Table of Contents

Toggle1. Introduction

Employee Stock Ownership Plans (ESOPs) have emerged as a pivotal tool for Indian companies looking to attract, retain, and motivate top talent. By offering employees a stake in the business, ESOPs align individual performance with company growth, fostering a sense of ownership and long-term commitment.

However, designing and implementing an ESOP in India is not a straightforward task. The regulatory landscape—spanning the Companies Act, 2013, SEBI regulations, Income Tax rules, and FEMA guideline—can be complex and often overwhelming for founders and HR teams. Mistakes in compliance or plan design can result in penalties, disputes, or demotivated employees.

This is where an ESOP consultant becomes invaluable. With specialized expertise, consultants not only ensure that your plan is compliant and robust but also maximize its strategic impact on your workforce and organizational growth.

In this blog, we delve into the top seven benefits of hiring an ESOP consultant for your company, exploring how their guidance can transform your ESOP from a regulatory obligation into a powerful tool for talent management, financial optimization, and investor confidence.

2. Expert Legal and Compliance Guidance

Navigating the legal and regulatory landscape is one of the most critical aspects of ESOP implementation. India’s ESOP regulations are multi-layered, encompassing provisions under the Companies Act, 2013, SEBI guidelines for listed companies, Income Tax rules, and FEMA regulations for foreign investments. Even minor errors in compliance or documentation can expose companies to financial penalties, legal disputes, or challenges during audits.

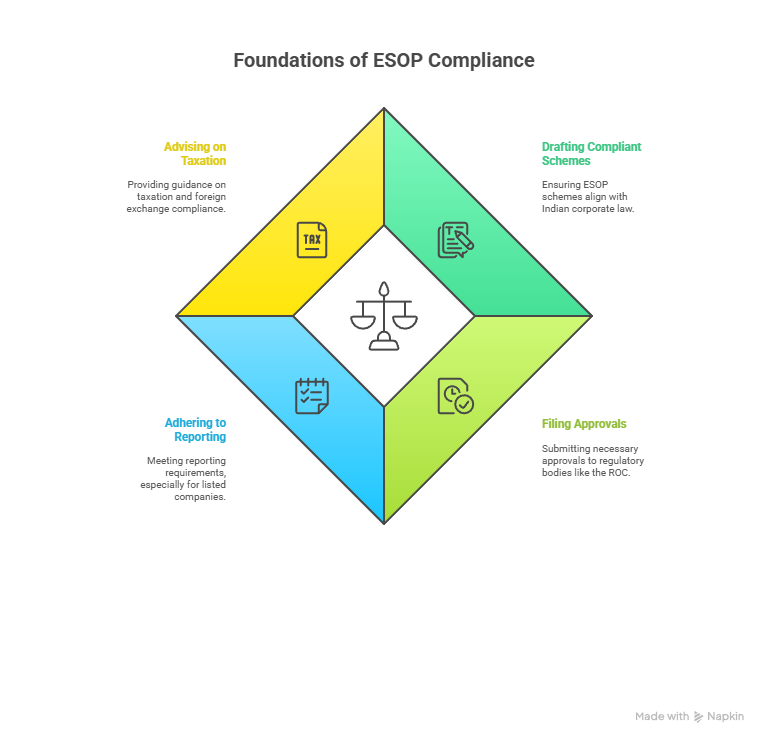

An experienced ESOP consultant provides end-to-end legal and compliance guidance, ensuring that every aspect of your plan—from grant letters to regulatory filings—adheres to statutory requirements. This includes:

- Drafting compliant ESOP schemes that align with Indian corporate law.

- Filing necessary approvals with regulatory bodies such as the ROC.

- Ensuring adherence to reporting requirements, particularly for listed companies under SEBI regulations.

- Advising on taxation and foreign exchange compliance, mitigating risks related to cross-border grants.

The implementation of ESOPs in India is governed by a combination of regulatory frameworks, making compliance a key concern:

- Companies Act, 2013: Governs the issuance of stock options, approval processes, and reporting requirements.

- SEBI guidelines: Applicable for listed companies, ensuring transparency and shareholder protection.

- FEMA/RBI regulations: Relevant for cross-border employees receiving ESOPs, ensuring foreign exchange compliance.

Understanding ESOPs in this regulatory context highlights why professional guidance is essential. Companies must navigate not only plan design and administration but also accurate valuation of shares—an area where the expertise of ESOP consultants and registered valuers becomes indispensable.

3. Optimized ESOP Plan Design for Retention and Attraction

An ESOP is only as effective as its design. A well-structured plan not only motivates employees but also strategically aligns their interests with the company’s long-term objectives. This is where an ESOP consultant plays a crucial role.

Strategic structuring includes defining

- Eligibility criteria: Determining which employees are granted stock options based on role, performance, or tenure.

- Vesting schedules: Designing timelines that encourage long-term retention and ensure that employees remain committed to the company’s growth.

- Exit mechanisms: Structuring buybacks, secondary sales, or IPO-related exits in a way that balances company liquidity and employee benefit.

For Indian startups, where competition for top talent is intense, a tailored ESOP plan can be a decisive factor in attracting skilled professionals. Consultants ensure that the plan is scalable, fair, and aligned with organizational goals, creating a framework that motivates employees while preserving company interests. By strategically aligning rewards with performance, companies can boost both retention and engagement, ultimately enhancing organizational stability and growth.

4. Accurate ESOP Valuation and Fair Pricing

Valuation lies at the heart of any ESOP plan. In India, professional valuation is mandatory for unlisted companies and critical for listed entities to ensure transparency, fairness, and regulatory compliance. Mispriced options can lead to employee dissatisfaction, tax complications, and compliance risks.

An ESOP consultant coordinates with registered valuers and merchant bankers to determine the Their expertise ensures that:

- Grants are priced accurately in accordance with regulatory standards.

- Employees receive equitable value for their options.

- Companies maintain transparency in financial reporting and audit trails.

Beyond regulatory compliance, accurate valuation also enhances employee trust in the ESOP program. When employees understand that the pricing reflects genuine market value, they are more likely to perceive the stock options as a tangible and meaningful benefit. Consultants help bridge this trust gap while ensuring that the plan withstands scrutiny from auditors, regulators, and investors alike

5. Streamlined Implementation and Administration

Implementing an ESOP involves meticulous coordination of multiple administrative and regulatory steps. From drafting grant letters to obtaining board and shareholder approvals, the process can be time-consuming and prone to errors if not handled professionally.

An ESOP consultant ensures streamlined implementation and administration by:

- Coordinating documentation, approvals, and regulatory filings such as PAS-3 submissions with the Registrar of Companies (ROC).

- Setting up ESOP trusts to manage grants and exercises efficiently.

- Automating grant and allotment processes, reducing manual intervention and minimizing errors. By managing these operational aspects, consultants free company leadership to focus on strategic priorities while guaranteeing a seamless rollout of the ESOP plan. This reduces administrative burden, mitigates risk, and ensures that the plan operates smoothly from day one.

6. Employee Education and Engagement Programs

- An ESOP’s success is not determined solely by its legal compliance or administrative precision; it also depends on employee understanding and engagement. Employees must recognize the value of their stock options and how participation impacts their financial future.

ESOP consultants enhance engagement through:

- Targeted training sessions that explain valuation, vesting schedules, and tax implications.

- Clear communication strategies that articulate the benefits of participation and the mechanics of exercising options.

- Programs that boost perception of ESOPs as meaningful benefits, increasing motivation and commitment.

- Educated and informed employees are more likely to appreciate the long-term value of their equity participation. This, in turn, enhances retention, encourages proactive contribution to company growth, and fosters a culture of ownership

7. Tax Optimization and Exit Strategy Advisory

- ESOPs can provide significant financial benefits, but realizing these advantages requires careful tax planning and strategic exit management. Indian startups, in particular, can leverage favorable schemes such as the https://www.startupindia.gov.in in Startup India initiative, which allows for deferred taxation on ESOPs, reducing immediate cash outflows and enhancing employee retention.

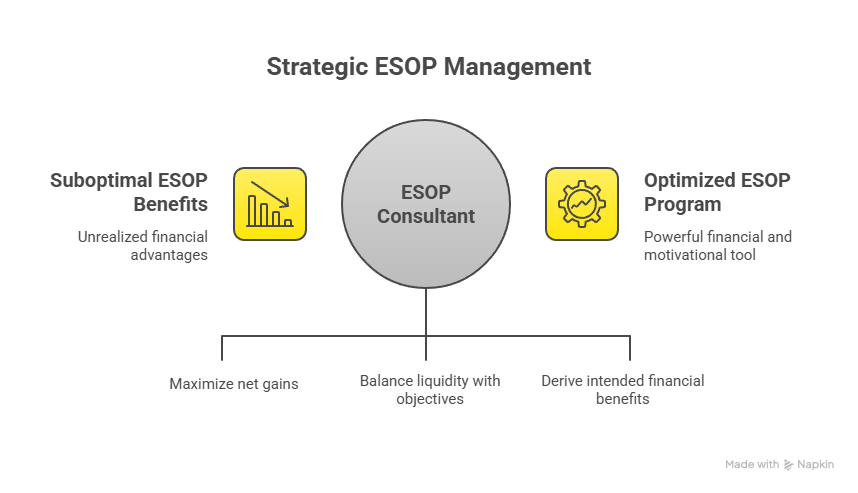

An ESOP consultant offers guidance on:

- Tax optimization for both the company and employees, ensuring compliance while maximizing net gains.

- Structuring exits through IPOs, buybacks, or secondary sales in a manner that balances liquidity with long-term company objectives.

- Maximizing post-exercise value, ensuring that employees and founders derive the intended financial benefits from the ESOP program

By aligning tax planning and exit strategies with company goals, consultants help transform ESOPs into a powerful financial and motivational tool for your workforce.

8. Boosting Credibility with Investors and Stakeholders

- A professionally designed ESOP plan does more than reward employees—it also signals strong corporate governance and strategic alignment to external stakeholders. Investors and shareholders often view a structured ESOP as evidence of a company’s commitment to long-term value creation and employee engagement.

ESOP consultants help companies:

- Support due diligence during fundraising rounds or mergers and acquisitions, ensuring that ESOP structures are transparent and compliant.

- Highlight employee incentive mechanisms to prospective investors, reinforcing the company’s commitment to talent retention and sustainable growth.

- Demonstrate governance maturity, enhancing trust and confidence among stakeholders.

By positioning ESOPs as a strategic advantage rather than a mere compliance requirement, consultants help companies strengthen credibility and foster investor confidence.

9. Risk Mitigation and Compliance Assurance

While https://www.marckenconsulting.com/esop-consulting-services offer tremendous benefits, they also carry inherent risks if not properly managed. Regulatory violations, administrative errors, or misalignment with corporate governance standards can lead to legal disputes, financial penalties, or employee dissatisfaction.

An experienced ESOP consultant helps companies mitigate these risks by:

- Identifying potential legal or operational pitfalls before they escalate.

- Ensuring ongoing compliance with evolving regulations under the Companies Act, SEBI, Income Tax, and FEMA rules.

- Protecting both company and employee interests, creating safeguards that uphold transparency, fairness, and accountability.

Through vigilant risk management and proactive compliance monitoring, consultants ensure that ESOPs remain a strategic asset rather than a potential liability.

10. Custom Solutions for Organizational Goals

No two companies are the same, and neither should their ESOP plans be. Consultants tailor ESOP structures to reflect each organization’s vision, culture, and stage of growth, ensuring the plan complements broader strategic objectives.

Key contributions of ESOP consultants include:

- Aligning the plan with company vision and culture, creating incentives that resonate with employees and reflect organizational values.

- Adapting plans for different growth stages, whether a startup seeking rapid talent acquisition or a mature company optimizing shareholder value.

- Supporting strategic HR and financial planning, integrating ESOPs with recruitment, retention, and long-term financial strategies.

By providing bespoke solutions, ESOP consultants ensure that stock option plans are not just compliance exercises but powerful levers for achieving organizational goals.

11. Monitoring, Reporting, and Continuous Improvement

The success of an ESOP does not end with its implementation. Ongoing monitoring and evaluation are essential to ensure that the plan continues to deliver intended benefits to both employees and the company.

ESOP consultants help companies maintain continuous oversight and improvement through:

- Ongoing performance tracking of the ESOP plan, ensuring milestones, vesting, and employee participation are on target.

- Updating policies in response to legal, regulatory, or market changes, keeping the plan compliant and relevant.

- Continuous enhancement of employee engagement and retention outcomes, adjusting communication, training, or plan design as needed.

This proactive approach ensures that ESOPs evolve alongside the company, remaining an effective tool for motivation, retention, and strategic growth.

12. Conclusion

Hiring an ESOP consultant offers a strategic advantage that goes beyond compliance. By providing expertise in legal and regulatory guidance, plan design, valuation, implementation, employee engagement, tax optimization, and investor credibility, consultants enable companies to unlock the full potential of their ESOP programs.

The expanded benefits—risk mitigation, customized organizational alignment, and continuous monitoring—further reinforce the value of professional guidance.

For founders and HR leaders, engaging an ESOP consultant early in the process ensures a smooth implementation, maximizes financial and motivational outcomes, and strengthens governance credibility.

Invest in expertise now, and transform your ESOP from a compliance requirement into a powerful tool for growth, retention, and long-term success.

An ESOP consultant guides companies through the design, implementation, compliance, valuation, and administration of Employee Stock Ownership Plans. They ensure legal adherence, optimize plan structures for talent retention, and support financial and tax strategies.

While not legally mandatory, hiring a consultant is highly recommended. Professional guidance minimizes regulatory risk, ensures accurate valuation, and streamlines plan management, making ESOPs more effective and beneficial for both employees and the company.

Consultants ensure the ESOP plan complies with the Companies Act, SEBI regulations, Income Tax rules, and FEMA guidelines. They handle documentation, approvals, filings, and ongoing monitoring to prevent penalties and audit issues.

Yes. Consultants create training programs, communication strategies, and educational materials that help employees understand the value of their stock options, boosting motivation, retention, and long-term commitment.

They coordinate with registered valuers and merchant bankers to determine fair pricing, ensuring transparency and fairness. They also advise on exit options like IPOs, buybacks, or secondary sales to maximize financial outcomes for both the company and employees.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.