In 2023, over ₹2 lakh crore worth of infrastructure and manufacturing projects in India were delayed or shelved due to poor planning, unrealistic financial projections, and underestimated risks. For lenders, this isn’t just a loss, it’s a red flag. For promoters, it’s a credibility hit that can jeopardise future funding.

That’s where a Techno-Economic Viability (TEV) Report comes into play. This is not just a formality, it’s a cornerstone document that evaluates whether a project is both technically sound and financially sustainable.

In India’s high-stakes funding environment, a TEV report is the difference between being seen as a viable investment or an avoidable risk. Whether you’re seeking a term loan from SBI or pitching your project to a private equity fund, the absence of a TEV study can derail your chances.

If you’re serious about project funding, investor confidence, and long-term viability, this is one document you can’t afford to skip.

Table of Contents

ToggleWhat is a TEV Report?

A Techno-Economic Viability (TEV) Report is a structured, in-depth analysis that assesses the technical feasibility and economic viability of a proposed or ongoing project. It dives deep into the project’s design, technology, market assumptions, costs, and financial projections to determine whether the initiative is realistically executable and worth funding.

TEV reports are essential tools for:

- Banks and Financial Institutions: Especially public sector banks like SBI and PNB, which mandate TEV studies for large loan proposals.

- Investors and NBFCs: Who use them to gauge the risk-return profile of a project.

- Promoters and Project Developers: Looking to enhance their funding appeal and validate assumptions.

In the Indian context, TEV reports are most commonly required for infrastructure, energy, real estate, and industrial manufacturing projects. They’re often prepared by empanelled consultants or valuation experts and are a prerequisite for major lending decisions, especially in scenarios involving new projects, expansions, or the revival of stressed assets.

Put simply, if your project is seeking serious capital in India, a TEV report isn’t optional, it’s foundational.

Why is a TEV Report Important?

When crores are at stake, gut instinct isn’t enough. Financial institutions and investors demand hard evidence, and that’s precisely what a TEV report delivers.

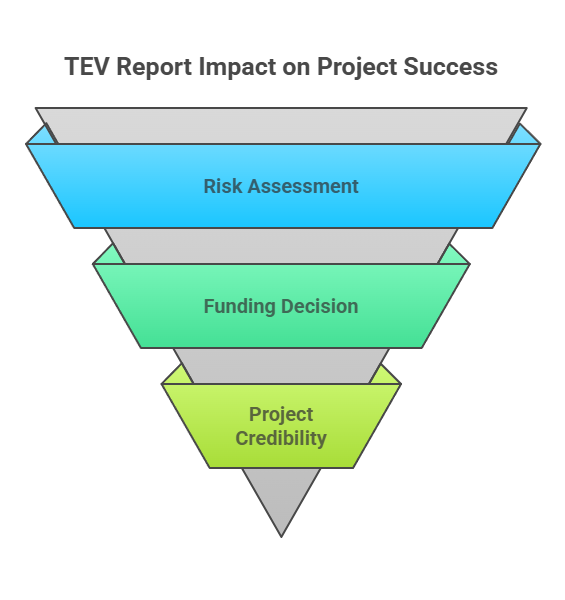

✅ Risk Mitigation and Project Viability

Every project carries risks, technical flaws, market misjudgments, and financial overreach. A TEV report anticipates these risks before they become costly mistakes. It assesses whether the project can be implemented as planned, with the available resources, and under realistic market conditions. The outcome? A well-informed, proactive risk strategy rather than firefighting later.

✅ Role in Funding and Investment Decisions

Indian banks, NBFCs, and private equity firms rely heavily on TEV reports before disbursing funds. For new, expansion, or revival projects, the TEV study serves as a third-party validation of the project’s assumptions, cost structures, and profitability metrics. Without it, loan approvals can stall, or worse, be denied outright.

✅ Enhancing Project Credibility

A TEV report doesn’t just build confidence, it signals preparedness. For promoters, it shows they’ve done their homework. For banks and investors, it makes the project look bankable, structured, and grounded in reality. In a competitive funding environment, that kind of credibility can set you apart.

Key Components of a TEV Report

A professionally-prepared TEV report typically covers five critical dimensions. Each section is a deep dive into a different lens of project assessment:

1. Technical Feasibility

This section evaluates whether the project is practically implementable, considering:

- Choice of technology and its relevance to Indian conditions

- Site selection, plant layout, and logistics

- Machinery, equipment specifications, and capacity utilization

- Availability of raw materials, utilities (power, water), and skilled manpower

It answers the question: Can the project be built and run as envisioned?

2. Economic Viability

Here, the report assesses the project’s sustainability in the broader market landscape:

- Demand and supply dynamics

- Competitive positioning

- Product pricing strategies and customer segments

- Long-term revenue potential

This is where the project’s real-world market appeal is tested. Will there be buyers? Is the pricing viable? Can it survive a saturated or volatile market?

3. Financial Feasibility

The most scrutinized part of the report, this section lays out:

- Projected cash flows and profitability

- Internal Rate of Return (IRR), Net Present Value (NPV), and Payback Period

- Debt Service Coverage Ratio (DSCR)

- Sensitivity analyses (e.g., what happens if costs increase or demand dips)

- Funding structure: equity vs. debt, term loan requirements, working capital needs

For lenders and investors, this section is often the make-or-break.

4. Managerial Competence

Even a brilliant idea can collapse under poor leadership. This section evaluates:

- The promoters’ track record

- Competence of the project management team

- Governance structure and ability to handle regulatory, market, and operational risks

In essence: Do the people behind the project inspire confidence?

5. Risk Assessment

No project is risk-free. This section outlines:

- Key technical, market, regulatory, environmental, and financial risks

- Risk mitigation strategies and contingency plans

- Stress testing across best-case and worst-case scenarios

This part assures stakeholders that the team is prepared for turbulence, and not just tailwinds.

TEV Report in Practice: The Indian Context

In India’s highly regulated and capital-intensive business environment, a TEV report isn’t just a formality, it’s often mandatory for securing project funding from banks and financial institutions.

📌 When Is It Required?

TEV reports are typically required for:

- Large-scale infrastructure and manufacturing projects

- Expansion or revival of stressed assets

- Loan restructuring and revival under the RBI frameworks

- Greenfield and brownfield investments exceeding specific financial thresholds

Indian banks, such as the State Bank of India, require TEV reports for large-scale funding proposals.

📌 Role of Empanelled Consultants

Not just anyone can prepare a TEV report. Leading banks, including public sector banks, maintain a panel of empanelled consultants, technical and financial experts with proven experience in project evaluation. Only these accredited professionals are authorised to submit TEV reports accepted for funding consideration.

This ensures credibility, consistency, and a uniform evaluation framework.

📌 Common Industries and Use Cases

TEV studies are widely used in sectors such as:

- Infrastructure (roads, ports, airports, logistics parks)

- Energy (thermal, solar, wind, hydro, oil & gas)

- Real estate and construction

- Manufacturing (steel, cement, textiles, FMCG, pharma)

- Agro-processing and food industries

- Public-private partnership (PPP) projects

📌 Process Overview

A TEV study is a rigorous process that typically includes:

- Initial project brief and data collection

- Site visit to assess on-ground realities

- Verification of technical assumptions and costing

- Market research and demand analysis

- Financial modelling with stress testing

- Compilation of findings into a structured report

The process can take anywhere from 2 to 6 weeks, depending on the scale and complexity of the project.

Standard Structure of a TEV Report

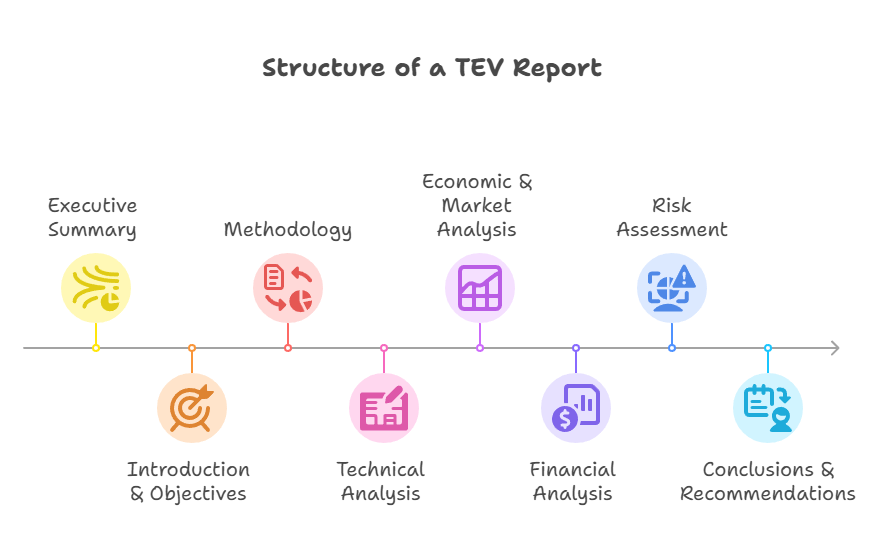

A well-documented TEV report follows a logical and detailed structure. Here’s what you can expect in a typical Indian TEV report:

📄 Executive Summary

A snapshot of the entire report, highlighting key findings, viability conclusions, funding requirements, and recommendations. Often read by decision-makers before they dive into the full report.

📘 Introduction & Objectives

Defines the purpose of the report, scope of the evaluation, and context of the project. It also explains who commissioned the report and what key questions it aims to answer.

🔍 Methodology

Outlines the approach, tools, data sources, and evaluation framework used. This may include site visits, financial modeling techniques, industry benchmarks, and assumptions. of the project. It also explains who commissioned the report and what key questions it aims to answer.

🏗️ Technical Analysis

Detailed review of:

- Project design and layout

- Equipment and machinery

- Technology selection

- Raw material availability and logistics

- Infrastructure and resource assessment

📊 Economic & Market Analysis

Covers:

- Industry overview and market trends

- Demand-supply gap analysis

- Competitive landscape

- Pricing strategy and customer segmentation

- Sales and revenue projections

💰 Financial Analysis

Includes:

Project cost and funding structure

- Profitability projections (P&L, balance sheet, cash flows)

- Key ratios: IRR, DSCR, break-even, NPV

- Sensitivity analysis and stress tests

⚠️ Risk Assessment

Identifies and analyses potential risks:

- Technical and operational risks

- Regulatory and environmental compliance

- Market uncertainties

- Financial risks and mitigation strategies

📌 Conclusions & Recommendations

Summarises the project’s overall feasibility and provides final observations:

- Whether the project is technically and economically viable

- Suggested improvements or modifications

- Funding recommendation and bankability status

TEV Report vs Other Project Evaluation Tools

In India’s project evaluation landscape, multiple tools are used to assess viability, but not all are created equal. Here’s how the TEV Report compares to other commonly used documents:

📘 TEV Report vs DPR (Detailed Project Report)

Aspect | TEV Report | DPR |

Focus | Feasibility, technical, and economic | Project execution plan |

Prepared By | Independent experts (empanelled consultants) | Promoter or technical consultants |

Used For | Funding decisions, viability checks | Project implementation |

Depth of Analysis | High (includes financial modeling & risk) | Operational details and estimates |

While a DPR outlines the project “how,” a TEV report evaluates the “should we do it” from a viability lens. Banks rely on TEV, not DPR, to approve funding.

📊 TEV Report vs Feasibility Study

Feasibility studies typically explore one dimension, technical, market, or financial, but not necessarily all in depth or together. TEV reports, on the other hand, integrate all dimensions holistically, with a lens toward bankability.

🧾 TEV Report vs LIE Report (Lenders' Independent Engineer Report)

TEV Report | LIE Report |

Conducted before the project begins | Conducted after funding is sanctioned |

Determines if the project should be funded | Monitors how the project is being executed |

Focused on viability | Focused on implementation progress |

Bottom line: A TEV report is the most comprehensive, decision-enabling document for Indian banks and investors before committing capital. It’s not just a technical analysis, it’s a funding gateway.

Why TEV Reports Matter for Indian Businesses

For Indian promoters, investors, and project developers, a TEV report does more than check a regulatory box, it reflects strategic foresight.

💡 Strategic Foresight for Promoters

By undergoing a TEV study early, promoters get a reality check on their assumptions. It helps them:

- Anticipate hurdles and mitigate risks

- Refine the business model

- Validate technology and pricing strategy

- Rework the capital structure, if needed

This is especially vital in a competitive market where project missteps can be expensive.

💰 Essential for Securing Capital

Banks and financial institutions often mandate TEV reports to:

- Approve term loans and working capital financing

- Restructure stressed assets or NPA accounts

- Evaluate new and expansion projects in capital-heavy sectors

Even private equity investors and venture debt funds are increasingly relying on TEV insights to evaluate project-stage investments.

Conclusion

A Techno-Economic Viability (TEV) Report is more than just an analytical document, it’s a strategic tool that brings clarity, builds investor trust, and lays the groundwork for long-term project success

In a high-stakes business environment where capital, credibility, and clarity determine your trajectory, a TEV report is your validation engine, rigorous, reliable, and respected by banks and investors alike.

👉 Ready to strengthen your project proposal?

Whether you’re a startup looking for funding or an established enterprise planning expansion, consult with experts to craft a TEV Report that does justice to your vision.

Frequently Asked Questions (FAQs)

TEV Reports are typically prepared by empanelled consultants, specialized financial advisory firms, or technical institutions with domain expertise. In India, major banks like SBI only accept TEV studies conducted by consultants listed on their approved panel.

Depending on the size and complexity of the project, a TEV Report can take anywhere between 2 to 6 weeks. This includes site visits, data analysis, stakeholder consultations, and preparation of the final report.

Absolutely. While TEV Reports are more common in large infrastructure and manufacturing projects, startups, especially those seeking debt financing or entering capital-intensive industries, can benefit immensely. A well-crafted TEV study can bolster credibility and unlock funding opportunities.

For most term loan or restructuring proposals above a certain threshold, public and private sector banks in India mandate a TEV Report. Even in cases where it’s not mandatory, having one significantly improves the chances of loan approval or investment.

Preparing a TEV Report requires a combination of technical, financial, and market-related data, including:

- Project concept note or Detailed Project Report (DPR)

- Cost estimates (CAPEX & OPEX)

- Projected revenues and financial statements

- Market research and demand-supply analysis

- Technical specifications and process details

- Promoter background and management profile

Providing accurate and up-to-date data helps ensure the report is both credible and decision-ready.