Table of Contents

ToggleI Introduction: More Than Just a Compliance Report

In India’s increasingly digital business ecosystem, application valuation has emerged as a critical factor in understanding true business worth. Applications today are core drivers of value, from fintech platforms streamlining lending to SaaS solutions transforming B2B operations, to app-based logistics businesses managing last-mile delivery. The application is no longer a backend tool; it’s a central economic asset that demands financial recognition and strategic focus.

Despite this shift, many Indian businesses continue to treat application valuation reports as routine or compliance-driven exercises. They’re often seen as paperwork required for investor documentation, tax filings, or regulatory submissions.

This narrow view is costly.

In reality, a professionally prepared valuation report is a powerful financial tool. It provides not only a credible estimate of your application’s worth but also strategic insights that influence capital raising, credit facilitation, internal decision-making, and legal compliance.

When done right, application valuation reports can redefine how your business is perceived by investors, regulators, and financial institutions. It can unlock funding opportunities, optimize tax positions, and lay the groundwork for sustainable growth.

This blog explores the deeper financial value of application valuation reports in the Indian context, beyond the checkboxes and statutory filings.

II. The Strategic Role of Application Valuation in Indian Businesses

At its core, an application valuation report is an expert financial assessment of the monetary value of your software application or platform. It quantifies the economic worth of the digital asset, be it a revenue-generating customer app, an internal enterprise tool, or an R&D-driven IP-based platform.

It’s important to distinguish between the two common practices:

- Technical Evaluation: Focuses on the application’s architecture, features, security, and functionality.

- Financial Valuation: Estimates the market or economic value of the app using methods like Discounted Cash Flow (DCF), Market Multiples, or Net Asset Value (NAV), depending on the stage and purpose of the valuation.

In India, application valuation has become increasingly relevant due to the integration of digital assets into balance sheets and compliance structures. Several regulatory frameworks make this process both mandatory and strategically valuable:

- Ind AS 38 (Intangible Assets): Governs how businesses recognize and value intangible assets like software. It allows capitalization of development costs and mandates impairment testing, making periodic valuation a necessity.

- Companies Act, 2013: Requires valuation from a Registered Valuer for certain corporate actions such as share issuance, mergers, or restructuring involving intangible assets.

- FEMA (Foreign Exchange Management Act): Mandates fair valuation for cross-border transactions involving Indian entities, especially for foreign direct investment (FDI) in tech businesses.

- SEBI AIF Regulations: Alternative Investment Funds (AIFs) must submit valuation reports certified by SEBI-registered entities to ensure transparency and protect investor interest.

These frameworks elevate application valuation from a mere accounting requirement to a strategic business function.

For startups raising capital, midsize enterprises entering foreign partnerships, or large corporations planning internal restructuring, understanding the strategic implications of valuation reports is not optional—it’s essential.

III. 5 Core Ways a Valuation Report Boosts Financial Performance

A robust application valuation report is more than a document—it’s a financial asset in its own right. When prepared by a qualified professional and aligned with Indian regulatory standards, it can unlock multiple levers of value creation for your business. Here are five ways it delivers tangible financial benefits:

1. Enhances Investor Confidence & Facilitates Fundraising

In today’s competitive fundraising landscape, credibility is currency. An independent valuation report, especially one conducted by a registered valuer, adds a layer of transparency and professionalism to your capital raise.

Whether you’re pitching to SEBI-regulated Alternative Investment Funds (AIFs), foreign venture capital firms, or seasoned angel investors, a valuation report reassures stakeholders that your projections are grounded in methodical analysis. It also plays a critical role in:

- ESOP structuring and pricing, ensuring fair market value under Income Tax guidelines.

- Private placements, where pricing must be defensible and regulatorily compliant.

- Foreign investments requiring valuation for FC-GPR filings under FEMA.

Get a SEBI-compliant valuation before your next funding round.

2. Improves Loan Eligibility and Borrowing Terms

For digital-first and asset-light businesses, securing credit can be challenging due to a lack of physical collateral. However, a credible valuation report can bridge this gap by quantifying the worth of intangible assets such as proprietary applications or platforms.

NBFCs and progressive banks now consider such valuations to assess loan eligibility, sometimes improving:

- Loan-to-value ratios

- Sanctioned limits

- Applicable interest rates

As fintech lending and cash flow-based financing models gain momentum in India, valuation reports are increasingly becoming a prerequisite for faster and better credit terms.

3. Aids Strategic Planning and Performance Benchmarking

An app valuation report does not merely assign a price tag. It provides strategic insights into the underlying value drivers, user metrics, engagement KPIs, monetisation models, and future cash flows.

This empowers founders, CFOs, and boards to:

- Compare performance across business units or geographies

- Make buy/sell decisions based on relative value.

- Enter joint ventures or partnerships with a clear understanding of the digital asset’s worth.

- Assess capital allocation efficiency, especially for ROI- or ROCE-based planning.

4. Strengthens Compliance & Optimizes Tax Strategy

In India, businesses operate under multiple compliance regimes, many of which require or benefit from application valuations:

- Companies Act, 2013: Valuation mandatory for share issuance or restructuring involving intangible assets.

- Income Tax Act: Used in transfer pricing, capital gains computation, and ESOP taxation.

- FEMA Regulations: Cross-border investments or disinvestments must follow valuation guidelines.

- SEBI Regulations: Especially relevant for publicly listed tech companies and AIF-funded startups.

A defensible valuation report ensures smoother audit trails, reduces litigation risk, and opens the door to more effective tax planning.

5. Supports Internal Management and Resource Allocation

Beyond external reporting and compliance, valuation reports are instrumental for internal decision-making. They help leadership identify which apps or digital units are underperforming or delivering maximum value.

This insight aids in:

- Budget allocations across product lines

- Evaluating divestiture or spin-off options

- Promoting capital-efficient growth strategies

IV. Key Valuation Methods Used in the Indian Context

Application valuation is both a science and an art. While it leverages data and models, the selection of the right approach depends on the app’s lifecycle stage, cash flow visibility, and market comparables. The most commonly used methods include:

1. Discounted Cash Flow (DCF)

Ideal for high-growth applications with visible revenue pipelines and monetization strategies. DCF projects future cash flows and discounts them to present value using an appropriate risk-adjusted rate.

Used for: SaaS products, fintech platforms, marketplaces with transaction revenue

2. Net Asset Value (NAV)

Applicable when the app is part of a larger asset-rich platform or where tangible investments (like R&D, IP licenses) dominate the balance sheet.

Used for: R&D-heavy tech, proprietary data platforms, in-house enterprise tools

3. Market Multiple Method

Relies on comparable company analysis or recent M&A deals in the sector. This method benchmarks your application against peers based on valuation multiples (e.g., EV/Revenue, EV/EBITDA, Price/User).

Used for: Consumer apps, fast-scaling B2C platforms, market-tested B2B SaaS

All these methods are aligned with the latest ICAI Valuation Standards, Ind AS 113, and sector-specific regulatory advisories issued by SEBI and IBBI.

V. Scenarios Where Valuation Reports Are Essential

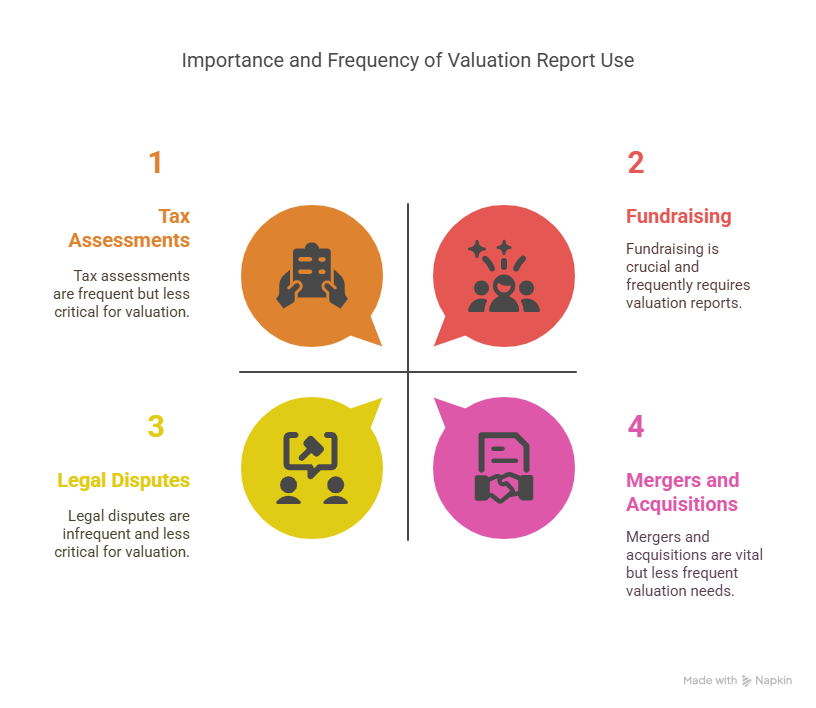

There are critical moments in a business lifecycle where a valuation report is not just helpful—it’s mandatory or strategic:

- Fundraising (Seed to Series D): Validates pricing for term sheets, ensures investor alignment, and meets regulatory requirements.

- Mergers, Acquisitions, and Buyouts: Offers a reliable basis for negotiation and integration planning.

- Share Buybacks or Stake Sales: Required to determine fair exit value and avoid shareholder disputes.

- ESOP Implementation or Liquidation: Ensures tax compliance and fair grant pricing.

- Legal Disputes, Arbitration, or Family Settlements: Acts as expert evidence in cases involving IP valuation or asset division.

- Tax Assessments or Investor Audits: Demonstrates prudence and preparedness during scrutiny from IT authorities or institutional investors.

VI. Why Generic or Template-Based Reports Hurt Your Valuation

In an era where technology and business models evolve rapidly, a one-size-fits-all valuation report can do more harm than good. Generic or template-based reports often:

- Oversimplify the asset’s unique value drivers: Each application has distinct features, user behaviours, revenue models, and growth potential. A templated report fails to capture these nuances, leading to undervaluation or overvaluation.

- Ignore sector-specific risks and opportunities: Indian fintech apps face different regulatory challenges compared to SaaS or logistics platforms. Templates rarely adjust for such critical variables.

- Lack of regulatory rigor and defensibility: Reports recycled from generic frameworks may not satisfy stringent audits, SEBI compliance checks, or investor due diligence.

- Damage credibility with investors and lenders: Savvy stakeholders can identify boilerplate reports quickly, which can raise red flags and diminish trust.

- Miss critical intangible assets: Elements like user community strength, proprietary algorithms, or platform integrations often require expert judgment, which a template cannot provide.

The bottom line: Valuation reports must be customized, data-driven, and prepared by professionals who understand both the technical and financial aspects of your business.

VII. What a High-Quality App Valuation Report Should Include

A superior valuation report goes beyond numbers; it tells the full story of your application’s value and potential. Key components include:

- Executive Summary: A clear overview highlighting key valuation findings and assumptions.

- Business and Industry Overview: Contextual analysis of the app’s market, competition, and growth trends specific to India’s digital ecosystem.

- Detailed Financial Analysis: Historical financials, user metrics, revenue breakdown, and profitability trends.

- Valuation Approaches Applied: Explanation and rationale for chosen methods (DCF, NAV, Market Multiples), including detailed calculations.

- Risk Assessment: Identification of business, regulatory, market, and technology risks with mitigation measures.

- Regulatory Compliance: Alignment with Indian accounting standards (Ind AS), ICAI valuation norms, and relevant SEBI/FEMA regulations.

- Sensitivity and Scenario Analysis: Impact of key variables (user growth rate, churn, monetization) on valuation to prepare for uncertainty.

- Conclusion and Recommendations: A professional summary that guides management and stakeholders on strategic actions.

- Supporting Documents and Appendices: Source data, assumptions, and references for transparency.

Such a report not only withstands scrutiny from regulators, investors, and auditors but also equips your leadership with actionable insights.

VIII. Conclusion: Use Valuation as a Tool, Not a Task

Valuation reports are often perceived as routine compliance exercises — boxes to tick or hurdles to cross. Yet, when approached strategically, they become powerful tools that elevate financial planning, unlock capital, and sharpen competitive advantage.

For Indian businesses thriving in fintech, SaaS, logistics, and other app-driven sectors, a tailored, robust application valuation report is indispensable. It bridges the gap between technology and finance, transforming intangible digital assets into tangible business value.

Before your next fundraising round, loan application, or strategic decision, invest in a professional valuation report. Doing so doesn’t just fulfill regulatory requirements — it positions your business for sustainable growth, investor confidence, and long-term success.

IX. Take the Next Step: Get Your Application Valuation Right

In today’s competitive Indian market, your app’s value is much more than a number — it’s a strategic asset. Don’t leave your valuation to guesswork or generic templates.

Partner with experts who understand the unique financial, technical, and regulatory nuances of your digital business.

- Ensure SEBI-compliant, investor-ready reports.

- Unlock better funding and borrowing terms.

- Drive strategic decisions with confidence.e

- Stay ahead in compliance and tax planning.

Frequently Asked Questions (FAQs)

An independent valuation provides credibility and objectivity that investors, lenders, and regulators trust. It ensures your app’s value is accurately reflected, supporting fundraising, compliance, and strategic decisions.

Typically, valuations are updated before significant funding rounds, mergers, share issuances, or at least annually to reflect market changes and business growth.

Yes. A precise valuation aligns with tax regulations and helps optimize capital gains, transfer pricing, and depreciation claims, reducing the risk of disputes and penalties.

Key documents include financial statements, user and revenue data, business plans, market research, technical documentation, and legal compliance certificates.

Valuations help set fair market prices for stock options, ensuring employees receive equitable benefits while complying with SEBI and tax guidelines.