Table of Contents

ToggleI Introduction: Why Valuation is the Startup Founder’s First Real Test

For Indian startup founders, fundraising valuation is not just about raising capital; it’s about relinquishing ownership, setting the tone for future expectations, and proving that the venture is worthy of external belief. The valuation a startup commands during a fundraising round is often the first moment of reckoning for a founder, where financial realities meet market perception. In this context, preparing an accurate and compliant investor valuation report becomes critical; not just to satisfy regulatory norms, but also to present a credible case to potential investors and protect long-term equity value.

In a hyper-competitive startup ecosystem like India’s, valuation is more than a number; it is a statement. It reflects how the market perceives your startup’s potential, the credibility of your team, and the scalability of your business model. It can influence the kind of investors you attract, the degree of control you retain, and the trajectory of your future funding rounds.

India’s startup landscape has matured considerably over the past decade. Investors today are more discerning, and founders are expected to walk into fundraising conversations with clarity, data-backed narratives, and a strong grasp of their business’s true worth. In this environment, understanding how fundraising valuations are calculated and what they signify,has become an essential leadership skill.

II. What is Fundraising Valuation?

Fundraising valuation is the process of determining the monetary worth of a startup at a specific stage of its fundraising journey. It serves as the financial foundation on which investment deals are negotiated. The valuation determines what percentage of ownership a founder must give up in exchange for capital and sets the terms for future exits and dilution.

There are two critical concepts in this context:

- Pre-money valuation: This is the value of the startup immediately before the new capital is infused. It reflects what the company is worth based on its assets, intellectual property, traction, and projected potential.

- Post-money valuation: This is the value of the company after the new funds have been added to the business. It is calculated by adding the amount of investment to the pre-money valuation.

For example, if a startup has a pre-money valuation of ₹10 crore and raises ₹2 crore in funding, the post-money valuation becomes ₹12 crore. The investor, having contributed ₹2 crore, would own approximately 16.67% of the company (₹2 crore ÷ ₹12 crore).

This valuation becomes the baseline for all discussions around equity dilution, ownership control, and investor returns. It is the number investors scrutinize to determine whether the risk-reward equation of your startup makes sense, and the number founders must defend with data, conviction, and a compelling narrative.

III. Key Valuation Methods Used in India

Indian startups operate in a diverse ecosystem, ranging from tech-heavy SaaS models to asset-light marketplaces and deep-tech ventures. As such, no single valuation method fits all. Investors and founders must choose the method most appropriate to the startup’s maturity, industry, financial visibility, and growth model.

Below are the most commonly used startup valuation methods in India:

Method | Description | Best Suited For |

Market Approach | Compares your startup’s valuation to similar businesses or recent transactions in the same sector. | Startups in popular, high-visibility sectors |

Income Approach (DCF) | Projects future cash flows and discounts them to present value using a discount rate. | Revenue-generating or growth-stage startups |

Cost Approach | Calculates the replacement cost of building the startup’s assets and operations from scratch. | Asset-heavy or early-stage ventures |

Berkus Method | Assigns value to five key factors: idea, team, prototype, partnerships, and traction. | Pre-revenue, early-stage startups |

Scorecard Method | Adjusts a standard valuation based on team strength, market size, product maturity, and competitors. | Founders raising angel or seed capital |

Venture Capital Method | Works backward from the expected exit value based on required investor return multiples. | Startups seeking VC funding with exit visibility |

Each method has trade-offs. For example, while the DCF model can provide a highly customized valuation, it relies heavily on financial forecasts that may be speculative for early-stage startups. On the other hand, qualitative methods like Berkus and Scorecard can be helpful for founders without meaningful revenue but with strong teams or IP assets.

Professional firms like Marcken Consulting help founders navigate this complexity by selecting and applying the most appropriate methods—or a hybrid model—based on the stage, sector, and target investor expectations. This ensures the valuation stands up to investor scrutiny and regulatory benchmarks.

IV. Factors Influencing Fundraising Valuation in India

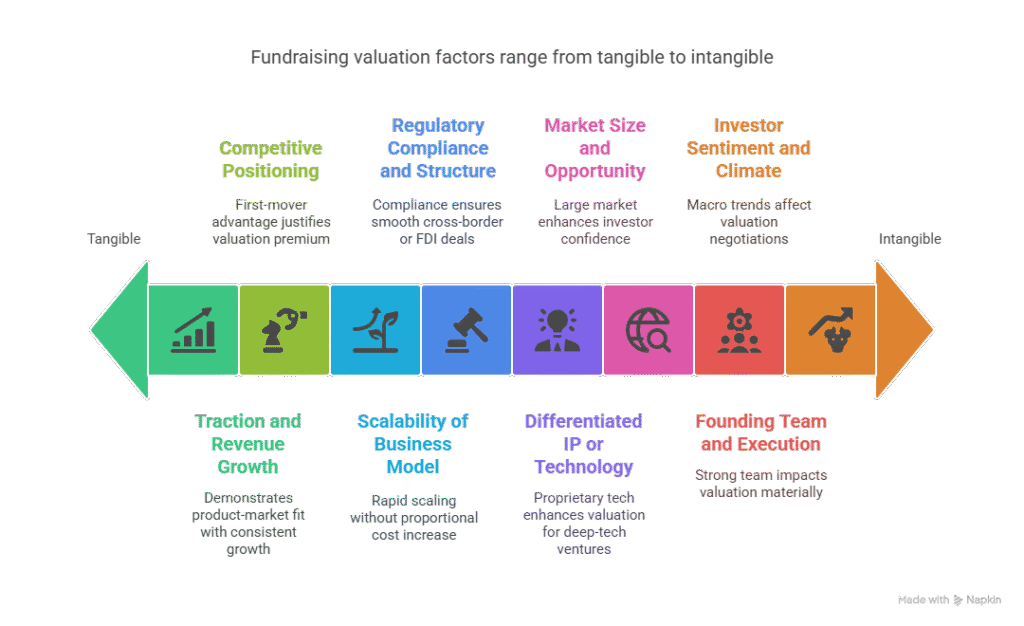

Valuation is never just about numbers. It’s shaped by a matrix of qualitative and quantitative factors that influence how investors perceive a startup’s future potential and risk exposure. In India, where investor sentiment can shift with sector cycles and macroeconomic indicators, founders must be especially attuned to the following valuation drivers:

1. Scalability of Business Model

Startups that can scale rapidly without proportionally increasing costs often command premium valuations. SaaS, fintech, and consumer internet platforms typically benefit from this.

2. Traction and Revenue Growth

Consistent growth in users, revenue, or GMV demonstrates product-market fit. Metrics like CAC (Customer Acquisition Cost), LTV (Lifetime Value), and churn also play a role in validating the unit economics.

3. Founding Team and Execution Capability

Investors bet on people more than ideas. A team with strong industry experience, execution history, or domain-specific skills can materially impact valuation.

4. Market Size and Opportunity

A large and expanding addressable market enhances investor confidence. Startups operating in sectors aligned with national priorities (e.g., digital health, climate tech, fintech inclusion) often attract better valuations.

5. Differentiated IP or Technology

Proprietary technology, patents, or defensible innovations act as valuation enhancers, especially for deep-tech or AI/ML ventures.

6. Competitive Positioning

A clear edge over incumbents or a first-mover advantage in an emerging segment can justify a valuation premium.

7. Regulatory Compliance and Structure

Especially in cross-border or FDI-involved deals, startups must comply with the Companies Act, FEMA, Income Tax Act, and SEBI regulations. Proper documentation and reporting through valuation reports are essential.

8. Investor Sentiment and Funding Climate

Broader macroeconomic trends, recent sectoral exits, and public market activity affect how conservative or aggressive investors will be during valuation negotiations.

Understanding and articulating these factors helps founders defend their valuation ask—and gives investors a structured lens to assess the opportunity. This is where Marcken Consulting’s Investor Valuation Report plays a critical role, combining market analysis, financial modeling, and regulatory compliance into a defensible document for your fundraising journey.

V. Current Trends in Indian Fundraising Valuations

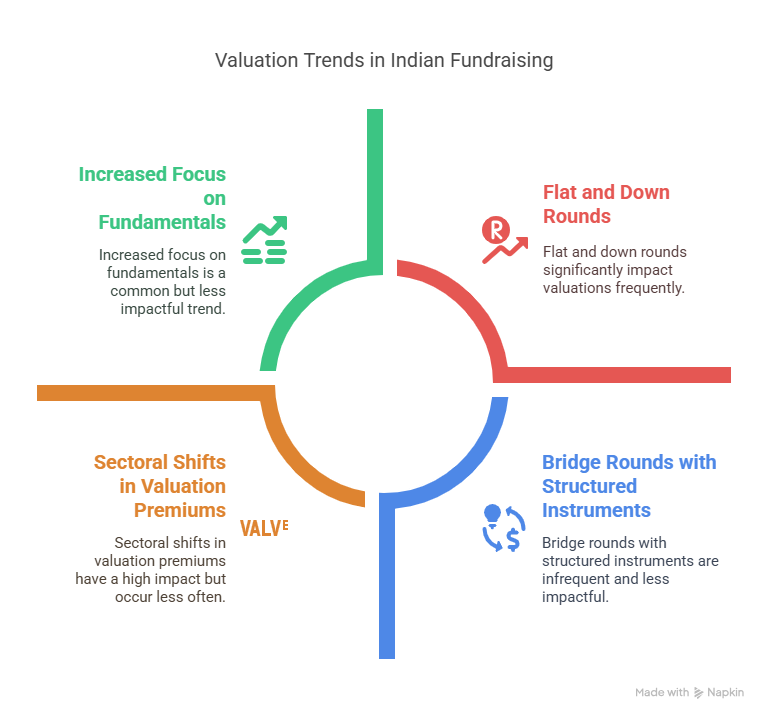

India’s startup ecosystem has entered a more discerning, data-driven era. While the country continues to produce unicorns and attract global capital, the valuation landscape has evolved significantly since the funding boom of 2021.

Here are the key valuation trends founders should be aware of:

1. Flat and Down Rounds Becoming Common

With capital becoming more selective, many growth-stage startups are raising funds at the same or even lower valuations than previous rounds. Notable examples include CRED, Byju’s, and PharmEasy. This trend is a result of both economic headwinds and investor demand for performance over projection.

2. Increased Focus on Fundamentals

The days of sky-high valuations based on GMV and user acquisition alone are over. Investors now place greater emphasis on profitability metrics, efficient burn rates, and monetization strategies.

3. Sectoral Shifts in Valuation Premiums

Sectors like SaaS, cleantech, EV infrastructure, and enterprise AI continue to attract higher valuations due to their long-term relevance. Meanwhile, hyper-funded consumer sectors are witnessing valuation compression.

4. Bridge Rounds with Structured Instruments

Startups are increasingly opting for convertible notes or SAFE (Simple Agreement for Future Equity) notes to avoid setting valuations too early, especially in uncertain fundraising environments.

5. Heightened Regulatory Scrutiny

With the tightening of FEMA, Income Tax Act provisions, and SEBI regulations, startups raising cross-border capital must ensure valuations are backed by certified reports and proper documentation.

These shifts underscore the importance of not just negotiating valuation, but justifying it. A defensible, well-articulated valuation backed by a credible Investor Valuation Report, like the one offered by Marcken Consulting can make all the difference between a term sheet and a stalled negotiation.

VI. Documentation Required for a Fundraising Valuation Report

A professionally prepared valuation report isn’t just a regulatory formality—it’s a strategic tool. Whether you’re raising capital from Indian investors or foreign VCs, a structured report gives investors confidence in your preparedness, transparency, and legal compliance.

Here’s what typically goes into a comprehensive fundraising valuation report:

- Business Overview and Executive Summary

A snapshot of your company’s vision, business model, product offering, and target market. - Historical Financials

Audited financial statements for the past 3–5 years (if available), including P&L, balance sheet, and cash flow. - Forecasts and Projections

Forward-looking financial models with assumptions, revenue forecasts, cost structures, and EBITDA projections. - Capitalization Table (Cap Table)

An updated view of equity ownership, investor stakes, options pool, and convertible instruments. - Market and Competitive Analysis

Industry trends, size of addressable market, customer segments, and competitor benchmarking. - Valuation Methodology

Detailed explanation of the approach used (DCF, Berkus, Scorecard, etc.), including sensitivity analysis. - Regulatory Disclosures and Compliance

FEMA guidelines, Income Tax Section 56(2)(viib), Companies Act references, and fair value as per RBI or CBDT norms. - Founders and Team Profiles

Highlighting key team members, advisors, and board members with their backgrounds and contributions. - Deal Summary or Term Sheet (if available)

Outline of the proposed investment, share structure, liquidation preferences, and governance rights.

At Marcken Consulting, our valuation reports are tailored to meet both investor expectations and Indian regulatory requirements. Whether you’re raising your first angel cheque or a cross-border Series A, we provide valuation support that’s as robust as it is investor-ready.

VII. Why Accurate Valuation Matters

In fundraising, the valuation isn’t just a negotiation figure—it’s a strategic milestone. An accurate and well-documented valuation report sets the tone for the entire funding round and beyond. Here’s why founders should treat it with the seriousness it deserves:

- Investor Confidence and Deal Closure

A valuation backed by a credible financial model and third-party validation signals professionalism and preparedness. It reduces friction in investor conversations and accelerates due diligence and deal closure. - Regulatory Compliance

Under Indian laws such as the Income Tax Act (Section 56), Companies Act, and FEMA, startups are required to issue shares at a justifiable fair value. An undervaluation or overvaluation without proper documentation can trigger tax scrutiny or penalties. - Optimal Equity Dilution

Founders often face the dilemma of raising too much capital at too low a valuation, leading to unnecessary dilution. A well-substantiated valuation helps retain control, maintain a strong cap table, and avoid future down rounds. - Foundation for Future Rounds

Every funding round sets a precedent. An overhyped valuation today may backfire in the next round. A defensible and growth-aligned valuation today ensures smoother progression in Series A and beyond. - Investor-Type Alignment

Early-stage angels may value vision and team. Late-stage VCs focus on metrics and scale. A valuation report that adapts to the maturity of your startup helps engage the right kind of capital.

In short, valuation isn’t a one-time checkbox, it’s a strategic weapon when used right.

VIII. Conclusion: Build with Clarity, Raise with Confidence

Fundraising in India is no longer a backroom negotiation—it’s a regulated, data-driven, and increasingly global affair. As a founder, knowing how to value your company—and proving that valuation—is essential to raising capital on your terms.

Whether you’re preparing for your first seed round or navigating a complex cross-border transaction, you need more than just a good pitch deck. You need a valuation report that stands up to scrutiny, attracts serious investors, and satisfies compliance authorities.

At Marcken Consulting, we specialize in crafting investor-grade fundraising valuation reports tailored for Indian startups. Our team brings the financial expertise, regulatory knowledge, and startup sensitivity you need to raise capital the right way.

Frequently Asked Questions (FAQs)

Pre-money valuation refers to the value of a startup before receiving external funding. Post-money valuation is the value after the investment has been added. For example, if a startup is valued at ₹10 crore pre-money and raises ₹2 crore, its post-money valuation becomes ₹12 crore.

Indian investors use a mix of valuation methods such as the Discounted Cash Flow (DCF), Market Comparables, and the Venture Capital Method. Early-stage startups may also be assessed using qualitative models like the Berkus or Scorecard methods, especially if they lack historical revenue data.

Yes, especially if you are issuing shares to investors, including foreign direct investors. Regulatory bodies like SEBI, RBI, and the Income Tax Department require a certified valuation report to justify share prices and comply with FDI, FEMA, and tax laws.

A valid fundraising valuation report in India must be issued by a Registered Valuer, Chartered Accountant, or Merchant Banker, depending on the regulatory requirements and investor expectations. Marcken Consulting offers compliant and investor-ready valuation reports.

Overvaluation can lead to future down rounds, investor mistrust, and difficulty in raising subsequent capital. Undervaluation may result in excessive equity dilution. Accurate, well-reasoned valuation helps maintain long-term credibility and cap table health.