Table of Contents

Toggle1. Introduction

Small and Medium Enterprises (SMEs) form the backbone of India’s economy, contributing significantly to employment generation, industrial output, and innovation. Yet, despite their critical role, many Indian SMEs face persistent financial challenges. Limited access to skilled financial professionals, fluctuating cash flows, compliance complexities, and the pressure to scale sustainably often leave business owners juggling multiple responsibilities, sometimes at the expense of strategic growth.

This is where Virtual CFO (Chief Financial Officer) services have emerged as a game-changer. A Virtual CFO provides expert financial guidance, strategic planning, and regulatory oversight, without the overhead of a full-time executive. For SMEs, this means gaining access to top-tier financial expertise in a cost-effective and flexible manner, enabling business owners to focus on their core operations while ensuring that the company’s finances are managed with precision and foresight.

In an environment where financial discipline and strategic decision-making can determine the survival and growth of a business, Virtual CFO services offer a solution that balances affordability with professional insight, helping SMEs navigate complexities with confidence.

2. What Are Virtual CFO Services?

A Virtual CFO is a qualified finance professional, or a team of experts, who provides strategic, financial, and compliance-related guidance to businesses remotely. Unlike traditional, full-time CFOs who are permanently employed by a single organization, Virtual CFOs serve multiple clients, leveraging technology to deliver high-level advisory services without being physically present in the office.

The distinction between a Virtual CFO and a full-time CFO lies primarily in the engagement model. Full-time CFOs are salaried executives with fixed responsibilities, often handling day-to-day accounting, reporting, and strategic planning internally. In contrast, Virtual CFOs operate on flexible arrangements, retainer-based, project-specific, or interim, allowing SMEs to access financial expertise as per their evolving needs.

Modern Virtual CFOs utilize cloud accounting platforms, secure communication tools, and data analytics software to provide services such as financial reporting, budgeting, cash flow optimization, tax compliance, and risk management. This technology-enabled approach ensures that SMEs receive timely insights, actionable recommendations, and strategic direction without the high costs associated with employing an in-house CFO.

In essence, Virtual CFO services combine professional financial leadership with operational flexibility, offering SMEs the dual advantage of expert guidance and cost efficiency—critical factors for sustaining growth in a competitive market.

3. Core Services Offered by Virtual CFOs

Virtual CFOs provide a comprehensive suite of financial services tailored to the unique requirements of SMEs. Their offerings go beyond traditional accounting, providing strategic insights that enable sustainable growth. Key services include:

Bookkeeping & Accounting Oversight

Ensuring accurate and compliant financial records forms the foundation of sound business management. Virtual CFOs supervise bookkeeping practices, verify accounting entries, and ensure alignment with Indian accounting standards. This oversight reduces errors, mitigates financial risks, and enables management to have a clear view of the company’s financial position.

Budgeting & Forecasting

Virtual CFOs assist in preparing detailed budgets and financial forecasts that guide business planning. By analyzing historical performance and market trends, they provide predictive insights that help SMEs allocate resources efficiently, plan investments strategically, and set realistic growth targets.

Cash Flow Management

Effective cash flow management is critical for SME sustainability. Virtual CFOs monitor inflows and outflows, optimize working capital, and provide actionable strategies to avoid liquidity challenges, ensuring that businesses maintain sufficient operational cash while supporting growth initiatives.

Tax & Regulatory Compliance

Navigating India’s complex tax landscape, including GST, TDS, ROC filings, and income tax compliance, is a persistent challenge for SMEs. Virtual CFOs manage statutory obligations, ensure timely submissions, and minimize the risk of penalties, keeping businesses compliant and audit-ready.

Financial Reporting & MIS

Accurate and timely reporting enables informed decision-making. Virtual CFOs generate Management Information System (MIS) reports, Profit & Loss statements, and balance sheets that provide insights into performance, profitability, and areas for cost optimization.

Fundraising & Investor Relations

For SMEs seeking growth capital, Virtual CFOs play a crucial role in fundraising. They prepare financial statements for due diligence, create compelling investor presentations, and assist in negotiating term sheets, helping businesses secure investment on favorable terms.

Risk Assessment & Internal Controls

Virtual CFOs identify potential financial risks and implement robust internal control systems. By assessing operational and financial vulnerabilities, they mitigate exposure to fraud, compliance breaches, and financial mismanagement.

Payroll & Statutory CompliancePayroll & Statutory Compliance

Managing payroll efficiently while adhering to labor laws, PF, and ESI requirements is critical. Virtual CFOs ensure smooth payroll operations, accurate calculations, and statutory compliance, reducing administrative burdens on SME management.

4. Benefits of Virtual CFO Services for SMEs

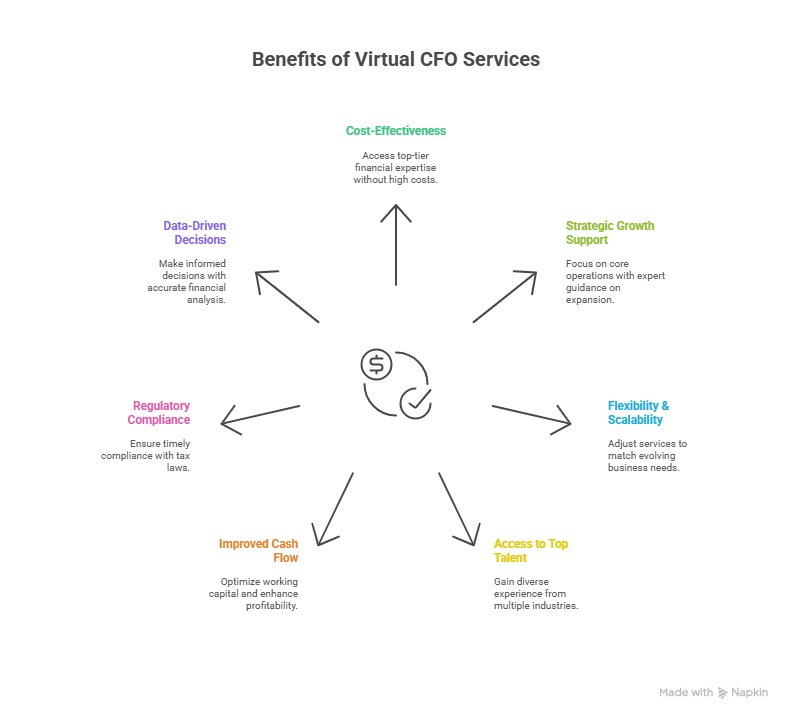

Adopting Virtual CFO services offers SMEs a combination of financial discipline, strategic insight, and operational efficiency. Key benefits include:

Cost-Effectiveness

SMEs gain access to top-tier financial expertise without incurring the high costs of a full-time CFO. Flexible engagement models allow businesses to pay for services that match their needs and budget.

Strategic Growth Support

Virtual CFOs enable business owners to focus on core operations while providing guidance on expansion, investment, and long-term planning. Their insights help drive sustainable growth.

Flexibility & Scalability

Virtual CFO services can be adjusted according to the evolving needs of a business. Whether scaling operations or navigating temporary financial challenges, SMEs can increase or reduce engagement levels seamlessly.

Access to Top Financial Talent

Virtual CFOs bring diverse experience from multiple industries, delivering best practices and strategic insights that may otherwise be inaccessible to SMEs with limited resources.

Improved Cash Flow & Cost Control

Through disciplined financial monitoring, Virtual CFOs help prevent cash shortages and overspending, optimizing working capital and enhancing profitability.

Ensured Regulatory Compliance

Keeping up with evolving Indian tax laws and statutory filings becomes manageable. Virtual CFOs ensure timely compliance, avoiding penalties and fostering credibility with stakeholders.

Data-Driven Decision Making

With detailed financial analysis and management reports, business owners can make informed decisions backed by accurate data rather than intuition, leading to better outcomes and reduced financial risk.

5. Why Indian SMEs Are Turning to Virtual CFOs

Indian SMEs operate in a dynamic and often challenging financial environment. While these businesses drive innovation and employment, many struggle with limited access to skilled financial professionals, inconsistent cash flows, and the increasing complexity of regulatory compliance. These challenges can hinder growth, create operational inefficiencies, and, in some cases, jeopardize business sustainability.

Statistics underscore these difficulties: studies reveal that over 60% of Indian SMEs experience cash flow constraints, and many fail to maintain timely compliance with GST, income tax, and other statutory requirements. These factors contribute significantly to SME failures, often stemming from preventable financial mismanagement rather than market conditions.

Virtual CFOs address these pain points by providing expert, scalable financial leadership. They optimize cash flow, implement disciplined accounting and reporting systems, and ensure regulatory compliance. Additionally, they offer strategic guidance on budgeting, forecasting, and risk management, empowering SMEs to make data-driven decisions and plan for sustainable growth without the burden of hiring a full-time CFO. By bridging expertise gaps efficiently and cost-effectively, Virtual CFOs are becoming an essential tool for Indian SMEs seeking stability and expansion.

6. Engagement Models of Virtual CFO Services

Virtual CFO services are designed with flexibility in mind, allowing SMEs to select an engagement model that aligns with their financial and operational needs. The most common models include:

Data-Driven Decision Making

Under this model, businesses engage a Virtual CFO on an ongoing basis for a fixed monthly fee. This ensures continuous financial oversight, regular reporting, and strategic advisory, ideal for SMEs seeking consistent financial guidance without committing to a full-time hire.

Project-Based Model

Some SMEs require specialized financial expertise for specific initiatives, such as fundraising, system implementation, or financial restructuring. Project-based engagements provide targeted support, with clearly defined deliverables and timelines, offering efficiency and precision.

Interim or Transitional CFO Support

During periods of transition, such as mergers, acquisitions, or temporary gaps in leadership, SMEs can engage a Virtual CFO on an interim basis. This ensures continuity in financial management, mitigates risk during critical periods, and provides experienced oversight while a permanent CFO is recruited or organizational changes are implemented.

By offering these flexible models, Virtual CFO services cater to the diverse needs of SMEs, allowing businesses to scale financial expertise according to growth stages, projects, and operational demands.

7. The Process of Working with a Virtual CFO

Engaging a Virtual CFO involves a structured approach that ensures SMEs receive tailored financial insights and actionable guidance. The typical process includes:

Business Understanding & Financial Assessment

The Virtual CFO begins by gaining a comprehensive understanding of the business model, operational processes, and financial health. This includes reviewing historical financial statements, analyzing cash flow patterns, and identifying key performance metrics. Such an assessment establishes a baseline for strategic planning and financial oversight.

Setting Up Accounting & Reporting Systems

Once the assessment is complete, the Virtual CFO works to establish or optimize accounting systems. This includes implementing cloud-based accounting software, creating standardized reporting formats, and defining financial controls to ensure accuracy, transparency, and compliance with Indian accounting and regulatory standards.

Regular Reporting & MIS Generation

Ongoing reporting is a core function of the Virtual CFO. Timely generation of Management Information System (MIS) reports, balance sheets, and profit & loss statements provides business owners with a clear view of performance, cash position, and profitability, enabling informed decision-making.

Strategic Advisory Sessions

Beyond routine reporting, the Virtual CFO engages in strategic sessions with management. These sessions cover budgeting, financial forecasting, investment planning, risk mitigation, and long-term growth strategies, aligning financial planning with business objectives.

Continuous Compliance Monitoring

Maintaining compliance with GST, income tax, ROC filings, and other statutory requirements is critical. The Virtual CFO continuously monitors regulatory changes, ensures timely submissions, and mitigates potential compliance risks, allowing business owners to focus on core operations.

8. How Virtual CFOs Help with Fundraising & Investor Relations

For SMEs seeking capital or preparing for expansion, Virtual CFOs play a pivotal role in supporting fundraising efforts and managing investor relations:

Preparing Financials for Due Diligence

Investors and financial institutions require accurate, detailed financial information during due diligence. Virtual CFOs prepare and validate financial statements, ensuring transparency, reliability, and alignment with statutory requirements, which increases investor confidence.

Creating Investor Presentations

A compelling investor presentation is critical for attracting funding. Virtual CFOs help craft clear, data-driven presentations that highlight business performance, growth potential, and strategic plans, making it easier for SMEs to communicate value to potential investors.

Term Sheet Negotiations & Investor Communications

Negotiating term sheets and managing investor communications can be complex for SMEs. Virtual CFOs provide expert guidance, advising on valuation, equity structures, and financial terms, while facilitating transparent communication with stakeholders to build trust and secure favorable investment outcomes.

9. Risk Management & Compliance

Effective risk management and regulatory compliance are essential for the long-term sustainability of SMEs. Virtual CFOs play a crucial role in identifying vulnerabilities and establishing frameworks that safeguard financial health:

Identifying Financial Risks

Virtual CFOs assess potential financial risks, including cash flow shortages, operational inefficiencies, and market fluctuations. By analyzing historical data and current business operations, they identify areas that could threaten stability and growth.

Implementing Internal Controls

To mitigate risks, Virtual CFOs design and enforce robust internal control systems. These controls help prevent errors, detect fraud, and ensure accurate financial reporting, enhancing both transparency and accountability within the organization.

Ensuring GST, TDS, ROC, and Income Tax Compliance

Navigating India’s complex regulatory environment is challenging for SMEs. Virtual CFOs ensure that all statutory obligations, ranging from GST and TDS to ROC filings and income tax compliance, are met accurately and on time, minimizing legal exposure.

Reducing Penalties and Legal Complications

By proactively monitoring regulatory requirements and maintaining strict adherence, Virtual CFOs help SMEs avoid costly fines, legal disputes, and reputational risks, allowing business owners to focus on growth and operational efficiency.

10. Key Considerations When Hiring a Virtual CFO

Selecting the right Virtual CFO is critical for maximizing the benefits of the engagement. SMEs should evaluate several factors before making a decision:

Choosing the Right Service Provider or Individual

Consider whether to hire a professional individual or a firm offering Virtual CFO services. Look for a track record of delivering results for SMEs and the ability to provide end-to-end financial guidance.

Evaluating Industry Experience & Expertise

A Virtual CFO with experience in your industry is better equipped to understand market dynamics, regulatory challenges, and operational nuances, providing more relevant and actionable advice.

Assessing Cost vs. Expected ROI

Engagement costs should be weighed against the anticipated benefits. A well-chosen Virtual CFO can deliver substantial ROI through optimized cash flow, improved financial planning, and strategic growth support.

Defining Scope & Engagement Terms Clearly

Clarifying the roles, responsibilities, and deliverables upfront ensures alignment and prevents misunderstandings. Define the engagement model, reporting frequency, and key performance metrics to maintain accountability and transparency.

11. Future of Virtual CFOs in Indian SMEs

The adoption of Virtual CFO services in India is on a steady rise, reflecting the evolving financial needs of SMEs and startups. As businesses seek cost-efficient ways to access strategic financial expertise, Virtual CFOs are becoming an integral part of organizational planning and decision-making.

Virtual CFOs play a crucial role in helping SMEs scale, providing guidance on funding, expansion, risk management, and operational efficiency. Their strategic insights allow business owners to make informed decisions while focusing on innovation and growth.

Emerging technologies are further enhancing the value of Virtual CFOs. Cloud accounting platforms, AI-driven analytics, and automated reporting tools enable real-time financial monitoring, predictive forecasting, and streamlined compliance processes. These innovations not only improve accuracy but also allow SMEs to leverage data-driven insights for smarter business strategies.

12. Conclusion

Virtual CFO services offer SMEs a powerful combination of cost efficiency, strategic guidance, and regulatory compliance. By outsourcing high-level financial management, business owners can focus on core operations while benefiting from professional oversight, improved cash flow, and informed decision-making.

In today’s competitive and rapidly evolving market, adopting a Virtual CFO is no longer just an option; it is a strategic imperative for SMEs aiming to scale responsibly, optimize resources, and maintain compliance. With flexible engagement models and access to top-tier financial expertise, Virtual CFO services empower Indian SMEs to achieve sustainable growth with confidence.

Frequently Asked Questions (FAQs)

A Virtual CFO provides strategic financial leadership on a part-time, remote, or project basis, whereas a full-time CFO is employed permanently within the company. Virtual CFOs are more cost-effective and flexible, making them ideal for SMEs.

The cost depends on the engagement model and scope of services. SMEs can expect monthly retainers ranging from ₹40,000 to ₹1,50,000, while project-based engagements are priced depending on complexity and duration.

Yes. Virtual CFOs assist with preparing financial statements, investor presentations, valuation support, and negotiations, ensuring startups are well-prepared for due diligence and investment discussions.

Virtual CFO services are suitable for businesses of all sizes. Even small enterprises benefit from professional financial oversight, cash flow management, and compliance support without the high cost of hiring a full-time CFO.

Virtual CFOs leverage cloud accounting software (such as Tally, Zoho Books, or QuickBooks), AI-driven financial analytics, and secure reporting platforms to provide real-time insights and maintain compliance efficiently.