Why are smart manufacturers in India obsessing over TEV?

Because in a landscape where margins are tight, regulations are dense, and competition is cutthroat, guessing your way through a project is a recipe for disaster. Forward-thinking manufacturing firms aren’t just building machines; they’re building certainty. And the blueprint for that certainty is the Techno-Economic Viability (TEV) study.

So, what exactly is TEV?

At its core, a TEV study is a dual-lens evaluation; it asks two vital questions:

- Can this manufacturing project be built correctly? (technical feasibility)

- Will it make economic sense in the long run? (economic viability)

It’s a comprehensive check that examines everything from technology and infrastructure to funding, market demand, and risk. In plain terms: TEV tells you whether your manufacturing project is worth the money, time, and sweat you’re about to invest.

Why this blog matters:

Whether you’re a startup aiming to impress investors or a seasoned SME looking to scale, a TEV study is not just a formality; it’s your first real filter against failure. In this blog, we break down exactly why TEV is vital for manufacturers in India, how it shapes strategy and funding, and how firms like Marcken Consulting’s valuation experts help decode it for real-world decisions.

Table of Contents

ToggleWhat Is Techno-Economic Viability (TEV)?

A Techno-Economic Viability study is a structured evaluation of a project’s technical soundness and financial sustainability. It merges engineering logic with economic rigor, the kind of due diligence that separates a viable manufacturing setup from a money pit.

Who uses TEV studies in India?

TEV studies are a common currency among:

- Manufacturing firms, especially those launching new plants or diversifying into new product lines

- Banks and financial institutions, which rely on these reports before sanctioning loans

- Regulators and policy bodies, who use TEV as part of compliance, subsidies, and clearance processes

Whether you’re pitching to a lender or preparing for scale, TEV helps all stakeholders align on one crucial question: Does this project make sense, both on paper and in the market, and on the shop floor?

The two-pillar foundation of TEV

Every TEV study rests on two interlocking dimensions:

- Technical Feasibility: Can the machinery, technology, infrastructure, and workforce deliver what is promised? Are the inputs available? Is the tech future-proof or outdated?

- Economic Viability: Will this venture generate sustainable returns? Does the cash flow cover debt? Is it resilient to market shocks or inflation?

A robust TEV study goes beyond optimism. It gives decision-makers hard data, which is why many firms turn to professional valuation services to get it right the first time.

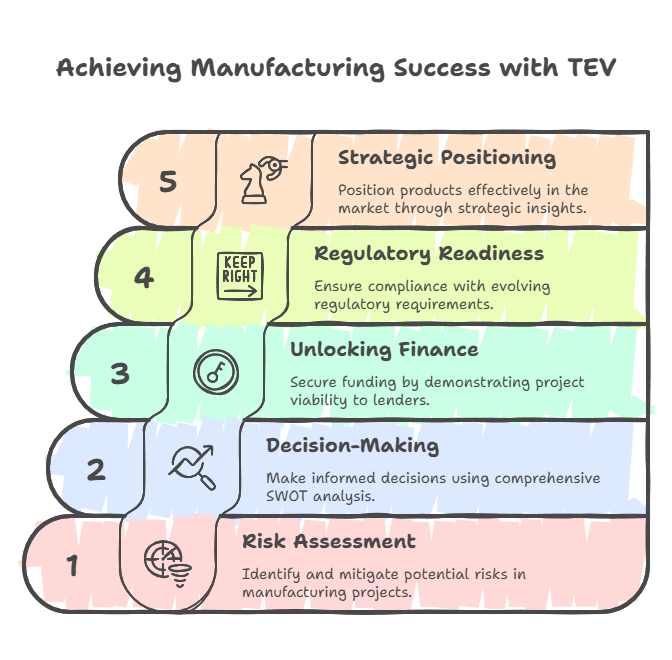

Five Reasons TEV Matters for Manufacturing Firms

TEV studies aren’t just about ticking boxes. They are decision frameworks that reveal whether a manufacturing project is resilient, relevant, and ready. Here are five powerful reasons manufacturers in India rely on them:

1. Risk Assessment & Mitigation

Manufacturing projects face a minefield of risks, technical failures, budget overruns, supply chain interruptions, and flawed market assumptions. TEV studies act like a radar, helping you spot these threats early.

By evaluating everything from raw material availability to machinery compatibility, firms can develop contingency plans, preventing costly surprises during execution. It’s proactive problem-solving, not reactive firefighting.

2. Better Decision-Making

Big capital calls for big clarity. TEV provides that clarity through a comprehensive SWOT analysis, laying bare the Strengths, Weaknesses, Opportunities, and Threats tied to a proposed venture.

It ensures that investment decisions aren’t driven by hope or hearsay, but by data, the kind of depth manufacturers often secure through an independent valuation report by a registered valuer, tailored to their business context.

3. Unlocking Finance

Banks and financial institutions don’t bet on hunches; they fund viability. That’s why many lenders make TEV reports mandatory before approving loans. A detailed TEV helps them gauge:

- DSCR (Debt Service Coverage Ratio): Can you pay your debts and stay afloat?

- IRR (Internal Rate of Return): Is your project delivering healthy returns?

- Profitability metrics: Are margins realistic or inflated?

In essence, TEV builds financial trust. And with the right advisory support, manufacturers can craft investor-ready documentation from the ground up.

4. Regulatory Readiness

India’s regulatory ecosystem for manufacturing isn’t just extensive, it’s evolving. From environmental clearances to industry-specific licenses, missing a regulatory step can derail an entire project.

TEV studies help firms stay ahead of the curve. By mapping every compliance checkpoint, safety codes, pollution norms, and industrial zoning laws, they act as a compliance compass, reducing the risk of delays and penalties. You can explore more on the compliance front through resources like the Ministry of Environment, Forest and Climate Change, and DPIIT’s industrial policies.

5. Strategic Market Positioning

TEV studies don’t just look inward; they scan the market battlefield. From understanding demand-supply gaps to analyzing price elasticity and consumer sentiment, a good TEV study offers firms the insight to position themselves strategically.

It’s how manufacturers decide what to produce, how much to scale, and how to price and place their products. For SMEs looking to break out of regional markets or enter new verticals, a TEV-backed strategy can offer a crucial edge.

Want more insights on industrial shifts? Dive into our blog archive on valuation and market insights for deeper analysis.

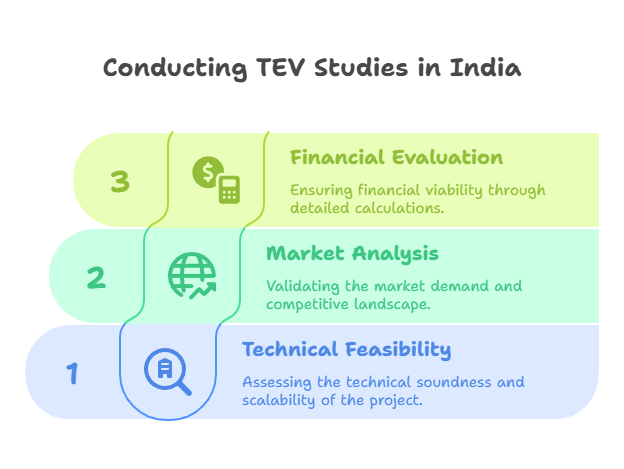

How TEV Studies Are Conducted in India

A TEV study isn’t one-size-fits-all; it’s a methodical, multi-disciplinary process that connects engineering with economics. Here’s how it’s typically structured:

Technical Feasibility

This phase examines whether the proposed technology, processes, and operational workflows are:

- Technically sound

- Scalable

- Compatible with local conditions

- Resource-efficient

It considers plant layout, equipment selection, energy requirements, and supply chain viability. This layer helps manufacturers align technical ambition with on-ground practicality.

Market Analysis

The goal here is to validate if there’s a real and sustainable market for what’s being built. Key elements include:

- Demand forecasting

- Competitor benchmarking

- Supply chain trends

- Pricing dynamics

- Route-to-market strategies

Market intelligence forms the commercial core of a TEV, helping manufacturers adapt before they invest. Our team at Marcken Consulting’s TEV service division ensures these insights are industry-specific and future-focused.

Financial Evaluation

Finally, the numbers must add up. Financial viability is assessed using:

- Projected cash flows

- Break-even points

- IRR and NPV calculations

- DSCR analysis

- Sensitivity scenarios (What happens if raw material costs spike, or demand dips by 10%?)

This financial realism helps businesses model best- and worst-case outcomes. For decision-makers, it’s not just comforting — it’s essential.

TEV in the Era of “Make in India”

India’s manufacturing sector is in a high-stakes transformation phase, fuelled by ambitious initiatives like “Make in India”, PLI schemes, and export-driven policies. But behind every bold policy lies a practical question: Can this project work?

That’s where Techno-Economic Viability (TEV) steps in, acting as a growth catalyst and risk filter for India’s manufacturing ambitions.

Policy-Driven Growth Needs Project-Level Precision

As the government pushes for domestic manufacturing across sectors, from electronics and EVs to defense and pharmaceuticals, manufacturers are under pressure to deliver high-impact, scalable projects. TEV studies ensure that these projects are rooted in reality, not hype. They help align business plans with policy frameworks, thereby smoothing out the road for subsidies, approvals, and clearances.

For firms tapping into these incentives, TEV becomes more than just internal due diligence; it becomes the language regulators and lenders understand. For instance, sectors supported under the Department for Promotion of Industry and Internal Trade often require viability assessments for fund approvals or industrial park access.

FDI Magnet & Self-Reliance Enabler

International investors and joint venture partners demand more than ambition; they demand clarity, reliability, and performance forecasts. TEV studies, with their detailed financial and technical modeling, offer the kind of transparency and professionalism that draws in FDI and builds trust in cross-border collaborations.

Simultaneously, for Indian firms aiming to reduce import dependency and localise their supply chains, TEV helps design resilient, efficient systems that lower input costs and increase self-reliance. It’s a strategic anchor for the Atmanirbhar Bharat vision.

Scaling with Smarts, Competing with Confidence

In a landscape where scaling too fast can be as dangerous as scaling too slow, TEV guides businesses through the growth puzzle. It helps identify:

- What to scale

- When to scale

- How to manage scale efficiently without destroying margins

Whether you’re a mid-cap expanding into a new region or a startup transitioning from prototype to production, a TEV study strengthens your case to stakeholders, especially when packaged alongside custom business plans for funding and regulatory pitch decks.

The Bigger Picture: Why TEV Is Strategic, Not Just Technical

Let’s be clear, a TEV study is not a checklist for bank loans.

It’s not a bureaucratic hoop to jump through.

It’s a strategic lens.

In a volatile manufacturing ecosystem, TEV enables firms to see around corners. It reveals not just whether a project is viable today, but whether it will adapt, survive, and thrive under pressure five years from now.

It’s the Foundation of Resilience

Manufacturing is capital-intensive and infrastructure-heavy. You don’t get many second chances. A TEV study forces you to confront every assumption about cost, capability, demand, and competition. This preemptive insight turns risk into readiness.

That’s why forward-looking firms partner with valuation-driven consultants to bake strategic foresight into every financial and technical forecast. Because when market dynamics shift, and they will, those with TEV-backed clarity will be the ones who pivot fast and win big.

Future-Proofing, Not Just Forecasting

The real value of TEV lies in its ability to safeguard your future bets. It encourages scenario-building, stress-testing, and innovation planning. In a world where technology evolves faster than machinery can depreciate, TEV helps you choose platforms, processes, and products that won’t age out in 18 months.

In short, TEV isn’t about validating what you want to do. It’s about preparing for what might come next.

Case for TEV: India’s Manufacturing Boom & Complexity

India’s manufacturing sector is no longer just an engine of economic output — it’s the country’s strategic launchpad for global competitiveness. According to the Economic Survey 2023–24, the sector grew at an average rate of 5.2% over the last decade, contributing significantly to GDP, job creation, and exports.

But with growth comes complexity.

The Rise of Complex, High-Stakes Projects

Today’s manufacturing projects involve:

- Cutting-edge automation

- Global supply chain integration

- Sustainability benchmarks

- Aggressive financial structuring

This means a higher chance of technical mismatches, cost overruns, and regulatory pitfalls. And unlike earlier decades, the margin for error is thinner. That’s why structured assessments like TEV have become a business imperative.

Reducing Project Failure Through TEV

Many project failures in India happen not due to execution flaws but due to bad planning, overestimated demand, underestimated costs, or overlooked technical constraints.

A TEV study acts like a pressure test before launch, forcing every assumption to pass through filters of feasibility and fiscal logic. Manufacturers that embed TEV early into their project planning are proven to:

- Reduce failure rates,

- Speed up funding approvals,

- Win regulatory nods faster,

- Unlock long-term cost savings.

It’s no surprise, then, that many mid-size and emerging manufacturing firms are now seeking external TEV consultants who can bring both valuation expertise and sector-specific insights, like the team at Marcken Consulting.

Conclusion

In a high-stakes manufacturing environment, where one wrong assumption can derail months of work and crores in investment, Techno-Economic Viability (TEV) is not just useful, it’s indispensable.

From early risk detection and smarter capital deployment to faster funding, regulatory clarity, and market-aligned strategy, TEV offers a full-spectrum advantage to Indian manufacturing firms. It enables manufacturers to build technically feasible projects, financially resilient and strategically positioned for growth.

TEV isn’t just a box-tick; it’s the blueprint for scalable success.

If you’re planning a new manufacturing unit, expansion, or pitching for funds, 8 get ahead with a TEV study backed by Marcken Consulting’s industry expertise.

Reach out to our experts today for tailored TEV consultations and unlock smarter, future-ready project planning.

Frequently Asked Questions (FAQs)

Yes, in most cases. Banks and financial institutions typically require a TEV report when evaluating high-capex or greenfield manufacturing projects. It helps them assess both risk and repayment potential. If you’re seeking funding, a bankable TEV report could significantly improve your chances of approval.

The duration varies depending on the complexity of the project. On average, a TEV study may take 3 to 6 weeks. Projects involving multiple sites or regulatory clearances may take longer due to field visits and stakeholder consultations.

While large enterprises may involve internal teams for data collation, external consultants, especially those with domain expertise in valuation and regulatory compliance, are usually brought in for objective assessments. Firms like Marcken Consulting provide sector-specific TEV services that banks and investors recognise.

A feasibility study is broader and often preliminary; it examines whether a project can be done.

A TEV study is more detailed and investment-ready; it evaluates whether the project should be done, factoring in technical fit, financial viability, market demand, and long-term sustainability. TEV often builds on a feasibility study to refine investment decisions.

Absolutely. For startups seeking seed funding or scale-up capital, TEV studies can:

- Validate the business model

- Prove market readiness

- Justify capital requirements

- Build trust with VCs and banks.

TEV is especially powerful when paired with a well-structured business valuation to showcase both vision and value.