Table of Contents

Toggle1. Introduction

In the dynamic landscape of Indian startups and growing enterprises, Employee Stock Option Plans (ESOPs) have emerged as a powerful tool to attract, retain, and motivate top talent. These plans not only offer employees a stake in the company’s growth but also align their interests with long-term business objectives. However, implementing an ESOP is far from a straightforward process. It requires careful planning, compliance with multiple regulatory frameworks, and accurate valuation of shares to ensure fairness and legal adherence.

This is where the distinction between ESOP consultants and registered valuers becomes crucial. While both play integral roles in the lifecycle of an ESOP, their responsibilities, authority, and expertise differ significantly. ESOP consultants guide companies through design, structuring, and administration, whereas registered valuers provide the legally mandated fair market valuation (FMV) of shares, ensuring compliance with statutory requirements.

The purpose of this blog is to clarify these differences, helping founders, HR leaders, and finance teams understand when and why to engage each professional. By the end of this read, you will have a clear perspective on how consultants and valuers complement each other, ensuring a compliant, transparent, and effective ESOP implementation.

2. What Are ESOPs and Why They Matter

Employee Stock Option Plans (ESOPs) are schemes that give employees the right, but not the obligation, to purchase a specific number of company shares at a predetermined price after a defined vesting period. Essentially, ESOPs transform employees into stakeholders, offering them a tangible stake in the company’s success.

From a strategic standpoint, ESOPs serve multiple purposes:

Employee Stock Option Plans (ESOPs) are schemes that give employees the right, but not the obligation, to purchase a specific number of company shares at a predetermined price after a defined vesting period. Essentially, ESOPs transform employees into stakeholders, offering them a tangible stake in the company’s success.

From a strategic standpoint, ESOPs serve multiple purposes:

- Employee retention: By tying employees’ financial upside to the company’s performance, ESOPs incentivize long-term commitment.

- Motivation and performance alignment: Employees are encouraged to work toward growth and profitability, as their personal gains rise with the company’s value.

- Wealth creation: ESOPs provide an avenue for employees to build significant financial value, especially in startups poised for growth or an eventual exit.

The implementation of ESOPs in India is governed by a combination of regulatory frameworks, making compliance a key concern:

- Companies Act, 2013: Governs the issuance of stock options, approval processes, and reporting requirements.

- SEBI guidelines: Applicable for listed companies, ensuring transparency and shareholder protection.

- FEMA/RBI regulations: Relevant for cross-border employees receiving ESOPs, ensuring foreign exchange compliance.

Understanding ESOPs in this regulatory context highlights why professional guidance is essential. Companies must navigate not only plan design and administration but also accurate valuation of shares—an area where the expertise of ESOP consultants and registered valuers becomes indispensable.

3. Who Are ESOP Consultants?

ESOP consultants are specialized advisors who help companies design, implement, and manage Employee Stock Option Plans in a compliant and strategic manner. Their role is particularly critical in Indian businesses, where regulatory requirements are intricate and evolving, and where ESOPs are often used as a strategic tool for talent retention and motivation.

Typically, ESOP consultants come from professional backgrounds such as Chartered Accountants (CAs), Company Secretaries (CS), HR consultants, or firms specializing in equity compensation advisory. They bring a blend of financial, legal, and human resources expertise to ensure that ESOPs are not only compliant but also effectively aligned with company objectives.

The scope of an ESOP consultant’s role goes beyond technical advisory. They provide guidance on plan structuring, administrative processes, and employee engagement. From helping set up ESOP trusts to educating employees about the benefits and mechanics of their options, consultants ensure that companies can smoothly navigate the complexities of ESOP implementation.

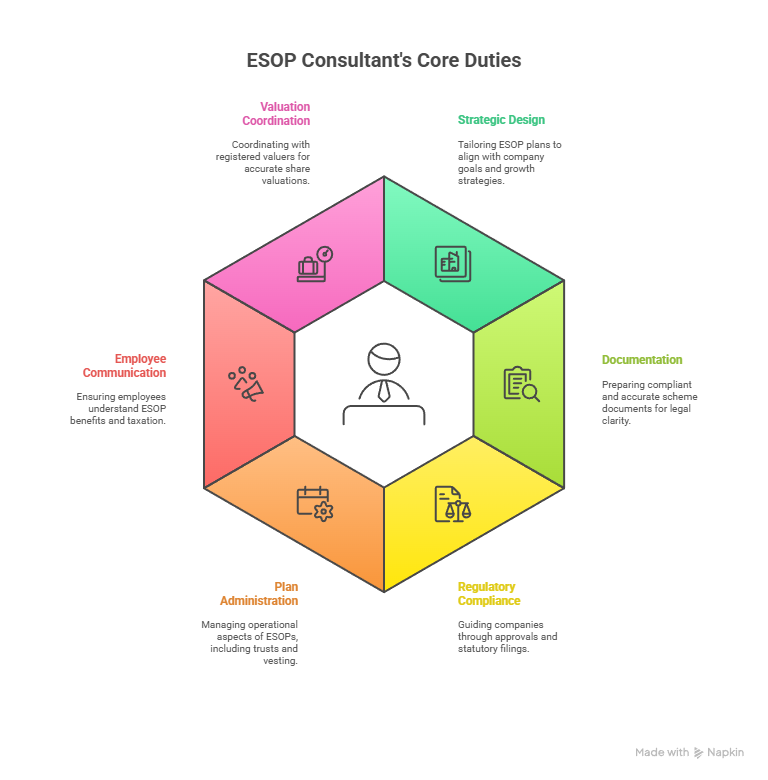

4. Key Responsibilities of ESOP Consultants

ESOP consultants wear multiple hats, offering a comprehensive range of services that cover the entire lifecycle of an ESOP. Their key responsibilities include:

Strategic Design of ESOP Schemes:

Consultants ensure that ESOP plans are structured to support company goals, whether it is enhancing employee retention, driving performance, or fostering long-term engagement. They tailor plans to suit the company’s stage, financial position, and growth strategy.

Drafting and Documentation:

ESOP consultants prepare scheme documents that comply with the Companies Act, 2013, SEBI guidelines, and other relevant regulations. Accurate documentation is crucial for legal clarity and audit readiness.

Regulatory Compliance Support:

They guide companies through necessary approvals, board resolutions, shareholder consents, and statutory filings. Consultants also provide step-by-step guidance on procedural compliance to avoid legal pitfalls.

Ongoing Plan Administration:

Beyond design, consultants manage the operational aspects of ESOPs, including setting up trusts, tracking grants, monitoring vesting schedules, and assisting with the exercise of options.

Employee Communication and Education:

Consultants play a pivotal role in ensuring employees understand their ESOP benefits, taxation implications, and exercise mechanics. Clear communication enhances engagement and trust in the ESOP program.

Coordination with Registered Valuers:

While ESOP consultants do not perform valuations themselves, they coordinate with registered valuers to ensure that share valuations are conducted accurately and in compliance with regulatory standards. They also help interpret valuation reports for management and employees.

5. Who Are Registered Valuers?

Registered valuers are professionals officially accredited by the Insolvency and Bankruptcy Board of India (IBBI) to conduct independent valuations of securities, including shares under ESOP schemes. Their role is distinct from ESOP consultants, as they possess the legal authority and technical expertise to determine the fair market value (FMV) of shares, a critical step for compliance with accounting, taxation, and regulatory frameworks.

The engagement of a registered valuer is mandatory for ESOP share valuations in India. Without an IBBI-recognized valuation report, companies cannot lawfully issue shares under ESOP schemes, nor can they satisfy statutory reporting requirements under the Companies Act, 2013, the Income Tax Act, or, in certain cases, SEBI and FEMA/RBI regulations for cross-border employees.

Registered valuers are required to meet stringent qualifications, which typically include:

- IBBI registration as a valuer for securities or financial assets.

- Successful completion of the IBBI valuation examination.

- Membership with a Registered Valuers Organisation (RVO).

- Relevant education and professional experience in finance, accounting, or valuation

This combination of accreditation, training, and experience ensures that their valuations are credible, transparent, and legally recognized.

6. Key Responsibilities of Registered Valuers

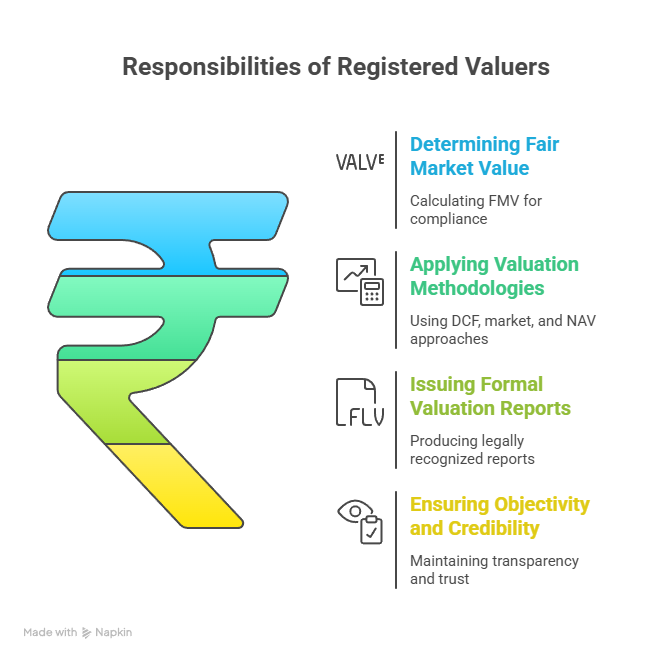

Registered valuers play a highly specialized and legally mandated role in the ESOP lifecycle. Their primary responsibilities include:

Determining Fair Market Value (FMV):

Valuers independently calculate the FMV of shares to ensure compliance with accounting standards, tax laws, and other regulatory requirements. Accurate FMV determination is crucial for grant, exercise, and reporting purposes.

Applying Appropriate Valuation Methodologies:

- Depending on the company’s stage, sector, and business model, valuers may employ methods such as:

- Discounted Cash Flow (DCF) approach

- Market approach (comparable companies or transactions)

- Net Asset Value (NAV) approach

Issuing Formal Valuation Reports:

Valuers produce signed, legally recognized reports that serve as official documentation for statutory filings, audit reviews, and regulatory submissions. These reports often form the backbone for compliance under the Companies Act, Income Tax Act, and, if applicable, FEMA/RBI regulations.

Ensuring Objectivity and Credibility:

Their independent evaluation ensures transparency, reduces conflicts of interest, and withstands scrutiny from regulators, auditors, and legal authorities. This objectivity is essential for maintaining trust among stakeholders, including employees, management, and investors.

7. Comparing Authority and Legal Standing

One of the most critical distinctions between ESOP consultants and registered valuers lies in their legal authority. While both play complementary roles in ESOP implementation, only registered valuers have the statutory power to sign off on valuation reports. ESOP consultants, despite their expertise in administration, compliance, and advisory, cannot issue legally binding valuations.

This distinction has direct implications for regulatory compliance:

- Consultants: Their engagement is highly recommended to ensure smooth design, administration, and communication of ESOPs, but it is not legally mandatory. Companies can technically operate without a consultant, although doing so increases the risk of procedural errors or non-compliance.

- Registered Valuers: Their reports are mandatory for share allotment, accounting purposes, perquisite taxation under the Income Tax Act, and, where relevant, cross-border compliance under FEMA/RBI regulations. For listed companies or regulated entities, SEBI guidelines further reinforce the necessity of a legally recognized valuation.

By understanding this legal hierarchy, companies can clearly delineate responsibilities, ensuring that all statutory requirements are met while leveraging consultants for advisory and operational support.

8. Background and Expertise Differences

The expertise and professional backgrounds of ESOP consultants and registered valuers differ substantially, reflecting the scope and nature of their responsibilities:

- ESOP Consultants: Typically bring advisory, HR, accounting, and legal knowledge to the table. Their skillset focuses on structuring ESOP schemes, regulatory compliance, employee engagement, and strategic alignment with company objectives. Consultants act as the bridge between management, employees, and valuers, ensuring clarity and smooth administration.

- Registered Valuers: Specialize in finance, accounting, and formal valuation methodologies, backed by IBBI accreditation. Their expertise lies in objectively determining the fair market value (FMV) of shares using methods such as DCF, market comparables, or net asset valuation. This technical rigor ensures that valuations are legally defensible, audit-ready, and compliant with statutory frameworks.

9. Scope of Work: Consultants vs Valuers

The scope of work for ESOP consultants and registered valuers differs fundamentally, reflecting their respective expertise and statutory responsibilities, yet the two roles are highly complementary in practice.

ESOP Consultants primarily focus on:

- Plan Design: Crafting ESOP schemes aligned with business objectives, employee retention strategies, and incentive frameworks.

- Administration: Managing operational aspects such as ESOP trusts, grant tracking, vesting schedules, and exercise processes.

- Communication: Educating employees on ESOP mechanics, taxation, and benefits.

- Compliance Advisory: Guiding management through regulatory filings, board approvals, and procedural requirements.

Registered Valuers, in contrast, specialize in:

- FMV Calculation: Independently determining the fair market value of shares to satisfy legal and regulatory requirements.

- Valuation Report Issuance: Producing formal, signed reports recognized by authorities for statutory and audit purposes.

- Audit and Regulator Compliance: Ensuring that valuations withstand scrutiny from tax authorities, auditors, and other regulators.

Together, these roles form a cohesive ecosystem: consultants handle the design, governance, and communication aspects, while valuers provide objectivity, credibility, and regulatory compliance through precise valuations. This collaboration ensures that companies can implement ESOPs effectively, maintain transparency, and minimize legal risk.

10. Practical Scenarios: When to Engage Each

Engaging consultants and valuers at the appropriate stages of the ESOP lifecycle is critical for smooth execution and compliance:

Pre-ESOP Implementation:

Engage ESOP consultants to design the plan, draft scheme documents, obtain approvals, and set up administrative processes.

During Grant, Allotment, or Exercise:

Engage registered valuers to determine the FMV of shares, issue legally recognized valuation reports, and ensure statutory compliance for taxation and accounting.

Ongoing Plan Management:

Continue working with ESOP consultants to manage employee communications, oversee trust administration, track vesting schedules, and coordinate compliance filings.

Example Workflow:

- Step 1: Consultant drafts the ESOP plan and obtains board/shareholder approvals.

- Step 2: Valuer calculates FMV and issues the valuation report.

- Step 3: Consultant communicates FMV, tax implications, and exercises to employees.

- Step 4: Consultant coordinates with valuer for subsequent valuation cycles during new grants or exercises.

This staged approach highlights how the two roles operate in tandem, ensuring ESOP implementation is strategically aligned, legally compliant, and employee-friendly.

11. Common Misconceptions and Clarifications

Despite the growing popularity of ESOPs in India, several misconceptions persist regarding the roles of ESOP consultants and registered valuers. Clarifying these distinctions is essential to avoid compliance risks and operational errors:

Do consultants perform valuations?

No. ESOP consultants provide advisory, administrative, and compliance support but do not have the legal authority or technical mandate to issue valuation reports.

Do valuers manage ESOP administration?

No. Registered valuers focus solely on objectively determining the fair market value (FMV) of shares and issuing legally recognized reports. They do not handle plan design, employee communication, or administrative operations.

Are both roles optional?

Only the engagement of consultants is optional. While their expertise significantly eases plan management and compliance, statutory filings and share allotments cannot proceed without a registered valuer’s report.

Understanding these distinct responsibilities is crucial for companies. Missteps—such as relying solely on consultants for valuations or skipping valuer engagement—can lead to regulatory scrutiny, tax complications, or legal disputes.

12. Conclusion

ESOP consultants and registered valuers serve complementary but distinct roles in the lifecycle of Employee Stock Option Plans. Consultants guide companies through design, administration, employee communication, and regulatory navigation, while valuers provide independent, legally recognized share valuations essential for compliance.

For founders, HR leaders, and finance teams, the key takeaway is clear: engage both professionals early and strategically. Proper coordination ensures that ESOPs are effectively implemented, legally compliant, and aligned with organizational objectives, minimizing risk while maximizing employee engagement and retention.

Frequently Asked Questions (FAQs)

No. Only a registered valuer accredited by the IBBI can issue legally recognized valuation reports. Consultants provide advisory and administrative support but do not have authority to perform valuations.

No. While engaging an ESOP consultant is highly recommended for smooth plan design, administration, and employee communication, their involvement is not legally mandatory.

A registered valuer must be engaged whenever shares are granted, allotted, or exercised under an ESOP. Their FMV report is legally required for statutory filings, tax compliance, and audit purposes.

No. Registered valuers focus solely on objective share valuation and report issuance. Administrative tasks, employee education, and compliance coordination are handled by ESOP consultants.

Engaging both ensures that the ESOP is strategically designed, operationally efficient, and legally compliant. Consultants manage plan lifecycle and employee engagement, while valuers provide credible, regulatory-compliant valuations—together mitigating legal and operational risks.