Table of Contents

ToggleIntroduction: Why Purchase Price Allocation (PPA) Matters in India

When companies shake hands on an acquisition deal, the spotlight usually falls on the big price tag. Headlines scream about billion-dollar takeovers, strategic partnerships, and market expansions. But beneath that headline number lies a far more technical and incredibly important process: Purchase Price Allocation (PPA).

PPA isn’t just a dry accounting ritual. In India’s increasingly complex mergers and acquisitions (M&A) landscape, governed by Indian Accounting Standards (Ind AS 103), PPA has become a vital mechanism that shapes how deals are reported, taxed, and perceived. It answers a deceptively simple question: What exactly did the buyer pay for? Was it land? Patents? Customer contracts? Brand reputation? Or simply goodwill?

Getting this allocation right isn’t optional. It directly influences financial transparency, regulatory compliance, tax treatment, and investor confidence, not to mention future business strategy. In short, PPA doesn’t just record the deal; it defines its value.

In this blog, we’ll break down the real-world benefits of Purchase Price Allocation in India and why ignoring it could cost companies far more than they realize.

1: What Is Purchase Price Allocation?

In the fast-evolving world of mergers and acquisitions (M&A), simply striking a deal isn’t enough; what happens after the handshake is just as critical. Enter: Purchase Price Allocation (PPA), the art and science of determining what, exactly, you bought when you acquired another company.

In simple terms, PPA is the process where the total purchase price paid for an acquisition gets allocated across all the acquired assets and liabilities, both visible and hidden, think buildings, machinery, patents, brand value, customer relationships, even the much-debated goodwill.

In India, PPA isn’t just good practice; the rulebook governs it: Indian Accounting Standards (Ind AS 103), aligned closely with global norms like IFRS. With M&A activity booming across sectors, from tech startups to legacy manufacturing, getting the allocation right is no longer optional; it’s the law.

Beyond just accounting compliance, PPA provides clarity. It tells stakeholders exactly how much of the purchase price went toward tangible assets (like equipment) versus intangibles (like trademarks, tech know-how, and customer contracts). That breakdown affects not just financial reporting, but tax obligations, regulatory scrutiny, and long-term business strategy.

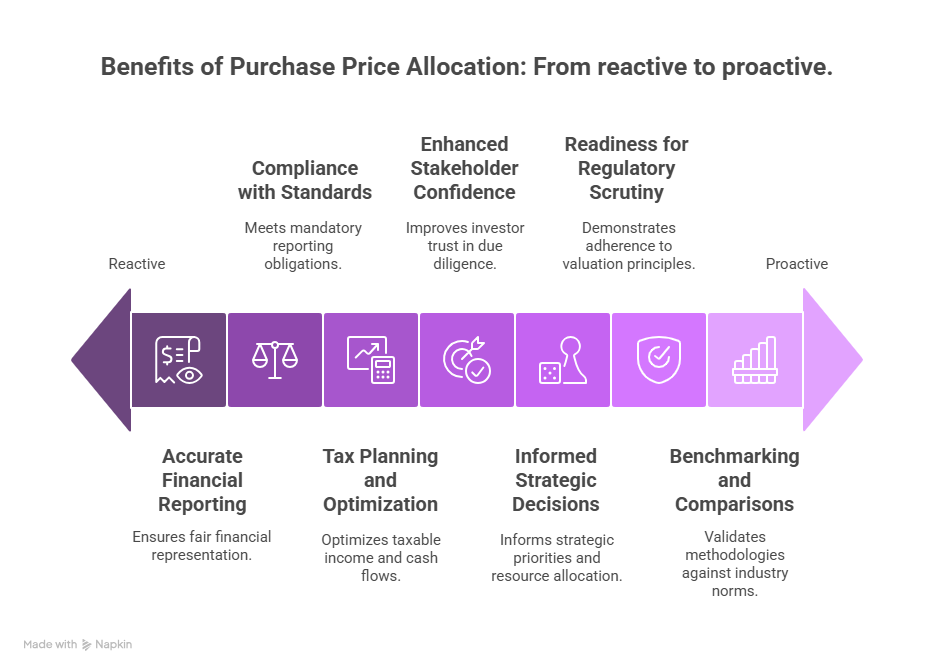

2: The 7 Key Benefits of Purchase Price Allocation

Purchase Price Allocation (PPA), while technical, delivers several strategic and financial advantages for acquiring entities. In the Indian context, especially under Ind AS 10, these benefits extend well beyond mere compliance. Below is a comprehensive analysis of the key advantages that PPA offers:

1️⃣ Accurate Financial Reporting

PPA ensures that all identifiable assets and liabilities of the acquired entity are recorded at their respective fair values on the acquirer’s financial statements. This leads to:

- A true and fair representation of the company’s post-acquisition financial position.

- Enhanced accuracy in financial reporting, reducing the likelihood of misstatements or omissions.

- Increased confidence among investors, regulators, auditors, and other stakeholders regarding the integrity of reported financial data.

By adopting fair value accounting, PPA strengthens the credibility and transparency of financial disclosures.

2️⃣ Compliance with Accounting Standards

Under Indian Accounting Standards (Ind AS 103) and International Financial Reporting Standards (IFRS), Purchase Price Allocation is a mandatory requirement for business combinations. Proper implementation ensures:

- Full compliance with statutory reporting obligations.

- Uniformity and consistency in financial statements across reporting periods.

- Alignment with both domestic and international financial reporting frameworks.

Notably, PPA is applicable not only in traditional M&A transactions but also in scenarios such as slump sales, business transfers, and internal corporate restructurings.

3️⃣ Tax Planning and Optimization

A correctly executed PPA can yield significant tax advantages:

- Different asset classifications carry distinct tax treatments, particularly regarding depreciation and amortization.

- Intangible assets such as goodwill, trademarks, and customer contracts may be eligible for tax-deductible depreciation.

- The landmark ruling in CIT vs. Smif Securities affirmed that goodwill arising from business combinations qualifies for depreciation under Indian tax law.

This allows the acquirer to optimize taxable income and improve post-acquisition cash flows over time.

4️⃣ Enhanced Investor and Stakeholder Confidence

Clear attribution of value to various acquired assets provides investors and analysts with critical insights into the transaction’s economics. PPA enables:

- Transparent disclosure of how the purchase consideration has been allocated.

- Justification of acquisition premiums paid.

- Improved investor confidence in management’s due diligence, valuation processes, and strategic decision-making.

Such clarity can contribute to greater stability in market perception and shareholder support.

5️⃣ Informed Strategic Decision-Making

Beyond compliance, PPA offers valuable information for future business planning:

- Identification of high-value intangible assets (e.g., brands, technology, intellectual property, customer relationships) informs strategic priorities.

- Supports resource allocation, integration strategies, capital investment decisions, and risk management.

- Facilitates negotiations in future transactions involving joint ventures, licensing arrangements, franchising, or fundraising.

Thus, PPA serves as a critical input in the organization’s broader strategic framework.

6️⃣ Readiness for Regulatory and Audit Scrutiny

Accurate Purchase Price Allocation enhances the acquirer’s preparedness for external audits, regulatory reviews, and tax assessments:

- Demonstrates adherence to sound valuation principles and financial governance.

- Reduces the likelihood of disputes with auditors or tax authorities.

- Establishes a robust audit trail that substantiates the acquisition’s financial treatment.

Such diligence reinforces the organization’s corporate governance standards and legal defensibility.

7️⃣ Benchmarking and Industry Comparisons

PPA contributes valuable data for market benchmarking and peer comparisons:

- Studies by leading firms such as EY, Incwert, BetaFin Partners, and others have consistently shown that a significant portion of deal value in Indian acquisitions resides in intangible assets and goodwill.

- Benchmarking allows companies to:

- Validate their allocation methodologies.

- Justify assumptions to auditors and regulators.

- Assess deal structures against industry norms and market practices.

This comparative analysis supports both internal decision-making and external compliance reviews.

3: Who Should Prioritize Purchase Price Allocation?

1️⃣ Companies Engaged in Mergers & Acquisitions (M&A)

PPA is directly applicable to any organization acquiring a business entity, whether through:

- Full acquisitions

- Partial acquisitions

- Slump sales

- Asset purchases qualifying as business combinations under Ind AS 103

Both strategic buyers and private equity investors must conduct a detailed PPA to ensure that all identifiable assets and liabilities are correctly valued and reported.

2️⃣ Listed Companies and Large Unlisted Corporations

For companies listed on recognized stock exchanges, as well as large unlisted entities that are required to adopt Ind AS, compliance with Purchase Price Allocation norms is non-negotiable. These companies face:

- Scrutiny from stock market regulators such as SEBI.

- Higher levels of audit review.

- Increased expectations for transparency from institutional investors, credit rating agencies, and financial analysts.

Accurate PPA ensures compliance, minimizes reputational risk, and sustains investor confidence.

3️⃣ Multinational Corporations (MNCs)

Cross-border acquisitions involving Indian subsidiaries or Indian target companies demand careful alignment with both Ind AS and international accounting standards such as IFRS and US GAAP. MNCs must ensure:

- Harmonization of PPA outcomes across multiple jurisdictions.

- Consistency in group-level consolidated financial reporting.

- Compliance with local and global tax regulations.

PPA in such scenarios also plays a role in global tax planning, transfer pricing, and audit defense.

4️⃣ Private Equity, Venture Capital & Investment Funds

For investment funds actively participating in acquisitions, PPA becomes an integral component of:

- Portfolio company valuation.

- Exit readiness.

- Fund-level financial reporting and disclosures.

- Tax efficiency planning.

Accurate allocation ensures that subsequent transactions, exits, or IPOs are based on robust, defensible valuations.

5️⃣ Organizations Undergoing Internal Restructuring

Even in cases where full acquisitions do not occur, internal reorganizations involving:

- Business unit transfers

- Spin-offs

- Slump sales within a group

May trigger the need for PPA under Indian accounting standards. Proper allocation ensures transparency within consolidated group accounts and compliance with statutory norms.

4: Key Indian Regulations & Case Laws Governing Purchase Price Allocation

In India, the framework governing Purchase Price Allocation (PPA) is shaped by multiple statutory, regulatory, and judicial authorities. A comprehensive understanding of these provisions is essential to ensure full compliance and effective implementation of PPA.

1️⃣ Indian Accounting Standards (Ind AS 103: Business Combinations)

The primary regulatory guidance for PPA in India emanates from Ind AS 103, which is largely converged with IFRS 3. Ind AS 103 mandates:

- Recognition of all identifiable assets acquired, liabilities assumed, and any non-controlling interest in the acquiree at their respective fair values on the acquisition date.

- Recognition of goodwill or bargain purchase gain based on the excess or deficit of purchase consideration over net identifiable assets.

- Application of the acquisition method for all business combinations.

The standard requires robust valuation practices, particularly for intangible assets such as intellectual property, brands, customer relationships, and technology.

2️⃣ Companies Act, 2013

While Ind AS 103 provides detailed guidance on the accounting treatment, the Companies Act, 2013 mandates proper maintenance of books of accounts, preparation of financial statements by applicable accounting standards, and true and fair presentation of financial position. Non-compliance may attract penal consequences under the Act.

3️⃣ Income Tax Act, 1961

The tax implications of PPA are governed by provisions of the Income Tax Act, 1961, particularly:

- Sections related to depreciation eligibility on intangible assets (Section 32).

- The determination of goodwill’s tax treatment post-acquisition.

- Transfer pricing considerations in cross-border or group transactions.

4️⃣ Landmark Judicial Precedent: CIT vs. Smif Securities Ltd.

One of the most significant rulings impacting PPA in India is the Supreme Court decision in CIT vs. Smif Securities Ltd. (2012), where it was held that:

- Goodwill acquired as part of a business combination qualifies as an intangible asset eligible for depreciation under Section 32 of the Income Tax Act.

- This precedent allows taxpayers to claim depreciation on goodwill arising from PPA, offering substantial tax planning opportunities.

Subsequent amendments and clarifications have refined the applicability of this principle; hence, ongoing legal interpretation remains relevant.

5️⃣ Regulatory Oversight: SEBI, MCA & ICAI

- SEBI (Securities and Exchange Board of India): Mandates disclosure of financial information, including PPA impact, for listed entities.

- MCA (Ministry of Corporate Affairs): Oversees compliance with the Companies Act and Ind AS adoption.

- ICAI (Institute of Chartered Accountants of India): Issues valuation guidance notes and professional standards that influence how PPA valuations are conducted and certified.

6️⃣ Professional Valuation Guidelines

Given the complexity of fair value measurements required under Ind AS 103, reliance on professional valuation standards, such as those issued by the ICAI and Registered Valuer Organizations (RVOs), has become critical. Proper documentation, methodology, and expert opinions are essential to defend valuations under audit or regulatory review.

In summary, PPA in India operates within a multi-layered regulatory framework that integrates accounting standards, corporate law, tax statutes, judicial rulings, and professional valuation guidelines. A thorough and compliant approach is essential to mitigate risks and maximize the financial advantages of PPA.

5: Common Challenges in Purchase Price Allocation Execution

In summary, PPA in India operates within a multi-layered regulatory framework that integrates accounting standards, corporate law, tax statutes, judicial rulings, and professional valuation guidelines. A thorough and compliant approach is essential to mitigate risks and maximize the financial advantages of PPA.

1️⃣ Valuation Complexity of Intangible Assets

One of the most significant challenges in PPA arises in valuing intangible assets such as:

- Brand names and trademarks

- Intellectual property (IP)

- Customer contracts and relationships

- Proprietary technology

- Non-compete agreements

Many of these assets do not have readily available market prices, requiring the application of sophisticated valuation methodologies such as:

- Multi-period excess earnings method (MPEEM)

- Relief-from-royalty method

- Cost approach

The subjectivity inherent in these models introduces valuation risks and requires specialized expertise.

2️⃣ Availability and Reliability of Data

PPA demands detailed and reliable data from both the acquirer and target entity, including:

- Historical financial statements

- Forecasted cash flows

- Customer and vendor contracts

- Asset registers

- Legal agreements

In many cases, particularly in private company transactions, this data may be incomplete, inconsistent, or outdated, increasing the level of estimation and professional judgment involved.

3️⃣ Regulatory and Tax Authority Scrutiny

Given the financial implications of PPA, especially concerning goodwill amortization and depreciation of intangibles, tax authorities may:

- Dispute asset classifications.

- Challenge valuation assumptions.

- Require extensive documentation and supporting evidence.

The lack of clear statutory guidance in certain areas may result in differing interpretations, leading to potential litigation or reassessment of tax positions.

4️⃣ Coordination Across Multiple Stakeholders

Executing PPA involves coordinated efforts among:

- Finance and accounting teams

- External valuation experts

- Legal advisors

- Auditors

- Tax consultants

- Regulatory compliance officers

Misalignment or miscommunication among these parties can delay the process or compromise its accuracy.

5️⃣ Timing Constraints

Under Ind AS 103, PPA must be completed within the “measurement period,” typically one year from the acquisition date. Failure to complete the allocation within this period may result in:

- Restatements of prior financial periods.

- Audit qualifications.

- Regulatory non-compliance.

Timely project management and resource allocation are critical to meeting these statutory deadlines.

6️⃣ Evolving Regulatory Interpretations

Given the convergence of Indian and international accounting standards, interpretations and practical guidance on certain PPA elements continue to evolve. This introduces uncertainty, particularly in cross-border transactions or novel deal structures.

Professional advisors must stay abreast of emerging regulations, judicial precedents, and global best practices to ensure defensible outcomes.

6: Professional Support Required for Purchase Price Allocation Execution

1️⃣ Valuation Experts

Registered Valuers (RVs) and valuation professionals play a central role in:

- Identifying and valuing tangible and intangible assets.

- Applying appropriate valuation methodologies such as Discounted Cash Flow (DCF), Relief-from-Royalty, Multi-Period Excess Earnings, and other income-based approaches.

- Preparing detailed valuation reports that withstand audit and regulatory scrutiny.

Their expertise ensures that fair value measurements are consistent with Ind AS 113 (Fair Value Measurement) and globally accepted valuation practices.

2️⃣ Accounting and Financial Reporting Consultants

Specialized accounting advisors assist in:

- Correct application of Ind AS 103 and IFRS 3 standards.

- Classification and presentation of assets, liabilities, goodwill, and bargain purchase gains.

- Ensuring compliance with disclosure requirements under the Companies Act, SEBI regulations, and stock exchange guidelines.

Their involvement minimizes the risk of financial misstatements and audit qualifications.

3️⃣ Tax Advisors

Given the significant tax implications of PPA, experienced tax professionals are engaged to:

- Assess the tax deductibility of goodwill and intangible assets.

- Structure the transaction to optimize tax efficiency.

- Prepare documentation to support tax positions in the event of assessments or audits.

Their input is particularly critical in light of evolving tax laws and judicial precedents such as CIT vs. Smif Securities Ltd.

4️⃣ Legal Advisors

Legal counsel assists in:

- Reviewing and interpreting acquisition agreements, contracts, and legal obligations.

- Ensuring proper title and ownership verification of acquired assets.

- Advising on regulatory filings and disclosures.

They help ensure legal compliance and minimize post-acquisition disputes.

5️⃣ Auditors

The external audit function reviews the PPA exercise to:

- Verify the reasonableness of valuation assumptions.

- Confirm compliance with accounting standards.

- Endorse the financial statements for regulatory and stakeholder reporting.

Early involvement of auditors during the PPA process can help pre-empt objections and streamline audit clearance.

6️⃣ Project Management Teams

Given the involvement of multiple professionals, robust project management is often required to:

- Coordinate timelines.

- Consolidate data from various stakeholders.

- Ensure adherence to statutory deadlines under Ind AS 103 measurement period.

Effective management ensures the timely and efficient completion of the PPA exercise.

In summary, the successful execution of Purchase Price Allocation is rarely a siloed effort. It demands an integrated team of valuation experts, accountants, tax advisors, legal counsel, auditors, and project managers to deliver an outcome that is both technically sound and fully compliant with applicable regulatory frameworks.

7: Conclusion: Why Purchase Price Allocation Is a Strategic Imperative

In the modern business environment, marked by increasing regulatory oversight, complex transaction structures, and heightened stakeholder expectations, Purchase Price Allocation (PPA) has evolved far beyond a mere accounting formality. It has become a strategic tool that directly influences an organization’s financial transparency, tax efficiency, investor confidence, and long-term value creation.

By accurately attributing value to acquired assets and liabilities:

- Organizations present a true and fair picture of their post-acquisition financial position.

- Investors and stakeholders gain deeper insights into the underlying economics of the transaction.

- Tax positions are optimized, leveraging available benefits while ensuring compliance.

- Management is empowered with actionable intelligence for future business planning, resource allocation, and strategic growth.

However, the complexities inherent in PPA demand a disciplined, multi-disciplinary approach involving specialized valuation, legal, tax, and accounting expertise. Inadequate or incorrect PPA execution not only exposes companies to regulatory and audit risks but can also erode shareholder value and compromise future financial performance.

For businesses engaged in mergers, acquisitions, internal reorganizations, or cross-border transactions, a well-executed PPA serves as both a compliance necessity and a value-enhancing mechanism, reinforcing its status as a strategic imperative in corporate finance.

Frequently Asked Questions (FAQs)

Purchase Price Allocation (PPA) is the process of allocating the purchase price of a business acquisition to its identifiable assets and liabilities at fair value, as required under Ind AS 103.

PPA ensures accurate financial reporting, regulatory compliance, optimized tax treatment, and transparent valuation of assets and liabilities in M&A transactions.

Yes, for companies following Ind AS or IFRS, PPA is mandatory under Ind AS 103 for any business combination, ensuring financial accuracy and regulatory compliance.

PPA directly affects tax treatment by enabling depreciation on certain intangible assets like goodwill, subject to evolving tax laws and judicial precedents.

Valuation professionals, registered valuers, tax consultants, accountants, and legal advisors collectively support the correct execution of PPA