Table of Contents

ToggleI. Introduction: Why Valuation is More Than Just Numbers in India

In India’s evolving regulatory landscape, valuation has transcended its traditional role as a mere financial tool. Today, it serves as a critical instrument of compliance, ensuring transparency, legal defensibility, and economic fairness across a broad spectrum of corporate and commercial activities. Whether it is a merger between two companies, the issuance of employee stock options, or the resolution of a distressed business under insolvency law, valuation lies at the heart of how these events are assessed, executed, and reported.

Valuation is no longer confined to balance sheet aesthetics or investor presentations. It is an institutional requirement embedded in law, designed to align stakeholder interests, prevent manipulation, and uphold market integrity. Indian regulators increasingly mandate the involvement of Registered Valuers, qualified professionals registered with the Insolvency and Bankruptcy Board of India (IBBI), to ensure that valuations are independent, methodologically sound, and legally robust.

Understanding the regulatory landscape that governs valuation is essential for corporates, investors, financial advisors, and compliance professionals. This blog offers a detailed exploration of the key Indian laws that mandate valuation, the scenarios in which valuations are required, the standards that govern them, and the professionals authorized to conduct such assessments.

II. Legal Backbone: Indian Laws That Mandate Valuation

Valuation in India is not governed by a single statute. Rather, it is a product of a multi-regulatory framework that draws its authority from several key legislations. Each of these laws outlines specific situations where valuation is mandatory and defines the methodology, qualifications, or professional standards applicable to the process.

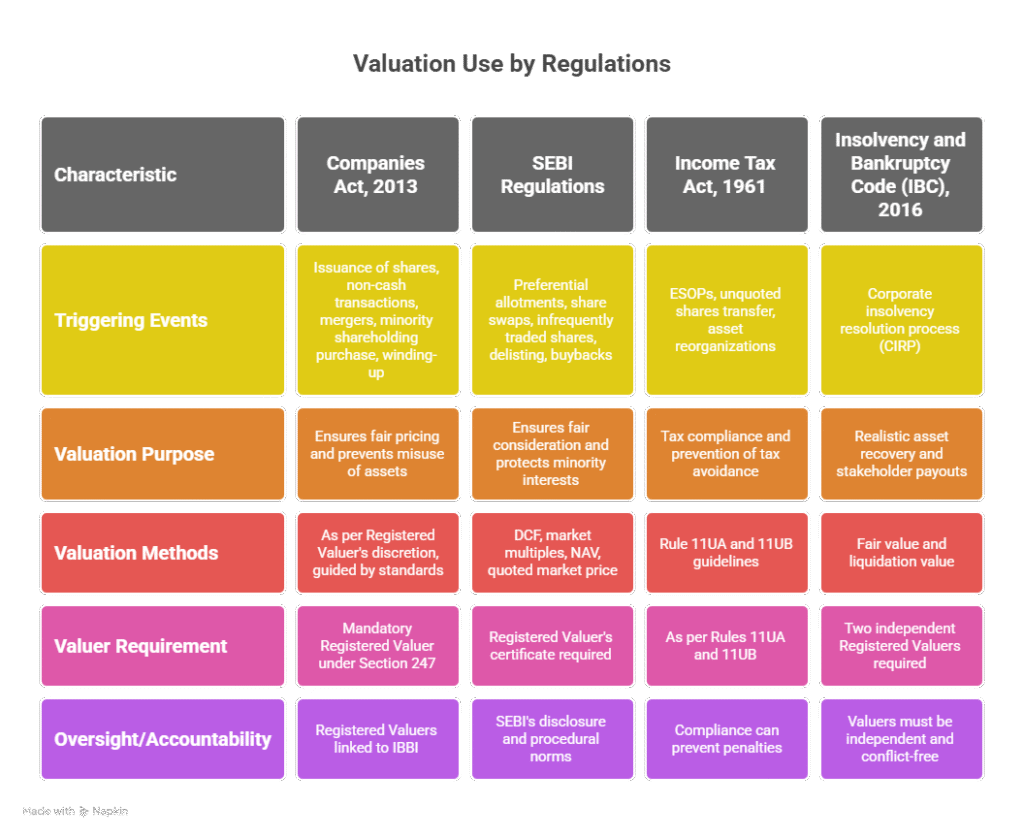

Here is an overview of the major Indian laws and regulatory instruments that require or regulate valuation:

Regulatory Framework | Purpose of Valuation |

Companies Act, 2013 | Issuance of shares, mergers and amalgamations, purchase of minority shareholding, liquidation, and more. Requires valuations to be conducted by registered valuers under Section 247. |

SEBI Regulations | Valuation of infrequently traded shares, preferential allotments, asset restructurings, and disclosures by listed entities. |

Income Tax Act, 1961 | Determining fair market value (FMV) for capital gains taxation, transfer pricing, ESOPs, and other transactions. Rules 11UA and 11UB prescribe specific methodologies. |

Insolvency and Bankruptcy Code (IBC), 2016 | Valuation of assets and liabilities during insolvency resolution, liquidation, and for determining fair and liquidation value by two registered valuers. |

Foreign Exchange Management Act (FEMA) | Valuation is required for inbound and outbound investments to comply with the RBI’s pricing guidelines on share transfers involving non-residents. |

Reserve Bank of India (RBI) Guidelines | Pricing of equity instruments, loan acquisitions, restructuring, and other capital account transactions involving foreign investment. |

Indian Accounting Standards (Ind AS) | Fair value measurements for financial reporting, business combinations, impairment testing, and share-based payments under Ind AS 113, 103, and others. |

Stamp Duty Acts | Valuation of assets transferred during mergers, demergers, and other corporate restructurings to determine applicable stamp duty. |

Each of these laws is triggered by a unique set of corporate events or transactions, but they are unified by one common thread: valuation is the instrument that ensures regulatory conformity, protects stakeholder rights, and upholds the principles of financial fairness.

In the following sections, we will examine how each of these frameworks specifically governs valuation requirements, the professional and methodological standards applied, and the real-world implications for compliance, governance, and strategic decision-making.

III. Deep Dive: How Each Regulation Uses Valuation

1. Companies Act, 2013

The Companies Act, 2013 has established valuation as a fundamental requirement for various corporate events that have legal, financial, or ownership implications. Here are the key provisions:

- Section 62(1)(c): Valuation is mandatory when a company issues shares on a preferential basis to ensure that the price offered is fair and does not dilute the interest of existing shareholders.

- Section 192(2): When non-cash transactions involve directors or related parties, valuation is needed to assess the fairness of asset transfers and avoid misuse of corporate assets.

- Sections 230 and 232: In schemes of compromise, arrangement, or amalgamation, valuation reports are submitted to the National Company Law Tribunal (NCLT) and play a decisive role in stakeholder consent and judicial approval.

- Section 236: For the purchase of minority shareholding, valuation helps establish a just exit price, particularly in squeeze-out situations.

- Section 281: During the winding-up process, valuation of assets and liabilities ensures an accurate representation of financial worth for distribution among creditors and shareholders.

The linchpin in all these scenarios is Section 247, which mandates that valuations must be carried out by a Registered Valuer. This provision not only professionalizes the practice but also instills accountability and independence by linking valuers to the Insolvency and Bankruptcy Board of India (IBBI). Registered valuers are bound by codes of conduct, valuation standards, and eligibility norms, making them the authorized gatekeepers of valuation integrity under Indian law.

2. SEBI Regulations

The Securities and Exchange Board of India (SEBI) plays a crucial role in regulating valuation for listed entities. Given the implications for public shareholders and market perception, SEBI mandates valuations in the following cases:

- Preferential Allotments: Valuation determines the issue price when shares are issued to promoters or investors on a preferential basis.

- Share Swaps and Mergers: In corporate restructurings involving share swaps, valuations ensure that shareholders of both entities receive fair consideration.

- Infrequently Traded Shares: When market data is insufficient to derive price discovery, independent valuation using techniques like DCF becomes essential.

- Delisting, Buybacks, and Open Offers: Valuation serves as a basis for determining exit prices and safeguarding minority interests.

SEBI accepts multiple valuation approaches depending on the nature of the asset or transaction:

- Discounted Cash Flow (DCF) Method

- Comparable Company Market Multiples

- Book Value or Net Asset Value (NAV)

- Quoted Market Price (for frequently traded shares)

Moreover, any valuation submitted to the stock exchanges must be backed by a Registered Valuer‘s certificate and aligned with SEBI’s disclosure and procedural norms.

3. Income Tax Act, 1961

The Income Tax Act, 1961 uses valuation as a tax compliance and anti-avoidance mechanism. Fair Market Value (FMV) becomes central in several contexts:

- Employee Stock Options (ESOPs): FMV determines the perquisite value for taxation at the time of exercise.

- Transfer of Unquoted Shares: Capital gains are computed using FMV as per Rule 11UA for shares not listed on any stock exchange.

- Valuation of Assets During Reorganizations: FMV is used in slump sales, gift taxation, and related-party transactions to prevent tax base erosion.

Rules 11UA and 11UB are the operative guidelines under the Act, outlining acceptable valuation methods:

- 11UA covers shares, securities, and tangible/intangible assets.

- 11UB deals with cross-border mergers and indirect transfer provisions, particularly in cases involving foreign entities.

Failure to comply with valuation rules can lead to adverse tax consequences, including reassessment, penalties, and disallowance of claimed deductions or exemptions. Hence, accurate and compliant valuation is not just a procedural formality—it is a tax risk mitigation tool.

4. Insolvency and Bankruptcy Code (IBC), 2016

Valuation is indispensable in the resolution framework under the Insolvency and Bankruptcy Code (IBC), 2016. It ensures that the resolution process is based on realistic expectations of asset recovery and stakeholder payouts.

- Fair Value and Liquidation Value: As per IBBI regulations, every corporate insolvency resolution process (CIRP) must involve two registered valuers who independently determine both the fair value (market-based assumption) and liquidation value (net recoverable amount).

- Resolution Plan Benchmarking: These valuations form the basis on which the Committee of Creditors (CoC) assesses and approves resolution plans.

- Conflict-Free Advisory: Valuers must maintain complete independence. They cannot be related to the corporate debtor or the insolvency professionals involved, preserving the objectivity of the process.

In the IBC framework, valuation not only facilitates decision-making but also minimizes disputes among stakeholders regarding asset recoverability.

IV. Who Can Sign the Report: The Rise of the Registered Valuer

The need for objectivity and standardization led to the institutionalization of the Registered Valuer system in India through the Companies (Registered Valuers and Valuation) Rules, 2017. This marked a significant shift from unregulated valuation practices to a professionalized and accountable system.

1. Regulatory Framework and Oversight

The Insolvency and Bankruptcy Board of India (IBBI) is the nodal authority responsible for registering and regulating valuers. It has developed a comprehensive framework that covers:

- Eligibility Criteria: Educational qualifications, experience in relevant asset classes, and successful completion of a valuation examination.

- Empanelment Process: Applicants must register through a Recognized Valuer Organization (RVO), which is responsible for monitoring and disciplinary action.

- Continuing Professional Education (CPE): Valuers are required to update their knowledge periodically to maintain registration.

- Ethics and Conduct: A strict code of conduct governs independence, confidentiality, objectivity, and compliance with applicable valuation standards.

2. Pathways Through Professional Bodies

The IBBI has recognized several Registered Valuer Organizations (RVOs) established by India’s premier professional institutes, such as:

- ICAI RVO (Institute of Chartered Accountants of India)

- ICSI RVO (Institute of Company Secretaries of India)

- ICMAI RVO (Institute of Cost Accountants of India)

These RVOs provide the training, certification, and oversight necessary to maintain a pool of competent and independent professionals equipped to handle valuations across diverse regulatory frameworks.

V. Standards That Keep It Real: Valuation Methodologies & Frameworks

In India’s regulatory landscape, valuation is not simply an estimation exercise — it is a structured, defensible process, subject to scrutiny by auditors, tax authorities, courts, and regulatory bodies. As such, the methodologies used must follow recognized frameworks and conform to accepted professional standards, such as the ICAI Valuation Standards and international best practices.

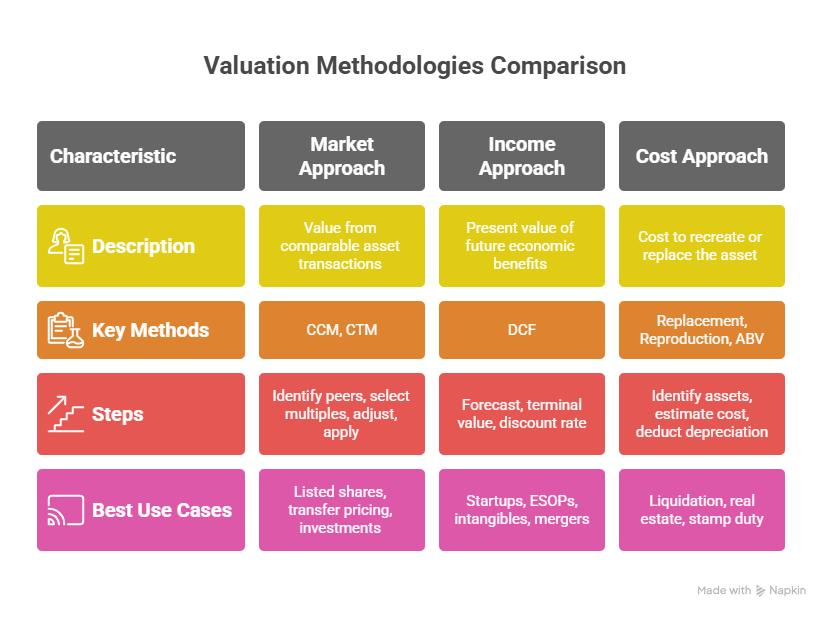

Three primary valuation approaches are recognized globally and mandated in Indian regulatory frameworks:

- Market Approach

- Income Approach

- Cost Approach

Each comes with distinct methodologies, step-by-step procedures, and a contextual fit depending on the asset, business, or compliance requirement.

1. Market Approach

The Market Approach determines value by referencing actual transactions involving identical or comparable assets. It is most suitable when sufficient market data is available and when the asset is actively traded.

Methods under the Market Approach:

- Comparable Company Method (CCM)

- Comparable Transaction Method (CTM)

Steps to Apply:

A. Comparable Company Method (CCM)

- Identify Peer Companies: Choose companies operating in the same sector with similar size, business model, and risk profile.

- Select Multiples: Common multiples include EV/EBITDA, P/E ratio, P/BV ratio, etc.

- Adjust Multiples: Adjust for size, growth, margins, and control/premium factors if needed.

- Apply to Subject Company: Multiply the selected multiple by the appropriate financial metric of the subject company.

- Determine Fair Value: Arrive at a value per share or enterprise value.

B. Comparable Transaction Method (CTM)

- Identify Precedent Transactions: Locate recent transactions in the same industry involving similar assets or companies.

- Calculate Transaction Multiples: Based on actual deal data.

- Adjust for Timing & Market Conditions: Normalize for differences due to transaction date or unique deal terms.

- Apply Multiples: Use them on the subject company’s metrics to estimate its value.

When to Use:

- Valuation of listed shares for SEBI compliance

- Transfer pricing

- Preferential issues under Section 62 of the Companies Act

- FEMA-compliant inbound/outbound investments

2. Income Approach

The Income Approach calculates the present value of future economic benefits, typically through Discounted Cash Flow (DCF) analysis. It is preferred when market data is insufficient or when the company’s intrinsic value lies in future growth.

Key Method: Discounted Cash Flow (DCF)

Steps to Apply:

- Forecast Cash Flows

- Prepare projections for 3 to 7 years based on business plans, historical performance, and industry dynamics.

- Use Free Cash Flow to Firm (FCFF) or Free Cash Flow to Equity (FCFE), depending on the requirement.

- Determine Terminal Value

- Use the Gordon Growth Model or the Exit Multiple Method to estimate value beyond the forecast period.

- Calculate Discount Rate

- Use Weighted Average Cost of Capital (WACC) for FCFF or Cost of Equity for FCFE.

- WACC = (Ke × E/V) + (Kd × D/V × (1–Tax Rate))

- Discount Cash Flows and Terminal Value to Present

- Apply the discount rate to bring all future values to present value.

- Adjust for Non-Operating Items

- Add cash & equivalents; deduct debt to derive equity value.

- Apply Control or Minority Discount/Premium

- Based on context (e.g., valuation for sale vs. internal reclassification)

When to Use:

- Startups and tech companies with negative earnings

- Valuation for ESOPs (Rule 11UA), angel tax (Section 56(2)(viib))

- Intangible asset valuation under Ind AS

- Share swap ratios in mergers..

3. Cost Approach

The Cost Approach values an asset based on the cost required to recreate or replace it, adjusted for depreciation and obsolescence. This method is rooted in the principle of substitution — no rational buyer would pay more than the cost of creating a similar asset.

Key Methods:

- Replacement Cost Method

- Reproduction Cost Method

- Adjusted Book Value Method (ABV)

Steps to Apply:

- Identify and Classify Assets

- Segregate assets into tangible (plant, machinery) and intangible (software, brand).

- Estimate Gross Replacement/Reproduction Cost

- Determine the current cost to rebuild or replace the asset as of the valuation date.

- Deduct Depreciation and Obsolescence

- Account for physical depreciation, technological obsolescence, functional and economic inefficiencies.

- Sum the Net Values

- Aggregate all adjusted values to arrive at the total asset value.

- Adjust for Liabilities

- If using ABV, deduct total liabilities from net asset value to arrive at equity value.

When to Use:

- Valuation for liquidation under IBC

- Real estate and infrastructure valuation

- Stamp duty assessments

- Non-operating asset valuations

Fair value determination under Ind AS 113 for fixed assets

Role of ICAI Valuation Standards

Issued in 2018, the ICAI Valuation Standards provide a uniform framework for how these methodologies are applied in practice. Key features include:

- Mandatory for CAs undertaking regulatory valuations

- Define scope, engagement terms, assumptions, and reporting format.

- Promote consistency across different valuers and cases.

Serve as audit support during litigation or statutory scrutiny.y

Examples of Application Based on Legal Requirements:

Regulation | Common Method Applied | Reason |

Companies Act (Section 62) | DCF or Market Multiples | Fair pricing for the new issue |

SEBI (Preferential Allotment) | Market Price or DCF | Disclosure to exchanges |

FEMA (FDI/ODI) | DCF or NAV | Pricing guidelines |

IBC (CIRP/Liquidation) | Market + Cost Approach | Realisable value for creditors |

Income Tax Act (ESOP/56(2)) | Rule 11UA FMV (DCF/NAV) | Tax fairness and avoidance of evasion |

In sum, the choice of method is never arbitrary — it must balance regulatory mandates, data availability, and the nature of the subject asset or business. A properly selected and applied methodology not only ensures compliance but also strengthens the credibility, transparency, and defensibility of the valuation.

Valuation Standards: Bringing Structure and Transparency

To eliminate inconsistency and subjectivity, the Institute of Chartered Accountants of India (ICAI) has issued ICAI Valuation Standards, which are now widely adopted by Registered Valuers and professionals for both financial and regulatory reporting. These standards define:

- Scope and premise of value

- Valuation date and assumptions

- Documentation and working papers

- Disclosures and limitations

- Selection of appropriate methodology

Key ICAI Valuation Standards include:

- VS 101 – Definitions

- VS 102 – Valuation Bases

- VS 103 – Valuation Approaches and Methods

- VS 201 – Scope of Work, Analyses and Evaluation

- VS 301 – Reporting and Documentation

Together, these ensure that the valuation process is replicable, auditable, and regulator-ready. They also act as a defense mechanism in case of litigation, audit review, or tax scrutiny.

Choosing the Right Method: What the Law (and Logic) Demands

The selection of methodology is not arbitrary—it must align with:

- Nature of the asset or enterprise (e.g., operating business vs. real estate)

- Regulatory requirement (e.g., FEMA requires pricing to be justified using internationally accepted methods)

- Purpose of valuation (e.g., Income Tax vs. IBC vs. SEBI may demand different premises)

- Availability of data (e.g., Market Approach requires comparable data, DCF requires forecast visibility)

A well-reasoned method selection, supported by documentation, not only fulfills the compliance objective but also improves the credibility of the outcome in the eyes of regulators, investors, and auditors.

VI. Why It Matters: Strategic Benefits of Regulatory Valuation

Beyond ticking legal checkboxes, regulatory valuation offers substantial strategic and operational value to businesses, investors, and stakeholders. Here’s why getting it right pays off.

1. Enhancing Investor Confidence & Fairness

A professionally conducted, legally compliant valuation builds investor trust, particularly in transactions involving share issuances, fundraising, or business combinations. For listed entities, adherence to SEBI and ICAI valuation standards serves as an assurance of price fairness, reducing the risk of shareholder disputes and market volatility.

2. Legal Defensibility and Audit Trail

In an era of increasing scrutiny from regulatory bodies, valuation reports double as legal artifacts. Whether in income tax assessments, IBC proceedings, or M&A litigation, a valuation backed by:

- Recognized standards,

- Registered professionals, and

- Transparent working papers

It can be the difference between compliance and contention. It provides an auditable trail and a robust defense in courtrooms, audit reviews, or during regulatory inspections.

3. Foundation for Strategic Decisions

Many business-critical strategies are built on the assumptions derived from valuation:

- Mergers and Acquisitions: Fair exchange ratios and deal pricing.

- Tax Planning: FMV for capital gains, ESOPs, and corporate reorganizations.

- Insolvency Resolution: Recovery estimates, restructuring options, and priority payouts.

Without accurate valuations, these strategies are built on shaky ground, exposing businesses to financial misjudgment and regulatory pushback.

4. Avoiding Penalties, Scrutiny & Reputational Risk

Incorrect, outdated, or non-compliant valuations can trigger:

- Penalties under the Income Tax Act or FEMA

- Disallowance of deductions or exemptions

- Reversal of preferential allotments or M&A approvals

- Regulatory sanctions or SEBI observations

- Erosion of stakeholder confidence

In an environment where valuation errors can lead to legal, financial, and reputational consequences, precision is not a luxury—it is a necessity.

VII. Common Pitfalls and How to Stay Clear

While the importance of valuation is well understood, the execution often falls short, resulting in regulatory red flags, legal challenges, or outright rejection of filings. Below are the most frequent pitfalls businesses and professionals encounter, and how to avoid them.

1. Non-Registered Valuers Signing Reports

Under the Companies Act, IBC, and SEBI regulations, valuation reports must be signed by a Registered Valuer (RV) — not just any Chartered Accountant, merchant banker, or consultant.

What to avoid:

Relying on internal finance teams or unregistered advisors to conduct regulatory valuations.

What to do:

Always engage a professional Registered Valuer, recognized under Section 247 of the Companies Act and registered with IBBI, especially for transactions involving:

- Equity allotment

- Mergers & demergers

- Insolvency or liquidation

ESOPs and fundraising

2. Ignoring Standard Methodologies

Valuation isn’t a creative exercise. Ignoring the recognized approaches (Market, Income, or Cost) or failing to justify methodology selection can render a report non-compliant.

What to avoid:

Arbitrary or hybrid valuation techniques without proper reasoning or support.

What to do:

Align method choice with:

- The nature of the transaction

- Regulatory mandate

Asset characteristics

Document the rationale clearly in the report, along with assumptions and sources.

3. Using Outdated Data or Assumptions

Many valuation reports fail because they use old financials, obsolete industry data, or outdated market multiples, especially when valuation is used months after preparation.

What to avoid:

Projections based on pre-COVID trends, stale comparables, or unsigned drafts.

What to do:

Use the most recent audited/management-approved financials, refresh valuation calculations if significant time has lapsed, and clearly mention the valuation date.

4. Lack of Documentation or Audit Trail

A clean report without working papers is non-defensible. In case of scrutiny by SEBI, RBI, Tax Department, or NCLT, backup files, computation models, and source references must be available.

What to avoid:

Reports without retained spreadsheets, assumption notes, or comparable databases.

What to do:

Maintain full documentation of:

- Source data (e.g., financials, projections, third-party reports)

- Computation sheets

- Meeting notes

Engagement letters

IX. Conclusion: Valuation is a Legal Language — Learn to Speak It Right

In today’s regulatory climate, valuation is more than a financial estimate — it is a legal, strategic, and operational necessity.

Whether you’re issuing shares, acquiring businesses, raising funds, or navigating insolvency, valuation sits at the core of decision-making and compliance.

Key Takeaways:

- Regulatory valuation is mandatory, not optional

- Only Registered Valuers are authorized to sign compliance-based reports.

- Valuation must follow recognized standards and methods.

- Inaccurate or non-compliant valuations invite penalties, litigation, or rejection.s

Smart businesses no longer treat valuation as a post-facto formality. They treat it as an embedded part of strategic planning, regulatory navigation, and stakeholder communication.

Frequently Asked Questions (FAQs)

Regulatory valuation refers to legally required valuation exercises mandated by Indian laws such as the Companies Act, SEBI Regulations, Income Tax Act, and IBC. It ensures fair pricing, stakeholder protection, and compliance with statutory requirements in financial transactions like mergers, fundraising, and share allotment.

Only professionals registered as Registered Valuers (RVs) with the Insolvency and Bankruptcy Board of India (IBBI) are authorized to issue valuation reports for regulatory purposes under the Companies Act, 2013, and other laws.

Valuation is mandatory in events like preferential allotment of shares, mergers or demergers, ESOP issuance, FDI under FEMA, insolvency resolution under IBC, and for tax computation purposes. Each regulation has specific triggers and formats.

Indian regulatory frameworks accept the Market Approach, the Income Approach (such as DCF), and the Cost Approach. The choice of method depends on the nature of the asset, transaction type, and legal requirement, as per ICAI Valuation Standards.

Failure to comply with regulatory valuation norms can lead to penalties, rejection of filings, investor disputes, and legal liabilities. Engaging a qualified Registered Valuer ensures defensibility, transparency, and alignment with Indian laws.