Table of Contents

Toggle1. Introduction

Brief Context on SME Growth in India

Small and Medium Enterprises (SMEs) form the backbone of the Indian economy, significantly contributing to the country’s GDP, exports, and employment. According to data from the Ministry of MSME, SMEs account for nearly 30% of India’s GDP and employ over 110 million people. With the rise of a digital economy, government-backed reforms, and enhanced credit access, SMEs are increasingly playing a transformative role in both rural and urban India. Yet, despite their potential, one of the biggest challenges these enterprises face is access to growth capital.

Why an IPO is a Game-Changer for SMEs

For many SMEs, Initial Public Offering (IPO) represents more than just a means of raising capital—it is a pivotal milestone that can accelerate growth, professionalize operations, enhance visibility, and open new market opportunities. By listing on SME-specific platforms such as BSE SME or NSE Emerge, these companies can tap into public market funding while retaining the flexibility suited to their size and operations. Moreover, a successful IPO can improve creditworthiness, attract strategic investors, and unlock liquidity for existing shareholders.

Importance of Getting the Process Right

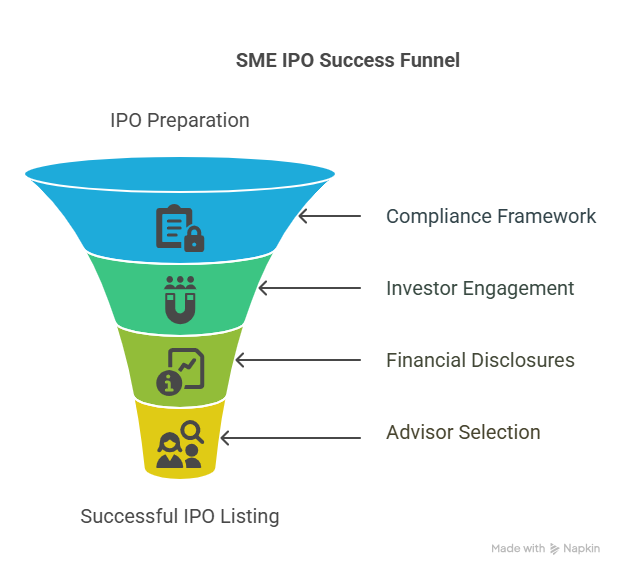

Launching an IPO is a complex, multi-stage process involving extensive regulatory compliance, financial transparency, and strategic planning. Without proper preparation and the right advisory support, companies can face delays, rejections, or underwhelming investor response. A well-executed IPO not only ensures compliance with SEBI and exchange regulations but also lays the foundation for a company’s long-term credibility in capital markets.

A Glimpse of What This Guide Covers

This comprehensive guide walks you through the essential steps required to launch a successful SME IPO in India—from assessing your eligibility and appointing key advisors to filing your prospectus, marketing the offer, and ensuring post-listing compliance. Drawing from the latest regulatory frameworks, market trends, and expert insights, this article is tailored for Indian SMEs ready to scale through public listing.

1. Understanding SME IPOs in India

Definition and Difference from Mainboard IPOs

An SME IPO refers to the public listing of shares by small and medium-sized enterprises on specialized platforms such as BSE SME and NSE Emerge. Unlike mainboard IPOs, which are suited for larger corporations with extensive market capitalization and investor scrutiny, SME IPOs are designed for smaller firms with relatively modest financial and operational histories.

The key differentiators include lower listing requirements, reduced compliance burdens, simplified disclosure norms, and streamlined processes. For instance, while a mainboard IPO may demand a minimum post-issue paid-up capital of ₹10 crore and broader public shareholding, an SME IPO can proceed with post-issue capital as low as ₹1 crore and a minimum of 50 allottees.

Relevance in the Indian Funding Landscape

In India, traditional funding sources such as bank loans, venture capital, and private equity are often inaccessible or insufficient for SMEs due to risk perception, collateral constraints, or scale limitations. The SME IPO platform fills this financing gap by providing companies with direct access to equity capital markets.

SEBI’s reforms over the past decade, along with the establishment of dedicated SME exchanges, have made it significantly easier for SMEs to raise capital via public issues. As of 2025, over 800 SMEs have successfully listed on BSE SME and NSE Emerge, collectively raising thousands of crores in capital.

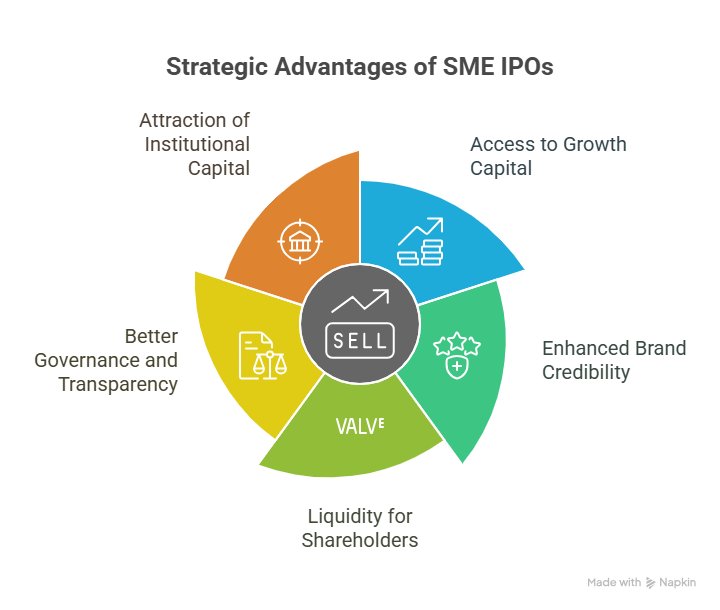

Key Benefits for SMEs

A successful SME IPO brings with it several strategic advantages:

- Access to growth capital: Funds raised can be used for expansion, debt reduction, product development, or working capital needs.

- Enhanced brand credibility: Public listing signals trust, stability, and long-term vision to stakeholders.

- Liquidity for shareholders: Promoters and early investors can unlock value and achieve partial exits.

- Better governance and transparency: IPO preparation compels companies to upgrade compliance and corporate practices, which can enhance investor and customer trust.

- Attraction of institutional capital: Listed SMEs often draw interest from domestic and international institutional investors.

Common Misconceptions

Despite its benefits, SME IPOs are often surrounded by myths:

- “IPO is only for large companies.” In reality, the SME platform exists precisely to cater to smaller enterprises.

- “IPO requires huge costs.” While there are costs involved, these are proportionate to the scale and often outweighed by long-term capital access and valuation gains.

- “Public markets are too complex for SMEs.” With the right merchant banker and advisory team, even first-time entrepreneurs can navigate the process smoothly.

“Listing leads to loss of control.” Promoters can retain majority ownership even after listing, especially with OFS (Offer for Sale) restrictions in place for SMEs.

2. Are You Eligible? – Self-Assessment Checklist

Before initiating the IPO process, SMEs must evaluate whether they meet the eligibility criteria laid down by SEBI (Securities and Exchange Board of India) and the specific SME platforms—BSE SME or NSE Emerge. A thorough self-assessment ensures that the business is IPO-ready and helps avoid unnecessary regulatory hurdles or delays.

SEBI & Exchange-Wise Eligibility Criteria

Both BSE SME and NSE Emerge prescribe detailed eligibility norms for companies seeking listing. While these may vary slightly across exchanges, the broad framework includes:

- The company must be incorporated under the Companies Act, 1956 or 2013, and must be classified as a public limited company.

- The post-issue paid-up capital (after the IPO) must not exceed ₹25 crore.

- The company should not have been referred to the Board for Industrial and Financial Reconstruction (BIFR).

- There should be no winding-up petition accepted by the court against the company.

Company Structure and Age

The company must be a public limited entity at the time of filing for the IPO. If your business is currently operating as a private limited company, LLP, or partnership, it must be converted to a public limited company through a statutory process.

In terms of age, most exchanges expect the company to have a minimum operational track record of 3 years. Alternatively, if the business is relatively new, it must demonstrate that its project has been appraised and funded by a recognized financial institution or government agency.

Financial Thresholds (Net Worth, EBITDA, Tangible Assets)

The financial metrics required vary slightly between NSE Emerge and BSE SME, but typically include:

- Net Tangible Assets: Minimum of ₹3 crore as per the latest audited financials.

- Net Worth: At least ₹1 crore (BSE SME) or ₹3 crore excluding revaluation reserves (NSE Emerge) over the previous two years.

- Profit Track Record: Operating profit (EBITDA) of at least ₹1 crore in 2 out of the last 3 financial years.

- Distributable Profits: Positive distributable profits in at least two out of the preceding three years.

Shareholding & Dematerialization Requirements

All equity shares must be in dematerialized (demat) form before the IPO. The company must ensure that its capital structure is compliant with SEBI regulations regarding disclosure, lock-in provisions, and promoter contribution.

Additionally, to ensure wider investor participation, the company must allot shares to at least 50 individual allottees, each subscribing to a minimum application size (typically ₹1 lakh or more).

Number of Allottees and Underwriting Mandates

- Minimum number of allottees: A successful SME IPO must have at least 50 allottees, apart from the promoters.

- Underwriting: 100% underwriting of the issue is mandatory. Importantly, the merchant banker must underwrite at least 15% of the issue amount on its account to ensure credibility and investor confidence.

Updated SEBI Norms (2024–2025 Changes)

SEBI has introduced several reforms in recent years to enhance transparency, investor protection, and the overall credibility of SME listings:

- Profitability Requirement: EBITDA of at least ₹1 crore in two of the last three financial years is now a hard requirement.

- Offer for Sale (OFS) Restrictions: The OFS portion cannot exceed 20% of the issue size, and individual selling shareholders are restricted from offloading more than 50% of their holdings during the IPO.

- Promoter Lock-in: Any excess promoter shareholding beyond the minimum required is now released in a phased manner post-listing to ensure continued commitment to the business.

Conducting a detailed eligibility check against these criteria is the first step toward a successful IPO. Companies not meeting these requirements may need to wait, restructure, or optimize financial performance before proceeding.

2. Are You Eligible? – Self-Assessment Checklist

Before initiating the IPO process, SMEs must evaluate whether they meet the eligibility criteria laid down by SEBI (Securities and Exchange Board of India) and the specific SME platforms—BSE SME or NSE Emerge. A thorough self-assessment ensures that the business is IPO-ready and helps avoid unnecessary regulatory hurdles or delays.

SEBI & Exchange-Wise Eligibility Criteria

Both BSE SME and NSE Emerge prescribe detailed eligibility norms for companies seeking listing. While these may vary slightly across exchanges, the broad framework includes:

- The company must be incorporated under the Companies Act, 1956 or 2013, and must be classified as a public limited company.

- The post-issue paid-up capital (after the IPO) must not exceed ₹25 crore.

- The company should not have been referred to the Board for Industrial and Financial Reconstruction (BIFR).

- There should be no winding-up petition accepted by the court against the company.

Company Structure and Age

The company must be a public limited entity at the time of filing for the IPO. If your business is currently operating as a private limited company, LLP, or partnership, it must be converted to a public limited company through a statutory process.

In terms of age, most exchanges expect the company to have a minimum operational track record of 3 years. Alternatively, if the business is relatively new, it must demonstrate that its project has been appraised and funded by a recognized financial institution or government agency.

Financial Thresholds (Net Worth, EBITDA, Tangible Assets)

The financial metrics required vary slightly between NSE Emerge and BSE SME, but typically include:

- Net Tangible Assets: Minimum of ₹3 crore as per the latest audited financials.

- Net Worth: At least ₹1 crore (BSE SME) or ₹3 crore excluding revaluation reserves (NSE Emerge) over the previous two years.

- Profit Track Record: Operating profit (EBITDA) of at least ₹1 crore in 2 out of the last 3 financial years.

- Distributable Profits: Positive distributable profits in at least two out of the preceding three years.

Shareholding & Dematerialization Requirements

All equity shares must be in dematerialized (demat) form before the IPO. The company must ensure that its capital structure is compliant with SEBI regulations regarding disclosure, lock-in provisions, and promoter contribution.

Additionally, to ensure wider investor participation, the company must allot shares to at least 50 individual allottees, each subscribing to a minimum application size (typically ₹1 lakh or more).

Number of Allottees and Underwriting Mandates

- Minimum number of allottees: A successful SME IPO must have at least 50 allottees, apart from the promoters.

- Underwriting: 100% underwriting of the issue is mandatory. Importantly, the merchant banker must underwrite at least 15% of the issue amount on its account to ensure credibility and investor confidence.

Updated SEBI Norms (2024–2025 Changes)

SEBI has introduced several reforms in recent years to enhance transparency, investor protection, and the overall credibility of SME listings:

- Profitability Requirement: EBITDA of at least ₹1 crore in two of the last three financial years is now a hard requirement.

- Offer for Sale (OFS) Restrictions: The OFS portion cannot exceed 20% of the issue size, and individual selling shareholders are restricted from offloading more than 50% of their holdings during the IPO.

- Promoter Lock-in: Any excess promoter shareholding beyond the minimum required is now released in a phased manner post-listing to ensure continued commitment to the business.

Conducting a detailed eligibility check against these criteria is the first step toward a successful IPO. Companies not meeting these requirements may need to wait, restructure, or optimize financial performance before proceeding.

3. The IPO Dream Team – Appointing the Right Merchant Banker

Launching a successful IPO—especially for SMEs—hinges on assembling a team of experienced professionals, and at the center of this ecosystem is the SEBI-registered Merchant Banker, also referred to as the Lead Manager. This financial intermediary plays a pivotal role in managing the IPO from end to end.

Why Merchant Bankers Are Essential

A merchant banker acts as the strategic advisor, compliance guide, and regulatory liaison throughout the IPO journey. For SMEs venturing into public markets for the first time, the process can be daunting, ranging from preparing disclosure documents to securing approvals and marketing the issue. The merchant banker ensures that each phase is executed correctly, compliantly, and efficiently.

Moreover, merchant bankers underwrite the issue, thereby assuring potential investors that the offer is backed by a reputable institution that has conducted due diligence.

What They Do: Due Diligence, DRHP Prep, Compliance

The core responsibilities of a merchant banker include:

- Due Diligence: Reviewing all aspects of the company’s operations, including financials, corporate structure, contracts, litigation, tax compliance, intellectual property, and promoter background.

- Preparation of Draft Red Herring Prospectus (DRHP): This document serves as the foundation of the IPO, providing potential investors with insights into the company’s business model, financial performance, risks, and plans.

- Regulatory Filings and Liaison: The merchant banker coordinates with the stock exchange (BSE SME or NSE Emerge), SEBI (if applicable), and the Registrar of Companies (ROC) for all statutory filings and approvals.

- Pricing and Issue Structuring: Based on market conditions, financial projections, and investor appetite, the lead manager helps finalize the issue price and size.

- Post-Listing Guidance: Even after the IPO, the merchant banker often assists the company with investor relations, compliance reporting, and strategic communications.

Choosing the Right One for Your Sector

Not all merchant bankers have the same strengths. Some specialize in manufacturing, others in technology, healthcare, or consumer services. When selecting a merchant banker, SMEs should consider:

- Experience in SME IPOs: Prior experience on SME platforms is critical.

- Industry Knowledge: Familiarity with your sector can help in positioning your company more effectively.

- Investor Network: A strong network of institutional and retail investors can enhance subscription levels.

- Reputation and Credibility: The merchant banker’s brand itself can signal quality to the market.

It’s advisable to interview multiple merchant bankers before finalizing one. Understanding their approach, timelines, and previous track record is essential to make an informed choice.

Collaborating with Legal, Compliance & Auditors

The merchant banker doesn’t work alone. For a seamless IPO process, they coordinate with:

- Legal Advisors: To vet contracts, handle regulatory interpretations, and ensure disclosures are sound.

- Statutory Auditors: To prepare and validate financial statements and restated accounts in line with IPO requirements.

- Company Secretary & Compliance Teams: For adherence to Companies Act provisions, board resolutions, shareholder consents, and other statutory filings.

This collaborative framework, when led by a capable merchant banker, forms the bedrock of a smooth and compliant IPO journey for any SME.

4. Drafting the Story – Preparing the DRHP

Once the merchant banker is appointed and due diligence is underway, the next critical step is the preparation of the Draft Red Herring Prospectus (DRHP)—a document that tells the company’s story to the public capital market.

What the DRHP Includes

A merchant banker acts as the strategic advisor, compliance guide, and regulatory liaison throughout the IPO journey. For SMEs venturing into public markets for the first time, the process can be daunting, ranging from preparing disclosure documents to securing approvals and marketing the issue. The merchant banker ensures that each phase is executed correctly, compliantly, and efficiently.

Moreover, merchant bankers underwrite the issue, thereby assuring potential investors that the offer is backed by a reputable institution that has conducted due diligence.

What They Do: Due Diligence, DRHP Prep, Compliance

The DRHP is a comprehensive disclosure document that provides potential investors with a transparent view of the company. It serves not only as a regulatory requirement but also as a communication tool to build market confidence. The major components include:

- Company Overview: Background, legal structure, business model, key products/services, and market presence.

- Financial Information: Restated audited financial statements for the last three financial years, along with key ratios, management discussion, and analysis.

- Risk Factors: Detailed and specific risks related to the business, industry, regulatory environment, and financial performance.

- Promoter and Management Details: Background of promoters, directors, KMPs, and their track record.

- Use of Proceeds: Clearly defined plans for how the IPO funds will be utilized (e.g., expansion, debt repayment, working capital).

- Corporate Governance & Policies: Internal controls, board practices, policies on related-party transactions, etc.

- Business Strategy: The future roadmap, growth opportunities, and competitive strengths.

The DRHP must be prepared with the utmost attention to detail and consistency, as it will be scrutinized by regulators, investors, and legal counsel alike.

How Due Diligence Is Conducted

Due diligence is the foundation upon which the DRHP is built. It is a rigorous review carried out by the merchant banker, legal counsel, and financial advisors to validate all aspects of the company’s disclosures.

- Financial Due Diligence: Verifying restated financials, tax filings, contingent liabilities, and capital structure.

- Legal Due Diligence: Examining licenses, litigation history, statutory compliance, and intellectual property.

- Operational Due Diligence: Assessing internal controls, vendor/customer contracts, HR policies, and IT systems.

- Promoter Background Checks: Ensuring no criminal or regulatory red flags exist.

All material information must be disclosed truthfully and in sufficient depth to avoid misleading investors.

Filing with NSE Emerge or BSE SME

Once the DRHP is finalized, it is submitted to the chosen SME platform—BSE SME or NSE Emerge. Unlike mainboard IPOs, where SEBI undertakes a detailed review, SME IPOs are primarily vetted by the respective exchange.

- The DRHP is submitted online along with requisite forms, declarations, fee payments, and compliance documents.

- It is not made public immediately but undergoes a preliminary examination by the exchange’s listing team.

Responding to Observations or Queries

After submission, the exchange typically issues observations or clarifications, which the company must address promptly. These could include:

- Gaps or inconsistencies in disclosures

- Clarification on financial figures or business risks

- Additional documentation on shareholding, legal matters, or governance

A revised DRHP may be filed with the necessary modifications. Only after these responses are satisfactorily addressed does the process move to the next regulatory milestone.

5. Approval Round – Clearing the Regulatory Path

Once the DRHP is reviewed and observations are addressed, the exchange begins its formal evaluation, culminating in the in-principle approval for listing.

Exchange Reviews, Site Visits & Interviews

As part of their evaluation, exchanges undertake a thorough vetting process, which includes:

- Site Visits: Officials from the stock exchange may visit the company’s registered office, manufacturing units, or service centers to verify operations and assess infrastructure.

- Management Interviews: Promoters and key executives may be interviewed by the Listing Advisory Committee to assess competence, governance, and future vision.

- Verification of Financials and Disclosures: Cross-checking the company’s submissions against audited reports, statutory filings, and market data.

This process ensures that only credible, transparent, and growth-ready SMEs make it to the exchange.

Key Documents & Responses Required

During this stage, several critical documents are scrutinized and may need to be resubmitted or clarified:

- Board resolutions and shareholder approvals

- Updated, restated financials and management certifications

- ROC filings and compliance certificates

- Updated corporate governance declarations

- Market maker and underwriting agreements

- Legal opinions and promoter undertakings

The company, along with its advisors, must be prepared to respond to any follow-up queries swiftly and accurately.

Final In-Principle Approval – What It Means and What Comes Next

Once the exchange is satisfied with the submissions and assessments, it grants the in-principle approval. This approval indicates that the company has met all listing prerequisites, subject to final steps such as:

- Filing the final Red Herring Prospectus (RHP) with the Registrar of Companies (ROC)

- Announcing the IPO schedule and pricing details

- Launching pre-IPO marketing and investor roadshows

In-principle approval is a significant milestone. It signals to the market and potential investors that the company is poised for listing and has successfully navigated the regulatory framework of an SME IPO.

6. The Hype Machine – Pre-IPO Marketing and Roadshows

With the in-principle approval secured, the next critical phase in launching a successful SME IPO is creating awareness and demand. Pre-IPO marketing isn’t just about visibility—it’s about trust-building, investor education, and shaping the narrative around your business.

Organizing Investor Roadshows

Investor roadshows are structured events where the company’s top management—usually alongside the merchant banker—meets with potential investors, analysts, and institutional funds to present the investment case.

Key aspects include:

- Presentation of business fundamentals: Revenue model, competitive edge, market size, and scalability.

- Financial performance and projections: Past financial results, future earnings potential, and fund utilization plans.

- Leadership credentials: Promoter experience, governance track record, and leadership vision.

Roadshows can be held physically in key metros or conducted virtually, especially for reaching out to geographically dispersed investors. They serve as an interactive forum, allowing for Q&A sessions that build transparency and rapport.

Regulatory-Compliant Advertising

SEBI and stock exchanges prescribe strict guidelines for advertising during the IPO process to prevent misleading claims or over-promotional content. Marketing collaterals must:

- Be neutral, fact-based, and in line with disclosures made in the DRHP/RHP.

- Carry statutory disclaimers and risk disclosures.

- Be pre-vetted by the merchant banker and legal advisors.

Common complaint formats include:

- Print and digital advertisements in financial dailies.

- Online banners on regulated portals.

- TV interviews (with caution) or expert panel discussions featuring merchant bankers.

All promotional activities must align with the “silent period” regulations that apply during the offer window.

Investor Education: Institutional & Retail

A successful IPO doesn’t only rely on institutional participation—it must also attract retail investors who often form the backbone of SME IPO subscriptions.

Efforts should focus on:

- Simplified investment guides on the company website and DRHP microsite.

- Webinars or live Q&A sessions explaining the business, sector potential, and IPO mechanics.

- Sharing case studies of past SME IPO success stories.

The more informed your investors are, the more confident they are likely to be during the subscription process

The Role of Anchor Investors in Boosting Trust

Though SME IPOs don’t always require formal anchor investors, having reputable early subscribers—such as HNIs (High Net-Worth Individuals), family offices, or small-cap institutional funds—can dramatically improve credibility.

These investors often commit funds before the public offer opens, indicating confidence in the company’s fundamentals. Their presence:

- Creates positive momentum

- Reduces perceived risk for other investors

- Increases the chances of full subscription or oversubscription

A transparent strategy for engaging with and disclosing such investor interest can catalyze a successful public debut.

7. The Launch – Pricing, Subscription & Allocation

After weeks (or months) of preparation, it’s time for the most critical moment—the actual launch of the IPO. This stage involves strategic decisions, logistical coordination, and strict compliance with timelines and regulations.

Setting the Issue Price

The final IPO price is determined by the company and its merchant banker based on several factors:

- Valuation methodologies: Peer comparison, discounted cash flows, or asset-based valuation.

- Investor feedback: Inputs gathered during roadshows or informal bids.

- Market conditions: Sector sentiment, benchmark indices, and liquidity trends.

The pricing may be done via fixed price or book-building, though fixed pricing is more common in SME IPOs.

The pricing must balance investor attractiveness with fair valuation—overpricing can lead to under-subscription, while underpricing can leave capital on the table.

Opening the IPO: Minimum Lot Size & Subscription Window

SME IPOs are subject to certain structural norms:

- Minimum Application Size: ₹1,00,000 or multiples thereof (this ensures participation from serious investors).

- Subscription Period: Typically open for 3–5 working days.

- Digital and Offline Application: Applications can be made via ASBA (Application Supported by Blocked Amount) through banks or brokers.

Real-time data on subscription status across investor categories (retail, HNI, etc.) is monitored and disclosed via the exchange.

Handling Oversubscription Scenarios

In cases where demand exceeds supply—especially among retail investors—the IPO is considered oversubscribed. This is a positive outcome, but requires strict adherence to allocation norms:

- Retail Category Allotment: Allotment is made through a computerized lottery system to ensure fairness.

- HNI and Institutional Category: Allocation is done proportionately based on application amounts.

Oversubscription also builds a strong listing-day sentiment and often results in premium valuation when trading begins

Basis of Allotment – Especially for Retail Investors

After the subscription window closes:

- The Basis of Allotment (BoA) is finalized by the Registrar to the Issue in consultation with the exchange.

- Refunds for unallocated applications are processed.

- Successful applicants are issued allotment advice, and shares are credited to their demat accounts before the listing date.

The BoA is made public, ensuring transparency in the allotment mechanism and trust in the process.

8. Life After the Bell – Listing and Post-IPO Compliance

The listing ceremony may mark the symbolic culmination of the IPO journey, but for the SME, it’s truly the beginning of a new chapter as a public company. The responsibilities post-listing are as critical as the effort to get listed.

Listing on BSE SME or NSE Emerge

Once the IPO is successfully subscribed and the basis of allotment is finalized, shares are credited to investors’ demat accounts, and the company is listed on the chosen SME platform—either BSE SME or NSE Emerge.

Key listing day highlights:

- Shares are assigned a unique ticker symbol and begin trading in the T+2 settlement cycle.

- The company joins the ranks of other listed SMEs and can benefit from increased market visibility and investor interest.

- Listing day performance, such as price movement and trading volumes, sets the tone for future investor engagement.

Both platforms provide ongoing support, visibility, and the potential for eventual migration to the mainboard, once eligibility conditions are met.

Role of Market Makers – Ensuring Liquidity for 3 Years

A unique feature of SME listings is the mandatory appointment of a Market Maker, who plays a vital role in ensuring liquidity in the company’s shares.

Market Makers:

- Provide buy and sell quotes daily for a minimum of 75% of the trading hours.

- Reduce price volatility and prevent illiquidity, especially in the early months of listing.

- They are typically appointed for three years post-listing.

Their involvement assures new investors that there is sufficient market depth and exit opportunities, encouraging broader participation.

Corporate Governance, Disclosures, and Reporting Norms

With public status comes a host of regulatory obligations. SME companies are required to maintain a higher standard of transparency and governance, including:

- Quarterly results and half-yearly financial disclosures

- Annual reports and Board of Directors disclosures

- Shareholding pattern filings every quarter

- Corporate governance reports (depending on size and migration status)

- Disclosure of material events or price-sensitive information

Non-compliance may result in penalties, suspension, or reputational damage—hence, companies must implement robust internal systems to meet ongoing obligations.

Transition Planning – From Private to Public Company Culture

Post-IPO success depends not just on regulations, but on cultural readiness.

- Board Composition: Inclusion of independent directors and strengthening board committees.

- Investor Relations: Designating a compliance officer or IR executive to communicate with stakeholders.

- Internal Controls: Transitioning from promoter-led decisions to structured, policy-based management.

- Strategic Discipline: Investors expect consistent communication, timely execution, and measurable growth metrics.

The shift requires a deliberate effort to foster a public company mindset, where transparency, accountability, and discipline become core to daily operations.

9. Common Pitfalls to Avoid

Despite the structured nature of SME IPOs, many companies falter due to avoidable missteps. Recognizing these early can save time, cost, and credibility.

Underestimating Compliance Requirements

Many SMEs focus heavily on the IPO preparation but overlook the post-listing regulatory burden. Filing delays, poor disclosures, or inadequate internal systems can lead to non-compliance, loss of investor trust, or even trading suspension.

Solution: Build a dedicated compliance framework from Day 1, and consider onboarding a Company Secretary with capital markets experience.

Inadequate Investor Outreach

An IPO is not just about raising funds—it’s about building relationships with the market. Many SMEs skip structured roadshows or limit investor communication, leading to under-subscription or muted post-listing interest.

Solution: Plan a well-articulated investor engagement strategy before, during, and after the IPO.

Weak Financial or Operational Disclosures

Incomplete, outdated, or inaccurate financials in the DRHP or RHP can derail the listing process. Regulatory authorities are increasingly thorough in their reviews.

Solution: Engage reputed auditors and legal advisors early to ensure your financial and operational records are IPO-ready.

Choosing the Wrong Advisors

Your merchant banker, legal counsel, and registrar are the pillars of your IPO journey. An inexperienced or misaligned advisor can delay timelines, cause compliance lapses, or fail in investor mobilization.

Solution: Choose SEBI-registered, SME-specialized advisors with proven track records and deep domain knowledge.

10. Secrets of a Successful SME IPO – Case Insights & Takeaways

As SME IPOs gain traction across India’s growth-focused business landscape, a pattern has emerged from the most successful listings in 2024–25. Companies that outperform on listing day—and sustain momentum thereafter—share a common DNA of readiness, clarity, and commitment.

Patterns from High-Performing SME IPOs in 2024–25

From sectors like precision engineering and specialty chemicals to IT services and healthcare, the leading SME IPOs of the year demonstrated:

- Strong subscription rates across retail and institutional segments, often seeing 5x to 10x oversubscription.

- Consistent listing-day premiums, with opening prices exceeding the issue price by 20–50%.

- Sustained trading activity and analyst coverage even months after listing.

These outcomes were not coincidental but the result of well-executed processes and strategic positioning.

What Success Looks Like: Fundamentals, Governance, Transparency

The most celebrated SME IPOs typically feature:

- Solid financial fundamentals: steady revenue growth, positive EBITDA margins, and well-articulated use of funds.

- Clean corporate governance: credible promoters, independent directors, and zero litigation or regulatory issues.

- Clear disclosures: DRHPs with detailed risk assessments, market analysis, and transparent accounting practices.

They present a coherent investment thesis—one that aligns business goals with shareholder value creation.

Role of Storytelling and Investor Confidence

While numbers matter, narrative builds conviction. Investors want to know:

- What problem are you solving?

- Why now?

- Why are you the best team to execute?

Successful SMEs weave their IPO pitch around a compelling story of innovation, resilience, and market opportunity, backed by evidence, not just ambition. The result is a confidence multiplier, especially for first-time or retail investors.

Long-Term Benefits Beyond Capital

While the primary goal is to raise capital, the secondary effects of a successful IPO can be just as transformative:

- Brand Visibility: Listing increases media coverage and public awareness.

- Strategic Partnerships: A listed entity is often more attractive to institutional partners and large clients.

- Valuation Discovery: Market-based valuation allows founders to unlock long-term wealth through future dilution or mergers.

- Migration to Mainboard: Once scale is achieved, SMEs can graduate to the mainboard exchange, gaining access to larger institutional capital.

Conclusion

A successful SME IPO in India is not an overnight phenomenon—it is the result of planning, regulatory discipline, stakeholder trust, and effective execution.

Here’s a quick recap of the journey:

- Assess eligibility and suitability based on SEBI and exchange norms

- Appoint a skilled, SEBI-registered merchant banker.

- Prepare a detailed, compliant Draft Red Herring Prospects.

- Obtain regulatory and exchange approvals through transparent disclosures.

- Build demand through investor outreach and roadshows.

- Launch the IPO with the right pricing, subscription mechanics, and allotment procedure.s

- Transition into a public company with governance and disclosure rigour

- Leverage listing to accelerate growth, reputation, and strategic opportunities.

Plan early. Choose your advisors wisely. Stay compliant.

And most importantly – be patient. The market rewards transparency, preparedness, and consistency. With the right foundation, an SME IPO can be not just a financial milestone, but a transformational step toward national and even global growth.

Frequently Asked Questions (FAQs)

To be eligible, your SME’s post-issue paid-up capital must not exceed ₹25 crore, and you should have net tangible assets of at least ₹3 crore. Additionally, SEBI now requires a minimum EBITDA of ₹1 crore in 2 out of the last 3 financial years, ensuring operational viability.

It depends on your business type and goals.

- BSE SME is ideal for traditional businesses like manufacturing or consumer goods seeking high regulatory credibility.

- NSE Emerge is preferred by tech, logistics, and growth-stage service firms for its faster processing and flexible approvals.

Choose based on your sector, compliance appetite, and timing goals.

Typically, the full process takes 4 to 6 months, depending on your company’s audit readiness, documentation, and the speed of approvals. Delays can occur if there are compliance gaps or major red flags during due diligence.

Generally, no. Your company should have at least three years of operational track record. However, if you’ve recently restructured or merged with an older business, you may still be eligible, provided you meet alternate SEBI criteria and financial thresholds

You’ll need a full-stack team, including:

- A SEBI-registered merchant banker (mandatory)

- Legal advisors

- Chartered accountants and auditors

- A registered valuer for business valuation

- Optional: IPO consultants to guide branding, investor outreach, and compliance