Table of Contents

ToggleIntroduction

An Income Tax Valuation Report is a structured document prepared by a registered valuer or merchant banker to determine the fair market value (FMV) of a business, asset, or security. In India, this report serves as an essential compliance requirement under the Income Tax Act and is often a key reference point for regulators, investors, and tax authorities.

The significance of this report extends beyond simple number-crunching. It ensures transparency and accountability in financial dealings, particularly where taxation is concerned. From corporate mergers and acquisitions to the transfer of property or shares, and even in the allocation of employee stock option plans (ESOPs) or the distribution of inherited assets, the Income Tax Valuation Report plays a pivotal role in ensuring that values are assessed fairly and in line with prescribed tax norms.

Purpose of an Income Tax Valuation Report

At its core, the Income Tax Valuation Report serves to establish the Fair Market Value (FMV) of the subject asset or entity. This value acts as the benchmark for calculating tax liabilities and ensures that transactions are recorded in a way that reflects their true economic worth.

The report is particularly important for tax compliance, as the Income Tax Act prescribes specific valuation methods and reporting standards for different types of assets. By following these rules, businesses and individuals safeguard themselves against underreporting or overvaluation, both of which can invite penalties, disputes, or unnecessary scrutiny from tax authorities.

Beyond compliance, the valuation report also functions as a protective mechanism. It provides evidence-based justification for declared values in the event of an audit or investigation. This not only strengthens the credibility of the entity involved but also reduces the risk of litigation. In practice, it offers both businesses and individuals a layer of protection by ensuring their financial reporting stands up to regulatory and legal examination.

3. Key Components of the Report

3.1 Report Overview

Every Income Tax Valuation Report begins with a comprehensive overview. This section identifies the professional responsible for the valuation—whether a registered valuer under Section 247 of the Companies Act or a SEBI-registered merchant banker. Their name, registration number, and professional credentials are clearly stated to establish authority and compliance.

Alongside the valuer’s details, the report also specifies the client information. This includes the name of the company or individual commissioning the report, basic corporate details, and the purpose for which the valuation is being sought. This introductory detail ensures clarity and accountability right from the outset.

3.2 Scope of Work

The scope of work section outlines the precise subject of valuation. It provides a clear description of the asset, property, business, or shares being valued, along with the basis of consideration (e.g., ownership percentage, type of security, or property description).

This section also highlights any limitations or restrictions that may affect the valuation exercise. For example, incomplete documentation, ongoing litigation, or market uncertainties may be disclosed here. By explicitly stating these constraints, the report ensures transparency and sets realistic expectations regarding the accuracy and reliability of the valuation outcome.

3.3 Methodology

The methodology section is one of the most critical components of an Income Tax Valuation Report. It details the specific approaches adopted to determine the Fair Market Value (FMV) of the subject asset or entity. Depending on the nature of the valuation, the report may use methods such as the book value method, market value method, discounted cash flow (DCF) method, or the formula prescribed under Rule 11UA of the Income Tax Rules.

The choice of method is never arbitrary. The valuer or merchant banker provides a clear rationale for selecting a particular approach, taking into account the asset class, availability of data, and the purpose of the valuation. This justification not only enhances transparency but also ensures that the methodology is consistent with the requirements of Indian tax law.

By explicitly aligning the chosen method with the provisions of the Income Tax Act and Rules, the report demonstrates compliance and provides a defensible basis in the event of tax authority scrutiny.

3.4 Market Analysis

The market analysis section provides essential context for the valuation exercise. Here, the valuer evaluates prevailing market conditions, industry trends, and external factors that may influence the value of the asset or business. For example, sectoral growth rates, demand and supply dynamics, or macroeconomic conditions may all play a role in shaping the valuation outcome.

To strengthen the credibility of the report, the valuer also refers to comparable transactions or industry benchmarks. These references provide a practical check against theoretical models and serve as supporting evidence that the valuation reflects realistic market behavior.

This analysis ensures that the final valuation is not only compliant with tax regulations but also grounded in the economic realities of the Indian market.

3.5 Valuation Results

The valuation results section presents the outcome of the exercise—the determined Fair Market Value (FMV). This is supported with detailed calculations, financial models, and tabular presentations that clearly illustrate how the value was derived. The inclusion of step-by-step computations ensures transparency and allows stakeholders, auditors, or tax authorities to verify the logic behind the reported figures.

Where applicable, specific adjustments are incorporated to reflect market realities. For instance, minority interest discounts may be applied in cases where the valuation pertains to a non-controlling stake, while a lack of marketability discount may be considered for assets or securities that are not easily tradable. These adjustments align the valuation outcome more closely with real-world conditions and enhance its reliability.

3.6 Compliance & Declarations

A critical element of the report is the section on compliance and declarations. Here, the valuer explicitly confirms that the valuation has been conducted in accordance with the relevant provisions of the Income Tax Act, 1961, and the applicable Income Tax Rules. This formal declaration strengthens the legal standing of the report.

The report is typically signed and stamped by the registered valuer or merchant banker responsible for its preparation, thereby authenticating its accuracy and validity. Additionally, any potential conflicts of interest or observations regarding related party transactions are disclosed to maintain transparency and avoid any perception of bias.

Together, these declarations ensure that the report not only serves as a technical document but also as a legally compliant and trustworthy representation of value.

4. Supporting Documents Typically Required

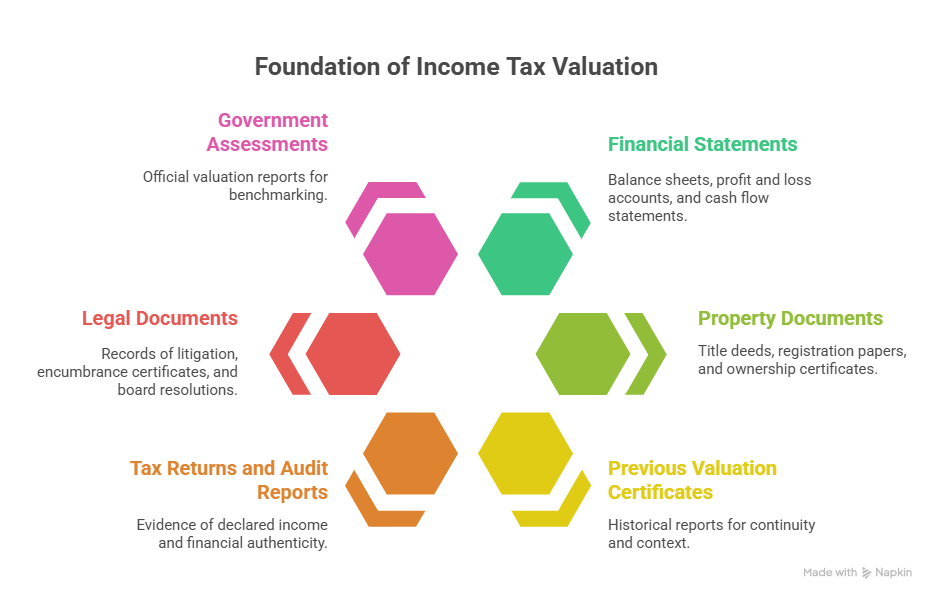

An Income Tax Valuation Report is supported by a range of documents that provide the factual foundation for the valuation exercise. These documents not only substantiate the calculations but also demonstrate compliance with regulatory requirements. The commonly required documents include:

An Income Tax Valuation Report is supported by a range of documents that provide the factual foundation for the valuation exercise. These documents not only substantiate the calculations but also demonstrate compliance with regulatory requirements. The commonly required documents include:

- Financial Statements: Balance sheets, profit and loss accounts, and cash flow statements, which form the basis for analyzing business performance and asset values.

- Property Documents: Title deeds, registration papers, or ownership certificates for real estate assets.

- Previous Valuation Certificates: Historical reports that help establish continuity and context for current valuations.

- Tax Returns and Audit Reports: Evidence of declared income and financial authenticity of the asset owner or business.

- Legal Documents: Records of litigation, encumbrance certificates, or board resolutions that may impact ownership or valuation.

- Government Assessments: Official valuation or assessment reports used for properties, often referred to for benchmarking purposes.

By consolidating these documents, the valuation report gains credibility and ensures that the conclusion is defensible before tax authorities or in legal proceedings.

5. Legal and Regulatory Framework

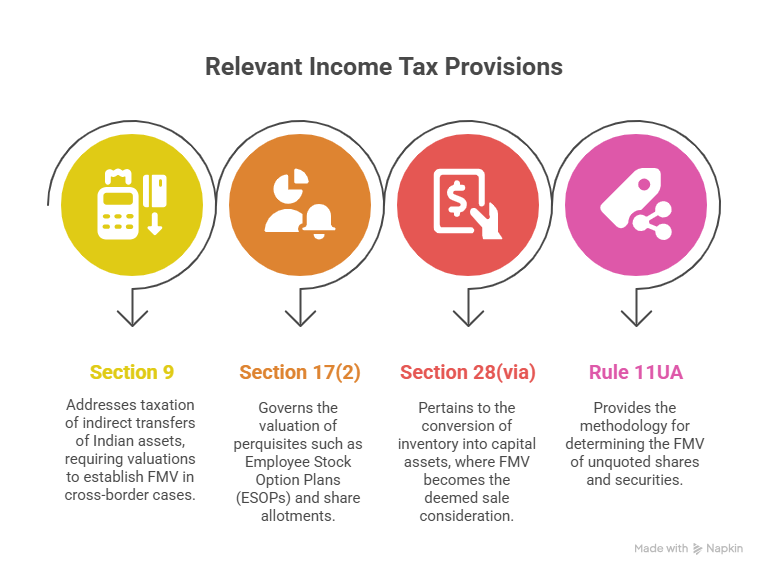

An Income Tax Valuation Report derives its authority from the Indian Income Tax Act, 1961, and the corresponding Income Tax Rules. Some of the most relevant provisions include:

- Section 9: Addresses the taxation of indirect transfers of Indian assets, requiring valuations to establish FMV in cross-border cases.

- Section 17(2): Governs the valuation of perquisites such as Employee Stock Option Plans (ESOPs) and share allotments.

- Section 28(via): Pertains to the conversion of inventory into capital assets, where FMV becomes the deemed sale consideration.

- Rule 11UA: Provides the methodology for determining the FMV of unquoted shares and securities, one of the most widely applied rules in valuation exercises.

- Stamp Duty Valuation Rules: Applied in cases involving immovable property, ensuring that declared values are not understated for tax purposes.

Together, these provisions create the legal framework within which valuation reports are prepared, ensuring that they are both technically sound and legally compliant.

6. Why Accuracy Matters

Accuracy in an Income Tax Valuation Report is not just a technical requirement—it carries significant financial and legal implications. An undervaluation of assets or securities can lead to the understatement of taxable income, which may attract penalties, interest, and increased scrutiny from tax authorities. On the other hand, overvaluation can inflate tax liabilities or distort financial reporting, ultimately placing unnecessary burdens on businesses and individuals.

A carefully prepared and precise valuation report mitigates these risks by providing a defensible basis for declared values. It reduces the likelihood of disputes with tax authorities, ensuring smoother compliance and avoiding protracted litigation. Beyond regulatory protection, accuracy also plays a vital role in building investor and stakeholder confidence. For companies engaged in mergers, ESOPs, or fundraising, a credible valuation reflects sound governance and enhances the organization’s reputation in the market.

7. Conclusion

An Income Tax Valuation Report serves as much more than a financial exercise—it is the intersection of Fair Market Value (FMV), compliance, and protection. By systematically presenting methodology, market context, results, and supporting documentation, the report ensures both transparency and legal defensibility.

For businesses and individuals alike, the importance of accuracy, legal alignment, and professional credibility cannot be overstated. Working with registered valuers and SEBI-approved merchant bankers assures that the valuation is not only technically robust but also compliant with the provisions of the Income Tax Act.

In today’s regulatory landscape, a well-prepared Income Tax Valuation Report is not merely a requirement—it is an essential safeguard for financial integrity and long-term trust.

Frequently Asked Questions (FAQs)

Only Registered Valuers (under Section 247 of the Companies Act) and SEBI-registered Merchant Bankers are authorized to issue valuation reports for income tax purposes, depending on the nature of the transaction.

It is required in cases such as share allotment/ESOPs, mergers and acquisitions, cross-border transactions, capital gains computation, and property transfers, where fair market value (FMV) needs to be established for tax compliance.

The Income Tax Act recognizes methods such as the Net Asset Value (NAV) method and the Discounted Cash Flow (DCF) method for valuing unquoted equity shares, along with prescribed rules for property and securities.

Inaccurate reporting can lead to penalties, tax reassessments, and litigation with authorities. It may also reduce investor confidence in the company’s governance and financial credibility.

Yes. While both aim to determine value, an Income Tax Valuation Report is primarily compliance-driven, ensuring FMV reporting for taxation, whereas a business valuation report may focus on broader objectives like fundraising, M&A, or strategic planning.