Table of Contents

ToggleIntroduction: Why Business Valuation Reports Matter

A business valuation report is more than just a numerical estimate of a company’s worth—it is a strategic financial document with far-reaching implications. In India, valuation reports are often required for compliance with corporate laws, taxation regulations, and foreign exchange norms. They also serve as critical tools during investment rounds, mergers and acquisitions, restructuring, and strategic planning.

Given their role in high-stakes transactions, these reports must be prepared with accuracy, independence, and in accordance with legal standards. However, not every professional is permitted to issue a business valuation report for all purposes. Depending on the transaction and the applicable legislation, Indian law recognises different categories of professionals for valuation certification.

This blog provides a clear and detailed overview of who is authorised to issue valuation reports in India, and why choosing the right type of valuer is essential to ensuring legal validity, regulatory acceptance, and stakeholder confidence.

2. Regulatory Framework Governing Valuation Reports in India

India’s legal framework for business valuation is purpose-driven. This means that the eligibility of a professional to issue a valuation report depends on why the valuation is being conducted and under which regulation. The principal regulatory authorities involved in this framework include:

- The Ministry of Corporate Affairs (MCA) under the Companies Act, 2013

- The Securities and Exchange Board of India (SEBI)

- The Income Tax Department under the Income Tax Act, 1961

- The Reserve Bank of India (RBI) under the Foreign Exchange Management Act (FEMA)

Each of these regulatory domains stipulates specific requirements for valuation professionals. For instance:

- Under the Companies Act, 2013, only Registered Valuers recognised by the Insolvency and Bankruptcy Board of India (IBBI) can issue reports for statutory purposes such as mergers, private placements, and share swaps.

- For income tax purposes, particularly when using the Discounted Cash Flow (DCF) method, the SEBI-registered Merchant Banker is the authorised issuer.

- Under FEMA, both SEBI-registered Merchant Bankers and Chartered Accountants (CAs) may issue reports for transactions involving foreign direct investments or FCGPR filings.

3. Registered Valuers under the Companies Act, 2013

The Companies Act, 2013, introduced a formal regulatory mechanism for valuations through Section 247, which mandates that any valuation required under the Act must be conducted by a Registered Valuer. These professionals play a crucial role in ensuring that valuations are accurate, independent, and compliant with legal standards.

Who is a Registered Valuer?

A Registered Valuer is a professional who has been accredited by the Insolvency and Bankruptcy Board of India (IBBI) after meeting rigorous eligibility criteria. These include qualifications, relevant experience, completion of a valuation examination, and registration with a Recognised Registered Valuer Organisation (RVO).

Registered Valuers are obligated to follow the Valuation Standards notified by the IBBI, which ensures uniformity, objectivity, and transparency in the valuation process.

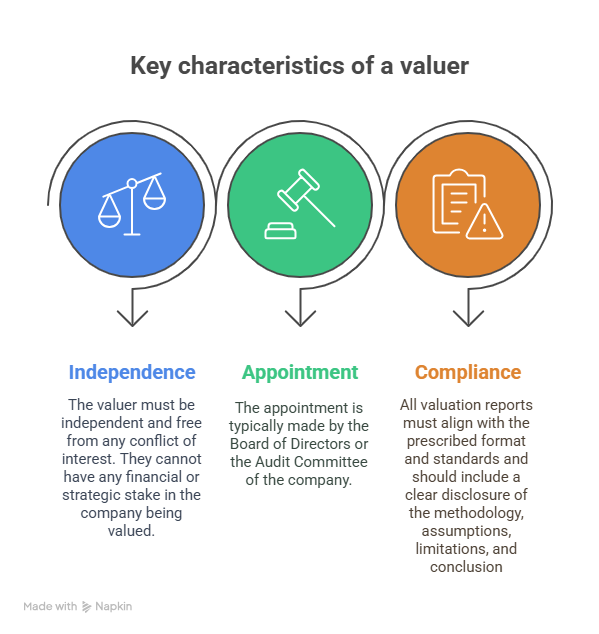

Key Characteristics

Independence: The valuer must be independent and free from any conflict of interest. They cannot have any financial or strategic stake in the company being valued.

Appointment: The appointment is typically made by the Board of Directors or the Audit Committee of the company.

Compliance: All valuation reports must align with the prescribed format and standards and should include a clear disclosure of the methodology, assumptions, limitations, and conclusion.

Common Scenarios Requiring a Registered Valuer

Registered Valuers are essential for the following transactions under the Companies Act:

- Preferential Allotment of Shares (Private Placement)

- Mergers, Demergers, or Business Restructuring

- Issue or Transfer of Shares to Related Parties

- Buy-Back of Securities

- ESOP Valuations

- Valuation of Assets in Corporate Insolvency Proceedings

Engaging a Registered Valuer ensures that the valuation report is legally valid, auditable, and accepted by regulatory authorities such as the Ministry of Corporate Affairs and the National Company Law Tribunal (NCLT).

4. SEBI-Registered Merchant Bankers for Income Tax Valuations

In India, valuations conducted for income tax purposes, particularly those using the Discounted Cash Flow (DCF) method, are governed by the Income Tax Act, 1961, specifically Section 11UA. In these cases, the law stipulates that only a Merchant Banker registered with the Securities and Exchange Board of India (SEBI) is authorized to issue a valid valuation report.

Applicability of SEBI-Registered Merchant Bankers

Merchant Bankers are financial professionals and institutions regulated by SEBI and are authorised to perform valuations when:

- A company is issuing shares to investors and must determine the Fair Market Value (FMV) for taxation purposes.

- There is a transfer of shares where the FMV must be determined to calculate capital gains or other tax liabilities.

- The valuation involves equity infusion by foreign or domestic investors, requiring FMV documentation.

The use of the DCF method—a forward-looking, cash flow-based approach—is common in these scenarios and requires deep financial modelling expertise. The Income Tax Act permits only SEBI-registered Merchant Bankers to perform this method, given its complexity and sensitivity to assumptions.

Key Responsibilities and Standards

- Valuation Methodology must be clearly explained and justified in the report.

- The assumptions, projections, and discount rates used must be supported by rational documentation.

- The report should be dated and signed by the authorised representative of the Merchant Banker and submitted as part of tax filings or regulatory disclosures.

Regulatory Importance

- Income tax authorities, particularly during assessments or audits, will only accept a valuation report issued by a SEBI-registered Merchant Banker if the DCF method is applied. Using any other professional or unauthorised person could lead to non-acceptance of the report, additional tax liabilities, or penalties.

5. Chartered Accountants for Specific Foreign Transactions

When it comes to foreign investments, cross-border transactions, or regulatory filings under the Foreign Exchange Management Act (FEMA) and the Reserve Bank of India (RBI), the rules around who can issue a business valuation report become more flexible, but still precise.

In such cases, valuation reports are required for compliance with procedures like:

- FCGPR filings (Foreign Currency-Gross Provisional Return) are required when a company receives foreign direct investment and issues shares to non-residents.

- Transfer of shares between residents and non-residents.

- Pricing guidelines verification under FEMA regulations.

Who Is Eligible?

For these purposes, the valuation report can be issued by either:

- A SEBI-registered Merchant Banker, or

- A Chartered Accountant (CA), provided they meet certain qualifications and follow RBI’s accepted valuation methodologies.

However, for the report to be legally robust and regulator-accepted, the CA must:

- Demonstrate experience in business valuation and understanding of international investment norms.

- Follow internationally accepted methods like the Net Asset Value (NAV) method or the DCF method, as prescribed under FEMA guidelines.

Ensure that the valuation is aligned with the RBI’s pricing norms and is backed by documentation.

Important Caveat

While CAs can issue valuation reports for foreign investment purposes, they cannot issue reports required under the Companies Act, 2013, unless they are also IBBI-registered valuers. This distinction is critical when evaluating compliance for domestic versus cross-border transactions.

6. Summary Table – Who Can Issue What, and When?

To simplify regulatory requirements, here is a consolidated view of who is authorised to issue a Business Valuation Report in India, based on the specific use case or governing legislation

Purpose / Regulation | Who Can Issue the Valuation Report |

Companies Act, 2013 | Registered Valuer (must be registered with IBBI) |

Income Tax Act (DCF method, Section 11UA) | SEBI-Registered Merchant Banker |

FEMA / RBI (e.g., FCGPR filings, foreign funds) | SEBI-registered merchant Banker or Chartered Accountant |

General advisory or consulting (non-statutory) | Chartered Accountant (not valid for statutory compliance) |

This summary offers a quick compliance reference for businesses, advisors, and investors. It is vital to choose the correct category of valuer depending on your transaction’s regulatory context. A misstep here could result in non-compliance, delayed filings, or even regulatory penalties.

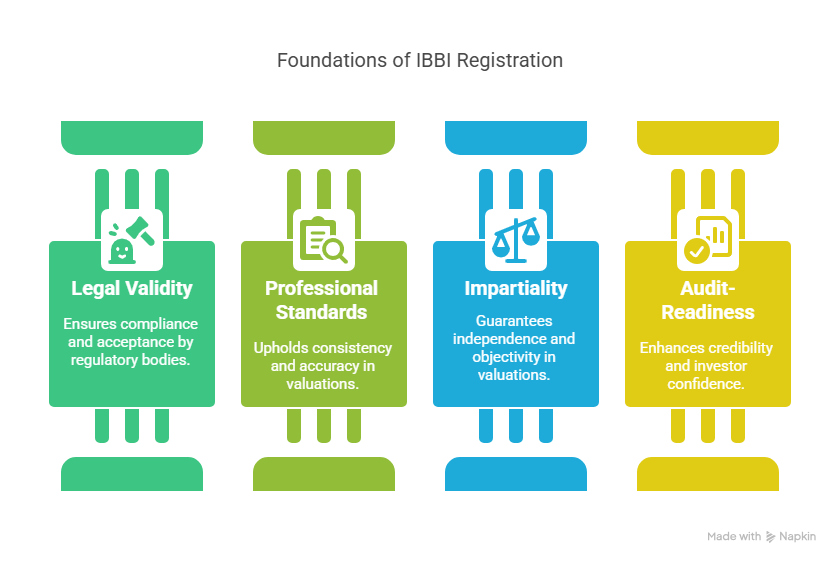

7. Why IBBI Registration Matters

The Insolvency and Bankruptcy Board of India (IBBI) serves as the apex authority governing registered valuers under the Companies Act, 2013. Choosing an IBBI-registered valuer is not just a legal requirement in many cases—it is a mark of credibility, independence, and professional rigour.

This summary offers a quick compliance reference for businesses, advisors, and investors. It is vital to choose the correct category of valuer depending on your transaction’s regulatory context. A misstep here could result in non-compliance, delayed filings, or even regulatory penalties.

Frequently Asked Questions (FAQs)

Only professionals registered as Registered Valuers with the IBBI, SEBI-registered Merchant Bankers, or in some specific cases, Chartered Accountants can issue business valuation reports—depending on the regulatory requirement.

A Registered Valuer is a professional recognized by the Insolvency and Bankruptcy Board of India (IBBI) to carry out valuations mandated under the Companies Act, 2013. They are required for transactions like mergers, demergers, and preferential allotments.

Yes, but only for non-statutory purposes or in certain FEMA/RBI filings. For Companies Act valuations, the CA must also be a Registered Valuer under IBBI to be legally valid.

They are mandatory when the Discounted Cash Flow (DCF) method is used under Section 11UA of the Income Tax Act, especially in cases of share issuances or transfers.

Such a report may not be accepted by regulatory authorities and could lead to non-compliance penalties or rejection of filings such as FCGPR, M&A approvals, or capital restructuring documentation.