Table of Contents

Toggle1. Introduction: Understanding Equity Valuation in the Indian Context

Equity valuation is the analytical process of determining the fair value of a company’s shares. It is a critical function in corporate finance, investment analysis, regulatory compliance, and strategic decision-making. For entrepreneurs, investors, regulators, and stakeholders, accurate valuation serves as the foundation for informed action—whether that involves raising capital, entering a merger, or meeting statutory requirements.

In India, the relevance of equity valuation is heightened by a complex regulatory environment. The Companies Act, 2013, the Income Tax Act, FEMA, and the Insolvency and Bankruptcy Code (IBC) all mandate valuation in various contexts, from issuing new shares to cross-border investments and insolvency proceedings.

To ensure credibility and legal validity, equity valuations in many cases must be supported by a Registered Valuer Report. Prepared by professionals accredited by the Insolvency and Bankruptcy Board of India (IBBI), this report serves as a legally recognized valuation document used for compliance, litigation, investment transactions, and financial reporting.

2. What Does Equity Valuation Involve?

Understanding equity valuation begins with clarity on a few core financial concepts and valuation methodologies that form the backbone of the process.

Key Definitions

Fair Value: The estimated price at which an asset or liability could change hands between informed, willing parties in an arm’s length transaction.

Market Value: The price an asset would fetch in the open market, often influenced by prevailing investor sentiment and market conditions.

Book Value: The net asset value of a company as recorded in its balance sheet, calculated as total assets minus total liabilities.

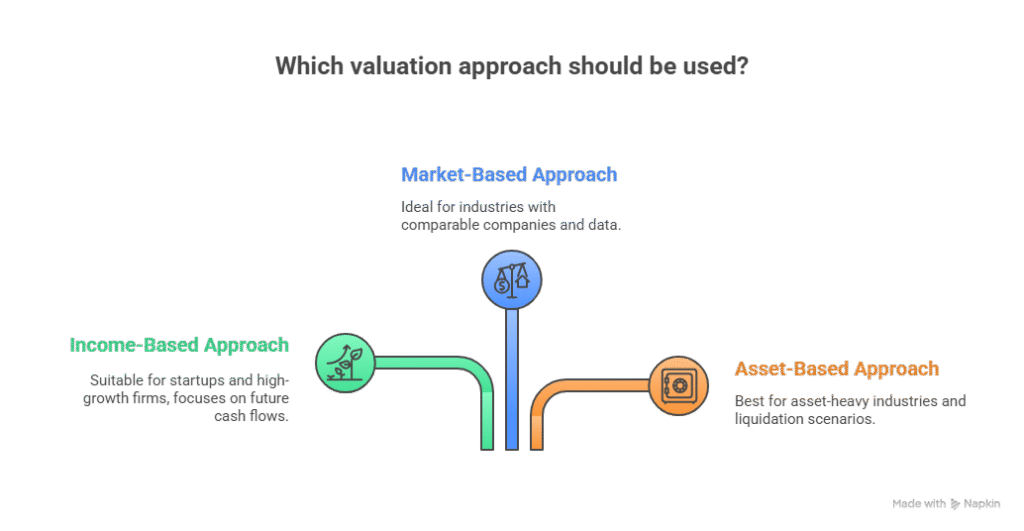

Primary Valuation Approaches

Income-Based Approach

This method evaluates a company based on its future income-generating capacity. The most widely used technique under this approach is the Discounted Cash Flow (DCF) method, which projects future cash flows and discounts them to present value using an appropriate discount rate. It is particularly suited for startups, service-based businesses, and firms with strong growth potential.

Market-Based Approach

This approach relies on market multiples derived from comparable public companies or recent transactions within the same industry. Common metrics include Price-to-Earnings (P/E), EV/EBITDA, and Revenue Multiples. It is typically used in sectors where comparable companies and reliable transaction data are available.

Asset-Based Approach

This method calculates a company’s value based on the net value of its assets. Techniques include Net Asset Valuation (NAV) and Replacement Cost Method, and they are generally employed for asset-heavy industries, liquidation scenarios, or internal business reorganizations.

The choice of method depends on various factors, including the nature of the business, the stage of the company, the purpose of the valuation, and regulatory requirements. In practice, professional valuers often apply more than one approach to cross-validate outcomes and arrive at a robust, defensible valuation figure.

3. Who Needs Equity Valuation, And Why?

Equity valuation is not a niche financial tool; it is a fundamental requirement across a wide spectrum of business and regulatory scenarios in India. Various stakeholders rely on accurate valuation to make strategic decisions, comply with legal obligations, and ensure financial transparency.

Startups and Growing Businesses

Equity valuation is critical during fundraising rounds, including private placements, rights issues, and convertible instrument issuances. Investors require defensible valuations to assess potential returns and negotiate deal terms, while founders must justify the pricing of shares being offered.

Mergers, Acquisitions, and Corporate Restructuring

In mergers, demergers, slump sales, or business consolidations, equity valuation forms the basis for determining swap ratios, consideration amounts, and fair treatment of shareholders. It also supports board and shareholder approvals and regulatory filings

Statutory and Regulatory Compliance

Several Indian laws mandate equity valuation by a certified professional under specific circumstances:

- Companies Act, 2013: Requires valuation for the issue of shares for consideration other than cash, preferential allotments, buybacks, mergers, and other corporate actions.

- Income Tax Act: Demands valuation for calculating capital gains, especially in cases involving the transfer of shares or other securities.

- Foreign Exchange Management Act (FEMA) and Reserve Bank of India (RBI) regulations: Mandate valuation reports for transactions involving foreign direct investment, foreign share transfers, or filings such as FC-GPR.

Transfer Pricing and Investment Decision-Making

In intra-group share transfers or international transactions, valuation ensures arm’s length pricing, preventing tax disputes and ensuring regulatory compliance. For investors and acquirers, equity valuation is a key input in investment appraisals, risk assessments, and financial modelling.

In summary, equity valuation serves as a foundation for legal compliance, financial due diligence, and strategic planning across startups, large corporations, and financial institutions alike.

4. Role of Registered Valuer Reports in Equity Valuation

Equity valuation in India is not merely a technical exercise; it is often a statutory requirement. The credibility of such valuations hinges on the involvement of professionals certified by the Insolvency and Bankruptcy Board of India (IBBI), known as Registered Valuers.

What Is a Registered Valuer Report?

A Registered Valuer Report is an official document issued by a professional who has been registered with the IBBI and affiliated with a Registered Valuer Organisation (RVO). It provides a reasoned, methodologically sound, and legally valid valuation of shares, businesses, or other assets. These reports are prepared in accordance with the standards set by the IBBI and serve as an authoritative basis for decisions by companies, investors, regulators, courts, and tax authorities.

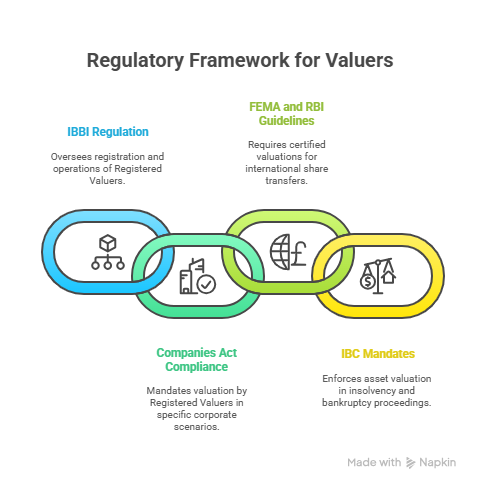

Why It Is Essential for Equity Valuation in India

- Insolvency and Bankruptcy Board of India (IBBI): The primary authority regulating the registration and functioning of Registered Valuers.

- Companies Act, 2013: Specifies situations where valuation by a Registered Valuer is mandatory.

- Foreign Exchange Management Act (FEMA) and RBI guidelines: Require valuations by certified professionals for cross-border share transfers.

- Insolvency and Bankruptcy Code (IBC): Mandates asset valuation in resolution or liquidation proceedings, to guide the Committee of Creditors and other stakeholders.

Registered Valuer Reports thus serve as a bridge between financial logic and legal necessity, making them indispensable in the Indian business ecosystem.

5. Key Scenarios Where Equity Valuation Is Mandatory

In India, several corporate and financial transactions trigger the requirement for equity valuation. These are not just best practices; they are often mandatory under statutory and regulatory frameworks. Below are the key scenarios where valuation is legally or commercially essential:

Fundraising: Venture Capital, Private Equity, and Angel Investment

When companies issue equity or convertible instruments to investors, be it through private placements, preferential allotments, or rights issues, valuation is required to justify the pricing of shares. A certified equity valuation:

- Helps investors assess the risk-return equation.

- Ensures compliance with Sections 62 and 42 of the Companies Act, 2013.

- Builds transparency and credibility in deal negotiations.

Foreign Direct Investment and FC-GPR Filings

In transactions involving non-resident investors, equity valuation becomes a compliance imperative under FEMA and RBI guidelines. A valuation report is required:

- For determining the issue price or transfer price of shares.

- At the time of filing Form FC-GPR (Foreign Currency – Gross Provisional Return).

- To ensure the transaction occurs at or above the fair value prescribed under law.

Mergers, Acquisitions, and Corporate Restructuring

Equity valuation is central to structuring and executing M&A deals. It informs:

- Share swap ratios and consideration amounts.

- Fair treatment of shareholders across merging or demerging entities.

- Regulatory filings, court applications, and board approvals.

In restructuring transactions—such as buybacks, slump sales, or capital reductions—valuation ensures compliance and protects stakeholder interests.

Loan and Collateral-Based Valuations

Banks and financial institutions require equity or business valuation reports to assess:

- The value of company shares is pledged as security.

- The enterprise value for structured or unsecured lending.

- Asset-backed loan assessments and risk modelling.

A valuation conducted by a Registered Valuer strengthens the lender’s position and enables prudent credit decisions.

ESOPs and Taxation Implications

When companies issue Employee Stock Option Plans (ESOPs), accurate valuation is required to:

- Determine the fair market value (FMV) for perquisite taxation under the Income Tax Act.

- Avoid future litigation or disputes with tax authorities.

- Support transparent employee compensation frameworks.

In all these scenarios, equity valuation serves as the backbone of both regulatory compliance and financial prudence.

6. Who Can Conduct Equity Valuation in India?

The legitimacy of an equity valuation hinges on who performs it. Indian regulations distinguish between professionals who are qualified to conduct valuations for different purposes.

IBBI-Registered Valuers

Under the Companies Act, 2013 and the Insolvency and Bankruptcy Code (IBC), valuations must be carried out by individuals registered with the Insolvency and Bankruptcy Board of India (IBBI). These professionals are:

- Chartered Accountants, Cost Accountants, or Company Secretaries with relevant experience.

- Members of a recognized Registered Valuer Organisation (RVO).

- Individuals who have passed the IBBI Valuation Examination in the relevant asset class.

Only such Registered Valuers are authorized to issue valuation reports for regulatory purposes, including share issuances, mergers, acquisitions, and insolvency proceedings.

Merchant Bankers

In certain cases, especially where valuations are governed by SEBI regulations (such as IPO pricing or valuation of listed securities), valuation reports must be prepared by a SEBI-registered Category Merchant Banker. Merchant Bankers are typically engaged for:

- Valuation of listed companies and securities.

- Pricing of public issues, rights issues, and open offers.

Cross-border valuations under specific SEBI or FEMA regulations.

Importance of Using Certified Professionals

Using uncertified or unauthorized individuals for valuation can:

- Lead to rejection of regulatory filings.

- Trigger penalties or litigation.

- Undermine credibility with investors, banks, and courts.

Engaging a certified professional not only ensures compliance but also provides a defensible, methodologically sound, and credible assessment of value.

7. How Equity Valuation Builds Transparency and Trust

In a business ecosystem where capital, compliance, and credibility intersect, equity valuation plays a pivotal role in fostering transparency and reinforcing stakeholder trust. Its value extends beyond numbers, it serves as a bridge between strategic intent and market integrity.

Investor Confidence

A well-documented and professionally conducted valuation enables potential investors, whether domestic or foreign, to make informed decisions. When valuations are supported by Registered Valuer Reports, investors are assured that pricing is fair, transparent, and in accordance with applicable regulations. This assurance reduces perceived risk and encourages capital inflow, especially during seed funding, Series A/B rounds, or foreign direct investments.

Dispute Resolution

Equity valuations are frequently called upon in legal and quasi-legal contexts, such as:

- Shareholder disputes.

- Divorce or inheritance litigation involving business interests.

- Arbitration cases involving transfer pricing or contractual breaches.

A certified valuation report offers an objective foundation for resolution. Courts and arbitration panels recognize Registered Valuer Reports as credible and admissible evidence, helping expedite settlements and reduce ambiguity.

Financial Reporting and Audit Readiness

Accurate equity valuation is essential for fair representation of investments in financial statements. Whether reporting on investments, impairment assessments, or ESOP-related expenses, companies rely on defensible valuations to ensure compliance with Indian Accounting Standards (Ind AS) and audit scrutiny.

Auditors increasingly insist on third-party valuation reports, especially where internal estimates may carry bias or lack sufficient documentation. In such cases, a Registered Valuer Report strengthens the audit trail and enhances stakeholder confidence in the reported figures.

In essence, valuation fosters transparency, mitigates risk, and positions businesses as trustworthy actors in the financial marketplace.

8. Limitations and Challenges in Equity Valuation

Despite its strategic importance, equity valuation is not without limitations. The process involves a degree of professional judgment, and the results are influenced by multiple dynamic and sometimes subjective factors.

Subjectivity of Assumptions

Valuation models often require assumptions about future revenues, discount rates, industry growth, and market behavior. While these inputs are grounded in data, they are still subject to interpretation. Two valuers may arrive at different conclusions based on varying forecasts, methodologies, or professional judgment. This inherent subjectivity can lead to divergent valuations for the same business.

Expectation Gaps Between Startups and Investors

Particularly in early-stage fundraising, there can be a mismatch between the valuation expectations of founders and the perceptions of institutional investors or venture capitalists. Startups often project aggressive growth or attach premium valuations to intangible assets such as brand value or technology IP. In contrast, investors may apply conservative assumptions, leading to valuation disagreements that affect deal closure.

Regulatory Scrutiny and Documentation Burdens

Equity valuations undertaken for compliance purposes, especially under the Companies Act, FEMA, or Income Tax Act, are subject to increasing scrutiny by regulatory authorities. The documentation must be detailed, methodologically sound, and defensible under examination. Any deviation or oversight in reporting can result in:

- Rejection of filings.

- Tax disputes or penalties.

- Delays in capital inflow or transaction execution.

Furthermore, valuers must remain up to date with evolving regulatory expectations, disclosure standards, and industry benchmarks, adding to the complexity and administrative burden of the process.

9. Conclusion: Valuation as a Strategic Lever

Equity valuation is far more than a statutory checkbox. It is a strategic tool that aligns financial realities with business ambition. For founders, it helps determine the value they bring to the table before raising capital. For investors, it provides clarity on risk, return, and negotiation leeway. For regulators, it ensures that transactions occur on fair, compliant terms.

When conducted by qualified professionals using sound methodologies, valuation becomes a business compass, guiding decisions related to funding, expansion, restructuring, and asset optimization. It fosters transparency, builds trust with stakeholders, and safeguards against regulatory or financial discrepancies.

In an evolving economic landscape, businesses that treat valuation as a strategic necessity, not just a legal formality, are better positioned to unlock opportunities, attract investment, and achieve sustainable growth.

Frequently Asked Questions (FAQs)

Equity valuation helps determine the fair value of a company's shares, which is essential for investment decisions, regulatory compliance, mergers and acquisitions, and financial reporting. It ensures that stakeholders transact at a justifiable and transparent price.

Not in all cases. However, equity valuation is mandatory under various laws, such as the Companies Act, Income Tax Act, and FEMA, especially during events like share issuances, fundraising, restructuring, and cross-border investments.

Equity valuation for regulatory purposes must be conducted by a Registered Valuer, certified by the Insolvency and Bankruptcy Board of India (IBBI). For certain transactions involving listed companies, SEBI-registered Merchant Bankers may be required.

The three primary approaches are:

- Income-Based Approach (e.g., Discounted Cash Flow method)

- Market-Based Approach (e.g., EBITDA or revenue multiples)

Asset-Based Approach (e.g., Net Asset Value method)

The appropriate method depends on the company’s stage, industry, and transaction type.

A Registered Valuer Report ensures that valuations meet legal, regulatory, and professional standards. It is legally recognized, enhances credibility, and serves as authoritative documentation for filings, audits, investor communications, and dispute resolution.