may challenge the ratio if it appears unfair or lacks proper valuation backing. That's why transparency is critical.

Approvals vary based on company type but often include board, shareholder, SEBI, RBI, and NCLT approvals — especially for listed or cross-border transactions.