In today’s complex business landscape, valuation isn’t just a financial exercise, it’s a regulatory necessity. Whether you’re raising capital, engaging in a cross-border transaction, or preparing for an IPO, Indian laws require that the value of your company be assessed accurately and fairly. And when it comes to regulatory-driven valuations, especially those involving foreign investors or public offerings, a Merchant Banker valuation is often mandatory.

This guide illustrates Merchant Banker Valuation in India, what it is, when it’s needed, who can perform it, and why it’s critical for your business. From compliance under FEMA and SEBI to ensuring investor confidence, we break down everything you need to know about this high-stakes process.

Table of Contents

ToggleWhat is Merchant Banker Valuation?

Merchant Banker Valuation refers to the valuation of shares or businesses conducted by a SEBI-registered Merchant Banker. These professionals are authorised under Indian law to determine the Fair Market Value (FMV) of a company’s equity or entire business entity for regulatory, tax, and transactional purposes.

This valuation becomes particularly important in scenarios involving:

- Fundraising, especially from foreign investors (FDI), where compliance with FEMA regulations is mandatory.

- Share transfers between residents and non-residents or vice versa.

- IPO pricing and preferential allotments, where transparency and regulatory compliance are critical.

- Mergers, acquisitions, or demergers, where stakeholders rely on a fair, third-party assessment of value.

- Corporate restructuring and exits, where a valuation report can influence deal terms and regulatory approvals.

In these contexts, a SEBI-registered Merchant Banker provides an independent, technically sound, and legally valid valuation report. Their role bridges the gap between regulatory mandates and business goals, ensuring compliance while supporting key corporate actions.

Who is Authorised to Issue Valuation Reports in India?

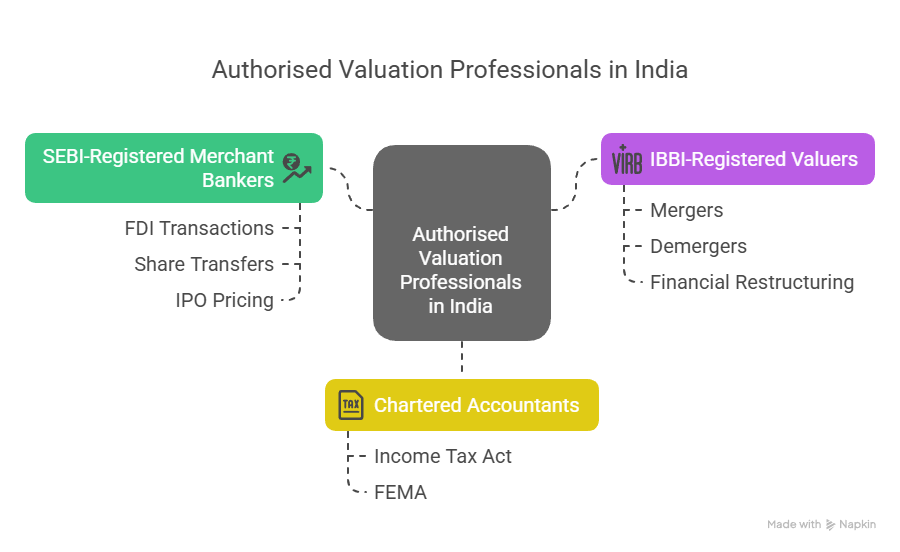

Valuation reports in India must be issued by professionals recognised under specific regulatory frameworks, depending on the nature and purpose of the transaction. Not all valuation professionals are authorised to issue reports for every scenario.

The following are the key categories of professionals permitted to issue valuation reports in India:

- SEBI-Registered Merchant Bankers: Authorised primarily for transactions involving foreign direct investment (FDI), share transfers between residents and non-residents, IPO pricing, and preferential allotments. Their reports are commonly required under FEMA, SEBI, and RBI regulations.

- IBBI-Registered Valuers: Appointed for valuations under the Companies Act, 2013, and the Insolvency and Bankruptcy Code (IBC). These valuers are typically involved in mergers, demergers, financial restructuring, and court-driven processes.

- Chartered Accountants (CAs): Recognised in specific cases under the Income Tax Act and FEMA, especially for the valuation of unquoted shares for tax computation purposes. Their role is limited in scope compared to Merchant Bankers and Registered Valuers.

Each category of professional has a distinct regulatory mandate. For transactions involving cross-border elements or public securities issuance, a valuation from a SEBI-registered Merchant Banker is often mandatory.

When is Merchant Banker Valuation Mandatory?

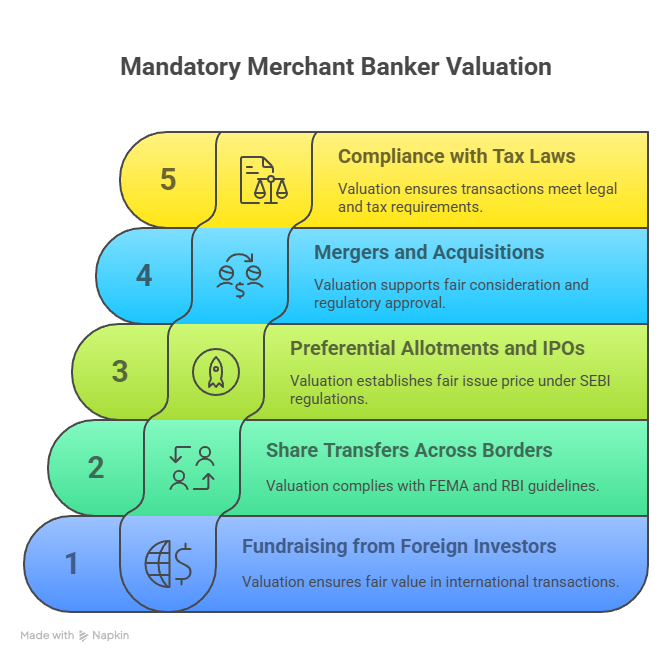

A valuation conducted by a SEBI-registered Merchant Banker is not just a best practice—it is legally required in several key situations involving regulatory compliance, fundraising, and corporate restructuring. Below are the primary instances where Merchant Banker valuation becomes mandatory:

- Fundraising from Foreign Investors: When companies issue shares or convertible instruments to non-residents, a Merchant Banker valuation is necessary to determine the fair value following FEMA regulations.

- Share Transfers Between Residents and Non-Residents: Valuation is required for determining the transaction price when shares are being sold or transferred across borders. This ensures compliance with FEMA and RBI guidelines.

- Preferential Allotments and IPOs: In cases of preferential share issues or initial public offerings, a valuation from a Merchant Banker helps establish a fair issue price in line with SEBI regulations.

- Mergers, Demergers, and Business Acquisitions: During corporate restructuring, Merchant Banker valuation supports fair determination of consideration or swap ratios and is often submitted as part of regulatory or shareholder approval processes.

- Compliance with SEBI, FEMA, and Tax Laws: Various laws, including the Income Tax Act (e.g., Rule 11UA), require valuation to ensure that transactions are conducted at arm’s length and reflect fair market value.

Although there was a proposal by SEBI in late 2024 to restrict Merchant Bankers from conducting valuations, it has been deferred as of March 2025. Therefore, Merchant Bankers remain eligible to issue valuation reports under current regulations.

Valuation Methods Used by Merchant Bankers

SEBI-registered Merchant Bankers apply internationally accepted valuation methodologies to ensure objectivity, regulatory compliance, and investor confidence. The method chosen depends on the nature of the business, its financial structure, and the purpose of the valuation. Commonly used methods include:

This forward-looking approach estimates the present value of a company based on projected future cash flows. It is particularly useful for startups and high-growth companies where historical earnings may not reflect true potential.

- Net Asset Value (NAV) Method

Suitable for asset-heavy businesses such as real estate or manufacturing, this method calculates the value by subtracting liabilities from total assets.

- Comparable Companies or Market Multiples

This market-based approach compares the company’s financial ratios (like EV/EBITDA or P/E) to those of similar publicly listed peers. It’s commonly used for companies in well-established sectors.

- Earnings Capitalization Method

This technique values a business based on its maintainable earnings, capitalised at a rate reflecting the business and industry risk. It is often used when a stable earnings history is available.

- Stock Market Price Method

Applicable to listed companies, this method uses the average market price of shares over a relevant period to determine value.

Merchant Bankers select the most appropriate method, or a combination thereof, based on the valuation objective, regulatory requirements, and the company’s financial profile.

Legal and Regulatory Framework

Merchant Banker Valuation in India operates within a robust legal and regulatory ecosystem. Multiple authorities have issued detailed guidelines on when and how valuations must be carried out. Key legislations and frameworks include:

- Companies Act, 2013

Governs valuation for matters such as the issue of shares, mergers, demergers, buybacks, and other corporate actions. Valuation under this Act often requires an IBBI-registered valuer, except where a merchant banker’s valuation is specifically accepted.

Overseen by the Reserve Bank of India (RBI), FEMA mandates fair valuation for all transactions involving non-residents, be it share subscription, transfer, or overseas investments. Here, the Merchant Banker valuation is often compulsory.

- Income Tax Act, 1961 – Rule 11UA

Specifies acceptable methods for the valuation of unquoted equity shares to determine the taxable value in case of issue or transfer. Compliance with Rule 11UA is necessary to avoid tax disputes.

- SEBI Regulations

Under SEBI’s regulatory framework, Merchant Banker valuation is essential for the pricing of IPOs, preferential issues, and other capital market transactions involving public interest.

Each of these laws outlines specific requirements on who can perform valuations, acceptable methodologies, and the documentation needed. Businesses must ensure alignment with the relevant provisions to avoid penalties, disallowances, or delays in regulatory approvals.

Recent Regulatory Developments

In December 2024, the Securities and Exchange Board of India (SEBI) proposed significant changes to the role of Merchant Bankers in valuation activities. The proposal aimed to restrict Merchant Bankers from conducting valuation services as part of their registration. This move was intended to enhance the independence and objectivity of valuation reports by entrusting these responsibilities primarily to registered valuers or accountants.

However, this proposal faced considerable industry pushback and was subsequently deferred in March 2025. As a result, Merchant Bankers continue to perform valuation activities for now, maintaining their critical role in fundraising, mergers, IPO pricing, and regulatory compliance.

Looking ahead, if these restrictions are implemented in the future, the landscape of valuation in India will undergo a substantial shift. Startups, foreign-invested companies, and other businesses relying on Merchant Banker valuations will need to adapt by engaging registered valuers or chartered accountants for these services. This could increase the cost and complexity of compliance, especially in cross-border transactions and fundraising rounds involving foreign direct investment (FDI).

It is crucial for companies to monitor regulatory updates closely to ensure timely compliance and avoid disruptions in their corporate actions.

Why is Merchant Banker Valuation Important?

Merchant Banker Valuation plays a pivotal role in the Indian corporate ecosystem for several reasons:

- Regulatory Compliance: Valuation by a SEBI-registered Merchant Banker ensures that businesses meet the stringent requirements set by regulatory bodies such as SEBI, RBI, and the Ministry of Corporate Affairs. This is especially critical in transactions involving foreign investments and share transfers.

- Fair Pricing for Stakeholders: An independent valuation guarantees that share prices reflect the true market value, protecting the interests of existing shareholders, new investors, and other stakeholders. It prevents undervaluation or overvaluation that could lead to disputes or financial loss.

- Investor Trust and Credibility: During fundraising rounds, whether domestic or international, a certified valuation report from a Merchant Banker enhances investor confidence. It serves as a credible assurance that the pricing is transparent, unbiased, and compliant with regulations.

- Essential in Cross-Border Transactions: Given the complexities of foreign exchange laws and international investment norms, Merchant Banker valuation ensures seamless compliance with FEMA regulations. This facilitates smoother foreign direct investment (FDI) inflows and outbound investments, supporting India’s integration into the global economy.

In summary, Merchant Banker Valuation is not merely a procedural requirement but a strategic tool that underpins corporate governance, financial transparency, and investor relations in India.

Conclusion

Merchant Banker Valuation stands as a fundamental pillar in the framework of Indian corporate finance. Whether for fundraising, mergers and acquisitions, regulatory compliance, or share transfers, a valuation conducted by a SEBI-registered Merchant Banker ensures that the process is transparent, credible, and aligned with the latest legal requirements.

Key takeaways from this guide include the critical importance of using Merchant Bankers for valuations related to foreign investment and regulatory filings, the variety of valuation methods employed, and the need to stay informed about ongoing regulatory developments that may impact valuation practices soon.

Given the evolving regulatory landscape, businesses, startups, and investors must stay current with SEBI, RBI, FEMA, and Companies Act guidelines to avoid compliance risks.

Ultimately, engaging qualified SEBI-registered Merchant Bankers or other authorized professionals for valuation services is not just a regulatory mandate, it is a strategic decision that safeguards your business interests, fosters investor confidence, and facilitates smooth corporate transactions.

Frequently Asked Questions (FAQs)

Merchant Banker Valuation refers to the valuation of shares or businesses conducted by a SEBI-registered Merchant Banker. This is often mandatory for regulatory and transactional purposes involving FDI, FEMA compliance, IPOs, and more.

It’s typically required during share transfers involving residents and non-residents, fundraising rounds, mergers, acquisitions, IPO pricing, and preferential allotments.

Merchant Bankers are authorised under SEBI to conduct valuations for FDI, IPOs, and FEMA compliance, while Registered Valuers (under IBBI) are mandated for valuations under the Companies Act and IBC.

Common methods include the Discounted Cash Flow (DCF), Net Asset Value (NAV), Comparable Company Analysis, and Earnings Capitalisation. The chosen method depends on the business type and transaction context.

Yes. While SEBI proposed restrictions in December 2024, these were deferred in March 2025. As of now, Merchant Bankers can continue performing valuations legally.