Table of Contents

ToggleIntroduction: Numbers That Speak Louder Than Words

In India’s dynamic and fast-evolving funding landscape, investor confidence is more than a competitive advantage, it’s a prerequisite. With domestic capital becoming more discerning and international funds scrutinizing every detail, businesses must present more than just ambition and potential. They must present evidence.

An Investor Valuation Report, when prepared with precision and regulatory insight, becomes that evidence. It transforms abstract ideas into measurable financial credibility. For growth-stage startups and established businesses alike, the Marcken Consulting Investor Valuation Report serves not merely as a compliance document but as a strategic trust signal. It reflects that your business is investment-ready, future-focused, and grounded in data that stakeholders can rely on.

Establishing Investor Confidence: The Credibility Multiplier

A professionally prepared valuation report is one of the most powerful tools a business can use to build credibility with potential investors. Numbers, when backed by robust financial models, industry benchmarks, and future cash flow projections, speak the language investors trust.

In an environment where hundreds of companies compete for the same pool of capital, Marcken Consulting’s Investor Valuation Report provides a distinct edge. It offers an objective, data-backed assessment of enterprise value, incorporating everything from revenue streams and profitability to sector-specific risks and market comparables.

Investors are increasingly wary of inflated projections and unsubstantiated valuations. A credible, third-party valuation assures them that the business has done its due diligence, understands its market position, and is prepared for transparent negotiation. Trust is not built through storytelling alone, it is established through numbers that withstand scrutiny. Marcken’s report delivers just that.

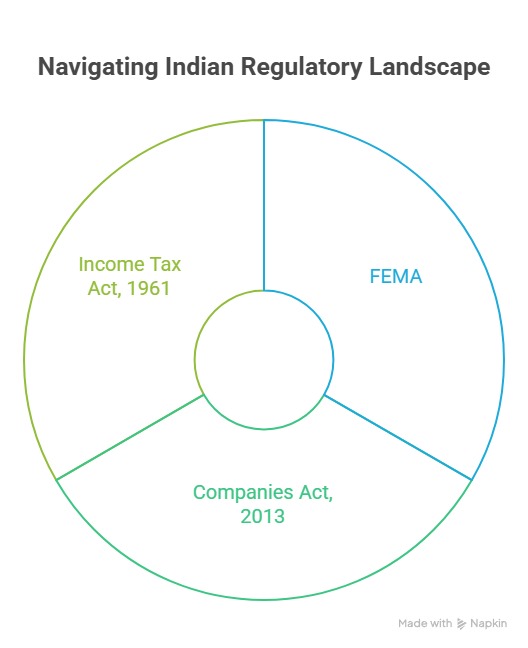

Regulatory Armor: Aligning with Indian Laws

In the Indian business environment, securing investment is not solely a matter of business potential, it is also a matter of legal and regulatory alignment. Several statutes govern how businesses can issue shares, bring in foreign capital, or allocate equity. Prominent among these are:

- The Foreign Exchange Management Act (FEMA) requires fair valuation of shares in case of foreign direct investment (FDI) and outbound remittances.

- The Companies Act, 2013 Mandates independent valuation for share issuance, rights issues, preferential allotments, mergers, and acquisitions.

- The Income Tax Act, 1961: Particularly under Section 56(2)(viib), requires valuation of shares to ensure alignment with fair market value and to avoid tax consequences for both the investor and the company.

Navigating these frameworks can be complex, and non-compliance can result in penalties, litigation, or rejection of transactions. The Marcken Consulting Investor Valuation Report is designed to eliminate these risks. Prepared by SEBI-registered Merchant Bankers or IBBI-registered Valuers, the report adheres strictly to the latest legal standards, valuation rules, and prescribed methodologies.

This not only ensures that your transaction stands up to scrutiny by regulators such as the RBI, SEBI, and Income Tax Department, but also instills confidence in investors that your business is operating within the letter and spirit of Indian law.

Fueling Fundraising: From Pitch Deck to Term Sheet

In the world of fundraising, data-backed clarity is invaluable. While a pitch deck can convey your business story, vision, and team strength, it is the valuation report that grounds that narrative in financial reality. For investors, especially venture capital funds, family offices, and international institutions, a valuation report is not optional; it is expected.

The Marcken Consulting Investor Valuation Report serves as a foundational element during capital raise efforts. It enables meaningful discussions with potential investors by providing:

- A transparent and well-reasoned valuation

- A basis for negotiation on equity dilution and investment terms

- Justification for valuation multiples, asset projections, and revenue forecasts

This becomes even more crucial in cases involving foreign direct investment, where regulatory clearances and pricing guidelines require meticulous documentation. Additionally, businesses participating in government-backed programs such as Startup India or seeking funding under SIDBI and other public-sector initiatives will often find that a credible valuation report is a prerequisite.

In short, Marcken’s report bridges the gap between business ambition and investor confidence, translating your financial roadmap into a form that aligns with both market expectations and regulatory norms.

Strategic Leverage: More Than Just Fundraising

While valuation reports are often associated with external fundraising, their strategic value extends much further. A professionally prepared fair market valuation serves as a decision-making tool across various stages of a company’s lifecycle, helping promoters, stakeholders, and boards make informed, forward-looking choices.

For instance, when a business is preparing for the entry or exit of partners, a credible valuation ensures equitable negotiations and smooth transitions. In the case of succession planning, especially within family-owned enterprises, a transparent valuation report helps facilitate orderly handovers and avoid disputes.

Similarly, for businesses considering an initial public offering (IPO) or preparing for institutional investment, a valuation report can serve as a benchmark for readiness, identifying key financial indicators, performance gaps, and market expectations. It offers clarity on the business’s true worth, which becomes critical when aligning with investment bankers, underwriters, and regulatory authorities during listing.

By integrating the Marcken Consulting Investor Valuation Report into internal strategy, businesses not only meet compliance and funding requirements but also position themselves to make smarter, data-driven decisions.

India-Specific Insights: Tailored to the Local Growth Narrative

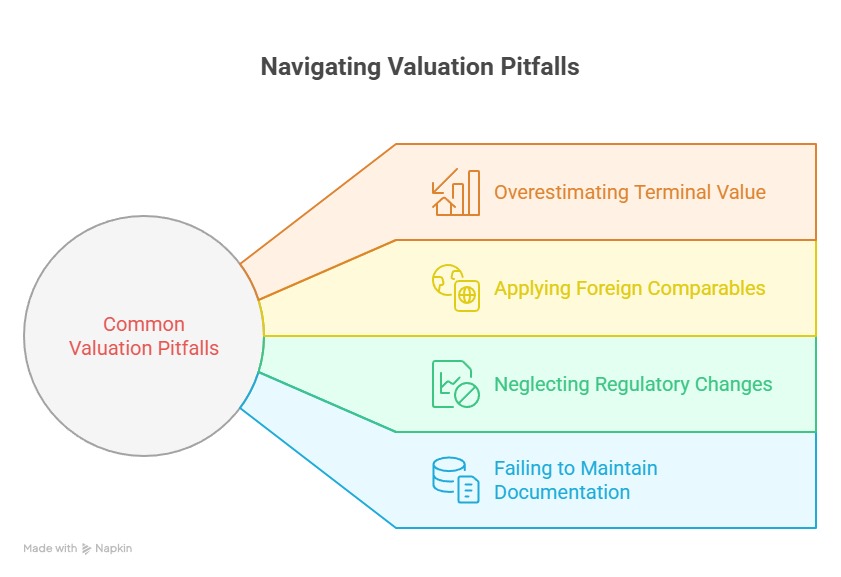

India’s economic environment presents unique opportunities and equally unique challenges. Global templates or valuation approaches often fail to capture the intricacies of the Indian market, from sector-specific growth dynamics to regulatory frameworks and investor preferences.

One of the common pitfalls in valuation is the use of foreign comparables, which may distort value, misrepresent risk, or misalign with local market realities. The Marcken Consulting approach avoids this by grounding valuations in domestic benchmarks, India-specific multiples, and regionally relevant market data.

Moreover, the report incorporates insights into government-led policy incentives, such as the Production-Linked Incentive (PLI) schemes, Startup India benefits, and the Digital India roadmap, all of which significantly impact the valuation trajectory of Indian enterprises.

It also reflects the growing investor appetite in sectors like fintech, clean energy, SaaS, manufacturing, and agritech, and considers macroeconomic factors such as India’s projected $1 trillion digital economy and increasing domestic capital participation.

In this context, the Marcken Investor Valuation Report becomes more than a financial document, it becomes a localised strategic asset that aligns with India’s evolving growth story and ensures that businesses are valued accurately within their ecosystem.

Risk Mitigation: Audit-Proofing Your Valuation

In today’s compliance-focused environment, the consequences of an improperly structured or loosely documented valuation can be significant. From tax penalties to failed investment deals and regulatory investigations, the risks of misjudging or misrepresenting enterprise value are far from negligible.

The Marcken Consulting Investor Valuation Report is designed to proactively address and eliminate these risks. By adhering to SEBI and IBBI standards and using globally accepted valuation methodologies tailored for the Indian context, it ensures that each report is fully audit-ready.

In the event of tax scrutiny — such as under Section 56(2)(viib) of the Income Tax Act — or during an investigation by regulators like the RBI or SEBI, a well-documented, independently prepared valuation report provides a strong line of defense. It demonstrates that the valuation process was objective, professional, and in full compliance with applicable laws, thereby significantly reducing the likelihood of adverse outcomes.

Growth Foundation: A Long-Term Strategic Compass

Beyond its immediate utility for fundraising and compliance, a professionally prepared valuation report serves as a strategic foundation for long-term business growth. It offers a financial baseline against which companies can benchmark future performance, set measurable goals, and monitor progress.

For businesses that offer Employee Stock Option Plans (ESOPs), valuation is critical for determining the fair value of shares to be issued. Ensuring transparency and accuracy in ESOP pricing not only meets regulatory expectations but also builds trust with employees and future talent.

Moreover, as businesses mature, a robust valuation report lays the groundwork for future capital raises, secondary transactions, and eventual exits, including acquisitions or public listings. It instills financial discipline and aligns internal planning with investor expectations.

The Marcken Consulting Investor Valuation Report is not a one-time compliance document — it is a strategic compass that supports sustainable growth. By helping businesses understand their true worth today, it equips them to make smarter decisions for tomorrow.

Conclusion: From Vision to Valuation — The Marcken Advantage

In the journey from entrepreneurial ambition to sustained business success, a clear, credible, and compliant valuation is a non-negotiable asset. It is the bridge between vision and execution, the point where strategic goals meet investor expectations, and where regulatory readiness meets market opportunity.

The Marcken Consulting Investor Valuation Report stands at the center of that bridge. It offers more than just a numerical estimate of worth; it delivers a carefully constructed analysis grounded in Indian regulatory frameworks, local market realities, and sector-specific dynamics. Whether you are preparing for a funding round, onboarding a strategic partner, planning a future exit, or simply seeking clarity about your company’s financial trajectory, Marcken provides the tools to move forward with confidence.

With a reputation built on precision, regulatory expertise, and deep market understanding, Marcken Consulting has become a trusted partner for Indian businesses looking to scale responsibly and attract the right kind of capital. In a landscape where trust is currency, and scrutiny is high, a Marcken valuation does more than satisfy, it strengthens.

Frequently Asked Questions (FAQs)

Equity valuation helps determine the fair market value of a company’s shares. In India, it plays a crucial role in investment decisions, fundraising, mergers & acquisitions, and regulatory compliance. Accurate valuation ensures businesses are neither overvalued nor undervalued — providing clarity for all stakeholders involved.

For startups, the Income Approach, particularly the Discounted Cash Flow (DCF) method, is most commonly used. Since early-stage ventures may not have listed peers or stable earnings, intrinsic valuation based on projected cash flows offers a better reflection of long-term potential. Marcken Consulting specialises in preparing DCF-based reports for startups across sectors.

Yes, under the Companies Act, 2013, a Registered Valuer is mandatory for corporate actions such as mergers, demergers, rights issues, and ESOP allotments. These professionals are empanelled with the IBBI and must be formally appointed by the company’s Board or Audit Committee.

Equity valuation directly influences how much equity an SME will need to dilute in exchange for capital. It helps in negotiating better terms with investors, justifying business potential, and presenting financial credibility. Valuation reports also act as a due diligence checkpoint in VC and angel funding rounds. Marcken Consulting offers valuation reports for funding that are investor-ready and regulator-compliant.

No. For share transfers involving non-residents, the Reserve Bank of India (RBI) requires valuation to be conducted using Indian valuation standards — typically the DCF method — and certified by a SEBI-registered Merchant Banker or a Chartered Accountant. Using foreign valuation benchmarks without localization can lead to regulatory challenges.