Table of Contents

ToggleIntroduction

In India’s rapidly evolving business ecosystem, mergers and acquisitions (M&A) have emerged as a critical strategy for companies seeking to expand, diversify, and enhance shareholder value. As industries consolidate and global capital flows increasingly target Indian enterprises, M&A activity is becoming a key driver of both corporate transformation and economic growth.

At the core of any successful M&A transaction lies a thorough understanding of the true value of the business involved. Valuation is not merely a procedural step—it shapes the financial narrative of the deal, influences negotiation dynamics, and determines regulatory alignment.

In this context, the Investor Valuation Report plays a pivotal role. Far beyond a compliance document, it is a strategic instrument that brings clarity, objectivity, and trust to the table. It provides stakeholders with an independent, data-backed assessment of a company’s financial worth, laying the groundwork for informed decisions, risk mitigation, and seamless deal execution.

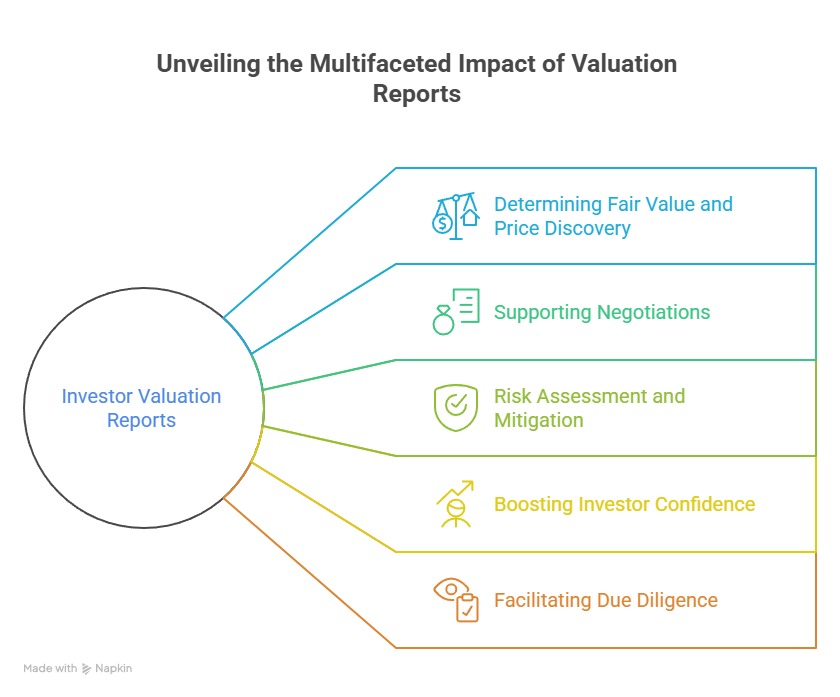

The Strategic Role of Investor Valuation Reports in M&A

1. Determining Fair Value and Price Discovery

One of the fundamental objectives of an Investor Valuation Report is to provide an unbiased, methodical estimate of a company’s worth. This assessment is based on a wide range of factors, including historical financial performance, asset base, future earnings potential, prevailing market conditions, and comparable transactions.

This data-driven approach not only ensures fairness in pricing but also protects both acquirer and seller from overvaluation or undervaluation, common pitfalls that can derail transactions or lead to post-deal dissatisfaction. In India, depending on the nature of the transaction, the valuation must often be carried out by a Registered Valuer under the Companies Act, 2013, or a SEBI-registered Merchant Banker, particularly when foreign investment or listed companies are involved.

2. Supporting Negotiations

A well-prepared valuation report serves as a strong anchor during negotiations. Rather than relying on subjective projections or informal estimates, the parties can engage with a clearly defined valuation benchmark.

This is particularly crucial when determining pre-money and post-money valuations, which directly affect the ownership structure post-acquisition. By establishing a shared understanding of the company’s value, the report enables more transparent, data-grounded discussions, empowering both parties to negotiate from informed and balanced positions.

3. Ensuring Regulatory Compliance

Indian laws require investor valuation reports in several regulatory contexts. Under the Companies Act, 2013, a valuation is mandatory for mergers, demergers, and certain share issuances. The Foreign Exchange Management Act (FEMA) mandates fair valuation in cases involving cross-border investments. Additionally, the Income Tax Act, 1961 requires valuation to prevent tax avoidance under provisions like Section 56(2)(viib).

In M&A transactions involving a merger or demerger, the valuation report must often be annexed to the scheme submitted before the National Company Law Tribunal (NCLT). Non-compliance or inaccuracies in the valuation report can result in regulatory delays, penalties, or even rejection of the proposed transaction.

4. Risk Assessment and Mitigation

The valuation process often brings to light risks that may not be immediately evident through financial statements alone. These can include contingent liabilities, ongoing litigation, asset misstatements, or operational inefficiencies. Identifying such issues before the transaction is closed allows the acquirer to re-evaluate the terms of the deal or negotiate specific indemnities and protections.

By enabling a comprehensive review of the target company’s financial and operational health, the valuation report contributes directly to risk-adjusted deal structuring, safeguarding the long-term interests of all stakeholders.

5. Boosting Investor Confidence

For private equity firms, venture capitalists, and institutional investors, the presence of a professionally prepared valuation report is often a precondition for engagement. It signals that the company has undertaken a thorough, transparent assessment of its value, supported by credible assumptions and financial disclosures.

This is particularly relevant for startups and high-growth firms, where intangible assets and future potential often constitute a large part of the valuation. An investor-grade report enhances the company’s credibility, reducing perceived investment risk and facilitating capital infusion.

6. Facilitating Due Diligence

Finally, the valuation report acts as a cornerstone document during the due diligence phase of an M&A transaction. Legal, financial, and operational due diligence efforts are often guided by the assumptions, data points, and projections included in the report.

It enables both parties to validate key deal parameters and reconcile any discrepancies early in the process. By streamlining due diligence, the valuation report helps prevent last-minute surprises and promotes a smoother, dispute-free closure of the transaction.

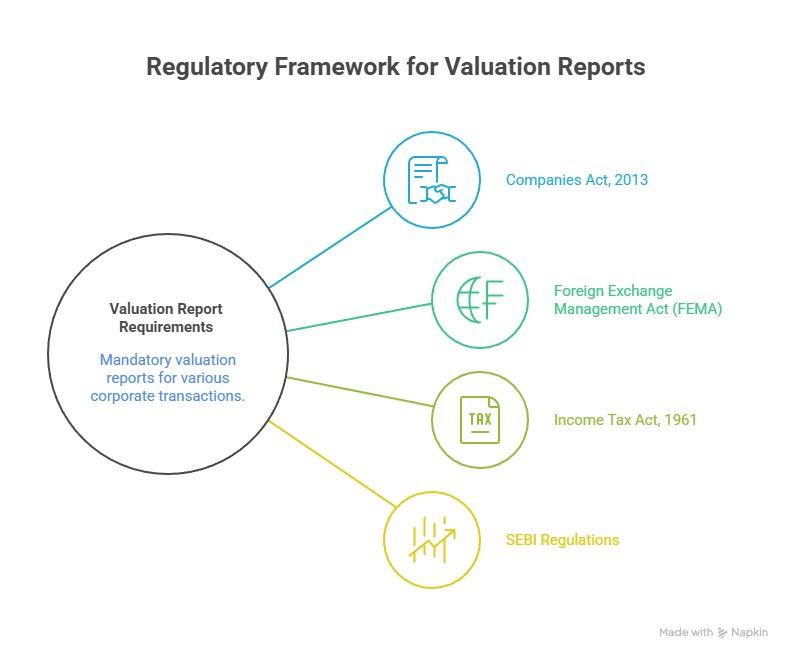

Indian Regulatory Framework: When Is a Valuation Report Mandatory?

In India, the requirement for a valuation report is not merely a best practice—it is embedded within the legal and regulatory framework governing corporate transactions. Various statutes and regulatory bodies mandate valuations to ensure transparency, protect stakeholders, and prevent tax and compliance-related irregularities. Below is a summary of the key regulations and their corresponding requirements:

Regulation | Requirement for Valuation Report |

Companies Act, 2013 | Mandatory for mergers, demergers, share swaps, and issuance of shares under schemes of arrangement. Valuation must be carried out by a Registered Valuer as defined under Section 247 of the Act. |

Foreign Exchange Management Act (FEMA) | Fair valuation is required for all inbound and outbound foreign investments to ensure arm’s length pricing. This is particularly relevant in cross-border M&A and equity infusions involving non-resident investors. |

Income Tax Act, 1961 | Under Section 56(2)(viib), valuation is required to justify the fair market value of shares issued at a premium to avoid taxation as income. This provision applies especially to unlisted companies raising funds. |

SEBI Regulations | In case of certain transactions involving listed and unlisted companies, SEBI mandates valuation by a SEBI-registered Merchant Banker. These include preferential allotments, takeover offers, and schemes involving listed entities. |

Adherence to these valuation mandates is essential not only for legal compliance but also to facilitate smooth approvals from regulatory authorities such as the Reserve Bank of India (RBI), Income Tax Department, and the National Company Law Tribunal (NCLT).

Practical Example: What This Looks Like in Real M&A Deals

To better understand the role of the Investor Valuation Report in Indian M&A transactions, consider a typical acquisition involving a mid-sized unlisted company and a strategic buyer.

1. Pre-deal Planning:

The process begins with the buyer conducting preliminary assessments and appointing advisors. Once the deal intent is formalised, a qualified Registered Valuer or SEBI-registered Merchant Banker is engaged to prepare an independent valuation report.

2. Valuation Stage:

The valuer undertakes detailed financial analysis, industry benchmarking, asset verification, and future cash flow projections. The final report outlines the fair market value of the target company, which is then used as the basis for negotiating deal terms, defining equity stakes, and determining the consideration structure.

3. Due Diligence and Documentation:

The Investor Valuation Report becomes a reference point during legal and financial due diligence. Discrepancies or red flags uncovered during this phase may lead to renegotiation or restructuring of the deal. Simultaneously, the valuation is incorporated into the Scheme of Arrangement, Share Purchase Agreement (SPA), or Business Transfer Agreement (BTA).

4. Regulatory Filing and Approval:

In cases involving mergers or demergers, the valuation report is annexed to the application submitted to the NCLT. It is reviewed by company auditors, legal teams, and regulatory authorities to verify its compliance and fairness. If the deal involves foreign investment, the report is also filed with the RBI for FEMA compliance.

5. Closing and Post-Deal Review:

Once approvals are secured and conditions precedent are satisfied, the transaction is closed. The valuation report remains a key part of the deal file, often referenced in audits, future rounds of investment, or potential disputes.

This real-world flow demonstrates that the Investor Valuation Report is far more than a box-ticking exercise—it is a foundational component that supports the M&A lifecycle from initial exploration to legal closure.

What Happens When You Skip It?

Omitting an Investor Valuation Report in an M&A transaction can lead to significant legal, financial, and reputational consequences. While some might perceive valuation as a procedural formality, its absence can undermine the integrity of the entire deal.

From a regulatory standpoint, non-compliance with mandatory valuation requirements under laws such as the Companies Act, FEMA, or the Income Tax Act can attract scrutiny, lead to the rejection of filings, or result in penalties. In more severe cases, it may delay or derail the transaction altogether, causing stakeholders to incur avoidable costs and uncertainty.

There have been rare instances where Indian courts have permitted mergers or acquisitions without a formal valuation report. However, such cases are exceptional, often based on unique facts, and should not be viewed as precedents. Relying on these exceptions exposes businesses to unnecessary risk and invites challenges from shareholders, creditors, or regulators.

Beyond compliance, the omission of a valuation report can damage the reputation of the parties involved. Investors, especially institutional or foreign ones, expect transparency and accountability. Proceeding without a valuation report may be perceived as a lack of diligence, eroding investor confidence, and reducing the credibility of the business. Furthermore, unresolved valuation disagreements can trigger post-transaction litigation, turning what should be a strategic milestone into a legal and financial burden.

In essence, skipping the valuation report compromises not only regulatory alignment but also the deal’s stability, fairness, and future defensibility.

Choosing the Right Valuation Professional: Why It Matters

The integrity and effectiveness of an Investor Valuation Report depend significantly on the expertise and independence of the professional conducting the valuation. In M&A transactions, especially in the Indian regulatory environment, selecting a qualified valuer is not just a matter of form—it can influence the trajectory of the entire deal.

Registered Valuers under the Companies Act, 2013, are recognized for transactions involving mergers, demergers, and share issuances where compliance with Section 247 is required. These professionals are registered with the Insolvency and Bankruptcy Board of India (IBBI) and must meet strict eligibility, experience, and examination criteria.

On the other hand, SEBI-registered Merchant Bankers are mandated for specific valuation roles, particularly in transactions involving listed companies, preferential allotments, or where SEBI regulations prescribe their involvement. Their financial expertise and regulatory standing make them indispensable for complex, capital market-linked transactions.

The credibility of the valuation professional directly impacts how the report is received by investors, legal counsel, regulators, and financial institutions. An experienced and independent valuer enhances trust, reduces the risk of regulatory pushback, and ensures that the valuation stands up to scrutiny, both during and after the transaction.

Common Valuation Methods Used in M&A Transactions

Investor Valuation Reports in M&A typically rely on established valuation methodologies tailored to the nature of the target business, the industry it operates in, and the transaction context. Three commonly used approaches in India are:

- Discounted Cash Flow (DCF): This method estimates the present value of expected future cash flows, discounted at an appropriate risk-adjusted rate. It is widely used for companies with stable, predictable earnings and growth prospects. In India, DCF is particularly favoured for technology firms, startups, and capital-intensive businesses.

- Comparable Company Analysis (CCA): This approach benchmarks the target against publicly traded companies with similar characteristics. Multiples such as EV/EBITDA or P/E ratios are used to derive value. It is suitable for businesses operating in mature industries with available peer data.

- Precedent Transaction Method: This involves analyzing transaction multiples from recent M&A deals within the same industry. It reflects real-world deal values and is useful for understanding market sentiment and acquisition trends.

While these methods are globally accepted, Indian regulators may specify or prefer certain approaches based on the transaction type. For instance, the Reserve Bank of India (RBI) often requires a fair valuation based on internationally accepted methodologies for cross-border deals. In contrast, tax authorities may scrutinize DCF valuations to ensure compliance with Section 56(2)(viib) of the Income Tax Act.

Selecting the right method—or combination thereof—is critical to ensure the valuation is defensible, aligned with market realities, and compliant with applicable laws.

How Investor Valuation Reports Support Post-Merger Integration

Beyond deal closure, the valuation report continues to serve a strategic purpose during the post-merger integration phase. The assumptions, benchmarks, and projections documented in the report offer a clear reference point for measuring the success of the merger or acquisition.

These benchmarks help management track key performance indicators (KPIs), such as revenue growth, cost synergies, and return on investment, against what was originally projected. Variances can then be analyzed to identify operational inefficiencies or integration gaps early in the post-deal lifecycle.

Moreover, the valuation provides a baseline for aligning internal financial goals with the anticipated benefits of the transaction. By doing so, it ensures that synergy realization—often cited as a primary justification for M&A—is not only monitored but also actively managed.

From an audit and planning perspective, the valuation report aids in budgeting, internal control design, and strategic decision-making. It also proves valuable during subsequent fundraising, refinancing, or when reassessing the business for future M&A or divestiture opportunities.

In essence, a professionally developed valuation report extends its utility far beyond the negotiation table, becoming a cornerstone of post-transaction value creation and governance.

Conclusion: The Valuation Report Is More Than a Formality

The Investor Valuation Report plays a central role in the M&A process—bridging the gap between strategy, regulation, and negotiation. It enables fair price discovery, ensures compliance with Indian laws, supports informed decision-making, and mitigates potential risks. Most importantly, it instills trust among stakeholders and provides a clear, defensible foundation for the transaction.

Far from being a regulatory checkbox, a well-prepared valuation report is a value-adding asset that enhances the efficiency, transparency, and integrity of the deal.

For Indian businesses and investors navigating the complex landscape of mergers and acquisitions, investing in a credible, professional valuation report is not just prudent—it is essential. It reinforces the company’s commitment to best practices, safeguards stakeholder interests, and sets the stage for a successful, dispute-free integration.

Frequently Asked Questions (FAQs)

Not always, but it is mandatory in most cases under the Companies Act, FEMA, Income Tax Act, and SEBI regulations, especially when share issuance or foreign investment is involved.

Depending on the transaction, it must be prepared by either a Registered Valuer (as per the Companies Act) or a SEBI-registered Merchant Banker.

Rarely. While courts have allowed it in exceptional cases, skipping the report can trigger compliance issues, delays, or investor distrust.

The most widely used methods are Discounted Cash Flow (DCF), Comparable Company Analysis (CCA), and Precedent Transaction Analysis.

Yes. It helps in post-merger integration, performance tracking, and is often referenced in future audits or fundraising.