Table of Contents

ToggleIntroduction

If you are a founder, chances are you have already encountered the terms “409A valuation” and “investor valuation.” At first glance, they sound similar; both talk about what your company is “worth.” But in reality, they serve very different purposes. This confusion often leaves startup leaders uncertain about which valuation they actually need and when.

For Indian startups, the distinction is particularly important. While an investor valuation is almost inevitable during fundraising, a 409A valuation enters the picture only when there are U.S. compliance requirements or global expansion plans. Understanding the difference is not just a technical detail; it directly impacts how you issue stock options, stay compliant with regulators, and attract capital without unnecessary risks.

This blog breaks down the essentials: what a 409A valuation really means, how it differs from an investor valuation, and how to know which one applies to your startup at different stages of growth.

What Is a 409A Valuation?

A 409A valuation is an independent, third-party assessment of the fair market value (FMV) of a startup’s common stock. It is mandated under Section 409A of the U.S. Internal Revenue Code, which sets the framework for deferred compensation, including stock options.

The main purpose of a 409A valuation is to establish the strike price of employee stock options (ESOPs) in a way that is defensible to tax authorities. Without it, companies risk running afoul of U.S. tax regulations, an error that can trigger severe penalties for both the company and its employees.

Why does this matter? Because the IRS expects stock options to be issued at or above fair market value. If they are not, employees may face immediate taxation and even additional penalties. A defensible 409A valuation acts as a shield against these risks, ensuring that your ESOP program is compliant and fair.

For most purely domestic Indian startups, a 409A valuation is not a legal necessity. However, it becomes crucial in specific scenarios:

- U.S. Holding/Subsidiary: If your startup has a U.S.-registered parent or child entity.

- U.S. Employees: If you employ U.S. citizens or residents.

- Global ESOP Programs: If you plan to grant stock options across borders under international incentive schemes.

- U.S. Market Expansion: If you are preparing to enter the U.S. market or raise funds from U.S.-based investors.

In these cases, a 409A valuation is not just best practice; it is mandatory for compliance. For startups with global ambitions, it ensures a solid foundation for issuing stock options and protects the company from regulatory pitfalls down the line.

What Is an Investor Valuation?

An investor valuation is the price of your company as determined during a fundraising round, typically with venture capitalists, angel investors, or private equity funds. Unlike a 409A valuation, this is not a compliance exercise. Instead, it reflects what external investors are willing to pay for a stake in your business at a given point in time.

Investor valuations are usually tied to the issuance of preferred shares, which come with special rights and privileges such as liquidation preferences, anti-dilution protection, or voting rights. The valuation is heavily influenced by negotiation between founders and investors, and it considers not only your company’s current performance but also its future growth potential.

This figure matters because it drives:

- Fundraising outcomes – How much capital you can raise, and at what dilution.

- Deal-making leverage – The terms you can negotiate in venture or M&A discussions.

- Market perception – How investors, employees, and future partners view your company’s worth.

Unlike a 409A valuation, an investor valuation is not used for ESOP strike pricing or tax compliance. Instead, it acts as a market signal: a snapshot of what investors believe your company could achieve, not what it is worth today under accounting or regulatory standards.

Key Differences Between 409A and Investor Valuation

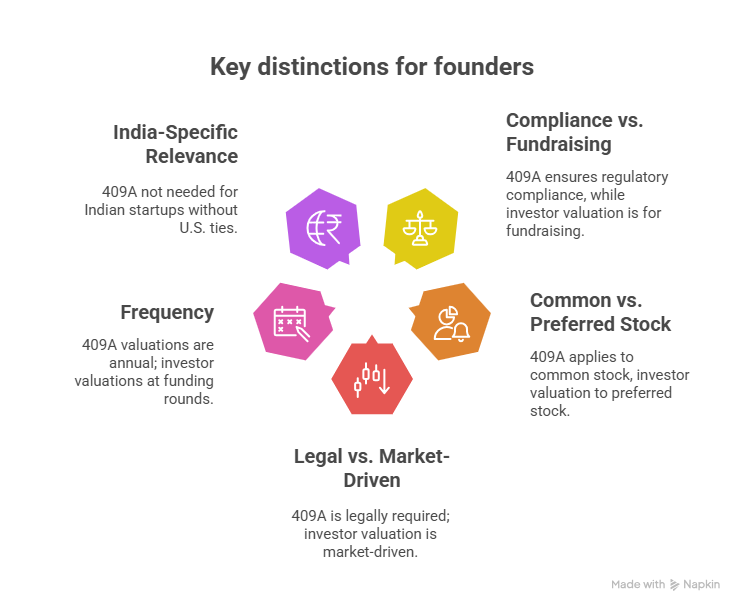

While both valuations address the question of “what is my company worth?”, they serve very different purposes. A 409A valuation ensures legal and tax compliance, while an investor valuation sets the price of entry for external capital.

Here are the major distinctions every founder should understand:

Compliance vs. Fundraising:

- 409A is designed for regulatory compliance with U.S. tax law.

- Investor valuation is a fundraising mechanism negotiated with VCs and angels.

Common Stock vs. Preferred Stock:

- 409A applies to common stock (used in ESOPs).

- Investor valuation applies to preferred stock (issued during funding rounds).

Legal Necessity vs. Market-Driven:

- 409A is legally required for companies with U.S. ties.

- Investor valuation is market-driven and optional, but practically unavoidable when raising capital.

Frequency

- 409A valuations must be updated annually or after significant corporate events.

- Investor valuations occur at each funding round.

India-Specific Relevance:

- Indian startups without a U.S. presence generally do not need a 409A.

- Investor valuation is essential for any company raising capital, whether in India or internationally.

Quick Comparision table

Feature | 409A Valuation | Investor Valuation |

Purpose | IRS/tax & ESOP compliance | Fundraising and deal-making |

Required by | U.S. law (for U.S. entity/ESOPs) | Investors (VCs, angels, PE firms) |

Applies to | Common stock (employee stock options) | Preferred shares (fundraising rounds) |

Frequency | Annual or after major events (merger, funding) | At each funding round |

India Relevance | Needed only if U.S. presence or cross-border ESOP | Required for raising capital anywhere |

When Does Your Startup Really Need Each?

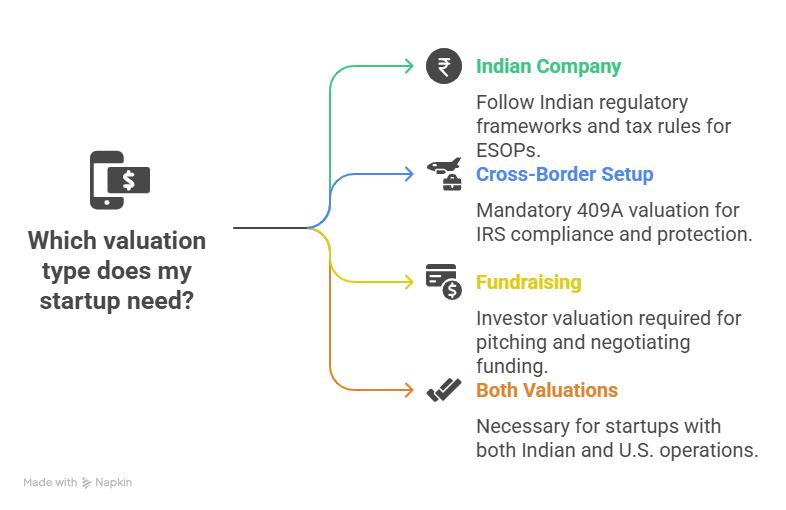

The decision between a 409A valuation and an investor valuation is not an either-or scenario; it depends on your company’s structure, growth stage, and strategic goals.

- Purely Indian Company with Indian Employees:

If your business is incorporated in India, operates solely within India, and employs only Indian staff, a 409A valuation is not necessary. Instead, you would follow Indian regulatory frameworks and tax rules for ESOPs, which have their own valuation requirements under the Income Tax Act and Companies Act. - Cross-Border Setup (U.S. Entity, U.S. Staff, or Global ESOPs):

The moment your company establishes a U.S. holding/subsidiary, hires U.S. employees, or extends stock option programs internationally, a 409A valuation becomes mandatory. This ensures compliance with IRS rules and protects both the company and its employees from heavy tax penalties. - Fundraising (Domestic or International):

Regardless of jurisdiction, when you are pitching to investors or negotiating a funding round, an investor valuation is always required. This valuation sets the terms of the deal, drives capital inflows, and shapes market perception of your startup’s potential. - Real-World Scenario – Needing Both:

Many scaling Indian startups eventually require both valuations. For example, a Bengaluru-based SaaS company may raise capital from Indian VCs (requiring an investor valuation) while also setting up a Delaware parent entity to attract U.S. clients and employees (triggering the need for a 409A valuation). Recognizing this dual requirement early can help founders avoid compliance gaps and be investor-ready on both fronts.

Common Misconceptions Founders Have

Despite the importance of both valuation types, misconceptions often cloud founder decision-making. Here are the three most common myths:

- “Investor Valuation Replaces 409A Valuation.”

Not true. An investor valuation reflects the price of preferred shares, while a 409A valuation determines the fair market value of common stock for compliance. One cannot substitute for the other. - “A 409A Valuation Increases Fundraising Value.”

Another misconception. A 409A valuation is designed for regulatory compliance, not for negotiation with investors. In fact, 409A valuations are often more conservative than investor valuations, since they are grounded in present fair market value rather than projected growth. - “Indian-Only Startups Never Need a 409A Valuation.”

While this may be true in the early stages, it changes once a startup expands globally. Any U.S. entity, U.S. staff, or international ESOP program will trigger the need for a 409A valuation, regardless of where the company originated.

By clearing up these misconceptions, founders can make more informed decisions about when to engage valuation experts and how to align compliance with fundraising goals.

Conclusion

At their core, 409A and investor valuations are designed for very different purposes. A 409A valuation ensures compliance with U.S. tax laws and provides a defensible strike price for ESOPs, while an investor valuation determines how much capital you can raise and at what dilution.

For Indian startups, the right choice depends on business goals and geography. If you are operating locally with no U.S. footprint, investor valuation is your immediate concern. But if you are expanding internationally, issuing stock options globally, or setting up a U.S. entity, a 409A valuation becomes non-negotiable.

Ultimately, many successful startups will need both at different stages. The key is to understand the distinction, plan, and avoid costly compliance mistakes while still maximizing your fundraising potential.

Frequently Asked Questions (FAQs)

Failing to conduct a 409A valuation when required can expose your startup and employees to IRS penalties, including immediate taxation on stock options and additional penalties for non-compliance.

No. Investor valuation reflects the price of preferred shares and cannot be used to set ESOP strike prices. ESOPs must be priced based on the fair market value determined by a 409A (or equivalent local) valuation.

At least once every 12 months or whenever a significant corporate event occurs, such as a new funding round, merger, or major acquisition.

No. Indian regulators do not require 409A valuations. However, if your company has a U.S. presence, hires U.S. employees, or offers international ESOPs, a 409A valuation becomes mandatory under U.S. law.

Yes. Many professional advisory firms offer both 409A and investor valuations. However, it is important to choose a firm with expertise in cross-border compliance to ensure both regulatory accuracy and investor credibility.