In India’s fast-evolving business and investment landscape, understanding what a company is truly worth isn’t just important, it’s essential. Whether you’re an investor navigating the stock markets, a financial analyst drafting reports, a startup founder seeking funding, or a business owner planning a strategic exit, equity valuation is the foundation upon which smart decisions are built.

At its core, equity valuation helps answer a crucial question: What is the fair value of a company’s shares? And while there are several techniques used across the financial world, two primary approaches dominate both global and Indian valuation practices, the Market Approach and the Income Approach.

Table of Contents

ToggleWhat Is Equity Valuation?

Equity valuation is the process of determining the current worth of a company’s shares. Think of it as a financial x-ray, it helps you see beyond surface-level figures and understand what a business is truly worth based on either how similar companies are priced (market-driven) or how much money it can generate in the future (cash flow-driven).

This process plays a pivotal role in a wide range of scenarios: making informed investment choices, evaluating mergers and acquisitions, determining share prices for IPOs, or even settling legal and regulatory matters. In short, equity valuation is not just about numbers—it’s about perspective, strategy, and foresight.

The Two Primary Types of Equity Valuation

When it comes to valuing a company’s equity, financial professionals typically turn to two major schools of thought: the Market Approach and the Income Approach. While both aim to estimate a company’s share value, they differ significantly in how they get there.

Valuation Approach | Also Known As | Basis of Valuation | Best For |

Market Approach | Relative Valuation | Comparison with industry peers | Quick assessments, benchmarking |

Income Approach | Intrinsic Valuation | Future earning potential | In-depth analysis, long-term investments |

The Market Approach looks outward, basing the value of a company on how similar firms are priced in the market. The Income Approach, in contrast, looks inward, focusing on the company’s potential to generate cash in the future. Both are widely used in India, depending on the context, industry, and availability of data.

Type 1: Market Approach (Relative Valuation)

The Market Approach, also known as Relative Valuation, is one of the most widely used methods for estimating a company’s worth. It works by comparing the target company to similar publicly traded companies in the same industry, using valuation multiples derived from their financial metrics. This approach assumes that if companies are alike in size, sector, and performance, they should also be similarly valued by the market.

Rather than calculating value from the ground up, it leverages existing market data, making it a faster and more accessible tool for investors and analysts.

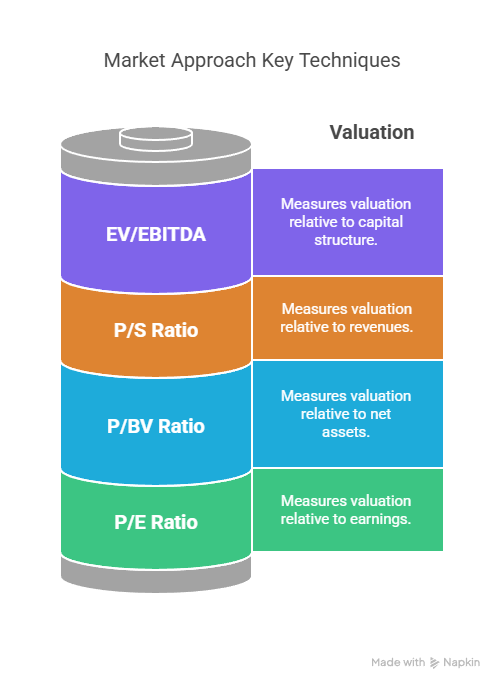

Key Techniques

- Price-to-Earnings (P/E) Ratio

This ratio compares a company’s share price to its earnings per share (EPS). If a company’s EPS is ₹10 and similar peers are trading at a P/E of 20, then the implied share price is ₹200. This is especially useful for comparing companies within the same sector.

2. Price-to-Book Value (P/BV) Ratio

Useful for sectors like banking and infrastructure, the P/BV compares a company’s market price to its book value (net asset value). A P/BV below 1 could signal undervaluation—common in asset-heavy industries in India.

3. Price-to-Sales (P/S) Ratio

This ratio compares the share price to revenues. It’s valuable for evaluating companies that have low or negative earnings but strong sales figures—common among early-stage tech firms and startups in India.

4. Enterprise Value to EBITDA (EV/EBITDA)

EV/EBITDA adjusts for capital structure and helps compare companies with differing levels of debt. This multiple is widely used in private equity and investment banking in India.

How It’s Used in India

In the Indian market, especially among NSE and BSE-listed companies, analysts routinely perform peer group analysis to derive fair value estimates. For example, if the average P/E ratio for mid-cap IT companies is 25x and your company reports ₹8 EPS, then the estimated fair price would be ₹200 (₹8 × 25).

This method is heavily favored in IPO pricing, stock broking reports, and equity research. It also aligns well with the real-time nature of Indian equity markets, where investor sentiment can drive swift price movements.

Advantages

- Fast and Easy to Use: Requires readily available data from listed peers.

- Reflects Current Market Sentiment: Captures how the market views similar businesses.

- Ideal for Benchmarking: Helps compare a company’s financial metrics to sector averages.

Limitations

- Depends on Comparable Companies: The method falls short when no true peers exist.

- Prone to Market Distortions: Speculation, hype, or market crashes can skew valuations.

- Not Future-Focused: Does not account for future cash flow potential or strategic plans.

Type 2: Income Approach (Intrinsic Valuation)

The Income Approach, also known as Intrinsic Valuation, estimates a company’s worth by analyzing its ability to generate cash or earnings in the future. Unlike the Market Approach, which compares against external peers, the Income Approach builds valuation from within—using projections, financial assumptions, and discounting techniques to assess the present value of future benefits.

This method is ideal for investors and analysts focused on long-term value, particularly when the market price does not reflect the company’s true earning potential.

Key Techniques

- Discounted Cash Flow (DCF)

DCF is the cornerstone of intrinsic valuation. It involves projecting a company’s free cash flows over a period (typically 5–10 years) and discounting them to present value using a discount rate, often the Weighted Average Cost of Capital (WACC).

Formula:

Where:

- FCFₜ = Free Cash Flow in year t

- r = Discount rate (e.g., 10%)

- TV = Terminal Value

- n = Final forecast year

2. Earnings Yield Method

This method estimates the value of equity by applying a required rate of return to projected earnings.

Formula:

If a company is expected to earn ₹25 crore and the investor requires a 10% return, the implied value would be ₹250 crore.

How It’s Used in India

The Income Approach is particularly effective in valuing private companies, startups, or listed firms with stable cash flows. For instance, suppose an Indian FMCG company is projected to generate free cash flows of ₹100 crore annually for five years, and the appropriate discount rate is 10%. The present value of these cash flows (excluding terminal value) would be calculated using the DCF formula, yielding an intrinsic value estimate.

This method is frequently used in regulatory filings, startup fundraising, and merger/acquisition due diligence, especially when market-based data is scarce or distorted.

Advantages

- Fundamental-Focused: Based on the company’s actual earning power.

- Long-Term Oriented: Ideal for investors seeking intrinsic, not speculative, value.

- Customisable: Allows for scenario-based analysis (e.g., conservative vs. aggressive forecasts).

Limitations

- Highly Sensitive to Assumptions: Small changes in growth rate or discount rate can drastically affect the outcome.

- Requires Detailed Financial Projections: Often difficult to obtain or unreliable for early-stage firms.

- Less Useful for Volatile Businesses: Inconsistent cash flows can lead to misleading valuations.

Comparative Table

Aspect | Market Approach | Income Approach |

Also Known As | Relative Valuation | Intrinsic Valuation |

Based On | Peer performance | Future cash flows |

Common Methods | P/E, P/BV, EV/EBITDA | DCF, Earnings Yield |

Best For | Quick comparisons | Long-term analysis |

Limitation | Market inefficiencies | Forecast sensitivity |

Which Method Should You Use?

Choosing between the Market Approach and the Income Approach depends on several factors—industry type, data availability, stage of the business, and the objective of the valuation.

When the Market Approach Works Best:

- Listed Companies: Especially in sectors with lots of active comparables, such as IT, banking, and FMCG.

- IPO Valuation: Where benchmarking against peer performance is critical.

- Time-Sensitive Decisions: When you need a quick snapshot based on current market sentiment.

When the Income Approach is Ideal:

- Startups and Unlisted Firms: Where market comparables don’t exist or are unreliable.

- Long-Term Investors and Acquirers: Who are more interested in intrinsic value and future cash flow potential.

- Stable, Mature Businesses: With predictable revenue streams, like infrastructure, utilities, or established manufacturing.

Why Not Use Both?

Many valuation professionals combine both methods to get a more balanced picture. For instance, a DCF valuation might show a company’s intrinsic worth, while a market multiple check ensures that it’s not completely out of line with industry benchmarks. This hybrid approach helps validate assumptions, reduce bias, and create a more robust valuation model, especially useful in Indian markets where data quality and volatility can vary widely.

Conclusion

Understanding both the Market Approach and the Income Approach is essential for anyone involved in financial decision-making, be it a startup founder, investor, analyst, or corporate executive. Each method offers a distinct lens through which to evaluate a company’s worth, and knowing when to use which can significantly influence outcomes.

Ultimately, the best valuation method is the one that aligns with your purpose, context, and available information. Whether you’re benchmarking against competitors or estimating intrinsic value for an acquisition, applying the right method—or a blend of both—can lead to smarter, data-driven decisions.

Get the Best Valuation Report From Expert Marcken Consulting.

Frequently Asked Questions (FAQs)

Equity valuation is the process of determining the value of a company’s shares. It’s important because it helps investors make informed decisions, enables business owners to raise capital, supports mergers and acquisitions, and is required for regulatory compliance in India.

The two primary types are:

- Market Approach (Relative Valuation): Values a company based on how similar companies are priced in the market.

- Income Approach (Intrinsic Valuation): Values a company based on its projected future cash flows or earnings, discounted to present value.

For startups in India, the Income Approach (especially Discounted Cash Flow or DCF) is usually preferred. This is because market comparables may not be available or relevant, and DCF focuses on the company’s future potential rather than current market sentiment.

The DCF method estimates future free cash flows over a set period, then discounts them back to present value using an appropriate discount rate (often the company’s cost of capital). A terminal value is also included to account for cash flows beyond the forecast period.

Yes, combining both methods can offer a more balanced and accurate valuation. While the Market Approach reflects current sentiment, the Income Approach captures long-term potential. Many Indian valuation professionals use both to cross-validate results.