A business valuation report is more than just a number on a spreadsheet; it’s the financial passport of your enterprise. Whether you’re preparing for a merger or acquisition, raising funds, issuing ESOPs, or fulfilling regulatory obligations, a valuation report determines the perceived worth of your business in the eyes of investors, buyers, regulators, and tax authorities.

In India, however, not everyone can issue a legally valid valuation report. The government has drawn clear lines to ensure these reports are credible, compliant, and actionable. A report from an unauthorized source can lead to compliance risks, tax disputes, or failed funding rounds; a costly misstep for any startup or SME.

At Marcken Consulting, we help founders and finance teams get it right the first time. Whether you’re chasing growth capital or handling compliance filings, our valuation experts ensure your report is not only technically sound but also regulator-ready.

Table of Contents

ToggleWho Is Legally Authorized to Issue Business Valuation Reports in India?

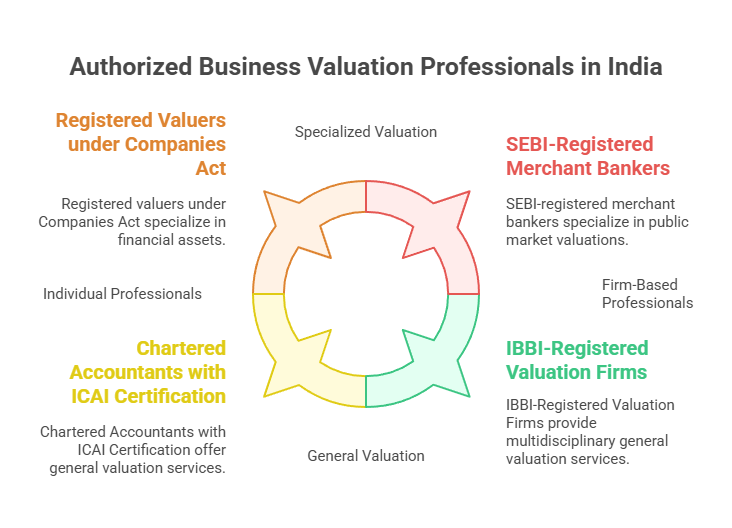

Not every accountant or consultant can legally issue a valuation report. India’s regulatory framework is specific about who is qualified and recognized to do this job. Let’s break down the four key categories of professionals authorized to issue business valuation reports in the country:

Registered Valuers under the Companies Act, 2013

The Companies Act, 2013, and the Companies (Registered Valuers and Valuation) Rules, 2017, laid the foundation for a regulated valuation ecosystem. Under these laws, only professionals registered with the Insolvency and Bankruptcy Board of India (IBBI) are allowed to issue valuation reports for statutory purposes.

To qualify:

- The individual must belong to a recognised profession (like CA, MBA, CFA).

- They must clear the IBBI Valuation Examination.

- They must register under a Recognised Valuer Organisation (RVO).

Most importantly, valuers must choose an asset class to specialize in: Land & Building, Plant & Machinery, Securities, or Financial Assets. For business valuation purposes, the relevant specialization is typically Securities or Financial Assets.

✅ The official list of registered valuers is published and regularly updated on the IBBI website.

IBBI-Registered Valuation Firms

Several established firms, including global names like Deloitte and Indian players such as My Valuation and Marcken Consulting, employ teams of IBBI-registered valuers to provide end-to-end valuation services.

These firms offer:

- Multidisciplinary expertise, combining financial modelling, compliance, and industry insights.

- Firm-level credibility adds weight to reports submitted to investors, courts, or regulators.

- Tailored services for diverse use cases: startup fundraising, M&A, regulatory filings, and litigation support.

If you’re an SME or startup founder, working with a valuation firm like ours ensures that your report aligns with both regulatory standards and industry expectations.

Chartered Accountants (CAs) with ICAI Valuation Certification

While not every Chartered Accountant can issue valuation reports, those who complete the ICAI’s Certificate Course on Valuation and register with the IBBI are legally allowed to perform valuations.

This pathway is governed by the ICAI Valuation Standards, which aim to bring consistency, transparency, and objectivity to the process. CAs following this route are bound by both ICAI’s professional conduct rules and IBBI’s valuation framework, ensuring robust reporting.

At Marcken Consulting, many of our team members hold ICAI certifications and are actively registered with the IBBI, bringing the best of both financial acumen and regulatory compliance to the table.

SEBI-Registered Merchant Bankers (For Specific Transactions)

In select cases, like preferential allotment of shares, IPO pricing, or SEBI-regulated transactions, valuation reports must be issued exclusively by SEBI-registered merchant bankers.

These professionals have:

- Deep knowledge of capital markets

- Licenses issued by the Securities and Exchange Board of India (SEBI)

- Authority to handle valuations that have a public market impact

This is particularly important for listed companies or for startups preparing to go public or raise funds from listed investors.

You can find the updated list of approved merchant bankers on the SEBI official portal.

Legal and Regulatory Framework

India’s business valuation landscape isn’t just guided by best practices; it’s governed by law. Several key regulations spell out who can issue valuation reports, under what circumstances, and for which types of transactions. Here’s a breakdown of the major legal frameworks:

Companies Act, 2013 & Registered Valuers Rules

The cornerstone of valuation regulation in India, this Act mandates that any valuation required under its provisions must be carried out by an IBBI-registered valuer.

The accompanying Companies (Registered Valuers and Valuation) Rules, 2017 detail the eligibility, examination, and registration process.

If you’re issuing shares, undergoing a merger, or restructuring your company, chances are this rulebook applies to you.

Income Tax Act, 1961

For taxation purposes, particularly in cases involving capital gains, gift taxation, or transfer pricing, business valuation plays a key role. The Income Tax Department often requires reports to be issued by registered valuers or merchant bankers, depending on the case.

Failing to submit a compliant valuation report may lead to tax disputes, penalties, or assessment challenges.

FEMA (Foreign Exchange Management Act)

For inbound or outbound investments, share transfers involving NRIs, or cross-border restructurings, FEMA kicks in. The RBI guidelines under FEMA require valuation reports from authorized professionals, usually IBBI-registered valuers or merchant bankers, to determine fair market value.

This becomes especially critical when you’re raising funds from foreign investors, a space Marcken Consulting specializes in, ensuring both valuation and funding are aligned with RBI and FEMA regulations.

Insolvency and Bankruptcy Code (IBC), 2016

If a business is undergoing insolvency or liquidation, valuations must be conducted by two independent IBBI-registered valuers. These reports are used by Resolution Professionals, the Committee of Creditors, and NCLT to determine fair resolution plans or asset sales.

SEBI Regulations

When a listed company is conducting a preferential allotment, ESOP issuance, or preparing for an IPO, SEBI regulations often require the valuation to be performed by SEBI-registered merchant bankers.

This rule ensures investor protection and market integrity, making proper documentation non-negotiable.

📜 The full list of merchant bankers can be accessed via SEBI’s official website.

How to Find a Qualified Business Valuer

Now that you know who’s eligible and what laws apply, let’s talk about how to find a certified valuer. Whether you’re an entrepreneur, CFO, or investor, knowing where to look saves both time and risk.

IBBI & MCA Directories

The IBBI maintains an up-to-date list of registered valuers. You can search by:

- Name

- Location

- Asset Class (e.g., Securities or Financial Assets)

Similarly, the Ministry of Corporate Affairs offers directories and circulars for regulatory guidance.

ICAI-Certified Valuers

If you’re working with a Chartered Accountant, ask whether they’ve completed the ICAI’s Certificate Course on Valuation and are registered with IBBI. Only then are they permitted to sign off on business valuation reports. These professionals often follow ICAI Valuation Standards, which ensure consistency and professional integrity.

SEBI Merchant Banker List

For SEBI-regulated transactions like IPO valuations or equity pricing, you’ll need a SEBI-registered merchant banker. Their contact details and categories of operations are publicly listed on SEBI’s website.

Work with a Full-Service Valuation Firm

Instead of managing multiple professionals, many startups and SMEs choose a valuation advisory firm with a team of IBBI-registered valuers, CAs, and financial experts under one roof.

At Marcken Consulting, we bridge the gap between valuation, compliance, and fundraising. Our in-house experts are registered, certified, and seasoned, helping you save time, reduce cost, and meet every regulatory deadline with confidence.

Looking for a valuation tailored to your startup stage or fundraising round? Let’s connect — we speak both finance and founder fluently.

Summary Table: Who Can Issue a Business Valuation Report in India?

Authority / Professional | When Applicable | Registration / Regulation |

IBBI-Registered Valuer | Most business, asset, and statutory valuations | IBBI, Companies Act, 2013 |

ICAI-Certified CA (also registered with IBBI) | Business valuations under the ICAI framework | ICAI, IBBI |

SEBI-Registered Merchant Banker | Preferential allotment, IPO pricing, and SEBI-regulated transactions | SEBI |

Valuation Firms with In-House Registered Valuers | Startup valuations, M&A, regulatory filings, cross-border deals | IBBI, ICAI, SEBI |

Conclusion

When it comes to business valuation in India, credibility is everything. Whether you’re preparing for a fundraising round, handling regulatory filings, or navigating a complex M&A deal, choosing the right professional to issue your valuation report can make or break the outcome.

Only three categories are recognized by Indian authorities:

- IBBI-registered valuers

- CAs certified by ICAI and registered with IBBI.

- SEBI-registered merchant bankers, for capital markets-related valuations

Working with unqualified professionals or relying on generic templates is not just risky; it can lead to non-compliance, funding delays, or legal pushback.

At Marcken Consulting, we bring together registered valuers, financial analysts, and deal experts under one roof. Whether you’re a startup founder or a CFO at an SME, our valuation reports are tailored to your business model and built to meet Indian regulatory standards.

Need a certified business valuation report?

Talk to our team, our IBBI-registered experts are ready to help you move forward, confidently and compliantly.

Frequently Asked Questions (FAQs)

Only specific professionals are legally recognized to issue business valuation reports in India. These include IBBI-registered valuers, Chartered Accountants with ICAI’s valuation certification (who are also registered with IBBI), and SEBI-registered merchant bankers in cases governed by SEBI regulations. Each category is authorized for different types of transactions, such as statutory valuations, funding, or IPOs. It is crucial to choose a professional based on the nature and purpose of your valuation to ensure compliance and validity.

No, not every CA is authorized to issue a legally valid valuation report. Only those Chartered Accountants who have completed the ICAI’s Certificate Course on Valuation and are registered with the IBBI can issue such reports. Even then, their eligibility is generally restricted to specific asset classes like “Securities or Financial Assets.” If your CA is not registered with IBBI, the report may not hold legal weight under Indian regulations.

A SEBI-registered merchant banker is required when the valuation pertains to SEBI-regulated transactions such as preferential allotment of shares, IPO pricing, buybacks, and certain capital market disclosures. These bankers are licensed and recognized by SEBI to ensure investor protection and pricing fairness. If you’re a listed company or planning to go public, using a merchant banker for valuation is mandatory under SEBI rules.

You can verify the credentials of a valuer by visiting the official IBBI portal, which maintains a regularly updated list of all registered valuers. The database allows you to filter by name, location, and asset class (such as Securities or Financial Assets). This ensures you’re working with a legally compliant professional, which is essential for regulatory submissions and funding requirements.

Getting a valuation report from someone who is not authorized, like an unregistered CA, consultant, or internal finance team, may lead to non-acceptance by regulators, delays in fundraising, or even legal penalties. Indian laws like the Companies Act, FEMA, and SEBI regulations are explicit about who can issue these reports. A non-compliant report may be rejected during due diligence or lead to complications with the Income Tax Department or the RBI.