Table of Contents

ToggleIntroduction

In today’s competitive business landscape, attracting and retaining top talent has become just as critical as securing funding or expanding into new markets. One of the most effective tools Indian companies are adopting to achieve this balance is the Employee Stock Ownership Plan (ESOP).

An ESOP allows employees to own a stake in the company they work for, aligning their interests with the organization’s long-term growth. By sharing ownership, companies not only enhance employee motivation but also foster a culture of accountability and loyalty. Over the past decade, ESOPs have gained traction in India, particularly among startups, tech-driven enterprises, and even well-established businesses looking to strengthen their talent strategies.

However, designing and managing an ESOP in India is far from straightforward. The process involves complex regulatory, legal, tax, and valuation requirements under frameworks such as the Companies Act, 2013, Income Tax Act, and, for listed companies, the SEBI (Share Based Employee Benefits and Sweat Equity) Regulations. Missteps in execution can result in compliance issues, financial penalties, or dissatisfied employees.

This is precisely where an ESOP consultant becomes invaluable.

Why ESOP Consultants Matter for Startups and Established Companies

Whether you are a bootstrapped startup preparing for your first funding round or an established business seeking to retain key leadership talent, engaging an ESOP consultant is no longer optional—it is strategic. ESOP consultants combine legal expertise, financial acumen, and practical implementation skills to ensure the plan is not only compliant but also tailored to meet a company’s long-term goals.

For startups, consultants bring clarity in structuring plans that appeal to investors while providing genuine value to employees. For larger organizations, they help align ESOPs with succession planning, growth strategies, and workforce stability. In both cases, an ESOP consultant ensures that ownership is not just a financial instrument but a powerful motivator for sustainable business growth.

Role of an ESOP Consultant in India

An ESOP consultant in India plays a multifaceted role, offering end-to-end services that bridge the gap between business objectives and regulatory mandates. They act as strategic advisors, compliance experts, and facilitators who simplify the otherwise complex process of ESOP implementation.

Their expertise extends well beyond paperwork or compliance checks. A seasoned ESOP consultant helps companies design a plan that is legally sound, tax-efficient, and motivational for employees, while also addressing the long-term vision of founders and investors.

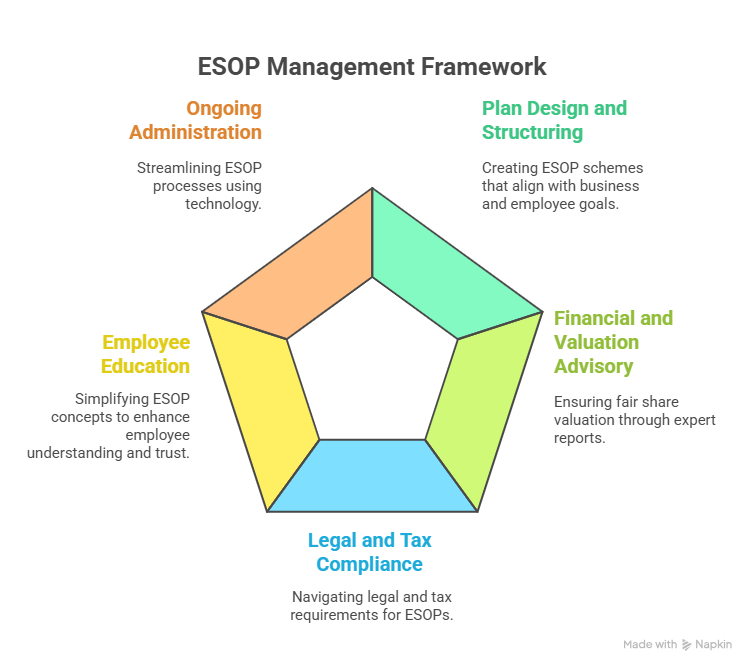

The role typically covers:

- Plan Design and Structuring: Creating schemes that align with business growth and employee retention objectives.

- Financial and Valuation Advisory: Ensuring fair and defensible share valuation as mandated under Indian law, often through Business Valuation Reports by Registered Valuers

- Legal and Tax Compliance: Guiding through documentation, filings, and compliance with the Companies Act, SEBI regulations, and tax provisions.

- Employee Education: Simplifying ESOP concepts for employees to increase participation and trust.

- Ongoing Administration: Leveraging technology platforms to streamline grants, vesting schedules, and regulatory reporting.

In short, an ESOP consultant provides a 360-degree solution—from the initial design phase to the day-to-day administration of the plan. Their involvement not only reduces legal and financial risks but also ensures that the ESOP truly delivers value to both employers and employees.

Designing and Structuring ESOP Plans

The foundation of a successful ESOP lies in its design. An ESOP cannot follow a one-size-fits-all template; it must be carefully structured to reflect the company’s growth trajectory, industry standards, and talent retention objectives.

An ESOP consultant works closely with founders and senior management to tailor a plan that balances business needs with employee aspirations. For example, an early-stage startup may design an ESOP to attract skilled talent without immediately straining cash flows, while a mature company may use ESOPs to retain senior leadership during expansion or succession planning.

The structuring process involves critical decisions around:

- Eligibility criteria: Determining which categories of employees (senior leadership, middle management, or all staff) qualify for options.

- Vesting schedules: Establishing timelines that reward loyalty and long-term association.

- Exercise price and methodology: Balancing affordability for employees with fairness for existing shareholders.

- Exit provisions: Creating clarity around scenarios such as funding rounds, mergers, acquisitions, or public listing.

Importantly, the design must comply with the Companies Act, 2013, which prescribes specific provisions on approvals, disclosures, and shareholder rights. By ensuring that the plan is both strategic and compliant, an ESOP consultant creates a scheme that adds tangible value for both employers and employees.

Regulatory and Legal Compliance

Implementing an ESOP in India is a legally intensive process. Every stage—right from board and shareholder approvals to ongoing reporting—requires strict adherence to multiple laws and regulations.

An ESOP consultant ensures that companies navigate these frameworks without risk of penalties or disputes. Key areas of compliance include:

- Companies Act, 2013: Mandates board and shareholder approvals, disclosures in financial statements, and detailed record-keeping.

- Labour laws: Protect employee rights, particularly in relation to eligibility and fair treatment.

- SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021: Applicable to listed entities, prescribing detailed requirements on disclosures, pricing, and corporate governance.

- Income Tax Act- ESOP taxation Rules: Governs the taxation of ESOPs at both the grant/exercise stage and on the sale of shares.

Beyond statutory compliance, consultants prepare and guide essential documentation such as board resolutions, shareholder agreements, grant letters, and regulatory filings. They also help companies stay compliant with evolving regulations, an area where startups and growing firms often face challenges due to limited internal legal bandwidth.

By bridging legal intricacies with practical implementation, ESOP consultants safeguard businesses from non-compliance risks while instilling confidence among employees, investors, and auditors.

Valuation Expertise

One of the most critical aspects of implementing an ESOP in India is ensuring that the company’s shares are valued fairly and in compliance with legal requirements. Accurate valuation not only determines the fair market value (FMV) of shares at the time of grant and exercise but also plays a vital role in taxation, accounting, and investor confidence.

An ESOP consultant works with registered valuers and valuation professionals to apply methodologies mandated under Indian law. Common approaches include:

- Net Asset Value (NAV) Method: A balance-sheet-based valuation approach often applied for early-stage or asset-heavy businesses.

- Profit Earning Capacity Value (PECV) Method: A profitability-driven valuation approach, more suited for growth-stage companies where future earnings potential is a significant driver of value.

By selecting the right valuation method and ensuring that it is both transparent and defensible, consultants help companies avoid disputes with tax authorities, shareholders, or auditors. Furthermore, accurate valuations instill confidence in employees, reassuring them that their stock options represent genuine, realizable value.

In practice, valuation is not a one-time exercise. It must be updated periodically—particularly during new grants, exercises, or funding rounds. Consultants ensure this ongoing compliance, integrating valuation seamlessly into the broader ESOP lifecycle.

Tax Optimization

Taxation is often the most complex and misunderstood aspect of ESOPs. Both the company and its employees face multiple tax events—at the time of exercise of options and again upon the sale of shares. Mismanagement at this stage can erode the financial benefits of an otherwise well-structured ESOP.

An ESOP consultant ensures that the plan is designed and executed in a way that minimizes tax liabilities while maximizing benefits for all stakeholders. Their role typically involves:

- Structuring exercise price and vesting terms to reduce immediate tax outflows for employees.

- Advising on the timing of grants and exercises to align with funding rounds or liquidity events.

- Optimizing company-level tax treatment, particularly with respect to deductions and accounting entries.

- Clarifying tax obligations for employees to avoid unpleasant surprises and ensure transparency.

For instance, employees may face a perquisite tax liability at the time of exercising options, followed by capital gains tax upon sale of shares. A well-designed ESOP, guided by a consultant, can mitigate these burdens by carefully sequencing grants, exercises, and liquidity events.

By bringing together legal expertise and financial foresight, consultants transform ESOPs into not just a retention tool but also a tax-efficient wealth-creation mechanism for employees—making the scheme far more attractive and sustainable.

Employee Communication and Training

While designing and structuring an ESOP is essential, its success ultimately depends on how well employees understand and value the plan. Many employees, especially in startups and mid-sized companies, may be unfamiliar with concepts such as vesting, exercise price, or liquidity events. Without proper guidance, what is intended as a reward can quickly become a source of confusion or even dissatisfaction.

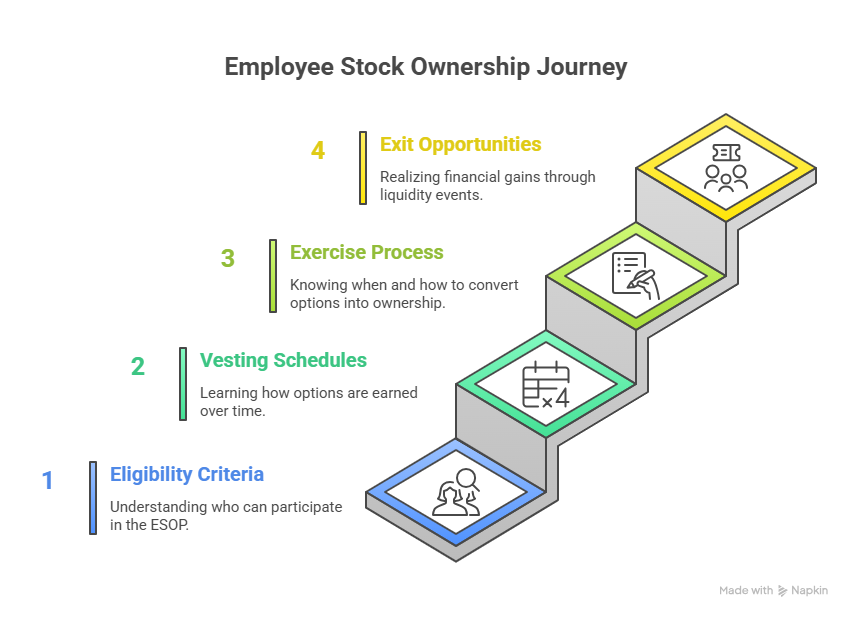

An ESOP consultant plays a crucial role in bridging this knowledge gap. They help management develop clear communication strategies and training programs that explain:

- Eligibility criteria: Who can participate in the ESOP and under what conditions.

- Vesting schedules: How options are earned over time and the importance of continued service.

- Exercise process: When and how employees can convert stock options into actual ownership.

- Exit opportunities: Liquidity events such as funding rounds, buybacks, mergers, or IPOs, where employees can realize financial gains.

Consultants often conduct workshops, create employee-friendly guides, and prepare FAQs to demystify the technicalities of ESOPs. By making the plan transparent and easy to understand, they ensure higher levels of employee engagement, trust, and participation. This not only improves retention but also turns employees into genuine stakeholders in the company’s success.

End-to-End Administration

Implementing an ESOP is not a one-time task; it requires continuous monitoring, reporting, and compliance over the life of the plan. For many businesses, particularly fast-growing startups, this ongoing administration can quickly become resource-intensive and error-prone if handled internally.

An ESOP consultant provides a comprehensive solution by overseeing the end-to-end management of the plan. Their services often include:

- Grant letters: Issuing accurate and compliant documentation to employees.

- Vesting schedules: Tracking progress, ensuring timely updates, and managing exceptions.

- Compliance monitoring: Ensuring statutory filings and board/shareholder approvals are completed without delay.

- Reporting: Generating periodic reports for management, investors, auditors, and regulators.

Increasingly, consultants leverage technology platforms to automate administrative tasks. Digital solutions enable seamless tracking of employee grants, instant report generation, and secure data management—reducing errors and saving significant time.

By combining expertise with technology, ESOP consultants ensure that administration remains smooth, transparent, and compliant. This frees up the management team to focus on business growth, while employees enjoy a professional and efficient experience with their stock options.

Managing Legal Complexity

The legal framework governing ESOPs in India is intricate, involving multiple laws and regulatory bodies. Companies must comply with the Companies Act, 2013, the Income Tax Act, and, for listed entities, the SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021. Each stage of the ESOP lifecycle—plan approval, documentation, grant, vesting, exercise, and reporting—requires precise execution in line with statutory requirements.

Failure to meet these obligations can result in regulatory penalties, tax disputes, or audit complications, any of which can damage both reputation and finances. For startups and high-growth companies, where resources are often stretched, such risks are particularly pronounced.

An ESOP consultant mitigates these risks by ensuring full legal compliance at every step. They prepare the necessary board and shareholder resolutions, draft grant letters, provide guidance on mandatory filings, and keep the company updated on regulatory changes. By proactively managing compliance, consultants allow companies to focus on growth without worrying about costly legal oversights.

Ensuring Accurate and Defensible Valuations

Valuation is not only a financial exercise but also a compliance-critical process. In India, ESOPs must be issued at a fair market value (FMV) determined by a registered valuer. An inaccurate or poorly documented valuation can raise red flags with regulators, trigger tax disputes, or even lead to litigation from shareholders or employees.

An ESOP consultant brings objectivity and professionalism to this process. By engaging qualified valuers and applying accepted methodologies such as Net Asset Value (NAV) or Profit Earning Capacity Value (PECV), they ensure that valuations are transparent, justifiable, and defensible in the event of regulatory scrutiny.

Accurate valuations also serve a strategic purpose. They help maintain fairness between existing shareholders and employees, reassure investors about governance standards, and give employees confidence that their equity truly represents value.

In essence, consultants safeguard businesses from valuation-related risks while reinforcing trust among all stakeholders—employees, founders, investors, and regulators alike.

Driving Tax Efficiency

Taxation is one of the most sensitive aspects of ESOP implementation in India. Both the company and employees are exposed to tax implications at different stages—grant, vesting, and exercise. A poorly structured plan can result in unexpected tax liabilities, eroding the intended benefit of employee ownership.

An ESOP consultant helps companies design tax-efficient schemes that maximize benefits while minimizing risks. For example, they guide on the timing of grants and exercises, the choice of valuation methods, and the structuring of vesting schedules. Consultants also align ESOPs with Section 17(2)(vi) of the Income Tax Act, ensuring that perquisite taxation is calculated fairly and accurately.

For employees, consultants provide clarity on tax obligations and help avoid mistakes such as exercising options at unfavorable times. For companies, the focus is on leveraging legitimate benefits while ensuring compliance. The result is a structure that rewards employees effectively without creating avoidable tax burdens.

Offering Objective and Unbiased Guidance

Implementing an ESOP often requires balancing diverse interests—those of founders, investors, employees, and regulatory bodies. Conflicts can arise over dilution, valuation, vesting terms, or exit opportunities. An internal team may struggle to navigate these complexities objectively.

An ESOP consultant acts as an independent advisor, ensuring decisions are made in the best interest of all stakeholders. They bring impartiality to critical aspects such as plan design, valuation fairness, and compliance oversight. By doing so, consultants enhance credibility with employees and investors alike, showing that the company is committed to transparency and good governance.

This neutrality is particularly valuable for startups and high-growth firms, where trust is essential in attracting and retaining both talent and investment. With a consultant’s unbiased perspective, businesses can build ESOPs that are fair, defensible, and aligned with long-term goals.

Saving Time and Resources

Designing and administering an ESOP demands a significant investment of time, expertise, and ongoing oversight. From drafting resolutions and handling regulatory filings to coordinating with valuers and tax professionals, the process is both detailed and time-sensitive. For founders and management teams already juggling fundraising, product development, and market expansion, these demands can quickly become overwhelming.

By engaging an ESOP consultant, companies save considerable time and internal resources. Consultants take over the heavy lifting—plan structuring, documentation, compliance checks, and administration—while ensuring nothing slips through the cracks. This allows leadership to stay focused on what they do best: building the business and driving growth, confident that the ESOP is being managed with precision.

Boosting Employee Motivation and Retention

An ESOP is more than a financial tool—it’s a strategic retention and motivation lever. When employees understand how equity ownership works, how it links to company performance, and how it can translate into long-term wealth, their commitment deepens. However, if the plan is poorly communicated or feels opaque, employees may undervalue the benefit, undermining its purpose.

An ESOP consultant ensures the plan is positioned as a clear and credible reward. Through structured communication, training sessions, and transparent reporting, consultants help employees see the real value of their options. This builds trust, aligns employees with company goals, and fosters a stronger sense of

Strategic Alignment with Business Goals

An ESOP should never be treated as a one-size-fits-all incentive scheme. For maximum impact, it must align with a company’s strategic priorities—whether that’s attracting investment, preparing for a merger or acquisition, planning an IPO, or simply building a stronger retention framework.

An ESOP consultant ensures the plan supports broader business objectives. For startups, this could mean structuring equity in a way that appeals to investors while minimizing founder dilution. For established companies, it might involve aligning ESOPs with succession planning, market expansion, or long-term shareholder value creation.

By tailoring ESOP design to strategic goals, consultants help businesses transform these schemes from a compliance exercise into a growth enabler—ensuring employees and the company move forward in the same direction.

Conclusion

In India’s dynamic business environment, Employee Stock Ownership Plans have become a cornerstone of talent management, wealth creation, and corporate governance. Yet their success hinges on proper structuring, regulatory compliance, fair valuation, and effective communication—all areas where expertise is non-negotiable.

An ESOP consultant provides that expertise. From navigating complex laws and delivering defensible valuations to ensuring tax efficiency and enhancing employee engagement, consultants bring clarity and professionalism to a process that can otherwise become overwhelming.

For startups and established businesses alike, partnering with an ESOP consultant is not merely a compliance safeguard—it is a strategic investment in long-term growth, employee loyalty, and shareholder trust.

In short, hiring an ESOP consultant in India is a smart move for any company looking to unlock the full potential of employee ownership while staying future-ready.

Frequently Asked Questions (FAQs)

An ESOP consultant designs, structures, and administers employee stock ownership plans while ensuring compliance with Indian laws. They also handle valuations, tax planning, employee communication, and ongoing ESOP management.

For startups, ESOP consultants bring clarity to complex regulatory and valuation requirements, help attract investors, and design retention-focused equity structures that align with growth plans.

Consultants use methods such as Net Asset Value (NAV) and Profit Earning Capacity Value (PECV) to determine fair market value (FMV) of shares, as required at both grant and exercise stages under Indian law.

Yes. A well-structured ESOP, guided by an expert consultant, minimizes tax burdens for both employers and employees, avoiding costly errors and penalties during grant, vesting, and sale.

Absolutely. Consultants create training and communication programs to explain eligibility, vesting, and exercise processes, ensuring employees understand and appreciate the real value of ESOPs.