Table of Contents

ToggleWhat is my company really worth?

If you’ve asked yourself this question—whether as a business owner, startup founder, CFO, or investor, you’re not alone. In today’s dynamic Indian business environment, understanding the equity valuation and fair value of your company isn’t just a number game. It’s a strategic necessity.

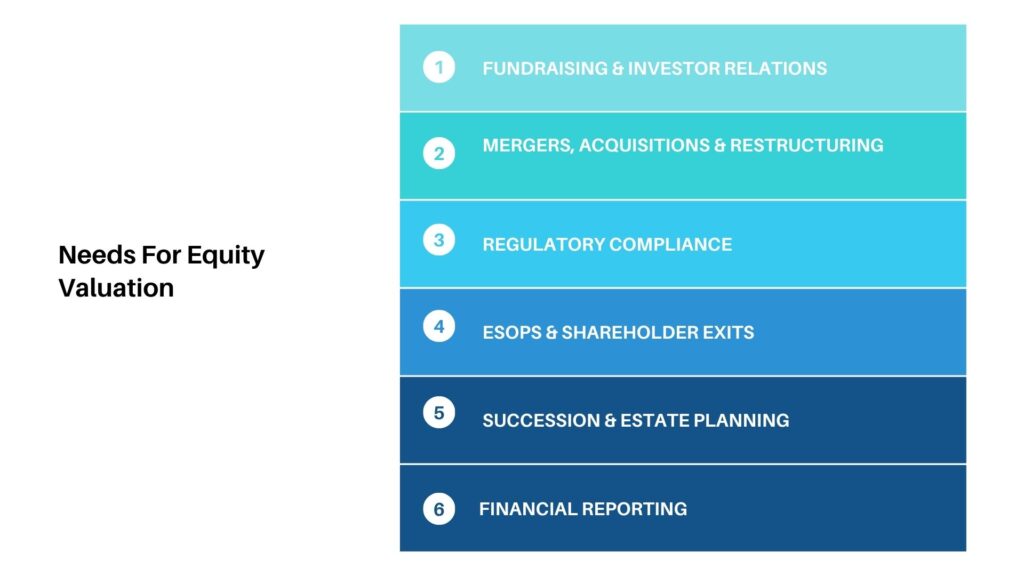

From fundraising and investor relations to regulatory compliance and shareholder exits, equity valuation is a foundational step that influences critical decisions. And in a market like India, where regulatory expectations meet fast-growing entrepreneurial ambition, getting your valuation right is non-negotiable.

At Marcken Consulting, we specialize in delivering equity and business valuation services that are not only regulator-compliant but tailored to the realities of Indian businesses. Whether you’re scaling up, restructuring, or preparing for a transaction, we’re here to unlock the true value of your enterprise.

2. Why Do Indian Businesses Need Equity Valuation?

Equity valuation is often misunderstood as something only large corporations or listed entities require. In reality, every business, startup, or established—needs valuation services at multiple stages of its journey. Here’s why:

a. Fundraising & Investor Relations

To raise capital from angel investors, VCs, private equity, or public markets, your company must present a clear and justifiable valuation. A credible valuation report helps you:

- Attract investor interest

- Avoid unnecessary dilution

- Strengthen your negotiating position

b. Mergers, Acquisitions & Restructuring

In M&A transactions, fair value is the starting point for deal negotiations. Whether you’re acquiring a company, merging entities, or spinning off a unit, valuation ensures:

- Transparent pricing

- Smoother transactions

- Reduced conflict among stakeholders

c. Regulatory Compliance

Indian laws mandate valuation reports for several corporate actions. For instance:

- Companies Act, 2013 – Share issuances, buybacks, and swaps

- Income Tax Act – Valuation under Rule 11UA and 11UB

- FEMA & RBI – Cross-border investments, FDI, ODI

- SEBI – Valuation for listed company transactions

d. ESOPs & Shareholder Exits

Whether you’re issuing stock options or facilitating a founder or investor exit, valuation helps:

- Set the right strike price

- Prevent disputes

- Ensure fair treatment of all stakeholders

e. Succession & Estate Planning

Promoters and family businesses increasingly seek independent valuation to plan:

- Ownership transition

- Wealth distribution

- Inter-generational asset transfer

f. Financial Reporting

For companies adopting IND AS, IFRS, or other international accounting standards, valuation is often required for:

- Fair value accounting

- Impairment testing

- Purchase price allocation (PPA)

3. How Does Marcken Consulting Deliver Equity Valuation?

At Marcken Consulting, we approach equity valuation as both a financial discipline and a strategic advisory tool. Our process is designed to balance technical accuracy with practical business relevance—so that the final report not only meets regulatory standards but also supports decision-making for fundraising, compliance, or corporate action.

Understanding Your Needs

Every engagement begins with a clear understanding of the client’s objective—whether it’s attracting investors, meeting a regulatory requirement, managing shareholder exits, or preparing for a merger. We align our valuation methodology and depth of analysis based on your business stage, industry sector, and end use of the report.

Data Collection & Analysis

Our valuation team, including IBBI-registered valuers, collects financial data, industry benchmarks, and relevant business details. This includes historical performance, projected financials, operational metrics, and market positioning. We also examine qualitative factors like business model sustainability, competitive advantage, and key risks.

Method Selection

We apply globally accepted valuation techniques, tailored for Indian businesses and regulators:

- The Discounted Cash Flow (DCF) method is used for companies with predictable revenues and growth plans.

- Comparable Companies Analysis benchmarks your company against publicly listed peers.

- The Net Asset Value (NAV) method applies to asset-heavy businesses or those in early stages.

- Precedent Transactions help estimate value based on recent industry-specific deals.

Our choice of methodology is always guided by the valuation’s purpose and the regulatory framework involved—be it SEBI, RBI, FEMA, or the Income Tax Act.

Draft, Discussion & Validation

Once we prepare a preliminary valuation, we share a draft report for discussion. This allows for review of key assumptions, growth projections, and valuation drivers. We encourage feedback and facilitate conversations with your finance teams, investors, or legal advisors as needed.

Final Report & Post-Valuation Support

After incorporating your feedback, we issue a final, regulator-compliant valuation report. It’s ready for submission to authorities, presentation to investors, or integration into financial disclosures. If your circumstances evolve, we also provide revaluation support, sensitivity analysis, and transaction advisory.

4. What Makes Marcken Consulting Different?

While many firms offer valuation services, Marcken Consulting is distinguished by its focus on compliance, customisation, and practical relevance. Our value lies not just in the methodology we apply, but in the insight and clarity we deliver alongside it.

Regulatory Precision

We ensure full compliance with all Indian legal and financial frameworks—SEBI guidelines for listed companies, MCA and Income Tax rules for share issuances or buybacks, FEMA regulations for cross-border investments, and RBI requirements for foreign direct investment. Our reports are ready to be reviewed by auditors, regulators, or investors without modification.

Industry-Specific Expertise

With over 300 valuation mandates delivered across sectors—technology, pharmaceuticals, BFSI, manufacturing, real estate, and more—we bring deep industry insight into every engagement. We understand sector-specific metrics, risks, and valuation benchmarks, which enhances the accuracy and credibility of our reports.

Tailored Approach

We avoid one-size-fits-all templates. Instead, we craft each valuation based on your business model, growth drivers, and reporting needs. Whether you’re a pre-revenue startup or a mature enterprise with diversified assets, we adapt our methods to fit your context and goals.

Responsiveness and Speed

We understand that valuations are often time-sensitive. That’s why we commit to quick turnarounds without compromising on rigour. Our internal processes and sector familiarity allow us to deliver reliable reports efficiently—helping you meet your timelines for investor meetings, filings, or transactions.

Marcken Consulting is not just a service provider—we’re a strategic partner in your valuation journey. We bring clarity, confidence, and compliance to every stage of your business lifecycle.

5. Typical Scenarios Where We Add Value

Equity valuation isn’t a one-time activity—it becomes relevant at multiple stages in your business journey. At Marcken Consulting, we support Indian businesses through diverse and often complex scenarios where valuation is not just required but crucial to success.

Fundraising

When raising capital—whether through angel investors, venture capital, private equity, or even an IPO—having a credible valuation is non-negotiable. We provide well-reasoned reports that help justify your ask, instil investor confidence, and minimise unnecessary equity dilution.

Mergers, Acquisitions, and Business Restructuring

During M&A, demergers, or internal group restructurings, fair valuation ensures transparent negotiations and smooth execution. We work closely with legal and financial advisors to provide support at every step of the transaction.

Regulatory Filings and Compliance

We help you meet regulatory requirements under the Companies Act, FEMA, SEBI, RBI, and Income Tax Act. Whether it’s issuing shares, buybacks, FDI, or cross-border transfers, our valuation reports meet the documentation standards expected by Indian regulators.

ESOPs and Shareholder Buybacks

Valuing shares for employee stock option plans or facilitating exits for shareholders requires a defensible valuation. We ensure the process is fair, transparent, and compliant with both corporate laws and accounting standards.

Disputes, Litigation, and Arbitration

When business disagreements or legal disputes arise, an independent valuation can be a critical part of the resolution process. We offer objective, court-admissible reports backed by data and industry benchmarks.

6. Why Choose a Professional Valuation Partner?

In a rapidly evolving regulatory and investment landscape, professional equity valuation is more than a checkbox—it’s a strategic necessity. Partnering with an experienced valuation firm brings several advantages that DIY or informal estimates simply cannot match.

Credibility and Trust

Investors, auditors, and regulators all rely on a professionally prepared valuation report. When the stakes are high—such as in fundraising rounds or corporate transactions—a credible report can make or break a deal.

Regulatory Compliance

India’s regulatory environment is rigorous. SEBI, RBI, and the Income Tax authorities demand that valuation reports be prepared by certified professionals following prescribed standards. Marcken Consulting ensures all reports are regulator-ready and defensible.

Strategic Insight

A good valuation doesn’t just provide a number—it offers insights into what drives your business’s value. Our approach helps you understand your growth levers, operational gaps, and strategic potential—turning the valuation exercise into a learning tool.

Risk Mitigation

Errors or inconsistencies in valuation can lead to tax penalties, compliance delays, or investor mistrust. With Marcken Consulting, you reduce those risks by working with experts who understand both the letter and the spirit of Indian valuation regulations.

7. Ready to Discover Your True Worth?

Whether you’re preparing for your next funding round, planning a merger, or simply ensuring regulatory compliance, a professional equity valuation is a vital step in your business journey. But more than that, it’s a reflection of your company’s past performance, current standing, and future potential.

At Marcken Consulting, we believe that valuation is not just about numbers—it’s about unlocking strategic clarity and creating a solid foundation for growth. Our approach is practical, transparent, and aligned with Indian regulatory frameworks, ensuring you get a valuation report that is both actionable and defensible.

We work with startups, SMEs, and corporates across industries and stages. Whether you need a one-time valuation or ongoing advisory support, our team is ready to help.

Frequently Asked Questions (FAQs)

Equity valuation determines the fair market value of a company’s shares. It's essential for fundraising, mergers, regulatory compliance, ESOPs, and strategic decision-making.

Businesses should seek valuation during fundraising, mergers & acquisitions, regulatory filings (under FEMA, Income Tax, SEBI), shareholder exits, or financial reporting under IND AS/IFRS.

We use globally accepted methods like Discounted Cash Flow (DCF), Comparable Companies Analysis, Net Asset Value (NAV), and Precedent Transactions, depending on your business context.

Yes. Our reports meet the standards set by SEBI, RBI, MCA, Income Tax Act, and FEMA, ensuring full regulatory compliance and credibility with stakeholders.

We prioritize speed without compromising accuracy. Most valuation reports are delivered within 7–10 working days, depending on the complexity and data availability.