Table of Contents

ToggleIntroduction: The Currency of Trust in Fundraising

When a startup pitches to investors, it’s not just selling a product, it’s selling a future. And while ambition and passion can grab attention, it’s cold, hard data that convinces capital to commit. This is where the Investor Valuation Report steps in as the linchpin of credibility.

In the high-stakes world of fundraising, perception matters, but numbers seal the deal.

An Investor Valuation Report is a professional assessment of a company’s worth, often backed by financial data, market analytics, future projections, and risk profiling. In India, this report is more than a formality; it’s a financial passport that signals seriousness, ensures legal compliance, and sets the stage for meaningful negotiation.

For Indian startups, especially those seeking venture capital or foreign direct investment, skipping this step isn’t just risky, it’s a red flag. In a competitive funding landscape, a valuation report separates investor-ready ventures from those still stuck in theory. It’s not just about impressing investors, it’s about aligning with India’s regulatory backbone and laying the groundwork for scalable, structured growth.

2. What Is an Investor Valuation Report?

At its core, an Investor Valuation Report is a strategic document that quantifies a company’s current value based on financials, assets, market trends, competitive positioning, and growth forecasts. It’s not merely an internal metric, it’s a tool used by investors to evaluate risk, ROI potential, and equity value. sebi

In India, one of the most credible forms of this report is the Merchant Banker Valuation, conducted by a SEBI-registered Merchant Banker. Unlike informal estimates, this valuation carries legal and professional weight, especially in high-value funding rounds or when foreign investment is involved.

If the total consideration exceeds the fair value of net identifiable assets

Why does this matter?

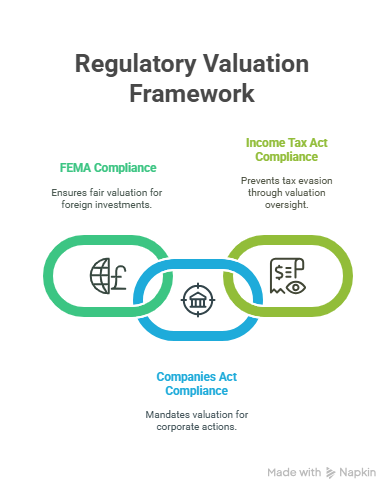

As Indian fundraising is governed by a triad of regulations:

- FEMA (Foreign Exchange Management Act): Mandates fair valuation for foreign investment inflows.

- Companies Act, 2013: Requires valuation for share issuance, mergers, and allotments.

- Income Tax Act, 1961: Ensures that share valuations align with tax provisions, avoiding penalties under Section 56(2)(viib).

An investor valuation report isn’t just a pitch tool, it’s a compliance necessity and a credibility builder. It translates the abstract vision of a business into numbers that investors and regulators understand and trust.

3. Attracts and Assures Investors

Before investors part with their capital, they need certainty. Not just about your product, but about your numbers, what you’re worth today, and where you’re headed tomorrow. That’s exactly what an Investor Valuation Report delivers: transparency in a format investors can trust.

In a fundraising scenario, especially in early-stage rounds, the valuation report becomes a proxy for due diligence. Angel investors, venture capitalists, and institutional funders aren’t just investing in potential, they’re betting on risk-calculated growth. A structured, data-driven valuation helps bridge the credibility gap.

This report pulls together audited financials, growth metrics, and market positioning to present a realistic portrait of your business. That clarity makes a complex, evolving startup feel grounded, tangible, measurable, and ultimately… investable.

In the world of funding, clarity is currency, and a valuation report is your most trusted tender.

4. Sets the Foundation for Negotiation

Valuation isn’t just a number, it’s your starting point for the high-stakes conversation around equity and control. An Investor Valuation Report clearly defines both pre-money (your value before new investment) and post-money (your value after funding) valuations, crucial figures that shape the deal.

With this information in hand, founders walk into negotiations with leverage, not guesswork. A credible, professionally prepared valuation limits ambiguity, sets realistic expectations, and arms you with facts when discussing how much equity you’re giving away, and at what price

More importantly, it helps protect founders from over-dilution, ensuring that control and value aren’t sacrificed too early in the growth journey. By anchoring the negotiation in verified data, the valuation report balances power at the table, transforming investor meetings from speculative pitches into serious, data-backed discussions.

5. Ensures Regulatory Compliance

In India’s evolving funding landscape, compliance isn’t optional, it’s fundamental. Whether you’re raising capital from domestic VCs or foreign investors, your valuation must stand up to scrutiny, not just from backers, but from regulators.

A valuation report prepared by a SEBI-registered Merchant Banker or a registered valuer ensures alignment with key legal frameworks:

- FEMA (Foreign Exchange Management Act): Mandates fair valuation for inbound foreign investments.

- Companies Act, 2013: Requires valuation for issuing new shares, preferential allotments, mergers, and buybacks.

- Income Tax Act, 1961: Prevents tax evasion through artificially inflated share values under Section 56(2)(viib).

Without a compliant valuation report, deals can be delayed, questioned, or even invalidated. With it? Transactions proceed smoothly, due diligence hurdles shrink, and investors are reassured that the structure of their investment is sound, legal, and audit-ready.

6. Supports Future Fundraising Rounds

The first round of funding is only the beginning. Growth demands more capital, and each subsequent round depends on a clear story of progress, financial, operational, and strategic

A well-documented valuation report becomes a benchmark that helps future investors assess how your business has evolved. It creates a timeline of value creation, from seed stage to Series A and beyond, making it easier to justify higher valuations, attract premium capital, and negotiate better terms.

For founders, this means not starting from scratch in every round. For investors, it’s a layer of accountability and reassurance. And for both? It’s a shared narrative of upward momentum, validated by third-party expertise.

In essence, a strong valuation report doesn’t just raise money, it lays the tracks for the rounds that come next.

7. Key Components of a Fundraising Valuation Report

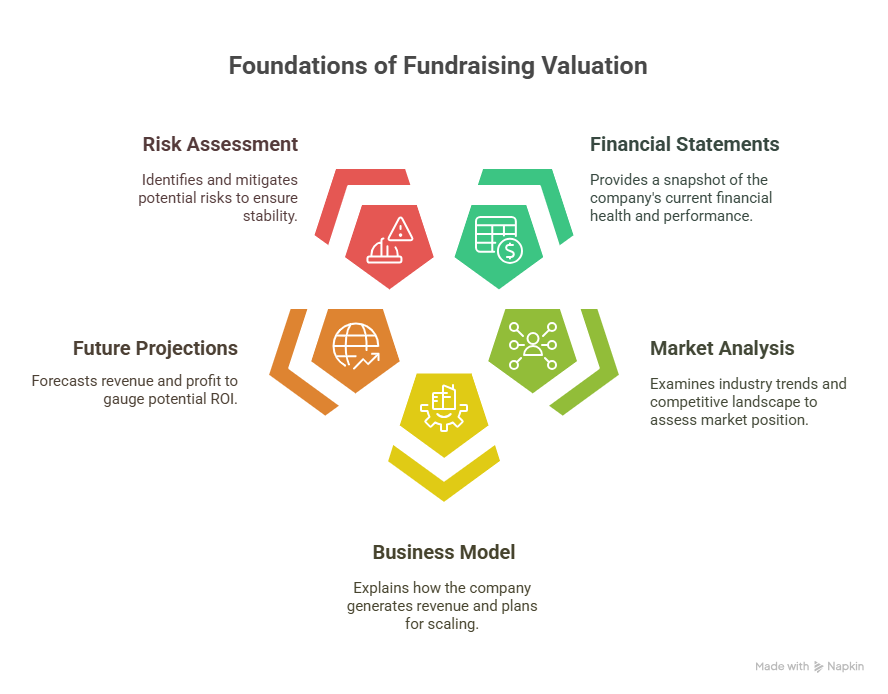

A credible Investor Valuation Report isn’t just a financial formality, it’s a strategic dossier. To serve its purpose across negotiations, compliance, and capital attraction, it must cover these essential building blocks:

📑 Financial Statements

- Income Statement

- Balance Sheet

- Cash Flow Statement

These show the business’s current financial standing and operational health, providing investors with a reliable snapshot of performance.

🔍 Market Analysis

- Industry Trends

- Competitive Landscape

A deep dive into the environment you operate in—what’s shaping the market, who your competitors are, and how you stack up.

💡 Business Model

- Revenue Streams

- Operational Strategy

How your company makes money, and how it plans to scale. This section decodes the logic behind your monetization approach.

📈 Future Projections

- Revenue & Profit Forecasts

Investors invest in tomorrow. Projected figures help them gauge potential ROI and understand your growth roadmap

⚠️ Risk Assessment

Key Risks Identified

Mitigation Strategies

From regulatory hurdles to operational dependencies, this section outlines possible risks and how you plan to neutralize them.

Conclusion: The Report That Talks Money

In the world of fundraising, you don’t just pitch a dream, you prove its value. An Investor Valuation Report is more than a compliance document; it’s your passport to capital, your credibility on paper, and your greatest ally at the negotiation table.

Whether you’re navigating the complexities of equity dilution or trying to win over cautious investors, the message is clear: the numbers must back your narrative.

So if you’re gearing up to raise funds, don’t go in blind.

Engage a SEBI-registered Merchant Banker or Registered Valuer who understands both the technicals and the storytelling that moves money.

Frequently Asked Questions (FAQs)

Yes, especially when raising capital from foreign investors or issuing shares under preferential allotment. As per FEMA, the Companies Act, and Income Tax rules, a valuation report by a Registered Valuer or SEBI-registered Merchant Banker is often legally required.

A valuation report defines your company’s pre-money and post-money value, giving you data-driven leverage during equity discussions. It helps protect ownership and minimizes unnecessary dilution.

Only a SEBI-registered Merchant Banker or a Registered Valuer (under Rule 11UA of the Income Tax Act or Companies (Registered Valuers and Valuation) Rules) is authorised to issue such reports, depending on the fundraising route.

Yes. Startups at an early stage can be valued using methods like the Discounted Cash Flow (DCF) or Market Multiple approach, based on projected revenues, comparable transactions, and market potential.

It’s good practice to update the valuation report before every funding round or major equity event. It keeps your valuation aligned with market conditions and company performance, building long-term investor confidence.