Table of Contents

ToggleIntroduction

In the world of corporate finance and investment, two terms frequently cause confusion among Indian investors and businesses alike: Enterprise Value (EV) and Equity Value. At first glance, they may appear interchangeable because both relate to how much a company is “worth.” However, the distinction between the two is crucial. Misinterpreting them can lead to flawed valuations, inaccurate comparisons, and misguided investment decisions.

This blog aims to clarify the difference between Enterprise Value and Equity Value, explain how each is calculated, and show how investors and analysts in India can correctly interpret these metrics in practical scenarios such as stock analysis, mergers, and acquisitions.

What is Equity Value?

Definition:

Equity Value represents the total value of a company that belongs to its shareholders. In simple terms, it reflects what investors collectively own in the business. It is also often referred to as the company’s market capitalization.

Formula(s):

- Equity Value = Share Price × Total Number of Outstanding Shares

- Alternatively, it can be derived from Enterprise Value as: Equity Value = Enterprise Value – Total Debt + Cash & Cash Equivalents

Perspective:

Equity Value provides the “shareholder’s slice” of the business. It is particularly relevant when assessing share-based investments, predicting stock movements, or determining what equity holders can claim after accounting for debts and obligations.

Example (Indian company scenario):

Suppose a listed company in India has 1,00,000 shares trading at ₹100 each.

- Equity Value = ₹100 × 1,00,000 = ₹1,00,00,000

This means shareholders collectively own ₹1 crore worth of the company, based on its current market price.

What is Enterprise Value (EV)?

Definition:

Enterprise Value (EV) represents the total value of a company, taking into account not just the equity held by shareholders, but also the claims of debt holders, while adjusting for the company’s cash position. It reflects what it would truly cost an investor or acquirer to purchase the entire business.

Formula(s):

- Enterprise Value = Equity Value + Total Debt – Cash & Cash Equivalents

- Alternately expressed as: Enterprise Value = Market Capitalisation + Total Debt – Cash

Here, both short-term and long-term debt are included, and highly liquid cash or cash equivalents are subtracted because they effectively reduce the acquisition cost.

Holistic Business Perspective:

Unlike Equity Value, which shows only what shareholders own, EV offers a comprehensive view of the company’s worth. It includes all sources of capital — both equity and debt. This makes it a more accurate measure when comparing companies or valuing a business in mergers and acquisitions, as it reflects the full economic value, regardless of financing structure.

Example (Indian company scenario):

Suppose a company has:

- Share Price: ₹100

- Total Shares: 1,00,000

- Total Debt: ₹20,00,000

- Cash & Cash Equivalents: ₹3,00,000 Then,

- Equity Value = ₹100 × 1,00,000 = ₹1,00,00,000

- Enterprise Value = ₹1,00,00,000 + ₹20,00,000 – ₹3,00,000 = ₹1,17,00,000

This means while shareholders collectively own equity worth ₹1 crore, the actual value of the business (including debt obligations) is ₹1.17 crore.

Key Differences Between Equity Value and Enterprise Value

Aspect | Equity Value | Enterprise Value (EV) |

Includes Debt? | No | Yes |

Excludes Cash? | No | Yes |

Perspective | Shareholder-focused (value of equity holders) | Holistic view (equity + debt holders) |

Commonly Used For | Shareholder analysis, stock price evaluation | M&A deals, business valuation, cross-company comparisons |

Formula | Share Price × Shares Outstanding | Equity Value + Debt – Cash |

Commentary on Implications:

- Investor Lens: Equity Value is the figure most relevant to shareholders because it indicates the portion of the company they own. For instance, retail investors buying stocks primarily look at market capitalisation, which is an expression of Equity Value.

- Acquirer Lens: Enterprise Value is the more practical measure in acquisitions and company comparisons. It shows the true cost of taking over a business — not just buying out shareholders, but also assuming responsibility for debt while benefitting from cash reserves.

- Analytical Lens: Equity Value is best for understanding shareholder returns, while EV is a better tool for cross-company valuation since it neutralises differences in capital structure.

Why the Distinction Matters

Understanding the difference between Equity Value and Enterprise Value is not merely academic — it has practical implications for investors, analysts, and businesses.

For Shareholders (Equity Focus):

Equity Value reflects the portion of a company attributable to shareholders. Retail and institutional investors typically assess this when evaluating stock price movements, dividend potential, and portfolio performance. It is the measure most aligned with shareholder interests.

For Acquirers and Investors (Enterprise Focus):

Enterprise Value provides a complete picture of what it would cost to acquire the business. Acquirers do not simply purchase equity — they also assume the company’s debt and gain access to its cash reserves. Hence, EV is the metric of choice in mergers and acquisitions, where the true economic cost of acquiring control must be understood.

Use Cases in M&A, Valuations, and Stock Analysis:

- M&A Transactions: Buyers evaluate EV to compare potential acquisition targets on a like-for-like basis, irrespective of capital structure.

- Valuation Multiples: Ratios such as EV/EBITDA are widely used in financial analysis because they provide a fairer basis for comparing companies across industries.

- Stock Market Analysis: While market capitalisation (equity value) is important for shareholders, professional analysts often complement it with EV to gain a more accurate view of the company’s intrinsic worth.

Easy Analogy for Better Understanding

Consider the purchase of a house:

- The total house value is ₹50 lakh.

- You take a home loan of ₹35 lakh.

- Your down payment is ₹15 lakh.

In this analogy:

- The down payment (₹15 lakh) is similar to Equity Value — the portion you own.

- The full house value (₹50 lakh) represents the Enterprise Value — the complete worth of the asset, including what you owe (the loan).

This example illustrates why Enterprise Value provides a broader perspective, while Equity Value reflects only the ownership stake. Both are accurate, but they answer different financial questions.

Common Mistakes in Interpretation (Indian Context)

Despite the clear formulas, misinterpretations of Equity Value and Enterprise Value are common in the Indian market. Some of the typical errors include:

1. Confusing Market Capitalisation with EV

Many investors assume that a company’s market capitalisation (equity value) reflects its total worth. However, market cap ignores debt obligations and cash reserves, which can significantly alter the true value of a business.

2. Ignoring Debt and Cash in Valuation

Analysts sometimes overlook the role of debt and cash when comparing companies. A business with heavy borrowings may appear attractive based on equity value alone, but factoring in debt via EV reveals a far more accurate picture of acquisition cost. Similarly, a company with substantial cash reserves could have a lower EV than its equity value, which changes the valuation dynamics.

3. Over-Relying on One Metric

Relying solely on equity value or enterprise value without considering the other often leads to incomplete analysis. Equity value is useful for understanding shareholder wealth, while EV provides a holistic perspective for M&A and business comparisons. Robust analysis requires both.

Practical Applications in India

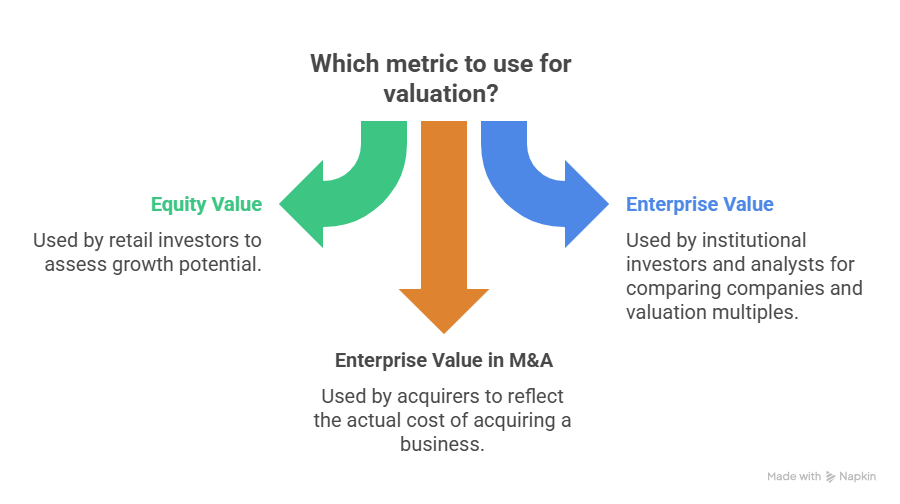

How Investors, Analysts, and Acquirers Use These Metrics

- Retail Investors: Typically focus on equity value (market cap) to assess the growth potential of their holdings.

- Institutional Investors and Analysts: Use both equity and enterprise value when comparing companies or assessing valuation multiples such as P/E or EV/EBITDA.

- Acquirers in M&A: Prioritise EV, as it reflects the actual cost of acquiring a business, including the obligation to service debt.

When to Look at EV vs Equity Value in Indian Markets

- Equity Value is relevant when the objective is to analyse shareholder returns, stock performance, or dividend potential.

- Enterprise Value is more appropriate when the goal is to compare companies across industries, evaluate acquisition targets, or conduct comprehensive valuations.

Role in Regulatory and M&A Transactions

In India, regulators and financial advisors often require both equity and enterprise value assessments during mergers, acquisitions, and restructuring exercises. For example, in takeover scenarios, SEBIhttps://www.sebi.gov.in/ regulations mandate fair valuation of shares (equity value), while acquirers simultaneously assess EV to understand the total acquisition cost. This dual approach ensures both shareholder protection and accurate deal pricing.

Conclusion

The distinction between Equity Value and Enterprise Value lies at the core of accurate financial interpretation. While Equity Value reflects what shareholders collectively own, Enterprise Value provides a holistic view of the company’s worth, capturing the claims of both equity and debt holders while adjusting for cash.

For shareholders, Equity Value is the more relevant metric, closely tied to market capitalisation and stock performance. For acquirers and analysts, however, EV delivers a clearer picture of what it would truly cost to purchase and operate the business. Both measures complement each other and should be applied depending on the context of analysis.

In short:

- Equity Value = Shareholder value

- Enterprise Value = Total business value

Given the complexity of valuations and their impact on investment or acquisition decisions, working with experienced valuation professionalshttps://www.mca.gov.in/ ensures accuracy, regulatory compliance, and reliable insights that drive better outcomes.

Frequently Asked Questions (FAQs)

Not always. While EV often exceeds Equity Value due to debt obligations, if a company has high cash reserves and little debt, EV can be lower.

Yes. If cash and cash equivalents significantly outweigh debt, EV can fall below Equity Value. This often occurs in cash-rich companies.

EV reflects the full cost of acquiring a business, including debt assumption and cash benefits. Hence, it is a more accurate measure for mergers and acquisitions than equity value alone.

- Debt increases EV because acquirers must take on repayment obligations.

- Cash decreases EV because it reduces the net cost of acquisition.

Retail investors typically focus on Equity Value (market capitalisation) to understand stock performance. However, considering EV provides additional insight into the company’s overall financial strength and acquisition attractiveness.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.