Table of Contents

Toggle1. Introduction

Mergers and Acquisitions (M&A) have become a cornerstone of corporate strategy for companies seeking growth, diversification, or market consolidation. In India, where the economic landscape is marked by regulatory complexities and a mix of domestic and cross-border players, the role of valuation is both strategic and indispensable.

Valuation is not just about determining a company’s worth. It is a critical financial assessment that influences deal structuring, stakeholder negotiations, tax implications, and regulatory compliance. Whether it’s a merger between Indian entities or an acquisition involving a foreign investor, valuation underpins every decision, from pricing to due diligence.

In the Indian context, valuation assumes greater importance due to:

- The diversity of industry sectors and business models

- The evolving regulatory environment

- The need to comply with multiple legal statutes, including the Companies Act, FEMA, and SEBI regulations

A credible, well-documented valuation mitigates the risk of future disputes and ensures that both acquirers and target companies approach negotiations on equal financial footing.

Companies Act, 2013

The Companies Act mandates that all valuations in connection with mergers, demergers, acquisitions, or arrangements be carried out by a Registered Valuer as defined under Section 247 of the Act. These valuers must be recognized by the Insolvency and Bankruptcy Board of India (IBBI).

Some of the key provisions include:

- The valuation report must be annexed to the scheme of merger/demerger filed before the National Company Law Tribunal (NCLT)

- The report should be based on internationally accepted valuation standards.

- Valuers must remain independent and disclose any potential conflicts of interest.

This framework ensures objectivity, credibility, and consistency across valuation reports presented during corporate restructuring.

SEBI Regulations

SEBI’s regulations apply when listed companies are involved in mergers and acquisitions (M&A) activity. Key components include:

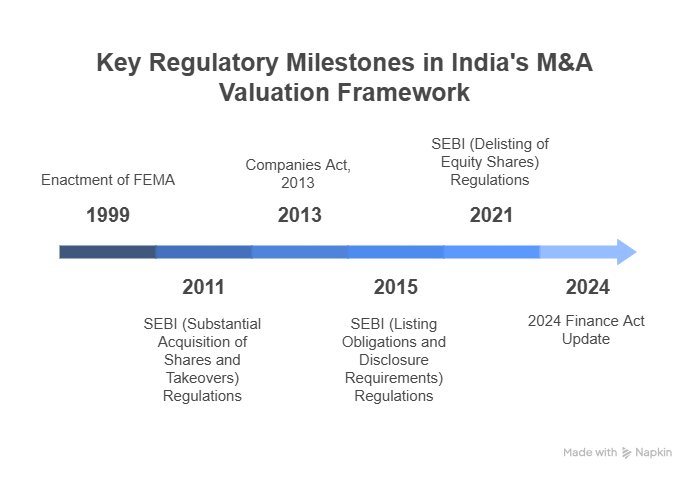

- SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011: Establishes pricing and disclosure requirements for open offers and share acquisitions.

- SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015: Mandates timely and accurate disclosures to shareholders during M&A transactions.

- SEBI (Delisting of Equity Shares) Regulations, 2021: Prescribes the reverse book-building method and minimum price discovery norms.

Valuation under SEBI rules must reflect not only financial performance but also market expectations, historical share price trends, and fairness to minority shareholders.

FEMA, 1999

The Foreign Exchange Management Act (FEMA) governs all cross-border M&A transactions involving foreign investors. The Reserve Bank of India (RBI) has laid down pricing guidelines to prevent undervaluation or overvaluation of Indian entities.

Key provisions include:

- For inbound investments, the issue or transfer of shares must not be at a price lower than the fair market value (FMV), which is usually determined via Discounted Cash Flow (DCF) or Net Asset Value (NAV) methods.

- For outbound investments, Indian companies must comply with the valuation guidelines of the host country and ensure proper disclosures under the ODI (Overseas Direct Investment) regulations.

FEMA compliance is crucial for approval of cross-border deals and for ensuring that remittance of funds and ownership transfer happen without regulatory bottlenecks.

Income Tax Act, 1961

Under the Income Tax Act, valuation is significant for several transactions, including:

- Slump sales

- Capital gains computation

- Transfer pricing between related parties

- ESOPs and share issuances

The Act specifies the use of FMV as determined by recognized valuation methods such as DCF, NAV, and comparable transaction multiples. Incorrect valuation can lead to disallowance of expenditure or additional tax liability.

2024 Finance Act Update: The Finance Act, 2024, introduced a notable amendment under Section 56(2)(viib) and Rule 11UA, which allows for a 15% premium above DCF-based FMV when issuing shares. This provides some flexibility for startups and high-growth companies raising capital during M&A or restructuring events.

By harmonizing these valuation norms across the Companies Act, FEMA, SEBI, and the Income Tax Act, India seeks to create a robust ecosystem for M&A activities that is fair, transparent, and investor-friendly.

Income Tax Act, 1961

Under the Income Tax Act, valuation is significant for several transactions, including:

- Slump sales

- Capital gains computation

- Transfer pricing between related parties

- ESOPs and share issuances

The Act specifies the use of FMV as determined by recognized valuation methods such as DCF, NAV, and comparable transaction multiples. Incorrect valuation can lead to disallowance of expenditure or additional tax liability.

2024 Finance Act Update: The Finance Act, 2024, introduced a notable amendment under Section 56(2)(viib) and Rule 11UA, which allows for a 15% premium above DCF-based FMV when issuing shares. This provides some flexibility for startups and high-growth companies raising capital during M&A or restructuring events.

By harmonizing these valuation norms across the Companies Act, FEMA, SEBI, and the Income Tax Act, India seeks to create a robust ecosystem for M&A activities that is fair, transparent, and investor-friendly.

3. Core Valuation Approaches Used in M&A

M&A valuation involves several methods depending on the nature of the business, industry, and deal structure. These approaches are categorized into three primary types: Asset-Based, Income-Based, and Market-Based. Each has its strengths and is often selected depending on the underlying value drivers of the company in question.

A. Asset-Based Valuation

Asset-based valuation determines a company’s worth based on the value of its underlying net assets. It is most suitable when a business derives value primarily from its physical assets rather than future income.

Net Asset Value (NAV) Method

Asset-based valuation determines a company’s worth based on the value of its underlying net assets. It is most suitable when a business derives value primarily from its physical assets rather than future income.

The NAV method calculates the total value of assets minus liabilities, adjusted to reflect the fair market value. This approach is particularly relevant in asset-heavy industries.

- Sector Preference: Manufacturing, Real Estate, Infrastructure

- Application: In situations involving liquidation or restructuring, and in cases where assets (like land or machinery) constitute a significant proportion of enterprise value.

Asset-based valuation determines a company’s worth based on the value of its underlying net assets. It is most suitable when a business derives value primarily from its physical assets rather than future income.

Case Study: Tata Steel – Bhushan Steel Acquisition

In Tata Steel’s acquisition of Bhushan Steel, a major portion of the valuation involved assessing the company’s physical infrastructure and capacity. The NAV method was crucial in estimating realizable asset value under insolvency.

B. Income-Based Valuation

Income-based methods estimate the present value of future economic benefits expected from the business. These methods are forward-looking and widely applied in dynamic and growing industries.

The DCF method calculates the present value of projected future cash flows, using a discount rate that reflects business risk.

- Preferred Sectors: IT, Technology, Startups, Pharma

- Parameters Considered: Revenue projections, operating costs, capital expenditure, tax impact, and Weighted Average Cost of Capital (WACC).

Case Study: Flipkart – Walmart Acquisition

Walmart used a DCF approach to determine Flipkart’s valuation, projecting future revenue growth in India’s booming e-commerce market while adjusting for country-specific risks and discount rates.

Capitalization of Earnings

This method estimates value by applying a capitalization rate to maintainable earnings. It assumes stable earnings and is effective in mature, steady-growth businesses.

- Sector Preference: FMCG, Retail, Traditional Manufacturing

- Key Assumption: Stability in future earnings based on historical data.

Dividend Capacity Method

This technique, though less commonly used, values a company based on its ability to pay dividends. It is occasionally applied in regulated sectors like utilities or where dividend distribution is a primary objective for investors.

C. Market-Based Valuation

Market-based valuation techniques rely on observable market prices of comparable companies or deals. These are especially useful in ensuring alignment with current market conditions and investor sentiment.

Comparable Company Analysis (CCA)

CCA involves identifying peer companies in similar industries and comparing valuation multiples like EV/EBITDA or P/E ratios.

- Data Sources: NSE/BSE listings, financial databases, analyst reports.

- Advantages: Quick benchmarking, real-time market relevance.

Precedent Transactions

This approach involves analyzing past transactions in the same industry to derive valuation benchmarks. It is especially useful in sectors with frequent M&A activity.

Case Study: Reliance Jio – Brookfield Infrastructure Investment

Brookfield used precedent telecom infrastructure deals to benchmark the value of Jio’s tower assets, ensuring fair pricing aligned with global trends.

Rule of Thumb Methods

In specific sectors like hospitality (e.g., valuation per room) or retail (e.g., valuation per store), thumb rules are used as preliminary checks. However, they must be supplemented with detailed analysis for accuracy.

4. Hybrid & Emerging Valuation Practices

Modern M&A scenarios, especially those involving complex, intangible-heavy, or technology-driven businesses, have led to the rise of hybrid valuation models and new-age practices.

Synergy Valuation

Synergy refers to the enhanced value derived from combining two entities. According to industry research, nearly 64% of deals now quantify synergies during valuation.

- Types of Synergies: Cost savings (e.g., shared infrastructure), revenue gains (e.g., cross-selling), and operational efficiencies.

- Approach: Estimating incremental cash flows attributable to synergies and discounting them.

Intangible Asset Valuation

Intangible assets such as brand value, software, intellectual property, and customer data are increasingly valuable, especially in digital and tech-based businesses.

- Use Cases: Pharma R&D, SaaS startups, e-commerce platforms, media companies.

- Valuation Tools: Relief-from-Royalty Method, Multi-Period Excess Earnings Method (MEEM)

Combined Methodology

Many valuation professionals now apply a blended approach—most commonly combining DCF with Comparable Company Analysis (CCA).

- Effectiveness: Research shows that combining DCF and CCA improves valuation accuracy by up to 78%.

- Use Case: Especially effective in volatile sectors or when each method has limitations on its own.

Other Emerging Approaches

Excess Earnings Method

Primarily used for valuing intangibles, this method calculates earnings over a fair return on tangible assets. These excess earnings are capitalized to derive value.

Guideline Public Company Method

Common in cross-border deals, this method involves selecting a group of publicly traded companies with similar operational and financial profiles, using their valuation multiples to estimate the subject company’s value.

5. Sector-Specific Valuation Insights

Valuation methods in M&A are not universally applicable across industries. Each sector has its own financial metrics, risk profiles, and value drivers. As such, selecting the right valuation methodology and multiples is essential to achieve a reliable and defensible valuation outcome. Below is a summary of common sector-specific valuation preferences, highlighting typical valuation multiples and notable deal examples:

Sector | Preferred Methods | Common Multiples | Example Deal |

IT Services | DCF + Comparable Company Analysis (CCA) | 8–12x Revenue | HCL Technologies – Modesoft |

Pharmaceuticals | Precedent Transactions | 6–8x EBITDA | Sun Pharma – Dilip Shanghvi stake |

Banking/Finance | Net Asset Value (NAV) + CCA | 1.2–1.8x Book Value | HDFC Bank – Millennium Merger |

Telecom | Precedent + Asset-Based | Infra-driven metrics | Vodafone – Idea Merger |

Manufacturing | Asset-Based + CCA | Adjusted NAV | Tata Steel – Corus Acquisition |

Each of these combinations reflects the dominant characteristics of the respective sectors. For instance:

- IT services firms are valued on the basis of future cash flow potential due to annuity-driven revenues and high margins.

- Pharma companies are typically valued using precedent transactions, where pipeline value, IP, and regulatory approvals play a key role.

- Banks rely on their book value, risk-adjusted returns, and regulatory capital, making NAV a critical method.

- Telecom valuations emphasize infrastructure, spectrum holdings, and subscriber base, which are well-captured through asset and precedent-based methods.

- Manufacturing firms often involve tangible assets and capacity utilization, hence the frequent use of NAV and adjusted multiples.

6. Key Challenges in Indian M&A Valuation

Valuing businesses in the Indian M&A landscape poses distinct challenges due to regulatory, structural, and market-specific complexities. These challenges must be navigated carefully to ensure valuations are accurate and compliant with Indian legal and financial frameworks.

1. Valuing Stressed Assets under IBC

Under the Insolvency and Bankruptcy Code (IBC), valuations are conducted during resolution processes. Here, stress in the business leads to inconsistent financials, and the value-in-use may be significantly lower than book value. Two registered valuers are typically appointed, but deriving a fair value under distress requires deep forensic and asset-level analysis.

2. Interpreting Ind AS 113 for Fair Market Value (FMV)

Ind AS 113 prescribes fair value measurement techniques, emphasizing observable inputs and exit price concepts. However, its practical application, especially for Level 3 inputs (unobservable market data), poses interpretation challenges. Indian practitioners often need to reconcile global standards with local accounting interpretations.

3. Data Limitations for Unlisted Companies

India has a large base of privately held businesses. For such companies, financial disclosures are minimal or delayed. This restricts access to reliable revenue figures, working capital cycles, and operational metrics, complicating both DCF and market-based approaches.

4. GST Compliance in Asset-Heavy Sectors

In asset-driven sectors such as logistics, manufacturing, and infrastructure, GST input credit and tax structuring significantly affect cash flows. Misalignment in GST treatment during asset transfers or business slumps can distort net realizable value and future tax-adjusted projections.

5. Regional Disparities in Comparables

India’s business environment varies widely across regions in terms of cost structures, consumer behavior, and legal frameworks. Comparable company analysis (CCA) often struggles with finding regionally relevant benchmarks, especially in Tier-2 and Tier-3 cities where data availability is sparse.

6. Legal Scrutiny in Shareholder-Sensitive Deals

In transactions involving public shareholders, especially under SEBI regulations, valuation reports are subject to high scrutiny. Discrepancies in methodology, fairness opinions, or the absence of robust documentation may result in regulatory rejection or litigation. Valuers must demonstrate full compliance with FEMA, Companies Act, and SEBI guidelines to avoid disputes.

7. Case Studies: Real-World M&A Valuation

Understanding how valuation methodologies are applied in real-life M&A deals offers practical insights into the nuances of deal-making. The following case studies illustrate how different valuation methods were used based on sector characteristics, deal objectives, and regulatory frameworks

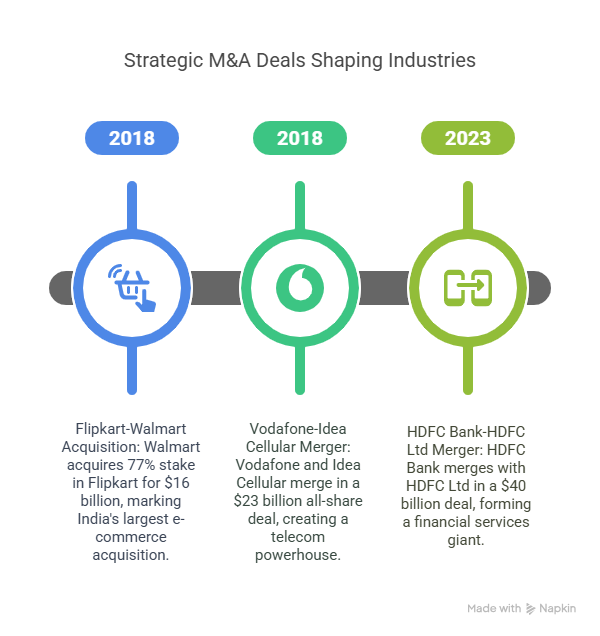

Case 1: Flipkart – Walmart (2018)

- Methodology: Discounted Cash Flow (DCF) + Comparable Company Analysis

- Deal Value: $16 billion

- Sector: E-commerce

In what was India’s largest e-commerce acquisition, Walmart acquired a 77% stake in Flipkart. The DCF method was instrumental in capturing Flipkart’s projected growth, margin improvement, and market expansion in a capital-intensive sector. Additionally, market comparables such as Amazon’s global valuation multiples were used to validate the deal’s fairness. Key valuation challenges included projecting user growth in a competitive market and justifying the valuation premium in a loss-making scenario.

Case 2: Vodafone – Idea Cellular Merger (2018)

- Methodology: Asset-Based Valuation + Precedent Transactions

- Deal Value: $23 billion (all-share merger)

- Sector: Telecom

This merger was driven by the need for scale in a highly competitive and capital-heavy telecom sector. The valuation approach factored in spectrum licenses, tower assets, and subscriber base using an asset-based method. Precedent deals in emerging markets were analyzed to benchmark valuation multiples. The deal structure prioritized balance sheet strength over immediate earnings, with a focus on long-term operational synergies.

Case 3: HDFC Bank – HDFC Ltd Merger (2023)

- Methodology: Net Asset Value (NAV) + Synergy Valuation

- Deal Value: Approx. $40 billion

- Sector: Banking and Housing Finance

This landmark merger aimed to combine India’s largest private lender with its parent housing finance company. NAV was used as the baseline valuation method due to the asset-heavy nature of both entities. Additionally, significant emphasis was placed on synergy benefits, such as cross-selling opportunities, operational consolidation, and funding cost optimization. Analysts projected substantial value unlock from merged customer ecosystems and technological integration.

8. Recent Developments Shaping Valuation Practices

The Indian valuation landscape continues to evolve rapidly, influenced by regulatory changes, investor expectations, and technological advancements. These recent developments are redefining how valuations are conducted in both domestic and cross-border M&A transactions.

1. 2024 Finance Act: Premium Requirement on DCF for Cross-Border Deals

The 2024 Finance Act introduced a mandate requiring a defensible premium layer in DCF-based valuations for cross-border transactions. The intent is to prevent undervaluation in outbound acquisitions and to align with the OECD’s Base Erosion and Profit Shifting (BEPS) framework. Valuers must now substantiate growth assumptions, cost of capital, and exit multiples in detail, especially when foreign shareholders are involved.

2. Rise of Synergy Quantification in Deal Structures

Dealmakers are increasingly quantifying synergies—both operational and financial—as part of the valuation narrative. According to industry data, nearly 64% of large M&A deals in India now include explicit synergy calculations in board presentations and fairness opinions. This includes headcount rationalization, shared infrastructure, and customer base expansion, often modeled using scenario-based DCF.

3. Growing Emphasis on Brand and Intangible Asset Valuations

As technology, healthcare, and consumer sectors gain prominence, brand value, user data, IP, and content libraries are becoming critical valuation components. Methodologies such as the Relief-from-Royalty and Excess Earnings Method are gaining traction to appropriately capture these elements, especially in startups and digital-first businesses.

4. Role of Technology in Valuation

Technology is transforming how valuations are prepared and validated. Advanced valuation platforms and AI-driven tools are being adopted by financial institutions and consulting firms. These solutions automate data gathering, scenario modeling, and report generation, while ensuring compliance with Ind AS, ICAI standards, and international best practices.

9. Conclusion

Valuation is the cornerstone of any successful M&A transaction. A well-structured, context-sensitive valuation is not only essential for determining the right price but also for building trust among stakeholders, complying with regulatory frameworks, and ensuring post-deal value creation.

As India continues to emerge as a global hub for strategic investments and cross-border M&A activity, the role of valuation is expanding from a mere compliance requirement to a strategic tool. Whether it is identifying growth opportunities, managing deal risks, or navigating sector-specific complexities, accurate and insightful valuation can significantly influence the success of a transaction.

Going forward, dealmakers, advisors, and investors must adopt a multi-method approach that blends traditional techniques such as DCF and NAV with sector-specific adjustments and synergy-driven insights. Recognizing the increasing importance of intangibles, regulatory developments, and technological enablers will be key to producing valuations that are both defensible and forward-looking.

In a dynamic and diverse market like India, thoughtful valuation is not just about numbers—it’s about understanding business realities, anticipating future potential, and creating long-term value.

Frequently Asked Questions (FAQs)

Valuation determines the fair price of the target company and helps ensure that both parties—buyer and seller—enter into a balanced and informed transaction. It also supports regulatory compliance, investor confidence, and long-term value realization.

There is no one-size-fits-all method. However, Discounted Cash Flow (DCF), Comparable Company Analysis (CCA), and Net Asset Value (NAV) are frequently used. The choice depends on the sector, business model, and deal objectives.

Synergies refer to the additional value generated from combining two companies, such as cost savings or increased revenue. These are estimated through projected cash flows and included in the valuation to justify a premium or strategic rationale behind the deal.

Challenges include limited financial data for unlisted companies, regional disparities in market multiples, complex regulatory frameworks, and interpreting fair value under Indian accounting standards like Ind AS 113.

The Act mandates a minimum premium in DCF-based valuations for cross-border deals, aimed at preventing undervaluation and capital flight. This has made it essential for valuers to provide robust justification for growth assumptions and pricing.