Table of Contents

ToggleI. Introduction

In today’s dynamic business environment, valuation reports are not merely financial statements but strategic documents that impact a wide spectrum of corporate activities. Among these, the MB Valuation Report, short for Merchant Banker Valuation Report, holds a particularly significant position, especially in India’s regulatory and compliance framework. Whether it is for foreign investments, share issuances, mergers, or dispute resolutions, the MB Valuation Report serves as an essential tool to establish the fair market value (FMV) of a company’s shares or securities by statutory norms.

This article provides a comprehensive insight into what an MB Valuation Report entails and explores its multiple use cases in the Indian corporate landscape.

II. What is an MB (Merchant Banker) Valuation Report?

An MB Valuation Report is a formal document prepared by a SEBI-registered Merchant Banker, presenting an independent and objective assessment of the fair market value (FMV) of a company’s shares or other securities. This valuation is based on extensive analysis and is designed to reflect the price that would be agreed upon between a willing buyer and a willing seller in an arm’s-length transaction.

The MB Valuation Report evaluates several critical aspects of a company’s financial and operational standing, which typically include:

- The company’s financial performance, profitability, and balance sheet strength.

- Its historical and projected growth trajectory.

- The prevailing conditions and trends within its industry sector.

- The broader market and economic environment impact the company’s operations.

To determine the FMV, Merchant Bankers employ globally recognized valuation methodologies. The most commonly used approaches include:

- Discounted Cash Flow (DCF) Method: A forward-looking approach that estimates the present value of a company’s future cash flows.

- Market Multiple Method: A comparative approach that benchmarks the company against similar businesses based on key financial ratios.

In India, the MB Valuation Report plays a pivotal role in regulatory compliance, particularly under legislations such as the Income Tax Act, 1961, and the Foreign Exchange Management Act (FEMA). It is often required when companies engage in foreign investment transactions, issue shares at a premium, or participate in mergers and acquisitions.

III. Who Can Issue an MB Valuation Report?

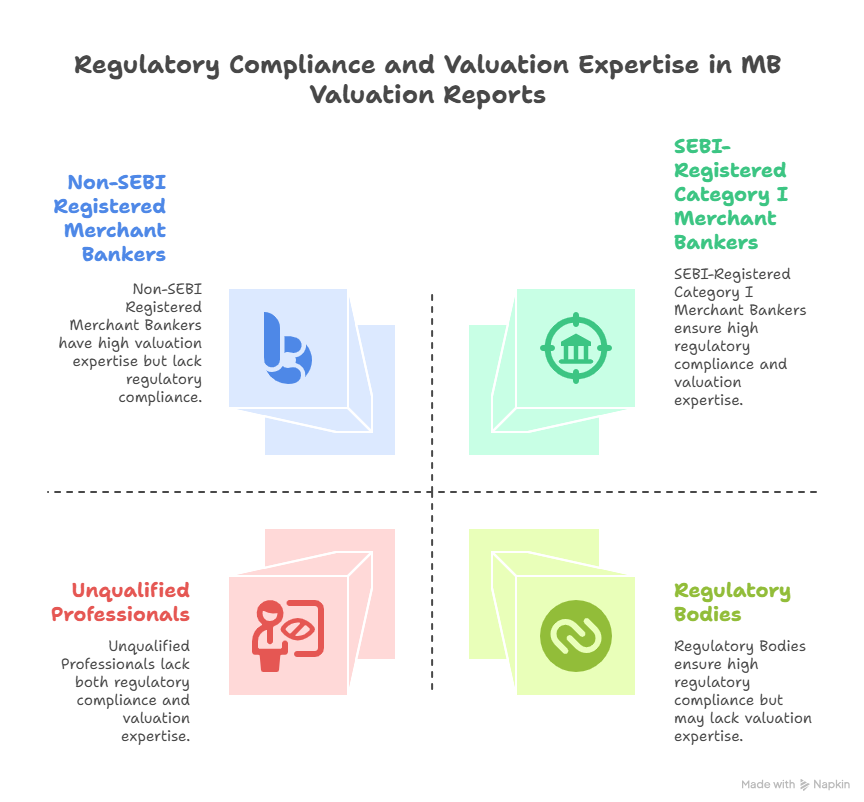

In India, not every professional or firm is authorized to issue an MB Valuation Report. The regulatory framework clearly defines the category of professionals permitted to conduct such valuations, ensuring both accuracy and legal compliance.

SEBI-Registered Category I Merchant Bankers

Only Merchant Bankers who are registered with the Securities and Exchange Board of India (SEBI) under Category I are authorized to issue MB Valuation Reports for specific regulatory purposes. Their role is particularly critical when valuations are required for:

- Compliance under the Income Tax Act, 1961 (such as for determining fair market value under Rule 11UA)

- Foreign Direct Investment (FDI) transactions that involve reporting to the Reserve Bank of India (RBI) under FEMA

- Issuance of shares to foreign investors or at a premium, where regulatory authorities demand an independent and certified valuation

These Merchant Bankers bring expertise, regulatory oversight, and credibility to the valuation process, ensuring that their reports are legally defensible and acceptable to various government authorities.

Registered Valuers under IBBI

For certain other valuation purposes, such as compliance under the Companies Act, 2013, valuation reports may also be issued by Registered Valuers who are accredited by the Insolvency and Bankruptcy Board of India (IBBI). While these Registered Valuers play an important role in corporate valuations, their reports are generally not accepted in place of Merchant Banker reports for specific transactions governed by FEMA or Income Tax provisions, where an MB Valuation Report is mandatory.

In summary, while both SEBI-registered Merchant Bankers and IBBI-registered Valuers are recognized professionals in the valuation domain, the authority to issue MB Valuation Reports for high-stakes regulatory compliance rests exclusively with SEBI-registered Merchant Bankers.

IV. Use Cases of MB Valuation Reports in India

1. Issuance of Shares at Premium (Income Tax Act, 1961)

When a company issues shares at a price higher than their face value, especially to new or foreign investors, the Income Tax Act, 1961, requires the determination of the fair market value (FMV) of those shares. This FMV helps ascertain whether the premium charged is justified and ensures that there are no violations related to unaccounted money or tax evasion. An MB Valuation Report provides an independent and defensible FMV, satisfying the compliance requirements under Rule 11UA of the Income Tax Rules.

2. Foreign Direct Investment (FDI) and FEMA Compliance

In transactions involving foreign investors, compliance with the Foreign Exchange Management Act (FEMA) is critical. The Reserve Bank of India (RBI) requires that share valuations for inbound FDI or outbound investments be certified by a SEBI-registered Merchant Banker. The MB Valuation Report becomes a necessary part of filings such as Form FC-GPR and other related submissions, ensuring that foreign exchange transactions are conducted at arm’s length and reflect true market value.

3. Private Placements and Preferential Allotments

When companies raise capital through private placements or preferential allotments, particularly at a premium, the Companies Act, 2013, and Income Tax Act demand robust valuation support. An MB Valuation Report helps establish the basis for share pricing and demonstrates that the transactions are conducted fairly, protecting both existing shareholders and incoming investors.

4. Mergers, Acquisitions, and Corporate Restructuring

During mergers, acquisitions, demergers, or other forms of corporate restructuring, MB Valuation Reports play a crucial role in determining the value of companies or business divisions involved. This valuation provides transparency, supports negotiations, and serves as evidence in regulatory filings, shareholder communications, and court approvals.

5. Regulatory Filings and Dispute Resolution

MB Valuation Reports are frequently used in regulatory filings and can serve as reliable documentation in case of disputes regarding share pricing or asset valuation. Their independent and regulated nature makes them credible in the eyes of regulatory authorities, tax departments, and judicial bodies.

6. Startups and Investment Rounds

Startups, particularly those seeking funds from venture capitalists, private equity firms, or foreign investors, often require MB Valuation Reports to validate their valuation figures. These reports assure investors and ensure that funding transactions comply with applicable tax and foreign exchange regulations.

V. When is an MB Valuation Report NOT Required?

While MB Valuation Reports are mandatory for several key regulatory and transactional scenarios, there are situations where such a report is not required. Understanding these exemptions helps businesses avoid unnecessary compliance costs and streamline their internal processes.

1. Issuance of Shares at Face Value

When a company issues shares at their nominal or face value, particularly in rights issues or allotments to existing shareholders, an MB Valuation Report is typically not required. Since no premium is involved, the regulatory need to establish fair market value does not arise. These transactions can often proceed without the involvement of a SEBI-registered Merchant Banker.

2. Internal Strategic or Policy Decisions

For internal purposes such as business strategy, long-term planning, or management policy formulation, companies may conduct their valuation exercises. These internal valuations are primarily intended for managerial decision-making and are not mandated by any statutory authority. Consequently, an MB Valuation Report is not necessary unless the internal assessment leads to transactions that invoke regulatory compliance.

3. Certain Domestic Transactions Not Involving Regulatory Bodies

In some domestic transactions where neither FEMA nor Income Tax provisions mandate valuation certification, companies may opt for alternative valuation approaches. For example, simple buyback transactions funded entirely by internal accruals and involving only domestic shareholders may not always trigger the need for an MB Valuation Report, provided they comply with relevant legal thresholds.

4. Transfers Between Closely Held Group Companies

In cases where shares or assets are transferred between related parties or within the same group, and where no external funding or foreign investment is involved, regulatory bodies may not require an MB Valuation Report, provided applicable exemptions apply under prevailing laws.

In all such cases, while the preparation of an MB Valuation Report is not compulsory, businesses should still evaluate whether any other form of valuation report is advisable or required under specific regulatory frameworks.

VI. Cost and Timeline for MB Valuation Report

The process of obtaining an MB Valuation Report involves both professional expertise and regulatory precision, which directly influence the cost and time required for its completion. Businesses planning transactions that necessitate such reports should factor these elements into their compliance timelines.

Cost

The professional fee for preparing an MB Valuation Report in India generally starts at approximately ₹65,000. However, the actual cost can vary depending on several factors, including:

- The complexity of the business structure and financial statements.

- The size and scale of the transaction involved.

- The industry sector and availability of comparable market data.

- The depth of financial projections and assumptions to be reviewed.

In transactions involving high-value mergers, foreign investments, or complex cross-border structures, fees may be significantly higher due to the additional diligence and analysis required.

Timeline

On average, the preparation and issuance of an MB Valuation Report can be completed within approximately 8 business days. The timeline may extend if:

- The financial data provided by the company requires extensive verification.

- Additional supporting documentation or management discussions are necessary.

- Regulatory consultations or clarifications are needed during the valuation process.

Businesses should initiate the valuation process well in advance of any regulatory filings or transactional deadlines to ensure timely compliance and avoid potential delays.

VII. Summary Table: MB Valuation Report Use Cases

To provide a clear snapshot of when an MB Valuation Report is required, who can issue it, and the applicable regulatory references, the following summary table has been compiled:

Scenario | MB Valuation Report Required? | Who Issues? | Regulatory Reference |

Issuance of shares at premium (Income Tax Act, 1961) | Yes | SEBI-registered Merchant Banker | Income Tax Act, Rule 11UA |

Foreign Direct Investment (FDI) / Foreign investment (FEMA) | Yes (in most cases) | SEBI-registered Merchant Banker | FEMA, RBI |

Private placement (Companies Act, 2013) | Yes | Registered Valuer (IBBI) | Companies Act, 2013 |

Rights issue at face value | No | Not Applicable | Companies Act, 2013 |

Internal company strategy/policy valuations | No | Not Applicable | Not Applicable |

This table serves as a quick reference guide for promoters, CFOs, and compliance professionals navigating the Indian regulatory landscape concerning share and business valuations.

VIII. Conclusion: The Strategic Importance of MB Valuation Reports

In today’s regulatory environment, MB Valuation Reports play a critical role not only in ensuring legal compliance but also in shaping the financial and strategic decisions of businesses operating in India. Whether dealing with foreign investments, issuing shares at a premium, or undergoing complex corporate restructuring, these reports provide the objectivity and transparency required to navigate both domestic and international regulatory frameworks.

By engaging SEBI-registered Merchant Bankers, companies gain access to specialized valuation expertise backed by recognized methodologies such as Discounted Cash Flow and market multiples. These professionally certified reports help mitigate regulatory risks, support dispute resolution, and build investor confidence, especially in high-stakes transactions involving cross-border capital flows or large-scale mergers.

Moreover, understanding when an MB Valuation Report is not required can help businesses avoid unnecessary costs and streamline internal decision-making processes. While the preparation of these reports involves both time and cost, their long-term benefits far outweigh the initial investment, particularly in ensuring regulatory compliance and protecting shareholder value.

For founders, CFOs, legal advisors, and compliance professionals, MB Valuation Reports are not just a regulatory formality, they are an essential part of the company’s financial governance framework.

Frequently Asked Questions (FAQs)

Only SEBI-registered Category I Merchant Bankers are authorized to issue MB Valuation Reports for regulatory purposes such as FEMA compliance, foreign investments, and share issuances under the Income Tax Act, 1961. For other scenarios, like Companies Act valuations, Registered Valuers (IBBI-accredited) may be eligible.

No, MB Valuation Reports are not required when shares are issued at face value, particularly in rights issues offered to existing shareholders. However, if shares are issued at a premium, especially to non-residents or foreign investors, MB valuation becomes mandatory.

Typically, the cost starts at ₹65,000 in India, though it may vary based on transaction complexity, company size, and scope of valuation. On average, it takes approximately 8 business days to prepare and deliver a complete MB Valuation Report.

Merchant Bankers usually apply globally accepted methods such as Discounted Cash Flow (DCF), Comparable Companies Analysis, Precedent Transactions, and Market Multiples. The choice of method depends on the company’s business model, industry standards, and regulatory requirements.

No, MB Valuation Reports are not required when shares are issued at face value, particularly in rights issues offered to existing shareholders. However, if shares are issued at a premium, especially to non-residents or foreign investors, MB valuation becomes mandatory.