Table of Contents

ToggleI Introduction: The Rise of Intangible Value

In today’s digital-first economy, a company’s real worth is often hidden in intangible assets you can’t see—its software, brand equity, customer data, and intellectual property. These assets don’t show up in the same way as buildings or machinery, but they often hold more strategic and financial value, especially for tech, media, and knowledge-based businesses.

Whether you’re navigating a merger, raising capital, preparing financial statements, or undergoing tax scrutiny, valuing intangible assets has become a strategic imperative. This is particularly critical for Indian companies in technology, pharmaceuticals, education, and media, where intangibles often drive the lion’s share of enterprise value.

This guide provides a practical, India-specific breakdown of major types of intangible assets and the most suitable valuation methods for each, aligned with regulatory frameworks and global best practices.

II. What Are Intangible Assets?

Intangible assets are identifiable, non-monetary, non-physical assets that hold long-term economic value. Unlike physical assets like machinery or buildings, they represent intellectual and reputational capital, often more powerful than tangible assets in driving business success.

Common Examples

- Brand Names

- Software and Applications

- Patents and Copyrights

- Customer Relationships

- Trademarks and Trade Secrets

- Franchise Rights

- Licenses and Regulatory Permits

- Goodwill

III. Why Valuing Intangible Assets Is Crucial

Intangible assets are often the most significant value drivers in today’s business landscape, especially for knowledge-intensive and tech-forward enterprises. Valuing these assets isn’t just a compliance requirement; it’s a strategic necessity across multiple business scenarios:

Regulatory Angle in India

Valuation and accounting of intangible assets in India are governed by a combination of domestic and international standards:

- Companies Act, 2013: Recognizes and governs accounting treatment for intangibles in corporate reporting.

- Ind AS 38 (Intangible Assets): Prescribes criteria for recognition, measurement, and amortization.

- SEBI Regulations: Applicable to listed entities for disclosure and transaction-related valuation.

- Income Tax Act, 1961: Relevant for transfer pricing, especially for cross-border IP transfers or intra-group service arrangements.

1. Mergers & Acquisitions

Accurate valuation of intangible assets ensures that the purchase price reflects the true value of the target company. It informs goodwill allocation, purchase price allocation (PPA), and helps assess synergy potential.

2. Start-Up Fundraising

For startups, especially in SaaS, fintech, biotech, and media, intangible assets often constitute nearly 100% of enterprise value. Investors require reliable valuation to justify funding, dilution, and growth projections.

3. Financial Reporting

Under Indian Accounting Standards (Ind AS), especially Ind AS 103 and Ind AS 36, companies must perform fair value accounting and impairment testing of intangible assets as part of post-transaction reporting or during annual audits.

4. Litigation & IP Disputes

In cases involving IP infringement, shareholder disputes, or commercial damages, a credible valuation of intangible assets helps quantify losses, support arbitration, or strengthen legal positions.

5. Strategic Planning and Monetization

Valuation helps businesses unlock revenue through licensing, franchising, or securitization of intangibles, while also guiding decisions around innovation, M&A strategy, and capital allocation.

IV. 10 Major Types of Intangible Assets and Their Valuation Methods

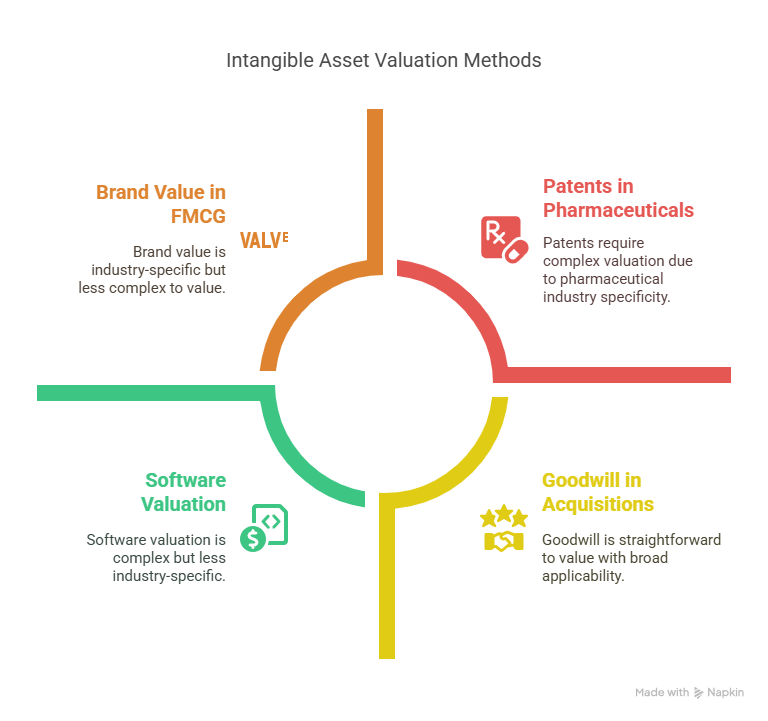

1. Brand Value

Brand value represents the commercial worth of a company’s name, reputation, and market recognition. In industries like FMCG, financial services, and luxury goods, brands drive customer loyalty and premium pricing.

Common valuation methods include the Relief from Royalty method, where the hypothetical royalty payments saved by owning the brand are calculated. Another approach is the Income Approach, which attributes a portion of future business earnings to the brand’s strength. In cases where transaction data exists, market comparables are used to benchmark brand valuations against similar brand sales.

The choice of method often depends on the brand’s maturity, availability of royalty benchmarks, and access to earnings data.

2. Application / Software

Proprietary software and applications, whether commercial SaaS platforms or internal IT tools, form critical intangible assets, especially for technology-driven businesses. In valuation, software is often assessed using the Multi-Period Excess Earnings Method (MPEEM), which isolates the cash flows attributable to the software after accounting for returns on other assets.

For internal-use software, the Cost to Recreate method is used, estimating the cost and time required to build a similar tool from scratch. If the software is commercially licensed, the Relief from Royalty method applies by estimating licensing income avoided through ownership.

The method selection depends on whether the software is monetized directly or supports broader business operations.

3. Patent

Patents protect inventions, processes, or technologies and are vital assets in pharmaceuticals, biotechnology, and industrial manufacturing. Patents are often valued using the Income Approach, where future revenues expected from the patent’s use or licensing are discounted to present value.

Alternatively, the Relief from Royalty method may be applied, particularly for patented technologies with established licensing benchmarks. For early-stage patents or those under development, a Real Options Model helps account for uncertainty and multiple development outcomes.

The stage of the patent—whether commercialised or still in R&D—largely determines the valuation method.

4. Goodwill

Goodwill arises in business acquisitions when the purchase price exceeds the fair value of the acquired company’s net assets. It reflects non-quantifiable advantages such as reputation, employee talent, customer relationships, and synergies.

Post-acquisition, goodwill is derived using the Residual Method, which deducts the fair value of identifiable assets from the transaction price. Over time, companies are required to test goodwill for impairment, typically using an Income Approach that estimates the present value of future earnings for the cash-generating unit.

Goodwill is only valued in the context of acquisitions and must be monitored annually for impairment as per Ind AS 36.

5. Trademark

Trademarks are legally registered brand identifiers such as logos, symbols, and taglines. They are commonly found in consumer-facing sectors such as fashion, cosmetics, and consumer electronics.

The Relief from Royalty method is the most widely accepted for trademark valuation, as it reflects what the business would have to pay to license the mark from a third party. In some cases, especially when recent trademark sales exist, the Market Approach may also be adopted.

Trademarks are typically valued as stand-alone assets during business combinations, especially when they represent a core revenue driver.

6. Copyright

Copyright protects original works of authorship, including software code, media content, educational material, and publications. In media and tech-driven businesses, copyright assets often represent future cash-flow potential.

Valuation typically follows the Income Approach, which forecasts future revenue streams attributable to the copyrighted material and discounts them to present value. In cases where the copyright is self-developed and not directly monetized, the Cost Approach—estimating historical development expenses—is appropriate.

The method depends on whether the copyright generates recurring revenue or serves an internal strategic purpose.

7. Customer Relationships

Customer relationships refer to the value of ongoing contractual or non-contractual interactions with clients, including subscription users, corporate accounts, or key repeat buyers. These relationships are critical for revenue continuity in sectors such as IT services, consulting, logistics, and SaaS.

The MPEEM is the most suitable valuation method here, as it quantifies the portion of business income directly attributable to existing customers, after accounting for supporting assets.

Customer relationship valuation is most relevant during acquisitions or PPA exercises, where future cash flow from customer retention is a key asset.

8. Franchise Agreements

Franchise agreements grant third parties the rights to use a business model, brand, or operating system. These are common in hospitality, fast food chains, retail outlets, and service businesses.

Valuation is usually performed using the Relief from Royalty method, which considers the stream of royalty income from franchisees. In some cases, a traditional Income Approach is applied by modeling the future franchise fee income.

The method choice is determined by the structure of the franchise—whether it’s single-location, master franchise, or territory-based.

9. Licenses and Permits

These include regulatory permissions to operate in controlled industries like telecom, banking, healthcare, and mining. Their value lies in exclusivity or compliance capability.

When similar license transactions are accessible, the Market Approach is used to benchmark values. However, more often, the Income Approach is applied by estimating the incremental profits made possible by holding the license.

Licenses are typically valued during business restructuring, acquisitions, or in bankruptcy scenarios where operational rights carry significant economic benefit.

10. Trade Secrets & Proprietary Technology

Trade secrets include formulas, methods, or technologies that are confidential and provide a competitive edge. These assets are highly valued in manufacturing, software, and R&D-heavy sectors.

The Income Approach is ideal when trade secrets directly impact margins or revenue through cost-saving or unique capabilities. Alternatively, the Cost Approach may be used to assess what it would take to replicate the knowledge base.

Valuation of trade secrets is especially important in IP litigation, licensing deals, or when seeking investment based on proprietary technology.

V. Comparative Summary Table

Asset Type | Common Valuation Methods | Best For (Sectors) |

Brand | Relief from Royalty, Income Approach, Market Comparables | FMCG, Consumer Services |

Software | MPEEM, Cost to Recreate, Relief from Royalty | SaaS, Tech, Digital Platforms |

Patent | Discounted Cash Flow, Relief from Royalty, Real Options | Pharma, Innovation-Driven Enterprises |

Goodwill | Residual Method, Income (for Impairment Testing) | M&A-Driven Businesses |

Trademark | Relief from Royalty, Market Approach | Retail, Fashion, Hospitality |

Copyright | Income Approach, Cost Approach | Media, EdTech, Publishing |

Customer Relationships | MPEEM | B2B Services, Fintech, Subscription Models |

Franchise Rights | Relief from Royalty, Income Approach | Food Chains, Fitness Studios, Quick Service Restaurants |

Licenses / Permits | Market Approach, Income (Incremental Benefit) | Telecom, Mining, Broadcasting |

Trade Secrets / Technology | Income Approach, Cost to Develop | Deep Tech, Process-Driven Manufacturing |

This comparative table offers a quick reference to match the right valuation method with the type of intangible asset and the industry context in which it is most applicable.

VI. Key Takeaways and Practical Tips

Valuing intangible assets isn’t a one-size-fits-all exercise. The right approach requires careful alignment between the nature of the asset, available data, and the business context.

Tip 1:

Use the Relief from Royalty Method (RRM) when clear market-based licensing rates are available. This is especially suitable for brand names, trademarks, and commercial software.

Tip 2:

Apply the Multi-Period Excess Earnings Method (MPEEM) for intangible assets that directly generate a distinct stream of future earnings, like customer contracts, SaaS platforms, or loyalty programs.

Tip 3:

Consider the Real Option Model for valuing intellectual property at the R&D stage or when outcomes are uncertain. This is helpful for early-stage pharma patents or experimental technologies.

Tip 4:

Stay aware of regulatory frameworks. Indian accounting and regulatory standards may prescribe or limit valuation methods, particularly for Purchase Price Allocation (PPA), impairment testing, and financial reporting.

These insights help ensure both defensibility and regulatory alignment when performing or reviewing an intangible asset valuation.

VII. Indian Regulatory and Professional Standards

Valuation of intangible assets in India must adhere to established accounting and professional standards. Key regulations include:

1. Ind AS 38 – Intangible Assets

Issued under the Companies Act, this standard outlines recognition, measurement, amortisation, and impairment testing guidelines for intangible assets.

2. Companies (Registered Valuers and Valuation) Rules, 2017

These rules, issued under Section 247 of the Companies Act, specify who can carry out valuations and how they must be conducted, including reporting formats and ethical conduct.

3. ICAI Valuation Standards / IVS

Registered valuers and professionals often follow ICAI Valuation Standards or the International Valuation Standards (IVS) for consistency and comparability. These standards provide structured methodologies and documentation practices.

4. SEBI Compliance

For listed companies or transactions involving securities, SEBI regulations may require valuations to be conducted by SEBI-registered merchant bankers, particularly for rights issues, mergers, or related-party transactions.

Compliance with these frameworks ensures that valuations are technically sound, legally robust, and auditor-ready.

VIII. Conclusion: Put Your Intangible Value to Work

In an economy increasingly shaped by ideas, innovation, and IP, intangible assets are no longer just accounting entries—they’re competitive weapons. Whether you’re preparing for a funding round, planning a merger, undergoing a statutory audit, or defending a transfer pricing position, properly valued intangibles can tip the scale in your favour.

The key is precision. Engaging a qualified valuation professional ensures that your intangible assets are not just identified and recorded but strategically leveraged in line with regulatory expectations and business objectives.

IX. Need Help Valuing Your Intangible Assets?

Marcken Consulting | Valuation Experts for the Digital Economy

Unlock the full potential of your intangible assets—whether it’s your brand, proprietary software, or intellectual property. Our reports are SEBI-compliant, audit-ready, and tailored to your business goals.

Get in touch today for a free consultation and discover how Marcken Consulting can help you realise the true value of what your balance sheet doesn’t show.

Frequently Asked Questions (FAQs)

Intangible assets are non-physical assets such as brand reputation, software, patents, and customer relationships that provide long-term economic benefits. Unlike tangible assets like land or machinery, intangible assets cannot be touched or seen but can significantly impact a company's value.

Valuing intangible assets is essential for mergers and acquisitions, startup fundraising, financial reporting (such as PPA and impairment testing), and litigation. In India, regulatory compliance under Ind AS 38 and the Companies Act also mandates the accurate reporting of these assets.

Popular methods include the Relief from Royalty Method (RRM), Multi-Period Excess Earnings Method (MPEEM), Discounted Cash Flow (DCF), and the Cost to Recreate approach. The choice depends on the type of intangible asset, available data, and business context.

Yes, but recognition depends on several factors such as identifiability, control, and future economic benefit. Under Indian accounting standards (Ind AS 38), only certain intangible assets can be recorded on the balance sheet, often excluding internally generated goodwill.

Valuation of intangible assets in India must be conducted by a Registered Valuer under the Companies (Registered Valuers and Valuation) Rules, 2017, or a SEBI-registered merchant banker in listed company transactions. Professionals must also comply with ICAI or IVS standards for consistency and regulatory acceptance.